Those Foreign-Funded Vehicles You Once Thought Doomed Are Quietly Flourishing Overseas

![]() 12/16 2025

12/16 2025

![]() 465

465

Introduction

Let's stop claiming they're on the verge of leaving China.

In recent years, numerous struggling foreign brands in China have come under the spotlight. Mitsubishi has terminated all its joint ventures in China, Polestar has withdrawn from its localized sales network, Skoda is "mulling over an exit from the Chinese market," and GAC Fiat Chrysler's production base has been sold. Earlier, Acura, Renault, and Fiat faced similar predicaments.

Indeed, with China's rapid electrification drive, foreign brands have seen their survival space further squeezed. Recent reports highlight a slump in sales of foreign luxury cars in China, as consumers increasingly turn to domestic brands. Foreign brands like Skoda, Peugeot, and Citroën, which languish at the bottom of sales charts, are barely mentioned anymore.

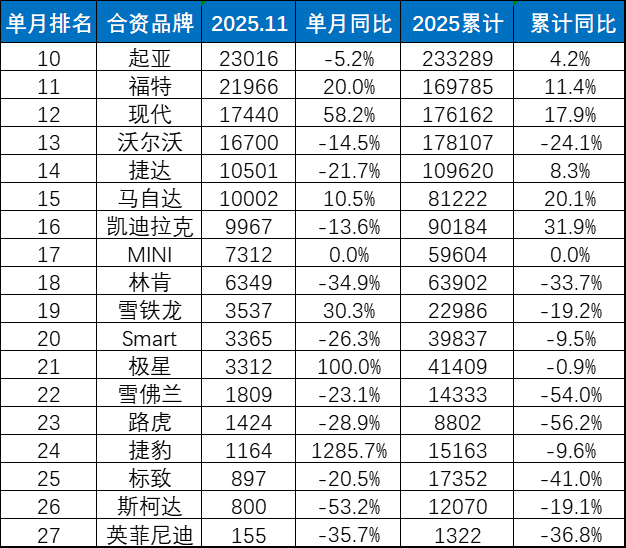

A glance at the sales data confirms this trend. According to the China Passenger Car Association, only 27 foreign brands recorded sales in China's auto market in November, compared to 76 domestic brands. Among them, 14 foreign brands sold fewer than 10,000 units monthly, underscoring their precarious situation.

But why, since the latter half of this year, have discussions about which foreign brand will exit China next dwindled? On one hand, the domestic new energy vehicle (NEV) boom has shifted the focus to competition among domestic brands. On the other hand, these struggling foreign brands have found new avenues for survival.

01 Reaping the Benefits of Exports

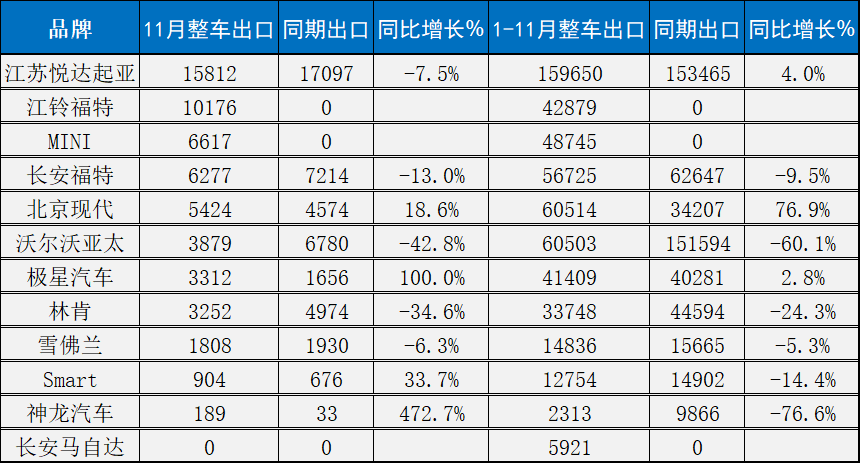

According to the latest statistics, several joint-venture brands have posted impressive export figures in 2025. Many second-tier joint-venture brands, which have been losing domestic market share and were on the brink of withdrawal, are quietly transforming their Chinese factories into global export hubs.

Beijing Hyundai exported 60,514 vehicles from January to November, marking a 76.9% year-on-year surge. Kia exported nearly 160,000 vehicles in the same period, providing a stable sales base. Even smaller brands like Polestar witnessed a 100% year-on-year increase in exports in November alone.

More notably, brands like Jiangling Ford, MINI, and Changan Mazda, which had zero exports during the same period, are now venturing into new territories. In just 11 months, Jiangling Ford exported over 42,000 vehicles, while MINI exported nearly 49,000, signaling a clear strategic shift.

Despite their weak domestic presence, some brands are thriving in exports, even experiencing explosive growth. A prime example is Dongfeng Peugeot Citroën (DPCA), whose exports surged 472.7% year-on-year in November. Though starting from a small base, this remarkable growth underscores its flexibility in shifting production overseas.

Behind these numbers lie stories of survival. For instance, Kia's domestic market share once plummeted below 1%, pushing it to the brink. By repositioning its Yancheng factory in Jiangsu as a global export base, it exported over 364,000 vehicles by the end of 2024, earning $3.6 billion and achieving a remarkable turnaround.

Changan Ford, leveraging its Chongqing and Hangzhou factories, became Ford's sole global producer of B- and C-segment sedans. The domestically produced Mondeo, rebranded for the Middle East market, became a hit, helping Ford achieve record sales in the region. Ford also doubled down on its partnership with Jiangling Ford this year to expand sales capabilities.

Clearly, the development model of joint-venture brands in China is undergoing a profound transformation—from "market for technology" to "Made in China for the world." This export data table is more than just numbers; it reflects the restructuring of the global auto industry, China's manufacturing upgrade, and the strategic choices of joint-venture brands to survive and thrive amid change.

As electrification and intelligence reshape the auto industry, China has emerged as a core battleground for this transformation. For joint-venture brands under pressure in China, exports are not a retreat but an expansion into new markets. China's market cannot be abandoned; instead, brands are redefining its role in their global strategies.

In the future, we may witness more joint-venture brands using China as a global production and export hub for electric vehicles, leveraging China's industrial chain advantages to produce vehicles for the world. This "Made in China, for the World" model could become the new norm for many multinational auto brands in China.

02 China’s Abundant Resources

From another perspective, China's auto market is witnessing a role reversal that defies tradition. In the past, multinational auto giants dominated the Chinese market by exchanging technology for access. However, with the rise of smart electrification, a profound power shift is underway: former technology teachers are now increasingly seeking core technologies from their Chinese students.

Faced with challenges, one of the most direct and efficient business models is rebadging or technology borrowing. Countless cases prove that mature Chinese models are highly competitive overseas. For example, the JAC T6 is sold in Russia as the SOLLERS ST6; the Changan Kaicheng F70 is rebadged as the Peugeot Landtrek in Latin America and the Middle East; and the SAIC Maxus T70 becomes the Chevrolet S10 Max in Mexico.

Even more striking is the success of models built on Chinese platforms. The Grand Renault Koleos, based on Geely’s Xingyue L platform, received over 7,000 orders in Korea within 15 days of its launch. The Chery Tiggo 5X, rebadged as the DR5 in Italy, saw a price increase but maintained strong sales. This reverse output model is currently the most widely used and effective approach.

Another deeper form of collaboration is platform and technology sharing, marking an upgrade from product-level cooperation to core technology integration. For instance, Changan Mazda has begun using Changan’s electrification platform to develop Mazda-branded new energy vehicles. Meanwhile, Stellantis is rumored to be partnering with Dongfeng Group to co-develop a new generation of Jeep off-road vehicles based on Dongfeng’s Voyah or Menger technology platforms.

According to reports, this "Joint Venture 2.0" model will see Stellantis handle styling and chassis tuning to maintain brand DNA, while Dongfeng provides core technologies like the three-electric systems (battery, motor, controller) and smart cockpits. The goal is to compress development cycles to just 18 months, with a new model launching in the first quarter of 2027. This approach allows foreign brands to leverage China's leading electrification and intelligence technologies at minimal cost to address their weaknesses.

The fundamental shift in foreign brands’ business strategies stems from the severe challenges they face in China and globally. Take Stellantis as an example: its first-half 2025 results were alarming, with revenue down 13%, a net loss of €2.3 billion, and global sales falling 8%. In China, its joint venture GAC Fiat Chrysler has exited, while Dongfeng Peugeot Citroën has struggled due to delayed electrification.

Whether directly purchasing Chinese models for rebadging or deeply integrating Chinese automakers’ mature platforms, these seemingly humble moves outline a new survival rulebook for foreign brands in the new global competition landscape. The underlying business logic is clear: when it comes to profit and survival, brand dignity must yield to commercial rationality.

For companies, this is a shrewd economic calculation. By leveraging China's mature, efficient, and cost-effective supply chain, foreign brands can launch competitive products at unprecedented speed and low cost. Take Stellantis’ investment in Leapmotor as an example: its goal is clear—to acquire technology and time through capital.

This major auto group gained access to Leapmotor’s self-developed "Four-Leaf Clover" electronic electrical architecture and other advanced technology platforms, shortening its R&D cycles and improving cost efficiency. Even more notably, it plans to rebadge the Chinese-made Leapmotor B10 as an Opel for sale in Europe, seen as the easiest and fastest way for Stellantis to electrify its brands.

In the midst of the auto industry’s greatest transformation in a century, those who can integrate the world’s best resources with the most open and pragmatic approach will gain the upper hand in the fierce market competition. Returning to the original question: will any foreign brands abandon China’s excellent resources? Almost certainly not.

Editor-in-Chief: Cui Liwen Editor: Wang Yue

THE END