Is the EU Fuel Vehicle Ban Set to Be "Eased" Soon? Six Nations Unite to Apply Pressure, Slowing Down Electrification

![]() 12/12 2025

12/12 2025

![]() 427

427

As the December 16 review deadline looms, the tug-of-war among various stakeholders intensifies once again.

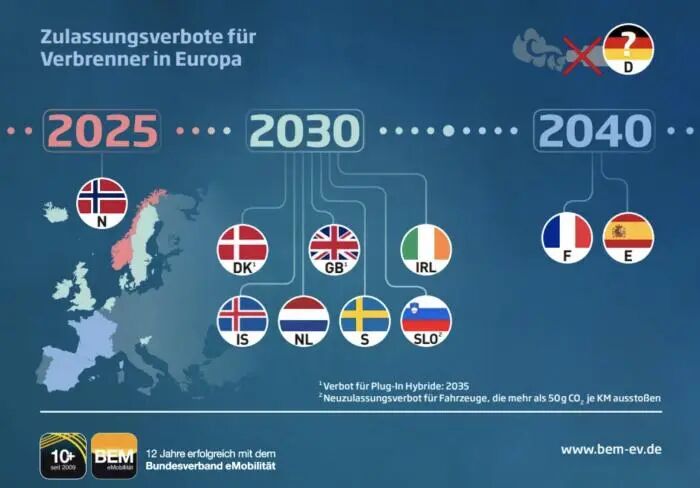

On Thursday, a bombshell announcement emerged: the EU is contemplating a "policy U-turn" on the fuel vehicle ban. According to insiders, under the collective pressure from leading auto-producing nations like Germany and Italy, the European Commission may delay the total prohibition on the sale of fuel-powered vehicles by 2035.

This move signifies the first major policy reversal in the global automotive industry's electrification trend.

In 2023, the EU enacted a landmark regulation, dubbed a "zero-carbon future" initiative, which mandates a complete ban on the sale of traditional fuel-powered sedans and small passenger vans emitting carbon from 2035 onwards. At that time, European automakers successively pledged their full commitment to electrification, with industry giants like Volkswagen and Mercedes-Benz pouring hundreds of billions of euros into the new energy sector.

However, the tide has turned.

With the global demand for electric vehicles (EVs) cooling off, signs of "electrification fatigue" have surfaced in the European market. Data reveals that EV sales growth in the EU plummeted from 40% in 2023 to a mere 15% in 2024, while hybrid vehicle sales soared by 23% against the trend. This market shift has directly undermined the EU's resolve to enforce the "fuel vehicle ban."

Six Nations Band Together to "Negotiate Concessions"

In this policy standoff, Germany, a major auto-producing nation, took the lead in launching an offensive.

German Chancellor Merz penned a letter to European Commission President von der Leyen, urging the EU to continue allowing the sale of electric vehicles equipped with fuel engines post-2035 and to permit the continued use of efficient internal combustion engines. He candidly argued that a single technological path would stifle innovation and that it would be misguided to "completely abandon" the sale of pure electric vehicles.

Last week, the prime ministers of Italy, Poland, Bulgaria, the Czech Republic, Slovakia, and Hungary co-signed a letter of support, forming an "anti-fuel ban alliance." These nations emphasized that forced electrification would erode the competitiveness of traditional automakers and lead to job losses.

Germany's staunch opposition is well-documented. According to the latest data from the German Automobile Industry Association, this pillar industry, which contributes 5% of the country's GDP and supports 8 million jobs, is facing a "stall" crisis. Audi's profits nosedived by 37.5% in the first half of the year, Porsche's net profit in the second quarter plummeted by 91%, and Mercedes-Benz's net profit shrank by 69%.

Behind these figures lies the stark reality of "51,500 job losses," as reported in an Ernst & Young consultancy report. In Baden-Württemberg, where one in every three families is tied to the automotive industry, these families now confront a "job crisis."

The plight of the German automotive industry did not materialize overnight.

On Munich's streets, only 1.7 out of every 10 new cars are electric. Consumer concerns over "range anxiety" and "battery degradation" have made the electrification transition arduous. Meanwhile, the 25% punitive tariffs imposed by the United States have sent German automakers' export costs soaring. Even if a U.S.-EU trade agreement is reached, Volkswagen Group still anticipates annual losses exceeding 3 billion euros.

At the political level, the "grand coalition government" formed by Merz's Union Party and the Social Democratic Party presents a delicate balancing act on the green transition. In Lower Saxony, a major automotive hub, one in every five voters is an automotive worker, compelling Klingbeil, the co-chair of the Social Democratic Party, to shift from being an "environmental pioneer" to a "job protector."

At the EU roundtable, Merz's advocacy for "technological neutrality" clashed head-on with von der Leyen's stance as a "green pioneer." The German government's latest policies, including a "3 billion euro electric vehicle subsidy" and an extension of the purchase tax exemption until 2035, resemble stimulants administered to a patient.

They offer temporary relief but fail to address the root cause.

"We support carbon neutrality, but not at the expense of decimating the entire industry," Merz declared at the EU summit, echoing the collective sentiment of the German automotive sector.

As the European Commission delays the review results, the German automotive industry stands at a crossroads. At Volkswagen's headquarters in Wolfsburg, a target of "50% electrification rate by 2030" is displayed on the wall, while fuel-powered vehicles continue to roll off the assembly lines.

This contradiction epitomizes the broader European automotive industry's transition.

The Clash Over the Green Path

While Germany was making impassioned speeches in Brussels, demanding a relaxation of the fuel vehicle ban, President Macron in the Élysée Palace in Paris was meticulously marking the new energy subsidy budget with a red pen. The French leader warned that any policy reversal in the EU's "green revolution" could exact a heavy toll on France.

"We have invested tens of billions of euros in building electric vehicle factories. Now is not the time to retreat," Macron emphasized at a recent cabinet meeting. Since launching an 8 billion euro "Automotive Revival Plan" in 2020, this former investment banker has bet the future of the French automotive industry on electrification.

According to the plan, the French government not only provides subsidies of up to 7,000 euros for each electric vehicle but also commits to achieving an annual production target of 1 million clean energy vehicles by 2025.

On Paris's streets, this policy resolve has translated into tangible market changes. The Renault ZOE electric vehicle set a sales record in 2024, while the Peugeot e-208 emerged as one of Europe's best-selling electric vehicle models. Data from the French Ministry of Ecological Transition shows that the proportion of electric vehicles in new car sales in France has surged from 5% in 2020 to 25% in 2024.

Behind France's vigorous push for the clean energy industry, particularly the electric vehicle sector, lies a strategic focus on lithium, a key component of electric vehicle batteries. In October 2022, France announced plans to mine its first lithium deposit in central France, one of the largest lithium mines in Europe.

"Lithium is the oil of the new era," declared French Minister of Mines Le Maire during a visit to the central lithium mine project. This initiative, costing 1 billion euros and led by French mining giant Imerys, is expected to meet 40% of France's future 25-year electric vehicle battery production demand.

Meanwhile, in Madrid's automobile factories, Volkswagen Group is constructing its largest electric vehicle production base in Europe. Spanish Industry Minister Reyes stated at the project launch ceremony, "We will not abandon our 2035 goal due to short-term pressure." This project, with an investment of 5 billion euros and expected to create 12,000 jobs, will serve as a benchmark for Spain's automotive industry transition.

Clearly, behind this clash over the green path lies the division and restructuring of the European automotive industry.

The European Commission was initially scheduled to announce the review results of the bill this Wednesday but abruptly announced a postponement on Monday. This delay is perceived by outsiders as a signal of "compromise" within the EU.

According to three EU Commission officials speaking on condition of anonymity, the Commission is crafting a compromise solution to extend the usage period of fuel engines in plug-in hybrid and extended-range vehicles until 2040, five years later than the originally planned 2035 ban. This adjustment, internally dubbed the "green transition period," aims to secure transition time for traditional automotive powers.

According to the draft, vehicles granted an extension must meet three "green conditions": utilizing advanced biofuels derived from agricultural waste or algae; adopting electric fuels (e-fuels) produced through carbon capture technology; and incorporating "green steel" in vehicle manufacturing, i.e., low-carbon steel produced through hydrogen-based steelmaking processes.

The Director-General of the EU Commission's Directorate-General for Climate Action stated at an internal meeting, "These technological combinations still hold the potential to enable the EU to achieve the zero-emission goal for passenger vehicles by 2035."

However, biofuels and electric fuels are not without controversy. Electric fuels produced using carbon capture or renewable clean electricity are still in the early stages of commercialization, while the emission reduction benefits of biofuels are also highly debated.

Overall, if the EU ultimately relaxes the ban, it will trigger a chain reaction. On the one hand, traditional automakers may slow down their investments in electrification and pivot towards hybrid technology; on the other hand, Chinese new energy automakers may accelerate their expansion in the European market. More profoundly, this policy shift may undermine the global consensus on "carbon neutrality" and cast a shadow over the electrification process in other regions.

This game over the automotive industry's future is not merely about technological routes but also a profound contest over Europe's economic model, job security, and global competitiveness. As the December 16 review deadline approaches, the tug-of-war among various stakeholders intensifies once again.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion. –END–