The state has decided to continue providing subsidies next year. Those planning to buy a car are in luck!

![]() 12/12 2025

12/12 2025

![]() 641

641

Introduction

If the purchase tax exemption was a 'wake-up call' for the 2026 auto market, then the continuation of national subsidies is undoubtedly a 'reassurance pill.'

From the 'Cars to the Countryside' initiative to purchase tax exemptions for new energy vehicles, and from 'trade-in' programs to substantial investments in infrastructure... In recent years, a series of policies introduced at the national level have effectively boosted consumer confidence, successfully unlocked latent market demand, and injected significant momentum into market development.

However, by the end of 2025, auto trade-in subsidies were halted in many regions, new energy vehicle purchase subsidies were set to expire, and the tax exemption policy for new energy vehicles was also coming to an end. These policy changes have not only given consumers a reason to buy cars in the fourth quarter of this year but also raised concerns about purchasing in 2026. After all, the phasing out of various preferential policies means an increase in vehicle purchase costs.

Just as this sense of 'urgency' and 'panic' in car-buying consumption was about to spread, a national-level meeting timely provided a 'reassurance pill' to those who have not yet purchased a car.

From December 10 to 11, the Central Economic Work Conference was held in Beijing. The meeting outlined economic work for 2026, including a focus on 'domestic demand-led growth and building a strong domestic market,' stating the need to optimize the implementation of the 'Two News' policies.

The so-called 'Two News' policies refer to large-scale equipment updates and consumer goods trade-in programs. Among them, the consumer goods trade-in policy, which is directly related to the public's interests, has drawn significant attention and is known as the 'national subsidy.'

The meeting's confirmation of optimizing the 'Two News' policies in 2026 implies that the national subsidy policy will continue next year. This clear stance sends a definitive signal to the market and consumers: the policy direction to promote auto consumption will remain unchanged in 2026.

01 Policy Direction: 'National Subsidies' Continue

To further promote consumption, the state issued 150 billion yuan in ultra-long-term special treasury bonds in 2024 for consumer goods trade-ins, known as the 'national subsidy.' Due to the positive results last year, the state increased its efforts in 2025, issuing 300 billion yuan in 'national subsidies' for consumer goods trade-ins, doubling the amount from 2024.

The impact of the 'national subsidy' has been remarkable, acting as a 'policy red packet rain' that has nurtured prosperity in the auto market.

According to the Ministry of Commerce, from January to November this year, consumer goods trade-ins drove sales of related products exceeding 2.5 trillion yuan, benefiting over 360 million people. Among them, over 11.2 million vehicles were traded in, bringing significant consumption vitality and terminal sales to the auto market.

Industry insiders point out that among these over 10 million vehicles, nearly 70% of private car buyers benefited from the 'trade-in' program. This indicates that, catalyzed by policies, consumption upgrade-driven additional and replacement demands have become the main force in the current auto market. Consumers are taking advantage of the subsidy window to retire old vehicles and opt for higher-quality, smarter, and more eco-friendly new cars.

Among these, new energy vehicles have emerged as the preferred choice for consumers. Data from 2024 shows that over 60% of trade-ins involved new energy vehicles. The impressive sales of 5.468 million new energy passenger vehicles in the first half of 2025 reflect the continuation and deepening of this trend, making the 'Two News' policies a key driver in accelerating the replacement of fuel vehicles with new energy vehicles.

Moreover, it is essential to recognize that the core logic of the 'trade-in' policy lies in revitalizing the vast existing automobile market by incentivizing the replacement of old vehicles with new ones through subsidies. This not only directly drives new vehicle sales but also promotes circulation in the second-hand car market. Additionally, it indirectly stimulates related industrial chains such as maintenance, financial insurance, etc., unlocking significant market growth potential.

Due to the effective impact of the 'national subsidy,' when Guangzhou, Jiangxi, Tianjin, and other regions announced the suspension of auto replacement subsidy policies in the latter half of the year, it caused quite a stir. Consumers expressed their hope for the policy's continuation.

Now, with the Central Economic Work Conference confirming that the national subsidy policy will continue next year and optimizing the implementation of the 'Two News' policies based on the current situation, potential car buyers can breathe a sigh of relief.

As for how the 'national subsidy' will be adjusted next year, industry insiders speculate that the subsidy amount in 2026 may moderately increase from the 2025 level and continue to optimize the allocation of funds, including increasing support for service consumption, to further leverage fiscal funds to drive consumption, industrial transformation and upgrading, and boost the economy.

Looking back at 2024, the introduction of the 'Two News' policies effectively stimulated auto consumption. Data from the Ministry of Commerce shows that in 2024, over 2.9 million vehicles were scrapped and updated, and over 3.7 million were replaced and updated, directly driving sales exceeding 920 billion yuan. Among them, after the implementation of the 'Two News' (trade-in, replacement update) policies, over 60% of trade-ins involved new energy vehicles, effectively guiding green consumption and stimulating the vitality and potential of the auto market.

In comparison, this year's subsidy policies have further expanded the scope and intensity of subsidies based on last year's scrappage and replacement programs. The results show that the state's 'Two News' policies have provided strong support covering the entire auto consumption chain. As a result, we have witnessed over 11.2 million vehicles being traded in during the first 11 months of this year.

Therefore, if the 'national subsidy' is further optimized and its amount increased next year, the vitality of auto market consumption is expected to be further stimulated.

02 Endogenous Drivers Amid Policy Adjustments

From the initial exploration of 'Cars to the Countryside' in 2009 to the 'New Energy Vehicles to the Countryside' initiative starting in 2019, and then to the central fiscal consumption subsidies of up to 300 billion yuan in 2025, preferential policies have consistently served as a 'reassurance pill' for automobile market consumption.

However, the prospects for the automobile consumption market are not without concerns.

The purchase subsidies for new energy vehicles, implemented since 2016, will officially expire on January 1, 2026. Under the current standards, pure electric passenger vehicles are eligible for a maximum subsidy of 12,000 yuan per vehicle. Data shows that in the first eight months of 2025, nearly 40% of new energy vehicle sales still benefited from purchase subsidies, with an average subsidy of about 8,000 yuan per vehicle.

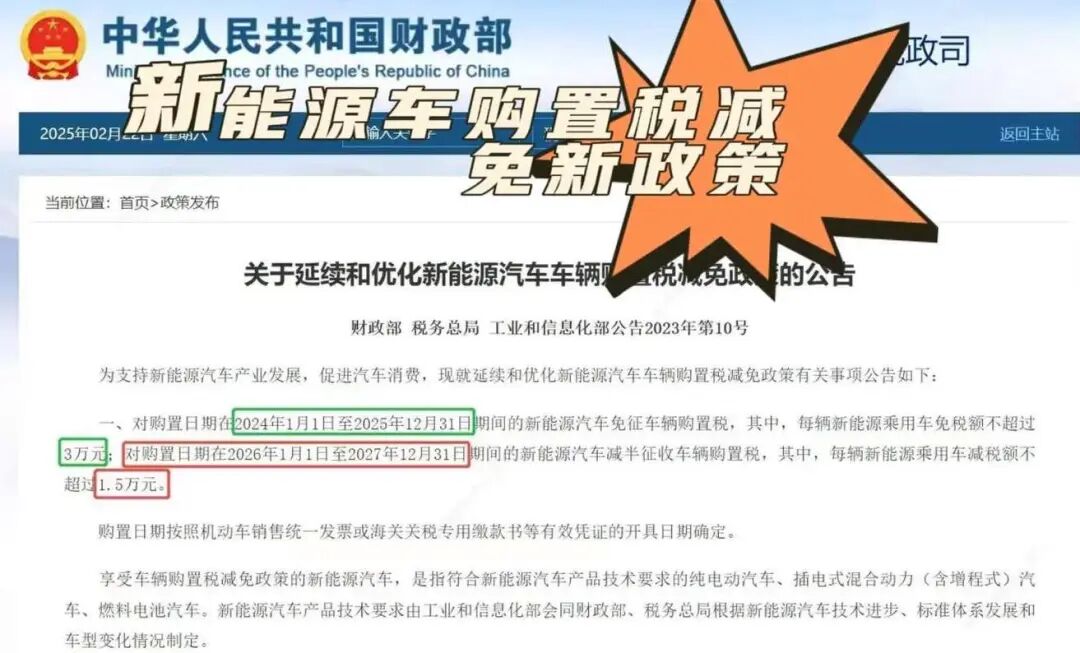

In 2026, the purchase tax exemption policy will undergo a dual adjustment of 'halving the tax and imposing technical restrictions.'

This marks the first shift from full exemption to a 50% reduction since the implementation of the preferential purchase tax policy for new energy vehicles. According to the new regulations, eligible new energy vehicles will enjoy a 50% reduction in vehicle purchase tax, valid until the end of 2027. The calculation method is 'vehicle price excluding tax × 5%,' with a maximum reduction of 15,000 yuan per vehicle.

At the same time, the policy imposes higher technical requirements on vehicles eligible for the tax reduction.

For pure electric vehicles, the energy consumption per 100 kilometers must not exceed the 'upper limit of energy consumption' set by the state for similar vehicle types. For plug-in hybrid vehicles, the new regulations specify mandatory conditions: a pure electric range of at least 100 kilometers; stricter requirements for fuel and electricity consumption; and if the vehicle's total mass exceeds 3.5 tons, the standards for 3.5-ton vehicles will apply.

It is evident that the new policy will directly impact consumers' vehicle purchase costs.

For example, the reduction in purchase tax exemptions for new energy vehicles in 2026-2027, shifting from full exemption in 2024-2025 to a 50% reduction. Under this rule, a new energy vehicle with a tax-inclusive price of 400,000 yuan will incur approximately 15,000 yuan more in purchase tax after the new regulations take effect compared to the current policy; if the vehicle does not meet the new technical requirements, the actual tax difference will widen to around 30,000 yuan.

Based on this, Morgan Stanley predicts that investors are concerned that intense market competition and potential subsidy cuts will continue to pressure sentiment in the Chinese auto industry and may affect the operational performance of automakers and suppliers in the first quarter of 2026.

The company expects a 6%-8% decline in domestic passenger vehicle sales in China in 2026, based on the 5% purchase tax reinstatement for new energy vehicles in 2026, or the equivalent 4.4% tax increase under a 13% value-added tax, and adjustments to the 'Two News' policies (scrappage update, trade-in), referencing historical patterns of post-stimulus policy callback (correction).

As subsidy policies expire, the new energy vehicle industry will face genuine market challenges. Besides a potential decline in consumer purchasing sentiment, automakers are also making strategic adjustments and technological breakthroughs in response to the upcoming policy changes.

Data shows that approximately 30% of plug-in hybrid models on the market may face the risk of being removed from the subsidy list due to their inability to meet the new requirement of a 100-kilometer pure electric range under WLTC conditions. Meanwhile, technology-focused companies like NIO and XPeng are beginning to demonstrate the unique value of battery swap models in this new era. When purchase tax exemptions reach their limit, the cost advantages of battery swap solutions will become more pronounced.

Domestic brands, with their rapid product iteration, have many models that already meet the new regulatory requirements, while joint venture brands, with slower platform renewal cycles, face greater challenges.

Additionally, in terms of pricing strategies, some brands have started to keep the tax-inclusive prices of their main models below 339,000 yuan to avoid a significant increase in purchase costs for consumers due to the 15,000 yuan reduction limit.

Overall, vehicle purchase decisions in 2026 will become more complex. Amid the interplay between policy adjustments and market endogenous drivers, while the reduction in purchase tax exemptions may cause short-term pain, the continuation of trade-in policies and robust growth in export markets provide new stabilizers for the industry.

Editor-in-Charge: Du Yuxin Editor: Chen Xinnan

THE END