Beyond Sales: Honda Can No Longer Afford to Compromise on Its 'Brand Reputation'

![]() 12/10 2025

12/10 2025

![]() 576

576

Introduction

GAC Honda has consistently demonstrated unwavering commitment to continuous brand development.

For Honda, 2025 undoubtedly stands as the most challenging year since its entry into the Chinese market. Behind the decline in sales lies not only Honda's failure to fully capitalize on the traditional fuel vehicle market but also, more critically, its inability to keep pace with mainstream transformations. This has triggered a severe chain reaction.

The outside world has long recognized Honda's inherent stubbornness. When confronted with unfamiliar domains, Honda tends to prefer gradually sensing market changes on its own rather than proactively seeking change or external assistance. However, given the drastic shifts in the current environment, if Honda wishes to maintain its presence in China, it can no longer afford to analyze the market at its own leisure.

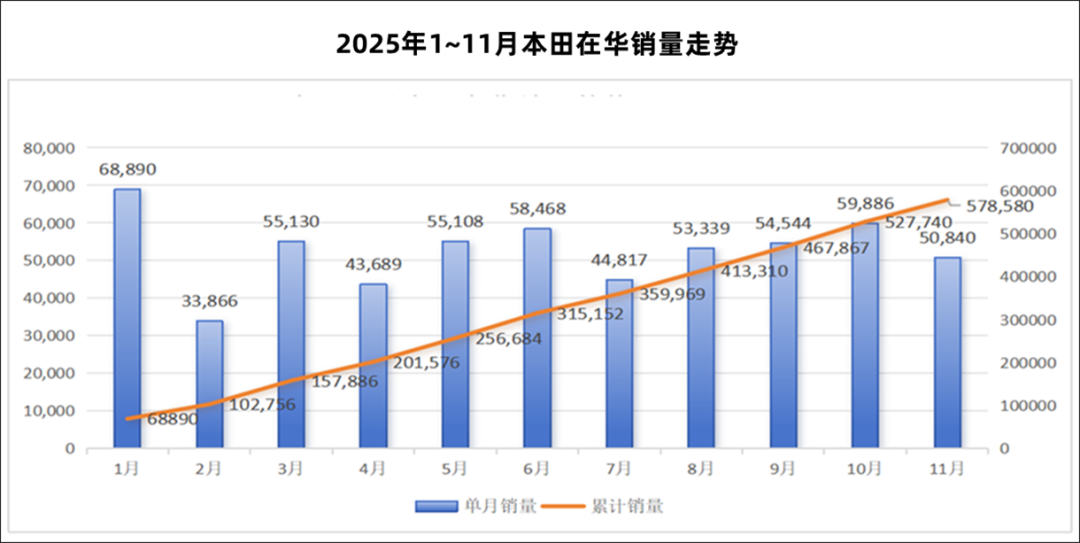

Last month, Honda's terminal automobile sales in China reached 50,840 units. From January to November 2025, the cumulative terminal automobile sales in China amounted to 578,580 units. These figures starkly highlight the evident issues compared to past performance.

Not long ago, when news broke that Honda had voluntarily delayed the launch of its new electric vehicle, the Ye GT, and even halted the entire project, it was initially difficult to accept. We sincerely lamented, "Is this still the Honda we know?" However, considering the current environment, Honda has made a decision that is most responsible for its own future.

Due to the reorganization of its pure electric product line, Honda is inevitably poised to face a product shortage in China in 2026. With this expectation, every decision Honda makes from now on becomes crucial.

In other words, when faced with difficulties, how should Honda endure the loneliness and survive this dark period before dawn?

Indeed, amidst the ongoing price wars and public opinion battles, many automakers have already fallen into passivity, blurring their original brand positioning, product matrix, and even development plans. Given this scenario, with dominant enterprises fully controlling the market rhythm, where can the remaining automakers still find a breakthrough? If Honda can solve this problem, perhaps any loneliness it faces will be resolved in a timely manner.

01 Brand: Honda's Last Moat

For a long time, competition in the Chinese auto market has been closely tied to the cost-effectiveness of the products themselves. Compared to the strategies of foreign automakers, this singular competition logic has only led to a polarized market trend. In other words, without price support, most automakers would be at a loss. Even if some new models gain popularity through hype, once they face backlash, recovery becomes challenging.

Against this backdrop, while Honda may suffer from product disadvantages, with the key to competition in the Chinese auto market shifting from products to brands, Honda still has opportunities to turn things around.

In China, Honda does not possess the neutral and universal qualities of brands like Volkswagen or Toyota. After over 20 years of market cultivation, the impression Honda has left on Chinese consumers is always individualistic, with a strong sporty flair. Although different from thoroughly niche Japanese brands like Mazda and Subaru, Honda has won recognition from many users with this attribute.

Nowadays, while it is an undeniable fact that Honda's year-on-year sales have declined, in terms of the brand itself, it remains a positive and considerable asset. Recently, Honda's two joint ventures in China have once again been making efforts to promote their brands. They are attempting to retain Honda's user base by focusing on the development history and cultural stories of Honda vehicles.

The 2025 GAC Honda Zao Meng Festival has just concluded. Like in previous years, this cultural feast that gathers all Honda users provides a stage for the outside world to once again showcase Honda's charm. Ultimately, before its brand loses market value, Honda has no reason to give up on cultivation.

Due to well-known reasons, Honda's public opinion presence has been declining year by year. The last time Honda garnered significant attention on social media was when the Civic Type R was officially introduced to China.

Entering 2025, with Honda's entire product lineup lacking competitiveness and amidst some negative public opinion, once-popular models like the Fit have become a microcosm of criticism towards Honda's fall from grace. Honda must feel helpless about this, but compared to the actions of other joint ventures that are starting to recover, Honda seems to have no other choice but to endure silently.

Fortunately, in the eyes of most consumers, Honda is still a reputable foreign brand. Coupled with the large number of Honda owners in China, it would be very difficult for newcomers to truly make Honda disappear from the Chinese market.

Although for many people, cultural events like the Zao Meng Festival may seem dispensable. In a market flooded with products featuring "refrigerators, TVs, and sofas," discussing brand value and historical precipitation may seem out of place.

However, as experienced at the GAC Honda Zao Meng Festival, where owners from all over the country choose to speak up for Honda simply because of their vehicles and the memories associated with them, it makes one ponder: Should the future of the Chinese auto market be a relentless competition for survival, or should it have a mature market competition mechanism that allows consumers to consider automotive products from all dimensions?

02 Brand: The Key to Future Competition

This year marks the fifth anniversary of the GAC Honda Zao Meng Festival and also the toughest year for Honda's survival in China. However, at the same time, with most speculative automakers being weeded out and consumer attitudes trending towards rationality, brand building must become a key focus for automakers moving forward.

As the Chinese auto market has developed to this point, an undeniable fact is that the competition strategies of Chinese automakers have become increasingly similar: whoever can produce the largest vehicle at the lowest cost with the most abundant configurations will dominate the market.

Looking back at the past year, no matter how much Honda emphasizes the essential attributes of automobiles, such as quality, safety, or driving pleasure, the market seems to turn a blind eye. Almost everyone is immersed in the same development rhythm, leading to a phenomenon where, since product strengths are becoming similar, consumers simply choose the best-selling models. This is how polarization emerges.

However, from the perspective of most automakers, is this phenomenon normal? When consumers only buy large vehicles for their affordability, and automakers follow suit by competing on price and configurations, how can they sustain their growth in the long run?

Just like the once-dominant BBA (BMW, Benz, Audi) and now Tesla, when facing Chinese users, companies hope that their brands also carry value. Under the premise of similar product strengths, external factors can make the market more vibrant, rather than blindly trapping the Chinese auto market in an orderly but low-quality vicious cycle.

Across the global auto market, no great automaker has ever succeeded by disregarding its brand image and solely competing on price. This means that for Honda or other automakers, having users pay for their brand value is not a boring endeavor.

For five years, relying on the Zao Meng Festival, GAC Honda has still been able to gather a massive number of users. Many people may not take this seriously, but such a performance is rarely seen in today's Chinese market. Is this stubbornness or idealism? In fact, Honda is well aware that as a company with a brand story, perhaps this is what needs to be persisted in.

Next year, the Chinese auto market is bound to become even more lively, with everyone intensifying their efforts in various aspects amidst fierce market competition. At that time, compared to the products themselves, the power of brands will undoubtedly stand out. Perhaps during this period, companies like Huawei and Xiaomi will grow into automakers with unique brand charm. However, these changes also remind us that joint venture brands, which already have a certain brand following, still have the opportunity to keep up with the mainstream.

Of course, looking back at the past few years, after being educated by the market, Honda has ultimately let go of its obsessions and gradually shifted its R&D thinking towards the Chinese market. The P7 is the best embodiment of GAC Honda's desire to change the status quo. However, the lack of optimism in sales still forces Honda to make further improvements. Therefore, brand building has become a top priority that Honda must undertake in its next phase and cannot afford to halt.

Unsurprisingly, GAC Honda will face a product shortage in 2026. The next pure electric vehicle that better meets the needs of Chinese users will have to wait at least two years. During this period, if Honda allows its original customer base to erode, how can it ensure the combat effectiveness of its two joint ventures? Therefore, on the surface, events like the Zao Meng Festival may seem like a celebration for Honda users, but in Honda's future plans, they may very well be the core of maintaining market presence.

Editor-in-Chief: Du Yuxin Editor: Chen Xinnan

THE END