Post-Subsidy Withdrawal Aftermath: Delving into the 'Cold Winter' of the Year-End Auto Market and the Puzzle of the 2026 Price War

![]() 12/19 2025

12/19 2025

![]() 507

507

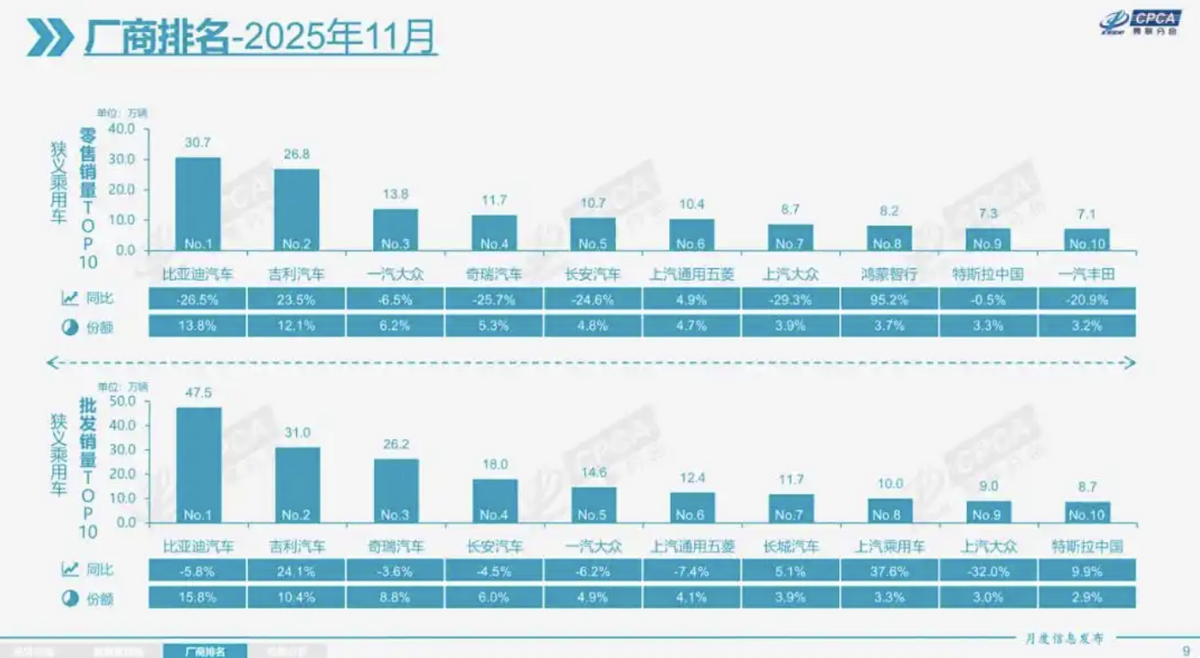

In November 2025, China's auto retail market, during what is traditionally the peak sales season, unexpectedly hit a 'stall,' recording an 8% year-on-year decline. This cast a pall over the market following the 'Golden September and Silver October' period. The dealer inventory warning index remained stubbornly high, with some brands surpassing the two-month alert threshold for inventory depth. This placed considerable pressure on capital turnover.

Behind this anomalous phenomenon lies a convergence of multiple factors. The multi-year purchase tax exemption policy is slated to expire as planned. Meanwhile, central and local vehicle purchase subsidies were fully utilized by the end of the year, prematurely tapping into a substantial portion of consumer demand. Policy stimuli, akin to potent stimulants, yield rapid results but inevitably lead to subsequent fatigue. So, what direction will the domestic auto market take in 2026?

Policy: 'Killing the Goose That Lays Golden Eggs'? Demand Discontinuity Amidst Deep Overdraft

In recent years, to stabilize automobile consumption, incentive policies of unprecedented scale have been rolled out at both the national and local levels. From 2024 to 2025, subsidy policies centered around trade-ins and new energy vehicle purchases were particularly intense. These policies effectively stimulated the market in the short term, compressing potential vehicle purchase demand for the next 1-3 years and 'advancing' it to 2025. In particular, trade-in subsidies and scrappage renewal subsidies successfully spurred replacement activity in the existing vehicle market.

However, this stimulus model of 'borrowing from the future to pay for the present' inevitably led to a 'vacuum period' in demand after policy withdrawal. The sales decline in November marks the onset of this overdraft effect becoming evident. Consumer vehicle purchase decisions follow a cyclical pattern, and after a wave of intense stimuli, the market requires time to rebuild its potential customer base. Industry analysis indicates that foot traffic to stores for some mainstream brands dropped by over 30% month-on-month after subsidies ended, with order conversion cycles significantly lengthening.

Dealers Under High Pressure: Inventory Backlog and Strained Capital Chains

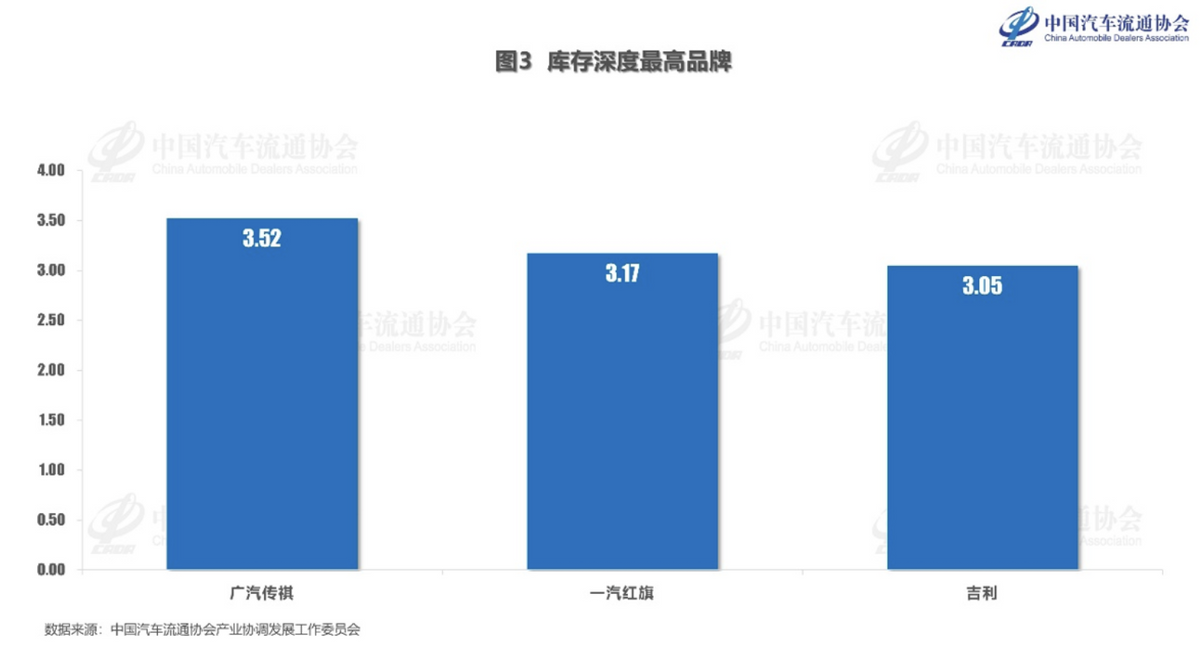

The most direct victims of the sales decline are undoubtedly frontline auto dealers. Data released by the China Automobile Dealers Association reveals that the comprehensive inventory coefficient for auto dealers climbed above 1.8 in November 2025, well surpassing the warning line of 1.5. Some brands with high inventory depth even exceeded 2.5.

High inventory not only implies substantial capital occupation costs—estimated to exceed 100 billion yuan across the industry—but also compels dealers to engage in 'price inversion' sales, where selling prices dip below manufacturer invoice prices, further eroding already thin profits.

Currently, dealers' gross profit margins on new vehicle sales are generally low or even negative, with survival heavily reliant on after-sales service and financial insurance businesses. The clash between the pressure from year-end sales targets and weak market demand places some dealers under severe capital chain strain.

December Market Outlook: A Clash Between Inertial Decline and Year-End Uptick

Looking ahead to the final month of 2025, the auto market's trajectory is shrouded in uncertainty, but downward pressure remains pronounced. On one hand, policy dividends have been fully exhausted, lacking new stimulus levers. The impact of earlier demand overdraft will continue to simmer. Meanwhile, consumers generally exhibit a 'buy high, not low' mentality, and with the vehicle price system potentially loosening further due to inventory pressures, a wait-and-see attitude may prevail.

On the other hand, automakers and dealers, aiming to meet annual sales targets, are poised to launch a final round of robust promotional pushes in December. Some pent-up rigid demand is also likely to be released by year-end, creating a certain 'year-end uptick' effect. However, considering the magnitude of November's decline and the weak market fundamentals, even if December witnesses a month-on-month recovery, achieving a year-on-year turnaround is exceedingly difficult, with a high probability of continuing a slight year-on-year decline or remaining largely flat. Traditional seasonal patterns have been disrupted, and the concept of a 'peak season' is being redefined.

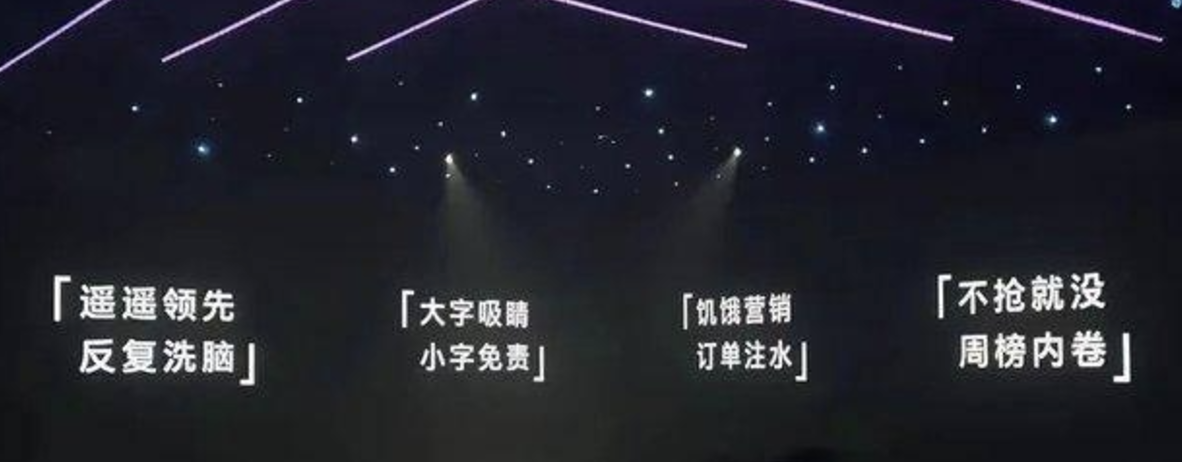

2026 Auto Market Outlook: Deepening Price Wars and a New Normal of Inventory Competition

Looking ahead to 2026, China's auto market, particularly the terminal private vehicle market, will enter a more intricate and profound new phase. Firstly, the continuation of fierce price and marketing wars is almost a foregone conclusion. Against a backdrop of sluggish overall demand growth and structural overcapacity, competition for market share will intensify. Multi-front battles will unfold between new energy and traditional fuel vehicles, domestic and joint venture brands, and among new automotive forces. 'Marketing wars of words,' as a low-cost means to attract attention and vie for traffic, will also become more prevalent.

Secondly, terminal sales face sustained downward pressure. Macroeconomic conditions, consumer confidence, market saturation (especially weakening first-time purchase demand), and the lagging impact of policy overdraft in 2025 collectively act as constraining factors. The private vehicle market will fully transition from a past 'incremental market' of rapid growth to a 'stock replacement market,' with growth relying more on product strength, technological iterations (such as intelligent driving and extended range), and genuine upgrades in user experience.

Furthermore, the focus of industry competition will shift. Relying solely on price stimuli and configuration pile-ups will no longer sustain competitiveness. Competition will increasingly deepen across dimensions such as technological strengths (e.g., intelligent cockpits, ultra-fast charging networks, AI large model applications), cost control capabilities (especially battery costs and full-industry chain cost reductions), business model innovations (e.g., more flexible battery leasing and upgrade services), and overseas market expansion. Domestic market 'involution' will compel automakers to hone their internal capabilities and seek differentiated breakthroughs.

Conclusion

The cooling of the auto market in November 2025 serves as a resounding wake-up call, marking China's automotive industry's formal departure from the old paradigm of high growth driven by robust policy cycles. It represents not only a natural reaction to the withdrawal of short-term stimulus policies but also a true reflection of the transitional pains faced by the market's endogenous growth drivers. For automakers, the future will hinge on maintaining product appeal and brand resilience after 'subsidy withdrawal.' For dealers, optimizing inventory management, enhancing operational efficiency, and diversifying profit models will be essential for survival. For industry regulators, the need arises to consider how to construct a more market-oriented and sustainable industrial promotion mechanism. Price wars may be inevitable during the shakeout process, but only through technological innovation, service upgrades, and globalization can China's automotive industry truly navigate through cycles and seize the initiative in the next development phase. The Chinese auto market in 2026 is destined to write a new chapter of competition amidst turbulence and transformation.