From 'Involution' to 'Anti-Involution': China's Auto Market Bids Farewell to Vicious Competition

![]() 12/10 2025

12/10 2025

![]() 516

516

'Anti-involution' remains in a 'critical phase.'

From an online buzzword to a policy focus, the evolution of the term 'involution' reflects profound changes in China's competitive ecosystem. Initially circulated among netizens to express individual powerlessness in fierce competition, the term has now become a key concept describing irrational competitive behaviors among enterprises and local governments.

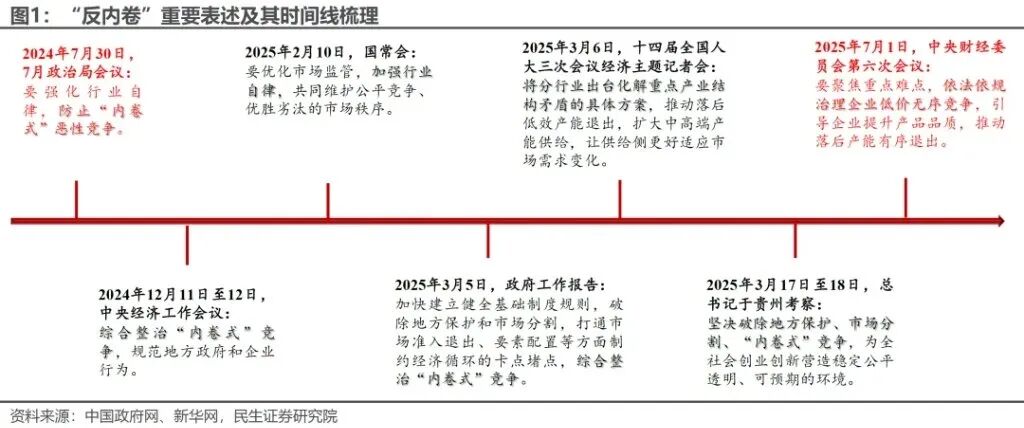

On July 30, 2024, the central government for the first time characterized vicious industry competition as 'involution-style,' sending a clear signal. In December of the same year, the Central Economic Work Conference further included 'comprehensive rectification of involution-style competition' on its agenda, calling for the regulation of local government and corporate behaviors. The consecutive deployment of two high-profile meetings marked the formal launch of 'anti-involution' governance efforts.

Entering 2025, governing 'involution-style competition' has become a key focus throughout the year.

Policymakers deeply recognize that eliminating irrational competition and building a unified national market are interconnected—if 'involution' is allowed to spread, market fragmentation will persist, domestic demand stimulation will be hindered, and China's strategic resilience in navigating complex international political and economic landscapes will face challenges.

In the automotive sector, on May 31, the Ministry of Industry and Information Technology (MIIT) and the China Association of Automobile Manufacturers (CAAM) jointly convened an industry symposium, explicitly defining disorderly 'price wars' among automakers as a typical manifestation of 'involution-style competition.' The meeting pointed out that such behaviors not only compress companies' profit margins but also undermine the industry's long-term capacity for R&D investment and quality improvement.

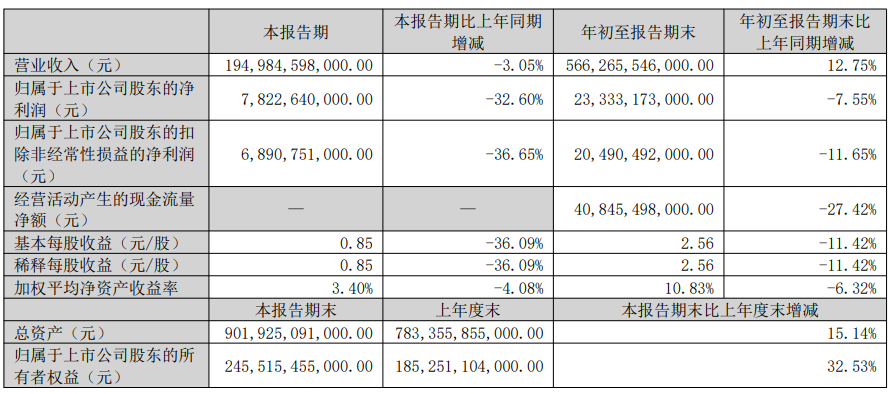

Data shows that the average profit margin of China's domestic automotive industry in 2024 declined by nearly 40% compared to 2021, with some automakers even falling into the predicament ('dilemma') of 'losing money on every vehicle sold.'

On June 3, the All-China Federation of Industry and Commerce's Automotive Dealers Chamber of Commerce issued the 'Initiative on Improving the Survival Conditions of Automotive Dealers,' exposing the deep-seated impact of 'price wars' on dealers.

In 2024, the average gross profit margin of automotive dealers nationwide fell below 3%, down 4 percentage points from 2021, with approximately 15% of dealers closing due to losses. In the initiative, the chamber called on automakers to 'set sales targets reasonably based on market demand and reduce inventory pressure on dealers' while promoting a 'manufacturer-dealer profit-sharing mechanism' to involve dealers in profit distribution.

On June 5, Ministry of Commerce spokesperson He Yongqian stated at a regular press conference that, in response to the 'involution-style competition' in the automotive industry, the ministry would actively collaborate with MIIT, the State Administration for Market Regulation, and other departments to strengthen comprehensive rectification and compliance guidance, uphold fair competition, and promote healthy industry development.

Previously, the Ministry of Commerce had jointly launched a special rectification campaign in the automotive circulation sector with multiple departments, targeting violations such as false advertising and forced tie-in sales. Despite initial success, interviewed companies and experts generally believe that 'anti-involution' remains in a 'critical phase,' with underlying contradictions not yet fundamentally resolved.

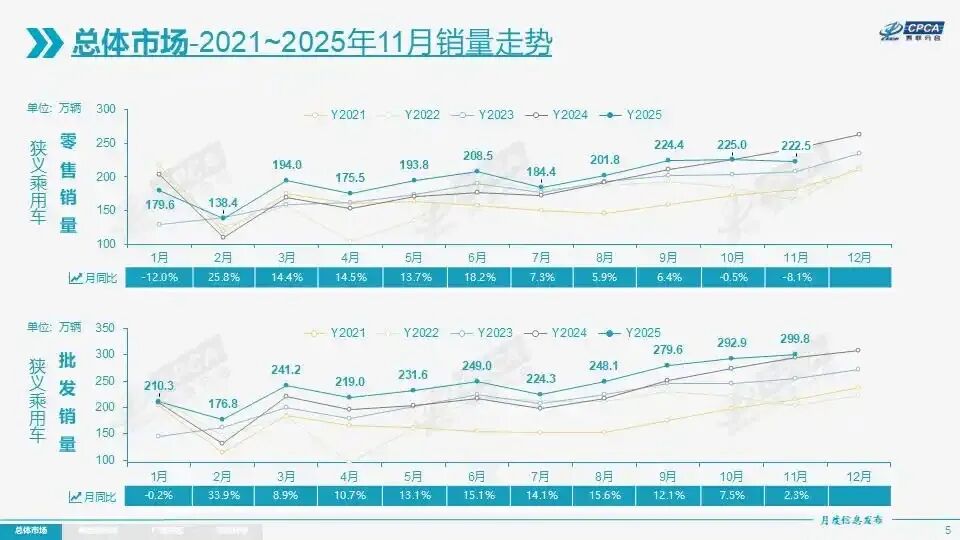

Industry insiders argue that 'driven by policies such as automotive trade-in subsidies, the automotive market maintained steady expansion in 2025. However, rising raw material costs, coupled with weak market demand, have not improved corporate profits, leaving the industry still 'large but not strong.'

Under intense price competition and product iteration pressures, most automakers' net profits remain on a downward trajectory. Overall, only five automakers achieved positive and growing profits.

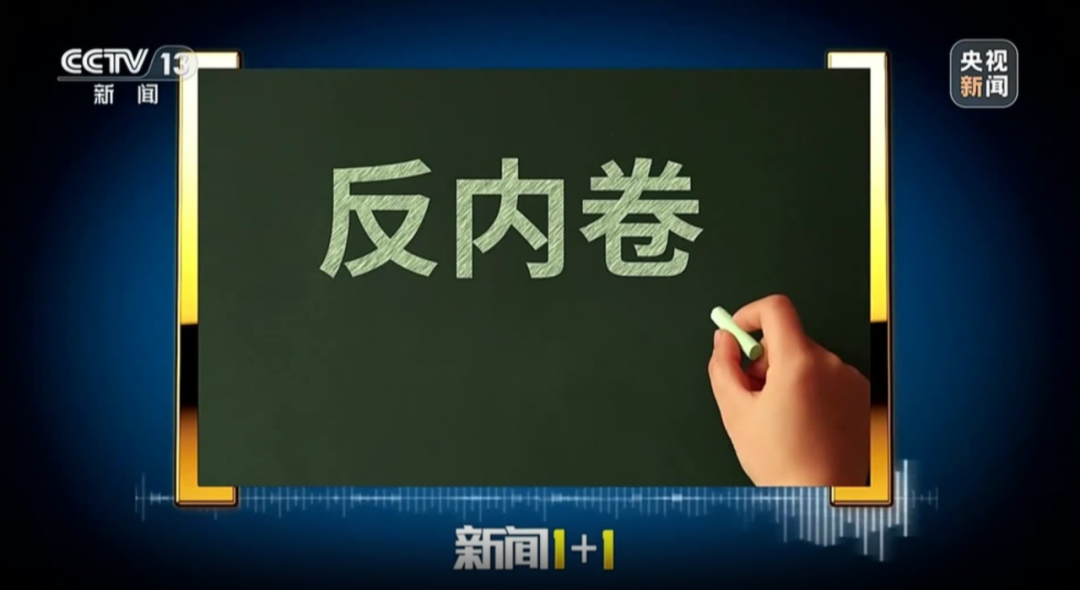

BYD's financials reveal the brutality of industry 'involution,' with operating revenue of 195 billion yuan down 3.1% year-on-year and net profit attributable to shareholders at 7.823 billion yuan, a 32.6% decline. Notably, as the industry price war eased marginally, its net profit rebounded 23.1% sequentially, signaling a potential profit bottom.

Behind this, BYD achieved a delicate balance between 'price-for-volume' and 'profit preservation' through economies of scale, technological iteration, and overseas market expansion.

Geely Auto emerged as an industry 'dark horse,' with third-quarter revenue of 89.2 billion yuan, up 26.5% year-on-year, and net profit of 3.82 billion yuan, a 59% increase. Its cumulative revenue for the first three quarters reached 239.5 billion yuan, with net profit at 13.11 billion yuan and sales volume of 2.17 million units, up 46% year-on-year.

This performance stems from its precise dual-track strategy of 'fuel + new energy' vehicles and sustained growth in high-end brands like Zeekr and Lynk & Co.

Seres, deeply collaborating with Huawei, showed resilience, with third-quarter revenue of 48.13 billion yuan, up 15.75% year-on-year, and net profit of 2.371 billion yuan, a slight 1.7% decline. In contrast, JAC Motors faced transformation pains, with revenue growth but net losses widening to 660 million yuan.

This divergence highlights that, within Huawei's ecosystem, automakers' supply chain integration capabilities, product positioning, and channel efficiency directly determine their success or failure.

SAIC Motor achieved significant performance improvement due to rising sales in its independent business and recovery in its joint ventures, with third-quarter net profit surging sixfold to 2.08 billion yuan. This reversal was driven by SAIC's technological accumulation in new energy (e.g., IM and Feifan brands) and initial success in the electrification transformation of its joint venture brands (e.g., Volkswagen and General Motors).

Great Wall Motors, despite third-quarter revenue growing 20.5% year-on-year to 61.25 billion yuan, saw net profit decline 31.23% to 2.298 billion yuan due to new model costs, channel adjustments, and price competition, with a nearly 50% sequential drop.

These figures expose its 'growing pains' in new energy transition—brands like Haval and WEY have not fully shed their reliance on fuel vehicles, while new energy brands like ORA and SALOON still require time to cultivate the market.

New energy vehicle (NEV) startups' financials present a 'mixed picture.' NIO's third-quarter revenue reached 21.79 billion yuan, up 16.7% year-on-year, but net losses stood at 3.66 billion yuan, remaining in a high-loss zone. XPeng Motors continued to improve profitability, while Leapmotor became the first NEV startup to achieve quarterly profitability with 150 million yuan in net profit.

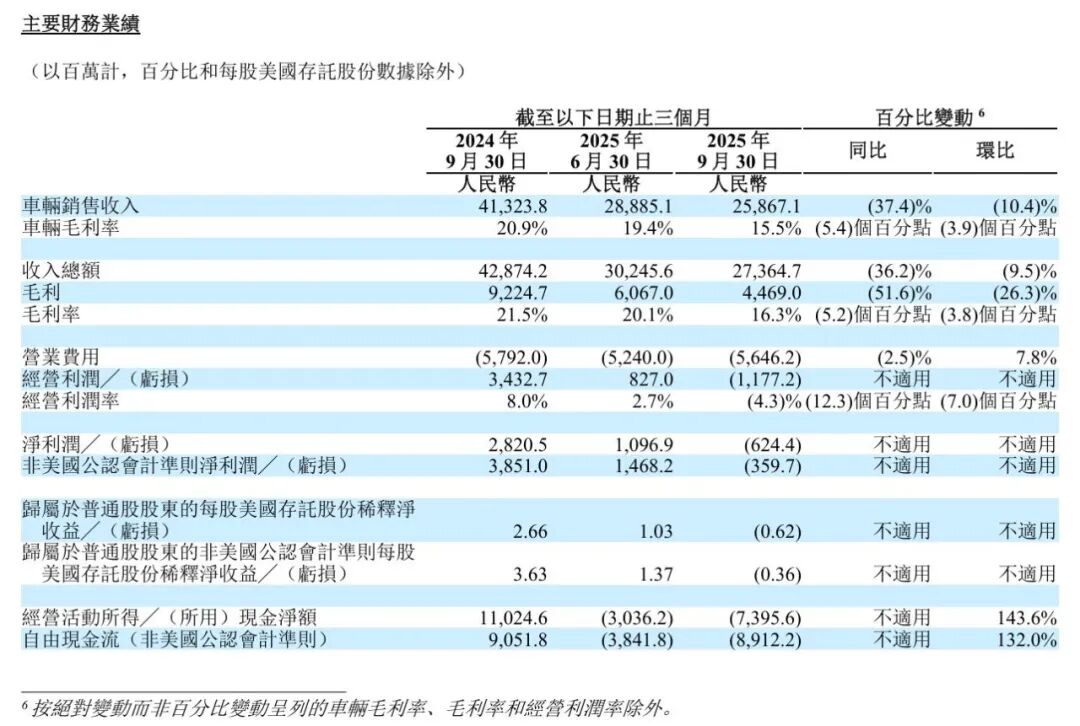

Li Auto faced multiple pressures. Despite a gross margin of 20.4% (excluding MEGA recall factors), its free cash flow deteriorated further from -3.8 billion yuan in the previous quarter to -8.9 billion yuan, indicating significant liquidity strain. Affected by intensified competition and investments in pure electric models, its third-quarter net loss reached 624 million yuan.

Overall, most automakers' third-quarter profits remained in a downward trend compared to the previous year. Persistent price wars and prolonged product update cycles have made it difficult for automakers to balance sales growth and profit improvement.

As the aftershocks of the third-quarter price war subside, the automotive industry has quietly entered the fourth-quarter ' Sprint period ' ('final sprint'). Some securities analysts view the fourth quarter as a critical 'bridge' period. While the negative impacts of the first-half price war are still being digested, competition is shifting from disorder to order, and industry differentiation is becoming clearer.

BYD's improvement potential mainly stems from dual drivers of product updates and export growth. In the domestic market, new DM models, Fangchengbao (Titan 3/Titan 7 starting to contribute sales), and high-end series deliveries are expected to support average selling prices and gross margins. Overseas, BYD's third-quarter passenger vehicle exports surged 155.9% year-on-year, accounting for 20.9% of total sales.

With capacity release ('capacity release') in Thailand and Brazil, the upcoming launch of a Hungarian factory, and the deployment of its own ro-ro fleet, China Galaxy Securities projects that BYD's export momentum will sustain, and the higher profitability of overseas operations will effectively 'boost company profits.'

Geely Auto's growth prospects still revolve around 'product mix optimization + overseas growth.' The sustained sales of the Galaxy series will help maintain stable gross margins, while the performances of Zeekr and Lynk & Co will continue to enhance profit elasticity from high-end brands. As export operations further solidify, Geely's profit structure will continue to optimize, with fourth-quarter performance expected to remain stable or improve.

Great Wall Motors is poised for recovery through product refreshes and export growth. In the fourth quarter, key new models like Gaoshan 7 and Haval H6L will launch, coupled with its profit advantages in overseas markets such as the Middle East and Russia, helping stabilize or rebound its vehicle gross margins. However, channel adjustments and new model cost pressures remain concerns, suggesting a relatively moderate pace of profit recovery.

NEV startups' fourth-quarter performances may continue to diverge, with profit inflection points becoming a market focus.

NIO founder William Li stated confidently in the earnings call that 'we aim to achieve profitability in the fourth quarter,' citing deliveries of high-price, high-margin models like the new ES8, which will drive vehicle gross margins to 18%. However, institutions remain skeptical—with sales target completion below 60% in the first 10 months and Q3 losses not narrowing significantly.

CMB International points out that NIO's fourth-quarter sales guidance is weak, predicting continued net losses. CICC believes its profit inflection point may arrive in mid-2026.

Li Auto's outlook is more conservative, with fourth-quarter delivery expectations of only 100,000–110,000 units, down 37%–30.7% year-on-year. Its recovery hinges on whether the production ramp-up of pure electric models i8 and i6 can accelerate to offset the gap from declining extended-range vehicle competition. CMB International projects Li Auto's Q4 gross margin guidance at 16%–17%, but if L-series redesigns require price cuts to stimulate sales, profit improvement will be delayed until 2026.

XPeng Motors, with a more diversified revenue structure, exhibits stronger resilience against fluctuations. Technology collaboration businesses are becoming a key profit contributor, with Chairman He Xiaopeng stating that Q4 technology collaboration revenue is expected to remain flat with Q3. Meanwhile, if new models receive stable feedback, rising capacity utilization will further alleviate cost pressures. In the medium to long term, the mass production of Turin chips and the deployment of the VLA 2.0 autonomous driving model will also provide sustained high-margin growth.

Beyond vehicle sales, cross-border businesses are emerging as new growth frontiers for automakers. Seres collaborates with ByteDance on humanoid robots, XPeng plans to mass-produce robots by the end of next year and commercialize flying cars, while Changan Auto and others have similar plans.

While these businesses offer limited short-term contributions, strategically, they are shaping automakers' future differentiated advantages and providing more structural possibilities for profit models.

Overall, China's automotive market in the fourth quarter is expected to see further rationalization of price wars, with profit improvements likely to continue. Under policy guidance and industry self-adjustment, extreme price wars are projected to subside, favoring overall gross margin recovery for automakers.

However, overseas markets have become a critical variable. Led by BYD, Chery, and Geely, China's automotive exports will sustain high growth, becoming a key driver of revenue and profit.

Differentiation will also accelerate further. Head automakers with technological barriers, strong brand equity, and diversified revenue streams are expected to emerge from the downturn faster, while those with slow transitions and ambiguous positioning will face prolonged pressure.

Notably, some automakers have shown signs of profit recovery through technological upgrades, cost control, and overseas expansion. Looking ahead, as 'anti-involution' policies advance, industry competition may shift from 'price competition' to 'value competition.' The ability to build moats in technology, branding, and supply chains will become decisive for automakers.

Note: Images sourced from the internet. For any copyright infringements, please contact us for removal. -END-