2025 Domestic Brand Rankings: BYD and SAIC in a Tight Race for the Top Spot, Leapmotor Emerges as a Potential New Leader Among Up-and-Comers

![]() 12/15 2025

12/15 2025

![]() 603

603

The latest figures from the China Association of Automobile Manufacturers reveal that, in the first 11 months of this year, Chinese-brand passenger vehicles have seen a total sales volume of 18.978 million units, marking a 19.4% year-on-year increase and accounting for 69.6% of the total passenger vehicle sales. These numbers are indicative of a fierce competition for rankings—an annual championship showdown between BYD and SAIC Motor, a collective surge by emerging brands, and the struggles and hopes of traditional automakers undergoing transformation.

I. The Annual Championship Showdown

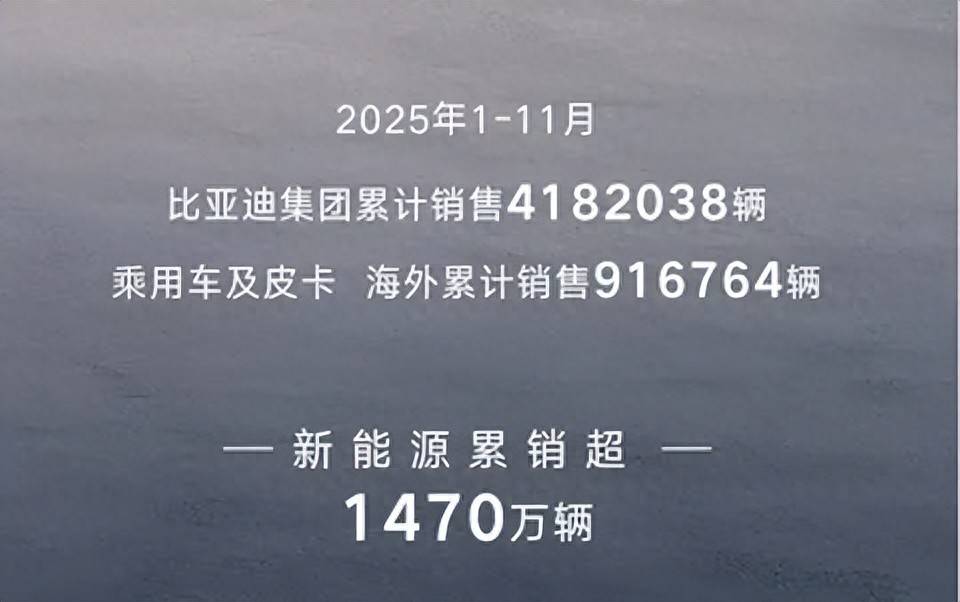

The biggest question mark (Chinese for 'suspense') in China's auto market for 2025 is undoubtedly: Who will clinch the full-year sales title? Last year, BYD outpaced SAIC Motor for the first time, selling 4.272 million units and ending SAIC's reign that began in 2006.

In the first 11 months of this year, BYD's cumulative sales have hit 4.182 million units, while SAIC Motor's cumulative sales stand at 4.108 million units. The gap between the two is narrow, at less than 80,000 units, and December is traditionally a peak sales month for automakers.

In terms of target achievement, BYD has reached approximately 90.9% of its full-year sales goal of 4.6 million units, whereas SAIC Motor has accomplished about 91.29% of its 4.5 million unit target. The competitive dynamics between the two highlight the clash of distinct development strategies. BYD leverages its all-new energy product lineup and vertically integrated supply chain advantages, while SAIC Motor pursues a dual-track approach of 'fuel + new energy'.

II. Up-and-Comers Cross the Finish Line Ahead of Schedule

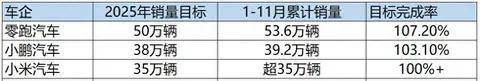

In China's auto market, a new wave of brands is rapidly gaining ground. By the end of November, three emerging brands—Leapmotor, Xiaomi, and XPeng—have already surpassed their full-year sales targets.

Leapmotor has sold a cumulative 536,000 units from January to November, achieving 107% of its full-year sales target of 500,000 units. Xiaomi Motors has delivered over 355,000 units in the first 11 months, exceeding its 350,000-unit target ahead of time. XPeng Motors has delivered a cumulative 392,000 units from January to November, not only surpassing its 350,000-unit annual target but also achieving a year-on-year growth rate of 156%.

The success of these brands can be attributed to their products' alignment with current market demands, leading-edge intelligent features, and efficient supply chain systems, which provide them with structural advantages amid price wars.

It's worth noting that the HarmonyOS Intelligent Mobility Alliance, as a unifying force, has grown from monthly sales of about 35,000 units at the start of the year to over 82,000 units in a single month in November, more than doubling its growth. Its full-year sales are projected to exceed 550,000 units.

III. Traditional Automakers Make a Last-Ditch Effort

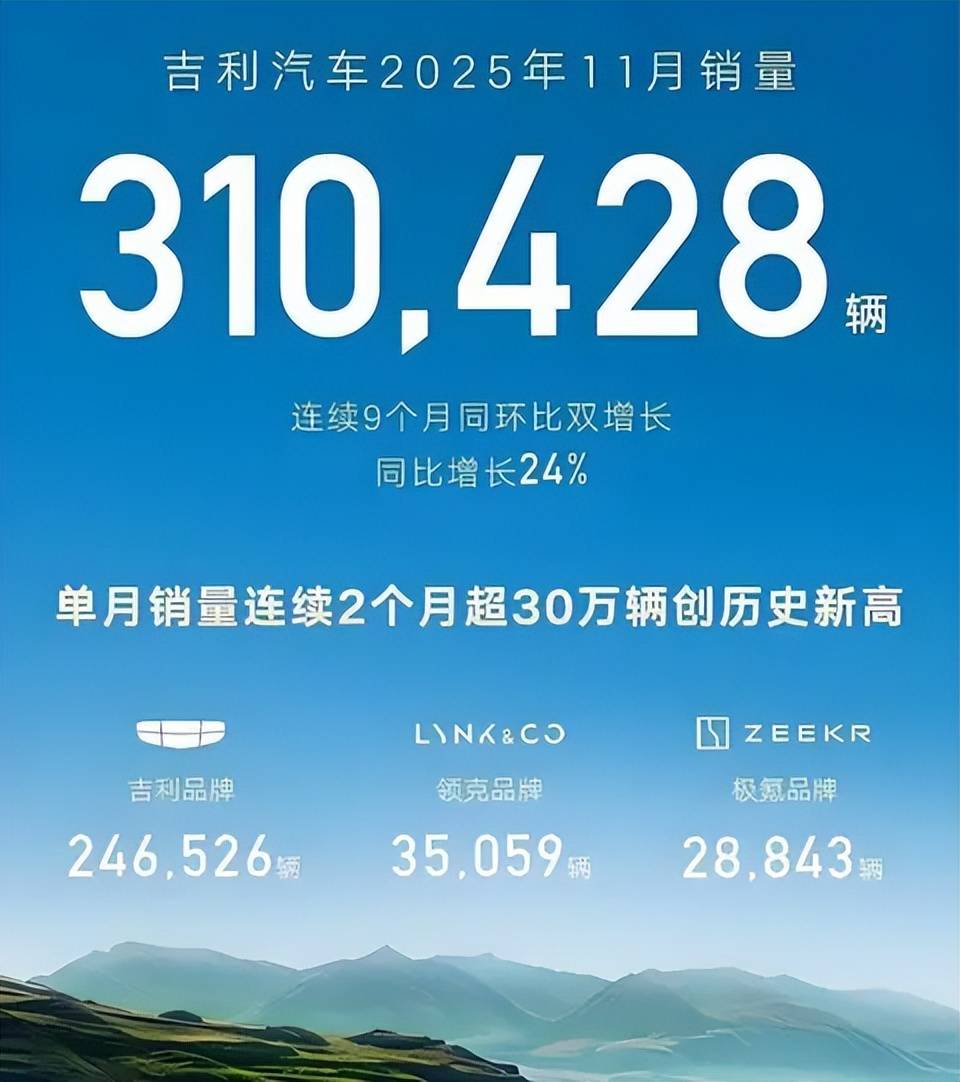

The competition among traditional automakers is equally intense. Geely Auto's cumulative sales in the first 11 months have reached 2.788 million units, achieving 92.93% of its revised full-year target of 3 million units. Its new energy vehicle sales have exceeded 1.534 million units, with a penetration rate exceeding 50%.

Changan Auto's cumulative sales in the first 11 months were 2.658 million units, achieving 88.6% of its 3 million unit annual target. Its new energy vehicle sales in the first 11 months reached approximately 995,000 units, a year-on-year increase of 54.66%.

Chery Group's cumulative sales in the first 11 months were 2.4 million units, with an annual target of about 3 million units, achieving about 80% completion. Its new energy vehicle sales in the first 11 months have exceeded 810,000 units.

FAW Group's cumulative sales in the first 11 months were 2.995 million units, with a target completion rate of 86.81%. The Hongqi brand's cumulative sales exceeded 420,000 units, a year-on-year increase of 9.2%.

IV. Growing Pains Amidst Transition

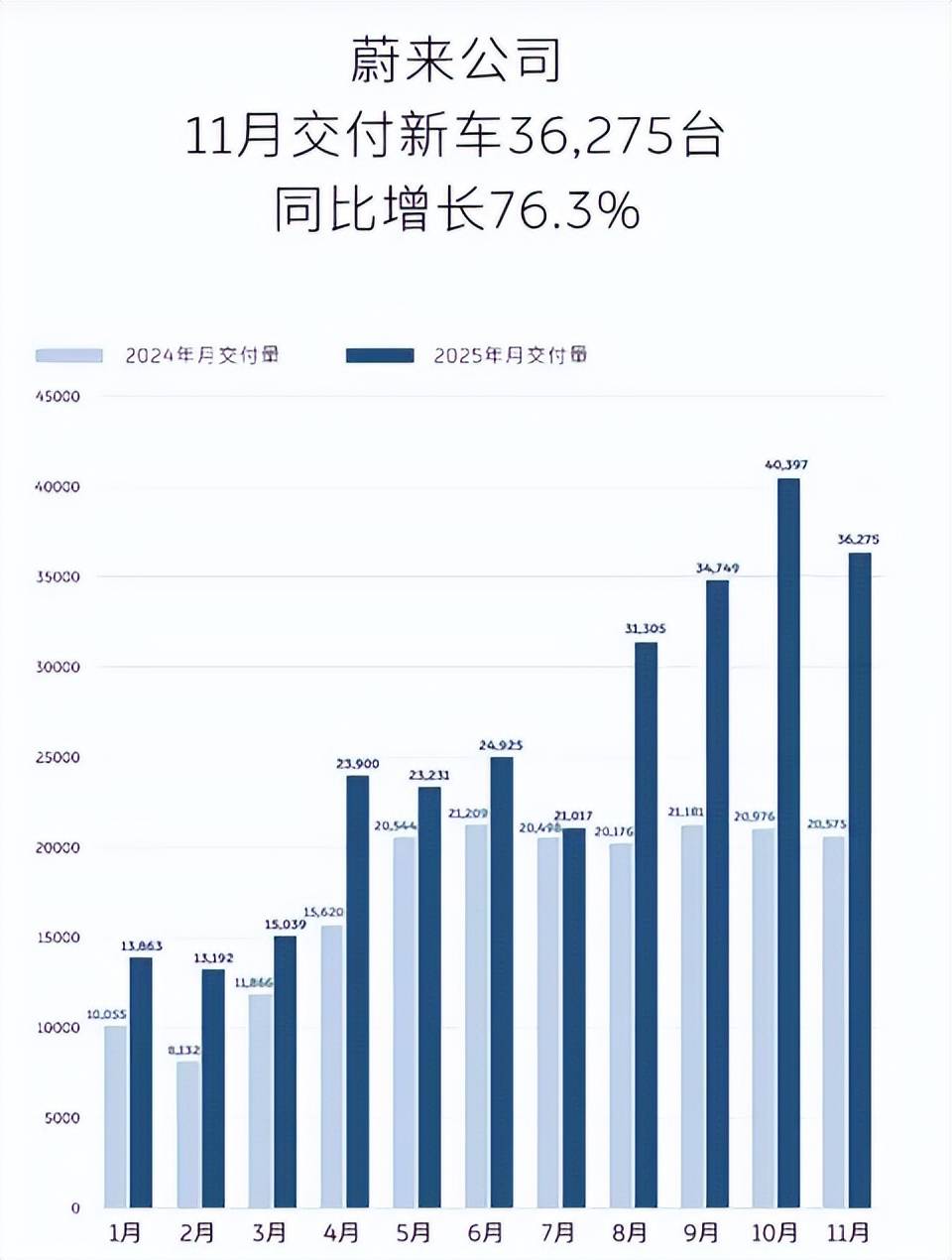

Not all automakers are finding the going smooth. As of November, automakers including Li Auto, Great Wall Motors, NIO, and Dongfeng Motor Corporation have all seen their annual target completion rates fall below 70%.

Great Wall Motors' cumulative sales in the first 11 months were 1.2 million units, while NIO's cumulative deliveries in the first 11 months were about 280,000 units. Although Li Auto lowered its sales target from 700,000 units to 640,000 units, its deliveries from January to November were only 362,000 units, with a completion rate of just 56%. The primary reasons are the decline in sales of the L series and the underperformance of pure electric vehicle models in the market.

As December arrives, automakers have kicked off their final push. Based on data from the first 11 months and their sprinting capabilities, the final rankings of China's auto brand sales in 2025 are becoming increasingly clear. The championship contest between BYD and SAIC Motor will keep everyone guessing until the very end, with full-year sales expected to range between 4.55 million and 4.65 million units.

Geely Auto is set to secure the third position and is highly likely to surpass its 3 million unit target, with full-year sales expected to reach 3.1 million units. Changan Auto and Chery Group will compete for the fourth and fifth positions, with full-year sales expected to be around 2.95 million units and 2.8 million units, respectively.

Among the emerging brands, Leapmotor will take the lead, with full-year sales expected to exceed 550,000 units; XPeng Motors will follow closely behind, with full-year sales expected to be around 420,000 units; Xiaomi Motors is projected to sell about 380,000 units for the full year. The 'HarmonyOS Intelligent Mobility Alliance' ecosystem model is expected to make a significant impact (Chinese for 'impact') on the top ten rankings.

Epilogue

The competitive landscape of China's auto market in 2025 reflects profound industry transformations, with new energy vehicles continuing to be the main driver of market growth. With less than 20 days left until the end of 2025, the annual rankings will soon be finalized. However, this grand competition, centered around technology routes, ecological models, and industrial value, has just entered its most thrilling phase. Let's stay tuned!