Profit Announcements Galore: Why Are Emerging EV Makers Focusing on Q4 This Year?

![]() 12/29 2025

12/29 2025

![]() 452

452

On December 25, ZHIJI's CEO Jiang Jun and Co-CEO Liu Tao revealed in an internal memo to all staff that the brand achieved its first instance of "full-cost profitability" in December. This milestone positions ZHIJI as the fourth profitable independent new entrant in the EV market, following Li Auto, Leapmotor, and VOYAH.

This year, emerging EV manufacturers like XPENG and NIO, along with certain upstream firms and suppliers, have all set their sights on Q4 as the period to achieve profitability. Many are curious about the clustering of profitability milestones at the year's end. What makes this timeframe so significant?

Amidst impending changes in purchase tax policies and evolving market dynamics, ZHIJI's monthly profitability offers a snapshot of broader industry transformations.

This achievement is not merely a standalone success but also signifies the conclusion of the elimination phase fueled by red-chip investments, ushering in an era of market-driven competition centered on profitability.

Editor|Li Jiaqi

Image Source|Internet

1

Q4 Profitability Surge: No Mere Coincidence

The selection of Q4 as the profitability window is not solely attributed to its status as a peak sales period, providing inherent opportunities for interim profitability. Beneath this synchronized decision lies a necessary response to dual pressures from policy shifts and the evolving stage of industry development.

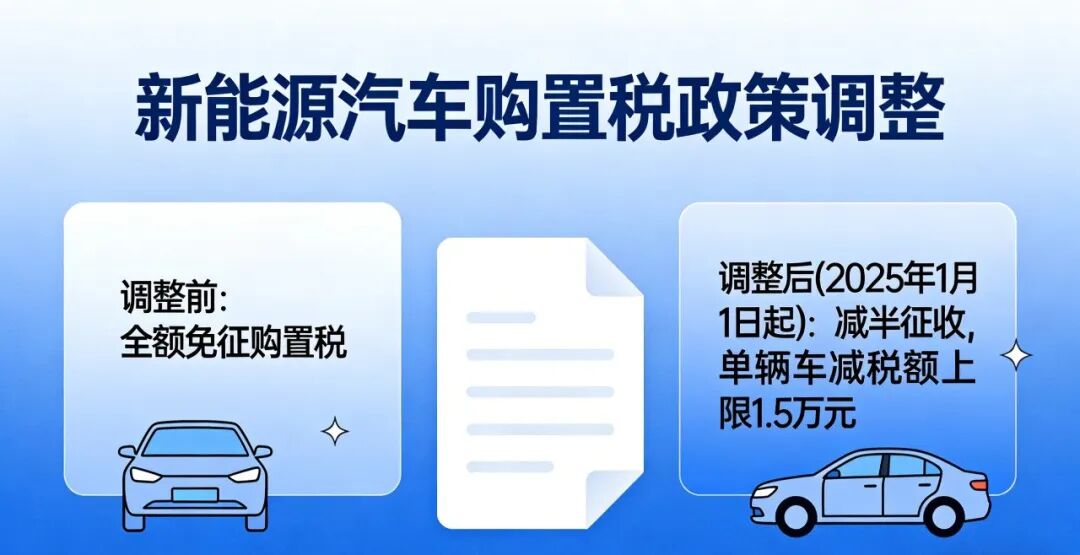

Starting January 1, 2025, the longstanding preferential purchase tax policy for new energy vehicles (NEVs) will undergo modifications. This prompts price-conscious consumers to reassess the cost-effectiveness of NEVs relative to traditional fuel vehicles. Demonstrating profitability and sustainability before the policy benefits wane serves as a vital endorsement of brand strength and long-term service capabilities.

Conversely, the policy-induced surge in vehicle purchases can effectively bolster sales volumes. Some consumers, considering the preferential policies, might expedite their purchases. This "final dividend" from policy changes offers crucial external conditions for automakers to attain single-quarter profitability.

After over a decade of development, the NEV market has transitioned from a "blue ocean" to a "red ocean." Previously, during rapid expansion, companies could capture market share through subsidies, price reductions, and marketing hype, with consumers having relatively vague brand perceptions and low loyalty. As the market matures, competition now hinges on technological prowess, cost management, and comprehensive system capabilities. Profitability and gross margin levels have increasingly become core indicators of corporate health, eclipsing mere sales figures.

In this context, Q4 has emerged as a pivotal "window period" for new entrants to demonstrate their sustainable competitiveness and viability to the market. Missing this opportunity could substantially heighten the challenge of achieving profitability next year, amidst diminishing policy benefits and intensified competition, potentially leading to marginalization.

Reflecting on the past, emerging EV makers have navigated through their initial "novice protection phase," with market differentiation becoming apparent. The time has arrived for profitability. Persistent losses and prolonged profitability timelines not only escalate market pressure but also erode investor confidence.

2

Three "Profitability Narratives" Among Emerging Forces

As profitability becomes a prerequisite for new entrants, the market differentiation landscape becomes more pronounced. Based on profitability performance, cash flow capabilities, and risk resilience, profitable or potentially profitable new entrants can be categorized into three tiers, each with distinct value propositions.

The first tier comprises companies achieving scalable profitability, exemplified by Seres. Through robust scaling effects, cash-based manufacturing capabilities, and leading per-unit profits, Seres has established not just interim profitability but a sustained, stable scalable profitability model.

The second tier includes companies like Li Auto and Leapmotor, which have attained single-quarter profitability and possess the foundational capabilities for sustained profitability. Despite occasional fluctuations, such as Li Auto's RMB 624 million loss in Q3 due to vehicle recalls, their positive profitability frameworks have been largely validated, with limited market concerns.

Also in this tier are Zeekr and Xiaomi. Backed by Geely's ecosystem, Zeekr has garnered recognition for its brand positioning and product strength in the premium pure EV market, with long-term profitability potential widely anticipated. Xiaomi, as a newcomer, generates high market expectations for its profitability prospects due to its vast ecological momentum and fan base.

Common to this tier is a clear demonstration of profitability capabilities and "paths," with the current task being to translate these into stable, repeatable financial results.

The third tier encompasses "state-owned new forces" like VOYAH and SHENLAN, including ZHIJI, which announced monthly profitability. Leveraging group resources, they achieve specific accounting metrics or interim break-even points. Compared to some first-generation innovators, their pace may be slower, but backed by large automotive groups like Dongfeng, Changan, and SAIC, they excel in risk resilience across supply chains, funding, and technology.

Long-term observers of the automotive industry will note that new entrants with group affiliations, having completed initial market accumulation and product matrix refinement, are transitioning from survival mode to offensive strategies. They could become the biggest variables in the next market phase, even "overtaking" leaders.

ZHIJI's profitability announcement at its fifth anniversary may signal this shift.

3

State-Owned New Forces: Transitioning from Defense to Offense Next Year!

A discernible trend is that state-owned new forces, including ZHIJI, are accelerating their path to independent capitalization.

In October, VOYAH formally submitted its application to list on the Hong Kong Stock Exchange via an introduction, marking a substantive phase in its listing plans. While ZHIJI has not announced explicit listing news, SAIC's earlier move to directly hold RMB 5.399 billion in registered capital of ZHIJI Auto, previously held by Yuanjie Fund, through physical distribution is seen as preparation for a subsequent listing.

Independent financing and listings enable brands to gain independent valuations and resources through capital markets, securing stronger funding for R&D, channel expansion, and brand marketing. This allows them to compete more agilely, forming a positive cycle of "profitability-investment-larger scale-stronger profitability." Such enterprises may become new investment targets in capital markets.

From a developmental perspective, these companies or brands are entering a "concentrated realization phase" for scale, technology, and products.

In November, VOYAH Taishan officially launched, nearly simultaneously with ZHIJI's LS9. According to automotive industry patterns, a new model typically requires around three months to ramp up production from launch. This ramp-up period coincides with year-end policy windows and peak consumption seasons. Once production ramps up, state-owned new forces like ZHIJI and VOYAH are expected to witness significant market sales growth.

This implies that next year will herald a new round of competition following market differentiation. First-tier brands will leverage stable profitability and cash flow to accelerate technological iteration and new model launches. Second-tier companies will focus on enhancing profitability stability, aiming for full-year profits. Third-tier state-owned new forces may leverage group resource advantages and accelerated development to overtake competitors.

However, profitability will no longer be the ultimate goal but the entry ticket. Only profitable enterprises can participate in the next round of competition in technology, products, and branding. This explains why Q4 has been targeted as the "profitability window" this year.

End