Banning the Sale of Cars at a Loss: Is Pricing Really the 'Root Cause' of the Auto Price War?

![]() 12/19 2025

12/19 2025

![]() 410

410

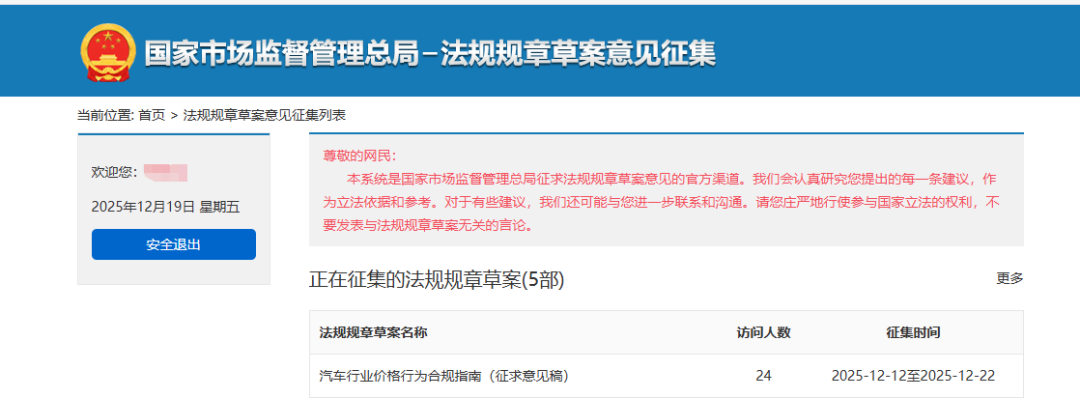

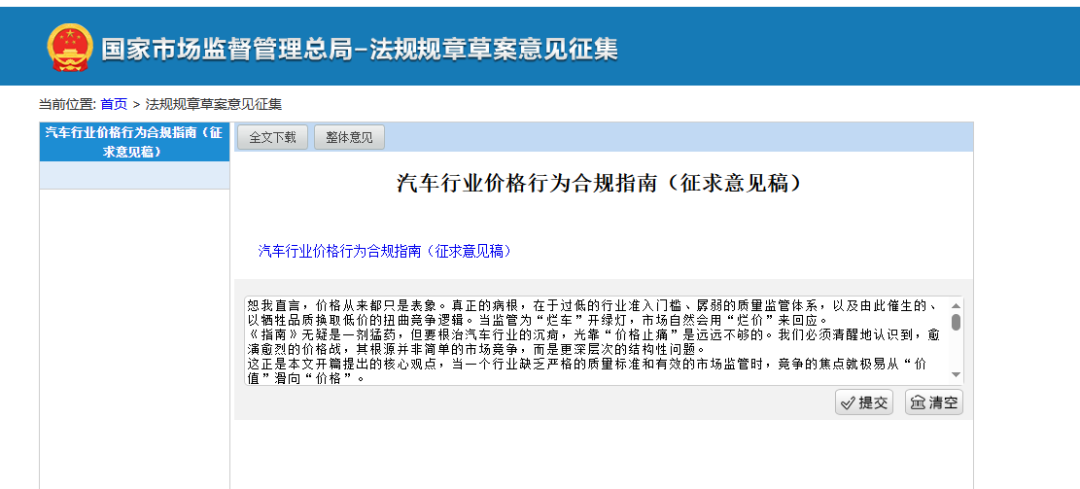

Recently, a document from the State Administration for Market Regulation—the 'Compliance Guidelines for Price Behavior in the Automotive Industry (Draft for Comment)' (hereinafter referred to as the 'Guidelines')—has sparked significant discussion within China's auto industry. However, as of the time the author submitted this article, only 24 individuals had accessed this crucial document, which impacts consumers, industry practitioners, and enterprises alike.

This situation reveals a lack of enthusiasm from the public and industry professionals for participating in policy discussions that directly affect them. Now, let's redirect our focus.

The most contentious provision in the 'Guidelines' is a core red line: prohibiting sales below cost! Suddenly, online interpretations such as "selling cars at a loss will become illegal" proliferated. This seems to suggest that the frenetic 'involution'—which has left automakers struggling, dealers incurring losses, and consumers torn between love and hate—is finally coming to a halt.

Regulators Take Action to Cool Down the Escalating Price War

However, just as we begin to breathe a sigh of relief over this seemingly impending end to the chaos, a deeper question arises: Are the automotive industry's persistent issues truly just about 'price'? Will halting 'sales at a loss' cure this vicious cycle of 'bad money driving out good'?

Let me be frank: Price is merely the surface issue. The real root cause lies in excessively low industry entry barriers, weak quality supervision systems, and a distorted competition logic that sacrifices quality for lower prices. When regulators allow 'subpar vehicles' to enter the market, the natural response is 'subpar pricing.'

The Madness and Trauma of the Price War

To understand the context behind the 'Guidelines,' we must revisit the 'bloody history' of China's auto market in recent years. Since Tesla initiated price cuts in early 2023, the inferno rapidly spread—from new energy vehicles to fuel-powered vehicles (internal combustion engine vehicles), from domestic brands to luxury BBA (BMW, Mercedes-Benz, Audi)—no one was spared.

The intensity of this war defied imagination. In 2023, Tesla's price cuts triggered a chain reaction. BYD achieved 'parity between fuel and electric vehicles' with its 'Champion Edition' models. Hubei Province's 'government-enterprise joint subsidies' slashed the price of the Citroën C6 by half, sparking a nationwide buying frenzy.

In 2024, the war escalated fully. BYD declared 'electric vehicles cheaper than fuel cars,' with the Qin PLUS Glorious Edition entering the 79,800-yuan range. Xiaomi's SU7 debuted at a 'surprise price' of 215,900 yuan. Luxury brands like BMW’s iX1 even offered '50% discounts,' collapsing the entire pricing system.

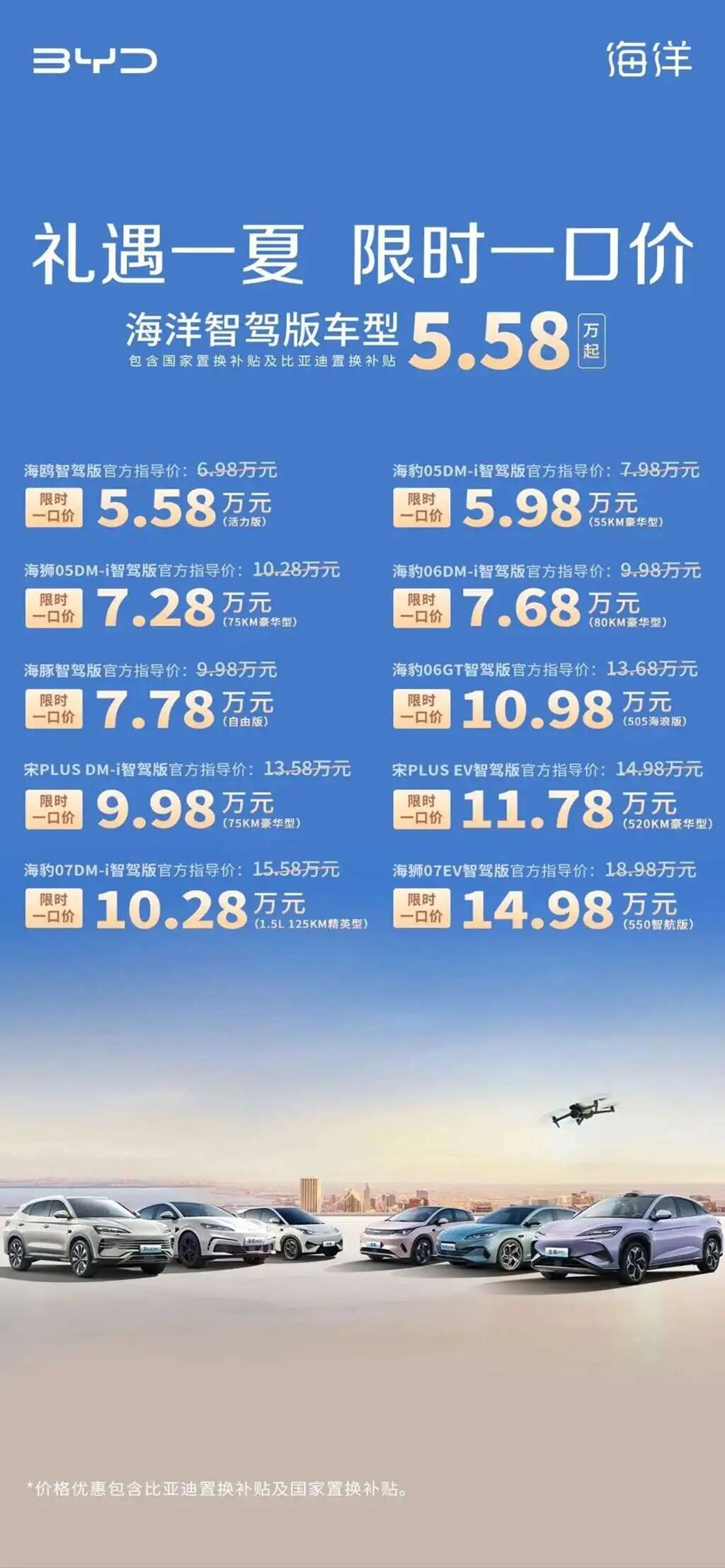

In 2025, the battle commenced on Day One. Over 23 automakers announced price cuts in January alone. BYD launched a massive promotion in May, with the Seagull Intelligent Driving Edition starting at just 55,800 yuan and the Qin PLUS DM-i bottoming out at 63,800 yuan.

In 2025, automakers led by BYD launched fierce price offensives, slashing prices across multiple models.

Behind the 'price-for-volume' frenzy lies severe trauma across the entire supply chain. This is no exaggeration—data reveals a harsh reality.

National Bureau of Statistics data shows the auto industry’s profit margin plummeted from 7.8% in 2017 to just 4.3% in 2024, and further to 3.9% in the first quarter of 2025—far below the average for industrial enterprises.

Profits at giants like GAC and SAIC have collapsed. Even market leader BYD saw its net profit drop 30% sequentially in the second quarter of 2025. New forces like Hetchi, Neta, and HiPhi drowned in losses, teetering on bankruptcy. The China Automobile Dealers Association reported that over 52.6% of dealers operated at a loss in the first half of 2025, with widespread 'price inversion' (selling below cost). Under high inventory pressure, dealers were forced to sell at a loss to earn manufacturer rebates. Nearly 2,000 4S stores exited the network in the first half of 2024, and regional dealer groups frequently 'went bust.'

Widespread dealer losses made store closures and network exits the norm.

Cost-cutting pressure from automakers cascaded down to suppliers, who faced not only annual price reduction demands of 10–15% but also extended payment terms, averaging 182 days—nearly double that of international automakers. The bankruptcy of Marelli, the world’s seventh-largest auto parts giant, sounded an alarm for the traditional supply chain.

Even consumers, who seemed to benefit, faced hidden risks. Bottomless price wars inevitably squeeze R&D and quality investment, leading to 'price cuts at the expense of quality.' China Quality Association data shows a two-year decline in new energy vehicle user satisfaction in 2024. Shrinking after-sales services and orphaned vehicles from bankrupt companies also became prominent issues.

Zhu Huaerong, chairman of Changan Automobile, admitted, 'The fierce competition has placed immense pressure on over 1 million workers across the supply chain.' Li Shufu, chairman of Geely Holding Group, was even more blunt: 'Endless involution will only lead to corner-cutting and fraud.'

It was against this industry-wide 'bleeding' backdrop that regulators finally wielded the 'scalpel.'

Where Is the Real 'Root Cause' of the Price War?

The 'Guidelines' are undoubtedly a strong remedy, but curing the auto industry’s ills requires more than just 'pain relief through pricing.' We must recognize that the escalating price war stems not from simple market competition but from deeper structural issues.

This brings me to the core argument I raised at the beginning: When an industry lacks strict quality standards and effective market regulation, competition inevitably shifts from 'value' to 'price.'

'If markets are highly competitive, laws are sound, and enforcement is strict, transparent competition is beneficial. Otherwise, endless involution will only lead to corner-cutting and fraud.' —Li Shufu, Chairman, Geely Holding Group

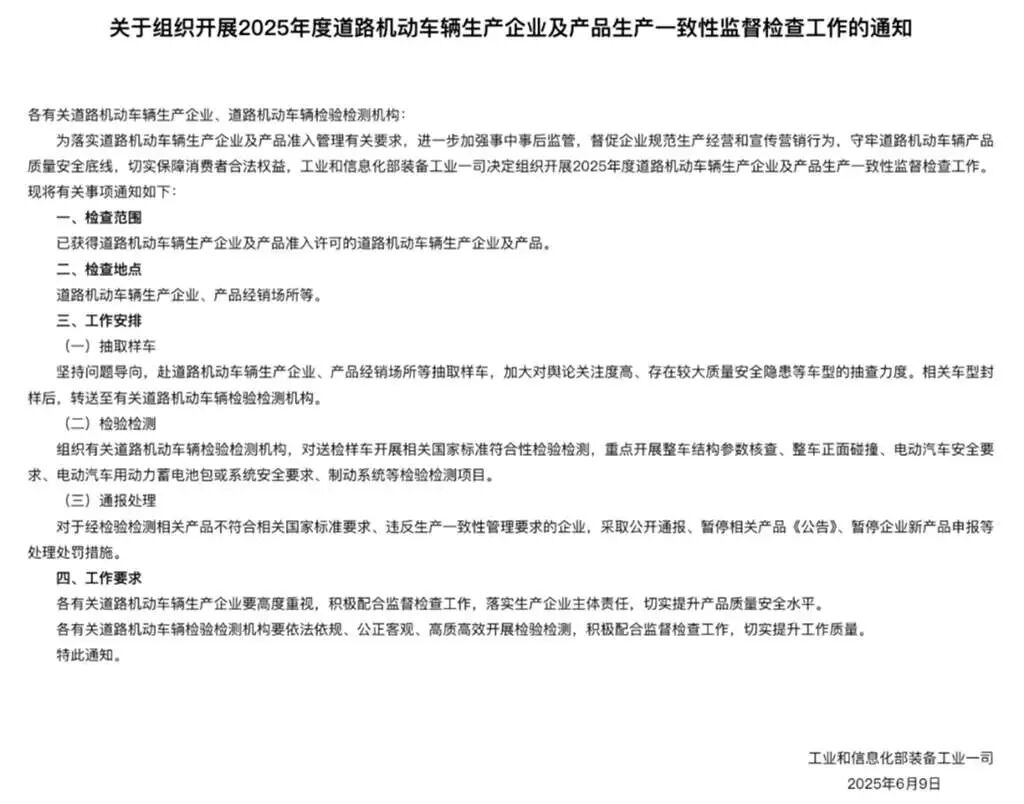

Despite China’s auto industry’s rapid growth in recent years, the risks of 'price-for-volume' persist. Zhang Jinhua, president of the China Automotive Engineering Society, pointed out that prolonged 'price wars' objectively incentivize automakers to sacrifice quality. In June 2025, the Ministry of Industry and Information Technology (MIIT) issued a notice explicitly stepping up inspections of models with significant quality and safety risks—a direct response to industry chaos.

When some companies slash safety standards, use inferior materials, and reduce core configurations to drastically cut costs and flood the market with irresistibly low prices, quality-focused, R&D-driven firms are trapped in a 'acclaimed but unpopular' dilemma. This is classic 'bad money driving out good.' The 'Guidelines' ban on sales below cost aims to break this vicious cycle, but a more fundamental solution lies in comprehensively upgrading mandatory national standards for the auto industry and establishing a 'strict entry, strict exit' regulatory framework to keep low-quality products out of the market from the start.

MIIT Strengthens Product Consistency Inspections

Another direct trigger for price wars is severe supply-demand imbalance. By 2024, China’s new energy vehicle production capacity reached 40 million units, but actual sales were only around 12.87 million. Massive idle capacity and inventory pressure forced automakers to slash prices to digest stock and keep factories running.

Xiao Zhengsan, president of the China Automobile Dealers Association, noted that the industry is undergoing a profound shift from 'scale-driven' to 'demand-driven' growth. The old 'produce-first, sell-later' model must change. However, this transformation is painful. Automakers, burdened by heavy fixed asset investments and employment pressures, cannot easily cut production and instead pass the pressure to the sales end, creating a vicious cycle.

One overlooked phenomenon is why some automakers can sustain 'selling at a loss for hype.' The answer may lie in local governments’ 'subsidy magic.'

To attract automotive manufacturing—a major contributor to GDP and tax revenue—some local governments offer low-cost land supply, tax breaks, R&D subsidies, and preferential municipal contracts to prop up local automakers. Industry insiders revealed that while a model’s factory price may be below cost, local comprehensive subsidies can still make it profitable per unit. This 'subsidy economics' distorts market signals, keeping 'zombie companies' alive and intensifying disorderly competition.

While the 'Guidelines' ban corporate-level sales below cost, defining and regulating these hidden local subsidies will pose a massive challenge post-policy implementation.

Where Will the Auto Market Head?

The 'Guidelines' mark a milestone in China’s auto industry maturation. They draw a legal red line against brutal price wars, but the market battle is far from over.

This is what consumers care about most. Short-term price hikes of 5–10% are likely for models previously sold at heavy losses. 'Rock-bottom prices' will become rare. For 'wait-and-see' consumers, the window for extreme low prices may be closing.

Regulating prices doesn’t mean raising them. Healthy competition drives costs down through technological progress and economies of scale, ultimately benefiting consumers. This is the hallmark of a mature market.

Of course, policy implementation won’t happen overnight. How to scientifically calculate complex automotive costs? How to define varied dealer rebates? How to regulate 'disguised dumping' through financial incentives or high-value gifts? These gray areas will become focal points of future regulatory-market clashes.

Regardless, the direction is clear. As the state cracks down on pricing chaos, China’s auto industry stands at a crossroads between 'wild growth' and 'refined operation.' This transformation, sparked by the 'Guidelines,' may bring short-term pain but will pave the way for China to nurture world-class auto giants in the long run.

Farewell to bottomless price wars. Let competition return to value itself. This isn’t just about saving an industry—it’s about respecting all market participants, including every consumer.

The 'Compliance Guidelines for Price Behavior in the Automotive Industry (Draft for Comment)' is still open for public feedback until December 22, 2025. I’ve submitted my suggestions and hope industry leaders will join the discussion!

Editor: Nick

Disclaimer: This article is based on publicly available information or data provided by interviewees. However, Caigou Business Review and the author do not guarantee the completeness or accuracy of the information or associations mentioned and do not represent any institutional stance. For infringement issues, please contact us for removal. Under no circumstances shall the information or opinions in this article constitute investment advice to any individual.

▼

-END-