Is there a Great Potential in the New Energy Vehicle Market for 'Large' Vehicles?

![]() 12/22 2025

12/22 2025

![]() 595

595

Lead | Introduction

As the new energy vehicle market gets ensnared in a whirlpool of homogenization, automakers are gradually shifting from 'competing on specifications' to 'understanding lifestyles.' For most Chinese consumers, the ultimate driving experience entails having it all: 'room for the whole family, ample luggage space, ease of driving with a commanding presence, and cost-effectiveness with power.' Thus, the wave of large new energy vehicles is upon us.

Published by | Heyan Yueche Studio

Written by | Cai Yan

Edited by | He Zi

Full text: 2,206 characters

Reading time: 4 minutes

The trend of consumers favoring large vehicles is evident from sales data.

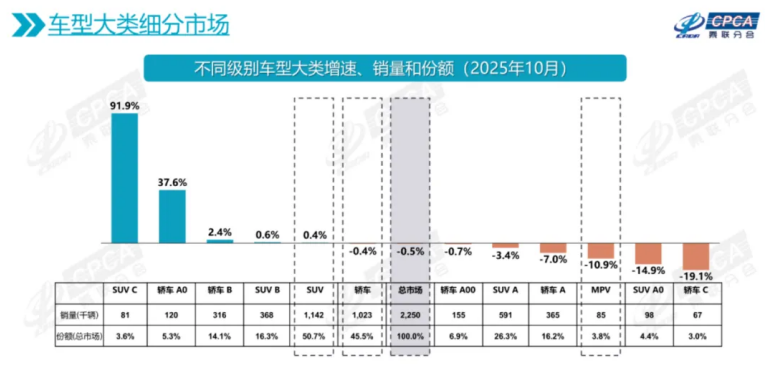

According to the China Passenger Car Association (CPCA), sales of C-class SUVs (including mid-to-large and large SUVs) increased by 26.5% year-on-year in 2024. By October of this year, sales of C-class SUVs surged by 91.9% year-on-year, with cumulative sales from January to October exceeding 40%, making it one of the fastest-growing market segments.

Focusing on best-selling models, the AITO M9 achieved cumulative deliveries exceeding 250,000 units within 21 months of its launch, setting a new delivery record for models priced at 500,000 yuan. The Li Auto L9 is nearing 300,000 cumulative deliveries. The Fangchengbao Titan 7 sold over 20,000 units in October, just one month after its September launch. The Zeekr 9X delivered over 10,000 units in November, even experiencing instances of scalpers snapping up orders. Models like the Leadao L90 and NIO ES8 have become lifesavers for their brands.

China's large new energy SUVs are staging a blue ocean land grab. A rough count reveals that over 15 new mid-to-large/large new energy SUVs emerged on the market from late 2024 to 2025. Behind these numbers lies not only automakers' anxiety about keeping pace with trends but also a question: Why are automakers making vehicles larger in the second half of the new energy era?

The Synergy Between Consumers and Automakers

The fundamental reason lies in the clever synergy between Chinese consumers and automakers: consumers love large vehicles, and automakers are happy to build them.

From the consumer's perspective, whether it's the practical needs of two-child or three-child families requiring six-seater vehicles for five-person outings or the 'better safe than sorry' consumer mindset, the core reason for favoring large vehicles is the lowered barriers to purchasing and using them in the new energy era.

In the fuel vehicle era, purchasing large vehicles required considering fuel economy, the tiered vehicle and vessel tax corresponding to large-displacement engines, and the high driving skill requirements for large vehicles. These pain points have been completely resolved in the new energy vehicle era—pure electric models address economic usage concerns, while electrification and intelligent technologies reduce the driving difficulty of large vehicles.

In real-world usage scenarios, concerns about cumbersome handling of large vehicles are mitigated by rear-wheel steering, which significantly optimizes turning radii. Difficult parking situations are resolved by intelligent parking and traced reverse parking in extreme scenarios.

Undeniably, the rapid growth of the C-class SUV segment may be related to price reductions, original BBA owners switching to domestic brand new energy large six-seater SUVs, or the impending 2026 halving of new energy vehicle purchase taxes. However, considering all factors, consumers ultimately desire a large vehicle that 'accommodates the whole family with luggage, drives easily with a commanding presence, and is cost-effective with power.' This mindset shares similarities with the logic behind pursuing large residential units.

Even excluding family vehicle factors, large vehicles can meet mild business reception needs. Typical examples include models like the AITO, high-end Li Auto series, Zeekr 9X, and LanTu Taishan. As the wheelbase and space of these large vehicles nearly match those of mid-to-large MPVs while offering six or seven-seater layouts, their 'refrigerator, TV, and comfortable sofa' configurations, along with superior driving comfort and intelligent performance, clearly outperform mid-to-large MPVs of the same size.

Thus, reflected in sales data, according to CPCA statistics, MPV sales reached 85,400 units in October, down 10.9% year-on-year. From 2022 to the first three quarters of 2025, MPV market share stabilized at 4%, but it dropped to 3.8% in October, indicating increasingly apparent market contraction. Friends closely following the new energy vehicle market can also sense this shift in automakers' new product launch rhythms. From 2023 to 2024, automakers were more inclined to launch MPVs but have shifted their focus to large six-seater SUVs this year.

From the automakers' perspective, the rush to build large vehicles is more importantly driven by profits, especially amid intense competition and shrinking profit margins in mainstream segments. Large vehicles offer more room for premium pricing and profits. Data shows that compact pure electric vehicles have a gross margin of only 8%-10%, while large extended-range SUVs generally reach 18%-22%. This is particularly evident at Li Auto, which, despite a continuous decline in gross margin in 2025, still achieves decent net profits.

Additionally, in terms of corporate strategy, focusing on large vehicles plays a significant role in establishing a premium brand image and achieving upward brand breakthroughs, acting as a showcase of strength. Taking Leapmotor as an example, its previously best-selling models were concentrated in the 100,000-150,000 yuan SUV segment. With the launch of the D19, Leapmotor officially stated that the D series aims to reshape consumer perceptions of Leapmotor as a 'volume seller relying on cost-effectiveness' and redefine value anchors.

The trend of automakers building larger vehicles is a result of mutual demand and production considerations. However, in today's fiercely competitive market, building large vehicles does not necessarily equate to 'great potential.'

Is There Really Great Potential?

While several large six-seater SUVs in 2025 have revitalized brand popularity through their product strength, further exploration reveals that amid the 2026 trend of halving new energy vehicle purchase taxes and diminishing marginal effects of market land grabs for large vehicles, can large vehicles continue to be the key to brand turnarounds?

Examining sales charts, it's evident that to sell large vehicles profitably and at premium prices, automakers must not only ensure their products have no fatal flaws or shortcomings but also establish a perfect (again, assuming correction to 'well-established') well-established supporting system in marketing, services, energy replenishment, and delivery. Even brand image significantly influences consumers' final decisions.

Take the October dark horse in the plug-in hybrid mid-to-large SUV segment, the Fangchengbao Titan 7, as an example. Its greatest strength lies in precise market positioning—intelligence + light off-roading + heavy scenario integration + lifestyle—which became the key to its standout success in BYD's premium lineup, rather than simply being 'large and luxurious.'

If the Fangchengbao Titan 7 naturally benefits from a strong brand effect, let's consider the Leadao L90 and NIO ES8. Before these two models' launch, market sentiment questioned NIO's 'survival,' highlighting its brand image challenges. Ultimately, what made the Leadao L90 and NIO ES8 lifesavers for the brand was their 'price + service + delivery + energy replenishment' supporting strategies, rather than 'front trunks' or 'marathon-style launch events.'

Selling large vehicles may seem 'full of potential,' but it's actually challenging. On one hand, the larger the vehicle, the higher consumers' expectations for effective interior space, posing greater technical and engineering challenges for automakers. Again, taking the Leadao L90 as an example, to create front trunk space, 49 components were integrated into one self-developed module. On the other hand, with more large vehicles expected to flood the Chinese auto market in 2026, automakers face a red ocean, making it no easy task to precisely identify market entry points and product labels.

Commentary

2025 has become a banner year for large vehicles, with models like the Fangchengbao Titan 7, Geely Galaxy M9, and Leadao L90 gaining significant traction in the market. With upcoming focus from Li Auto (new L9), Xiaomi (large SUV), and Huawei-affiliated models in this segment, another wave of intense competition is inevitable in 2026.

(This article is original to 'Heyan Yueche' and may not be reproduced without authorization.)