Survival Game Behind Ford Motor: Sales in Dire Straits, Integration for Self-Rescue, and Chen Xiaobo Joins the Team

![]() 12/15 2025

12/15 2025

![]() 439

439

Written by | Duoke

Source | Beiduo Business & Beiduo Finance

Currently, the Chinese automotive market is undergoing a structural transformation where self-owned brands are 'overtaking on bends.'

According to data from the China Passenger Car Association, in November 2025, retail sales of Chinese self-owned brand passenger vehicles reached 1.49 million units, with the market share climbing to 67%, a year-on-year increase of 3 percentage points. Mainstream joint-venture brands faced pressure, with retail sales of 490,000 units, a significant year-on-year decline of 19% and a month-on-month decline of 6%. The market shares of joint-venture brands fluctuated to varying degrees.

Under the trend of electrification transformation, joint-venture automakers are facing unprecedented transformation challenges. Even a century-old brand like Ford Motor has not been spared from the pain of sales 'flash crashes' caused by scattered sales channels and sluggish new energy transformation. Channel 'unification' is no longer a choice but the only way out for Ford to break through the predicament (dilemma).

Recently, Ford Motor showcased several models at the Guangzhou Auto Show, not only announcing its new global brand proposition 'Ready Set Ford – Unleash Your Nature, Go Wild' but also declaring the official pre-sale launch of the 'all-terrain camping SUV' Ford Fun Bronco, along with the release of pre-sale prices and benefits.

As Ford Motor's first new energy strategic model primarily developed by a Chinese team, and also Ford's first new energy answer since integrating its resources, channels, and service systems in China, the birth of the Ford Fun Bronco carries Ford's ambitions and determination to rejuvenate its brand and transform in the Chinese market.

However, the mid-to-large outdoor SUV market that Ford Motor envisions is already crowded with formidable competitors. Models like the Li Auto L7 and Seres M7 have achieved outstanding sales, while the Tank 400 Hi4-T, which caters to both home and off-road needs, has also shown remarkable market performance. Can the Ford Fun Bronco secure a place?

I. Sales and Performance Hit a 'Cold Bench'

Rewinding to 1995, Ford Motor became one of the earliest multinational automakers to enter the Chinese market by acquiring a stake in Jiangling Motors through American Depositary Receipts (ADRs). In 2001, it established Changan Ford as a joint venture with Changan Automobile, launching a 'dual-track' joint-venture operation model in China.

Leveraging its mature technology, resources, and scale advantages, Ford Motor's first domestically produced model, the Fiesta, officially rolled off the assembly line in 2003. Subsequent models like the Focus, S-MAX, and Mondeo also achieved strong sales, helping Ford quickly penetrate the market and become a leader among joint-venture brands.

In 2016, Ford Motor's vehicle sales in China exceeded 1.27 million units, setting a historical high for annual sales in China with a 14% growth rate. However, after this peak, Ford's sales began a downward trajectory, plummeting to 750,000 units in 2018 and further to just 560,000 units in 2019.

Even though Ford Motor's sales showed signs of recovery in 2020 and 2021, the 600,000-unit sales scale paled in comparison to the peak of over one million units. By 2024, Ford Motor's annual sales in China had dwindled to just 442,000 units, with its market influence significantly diminished.

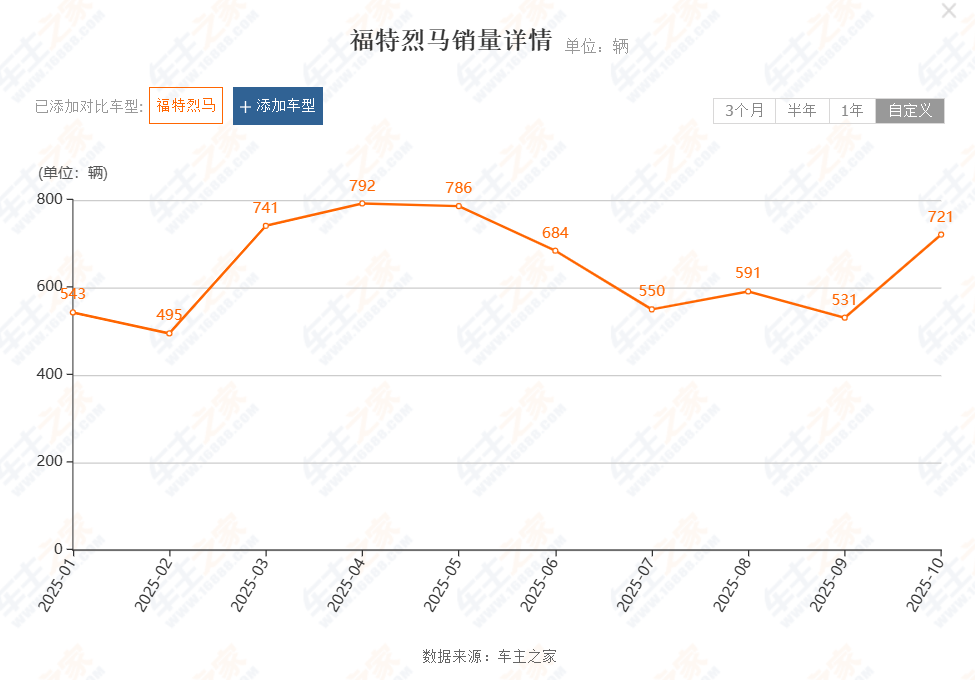

According to third-party platform information, in the first three quarters of 2025, Changan Ford sold a cumulative 77,067 units in China, a year-on-year decline of 7.56%. Jiangling Ford's sales were even lower at just 17,145 units, a 33.8% decrease. The Ford Bronco model, which was heavily bet on, sold only 531 units in September, with monthly sales hovering in the triple digits throughout the year, indicating a less-than-optimistic situation.

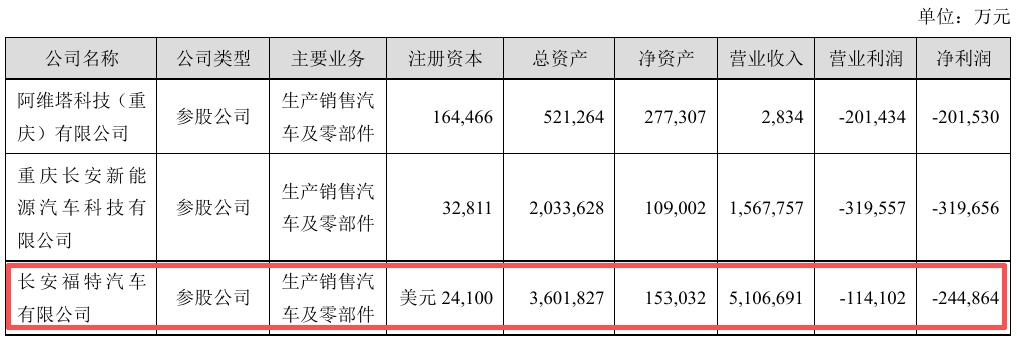

The persistent slump in sales has directly led to long-term performance pressures for Ford's two major joint ventures in China. Financial data from Changan Automobile shows that Changan Ford recorded a net loss of 2.449 billion yuan in 2022. Although it returned to profitability in 2024 with a net profit of 2.090 billion yuan, its revenue declined to 4.831 billion yuan.

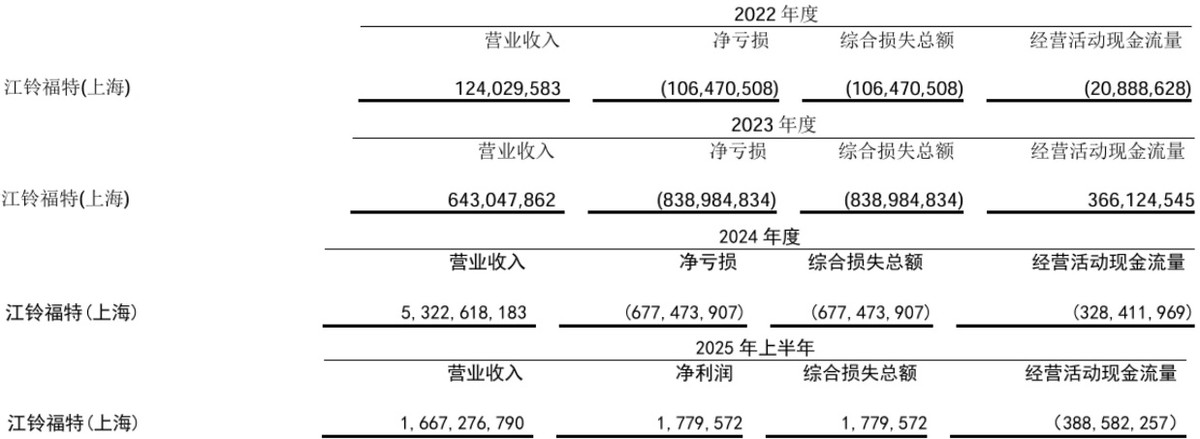

According to Jiangling Motors' financial report, Jiangling Ford's revenue doubled from 124 million yuan in 2022 to 5.323 billion yuan in 2024. However, its losses over the past three years were 106 million yuan, 839 million yuan, and 677 million yuan, respectively. It wasn't until the first half of 2025 that Jiangling Ford's net profit turned positive at 1.7796 million yuan.

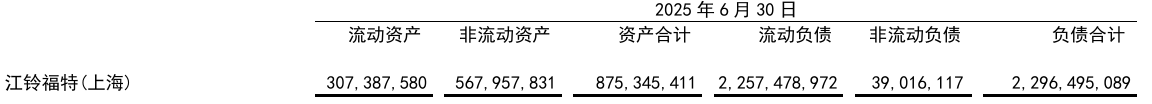

It's worth noting that as of the end of June 2025, Jiangling Ford's total liabilities reached a staggering 2.296 billion yuan, while its total assets were only 875 million yuan, resulting in a negative net asset value of 1.421 billion yuan and an astronomical debt-to-asset ratio of 262.46%, indicating insolvency. The operational pressure continues to mount like a snowball under persistent losses.

II. Launching the Prelude to Channel Integration and Renewal

Undeniably, Ford Motor's operational model in China has its merits. Under the dual-channel independent sales model, Changan Ford focused on the passenger vehicle market centered around home use, while Jiangling Ford concentrated on the rugged off-road and commercial vehicle markets. This approach once helped the company quickly carve out niche markets.

However, as market conditions evolved, the drawbacks of Ford Motor's dual-channel model became increasingly apparent, with scattered marketing, distribution, and after-sales systems leading to high management costs. It not only failed to form synergies and leverage Ford's brand cohesion but even resulted in overlapping product lines, turning sibling brands into competitors.

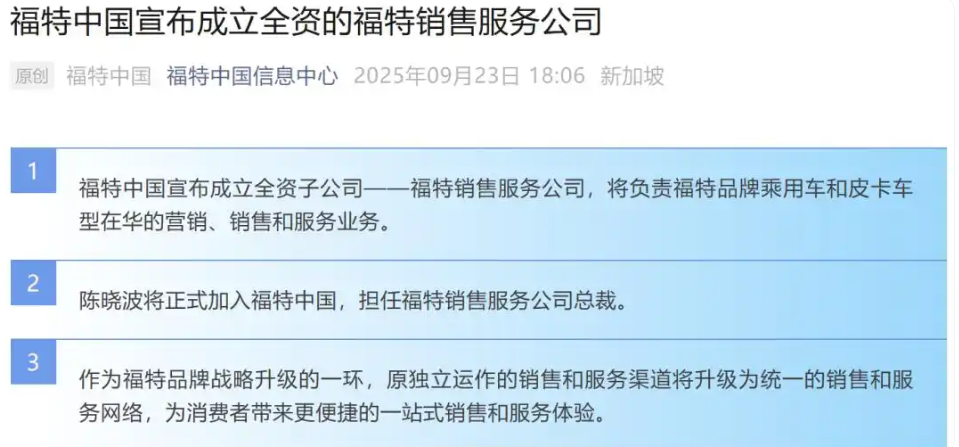

After years of trouble (distress), Ford finally fired the first shot in channel integration. On September 23, Ford China announced the establishment of a wholly-owned subsidiary, 'Ford Motor Sales and Service (Shanghai) Co., Ltd.,' to uniformly take over the marketing, sales, and service businesses of Ford brand passenger vehicles and pickup trucks in the Chinese market.

Meanwhile, Chen Xiaobo, a former executive of Changan Ford with extensive experience in marketing, sales management, and overseas markets for multinational and local automotive brands, joined Ford China as the president of Ford Motor Sales and Service (Shanghai) Co., Ltd., reporting to Wu Shengbo, president and CEO of Ford China and Ford International Markets Group.

It is reported that Changan Ford has approximately 270 dealers in China, while Jiangling Ford has around 110. After integration, Ford Motor will form a network of over 300 passenger vehicle dealers, creating a more rational and convenient sales and service system. It also plans to adopt a unified brand image of 'Ford Horizons' to strengthen the brand perception of 'One Ford.'

Simultaneously, Ford will focus on building the 'Ford Horizons' lifestyle ecosystem, covering four major sectors: 'Experience Spaces' (Horizons Spaces), 'Outdoor Lifestyle Communities' (Horizons Communities), 'Personalized Premium Modifications' (Horizons Gear), and 'Vehicle Services/Protection' (Horizons Care), to create a lifestyle of outdoor leisure, exploration, wild adventure, and fun.

Ford China stated that the establishment of a domestic wholly-owned Ford sales and service company would help the company uniformly implement the new brand proposition of 'FUN Your Nature, Go Wild,' strengthen its product and cultural advantages in niche markets such as off-roading and outdoors, and drive a comprehensive brand image renewal.

III. Can New Models Bring a Turnaround?

More than two months have passed since the establishment of Ford Motor Sales and Service Co., Ltd. How is Ford Motor's channel integration progressing? Chen Xiaobo, who recently took office, stated in a media interview that currently, consumers can access Ford's full range of products in any Ford brand showroom, indicating that the strategic integration is basically complete.

Chen also revealed that new energy layout would be a key development direction for Ford Motor after channel integration. The company aims to create a unified brand image and a complete Ford product lineup for consumers, presenting Ford's fuel vehicles, plug-in hybrids, performance pickups, and other models available in the Chinese market.

The 'all-terrain camping SUV' Ford Fun Bronco, launched on November 21, represents Ford Motor's significant move in the new energy sector. The model has a pre-sale price range of 229,800 to 272,800 yuan, offering both pure electric and extended-range powertrain versions to meet users' all-scenario mobility needs for 'city, play, and wild.'

In its promotional materials, Ford Motor spared no praise for the Ford Fun Bronco, stating that it is built on Ford's 'Ford Domain' native intelligent new energy architecture, incorporating Ford's global R&D resources and localized manufacturing capabilities. It deeply integrates electrification and intelligent technologies, boasting 12 unique scenario solutions in its class.

However, it's important to note that sluggish new energy transformation has long been a operational weakness for Ford Motor. The company only has a few new energy models on sale in China, such as the Ford Mustang Mach-E and Escape plug-in hybrid, with lackluster sales performance, accounting for less than 10% of its total sales.

In contrast, many self-owned new energy brands have already achieved brand elevation through continuous technological innovation. Taking the mid-to-large SUV segment where the Ford Fun Bronco competes, data from China Automotive Data Research Institute shows that in the first half of 2025, the Li Auto L6 and L7 claimed the top two spots with total sales of 96,354 and 47,374 units, respectively.

Additionally, the top ten sales list for mid-to-large SUVs features popular models from Harmony Intelligence like the Seres R7 and M7. The Tank 400 New Energy, which shares a similar rugged off-road positioning with the Ford Fun Bronco, also delivered impressive results with total sales exceeding 15,000 units in the first half of 2025.

As of now, Ford Motor has not disclosed sales data for the Ford Fun Bronco. Whether its differentiated positioning under full-channel operations can achieve a breakthrough in the new energy sector and help Ford make a comeback in the Chinese market still depends on the operational ecosystem stability after channel integration and the speed of implementing electrification and intelligent technologies.

From this perspective, Ford Motor still has much ground to cover.