Large Six-Seater SUVs Exert Substantial Pressure on MPVs

![]() 12/29 2025

12/29 2025

![]() 565

565

Lead-in

Introduction

The large six-seater SUV is experiencing a resurgence, yet the MPV's 'golden era' is far from concluding.

“I'd rather endure tears in a large six-seater SUV than experience a mere smile in an MPV.”

In the latter half of this year, numerous consumers have echoed similar sentiments. From their perspective, large six-seater SUVs boast a plethora of advantages over MPVs, encompassing more cutting-edge designs, luxurious features, a more comfortable driving experience, and superior off-road capabilities. In essence, large six-seater SUVs appear to 'overshadow' MPVs in their eyes.

While MPVs possess their own unique strengths and are even irreplaceable in certain aspects, the outcomes of this year's competition between large six-seater SUVs and MPVs suggest that the former may hold the upper hand. Particularly with the introduction of multiple large six-seater SUVs in the latter half of the year, such as the Geely Galaxy M9, NIO ES8, and Denza N9, spanning a price range from 100,000 to 500,000 yuan, the market competition between six-seater SUVs and MPVs has intensified further.

Under their influence, significant transformations are unfolding within the MPV market. Data reveals that cumulative MPV sales in the first 11 months of 2025 reached 936,000 units, marking a year-on-year increase of 1.7 percentage points. However, cumulative sales in the latter half of the year (July-November) witnessed a decline of over 4 percentage points year-on-year, indicating a market downturn and a reduction in overall market share compared to the same period last year.

In contrast, sales of large six-seater SUVs reached 368,000 units from January to July 2025, representing a year-on-year increase of over 40%. With sustained stable performance in the latter half of the year, sales of large six-seater SUVs in 2025 are projected to exceed one million units for the first time, marking a significant turning point in the Chinese auto market.

01 Who is Taking MPV's Market Share?

Once upon a time, the MPV market was perceived as the automotive industry's last untapped blue ocean. With the advancement of multi-child policies and the upgrading of family travel needs, spacious and comfortable MPV models have ushered in unprecedented development opportunities.

During this period, established players like the Toyota Sienna and Buick GL8 continued to dominate the charts, while new entrants like the Wey High Mountain and Denza D9 injected fresh vitality into this segment, creating a vibrant and diverse market landscape. On one hand, we have the market heritage and reputation of the 'veterans,' and on the other, newcomers are driving product innovation through intelligence and electrification, collectively propelling MPVs to the forefront of family vehicles.

However, market trends often shift more rapidly than anticipated.

In 2025, a potent 'diversion' force quietly emerged: the collective surge of large six-seater SUVs began to erode MPV's market share. This has led to a slowdown in sales growth for once-popular MPV models that routinely sold over 10,000 units per month. For instance, in the November 2025 MPV sales rankings, only the Wey High Mountain at the top sold over 10,000 units, while the Voyah Dreamer, Toyota Sienna, and Buick GL8 struggled below the 10,000-unit mark.

Meanwhile, a new batch of products emphasizing 'true six-seater' configurations, blending SUV off-road capability with MPV comfort, are rapidly capturing the attention of family users.

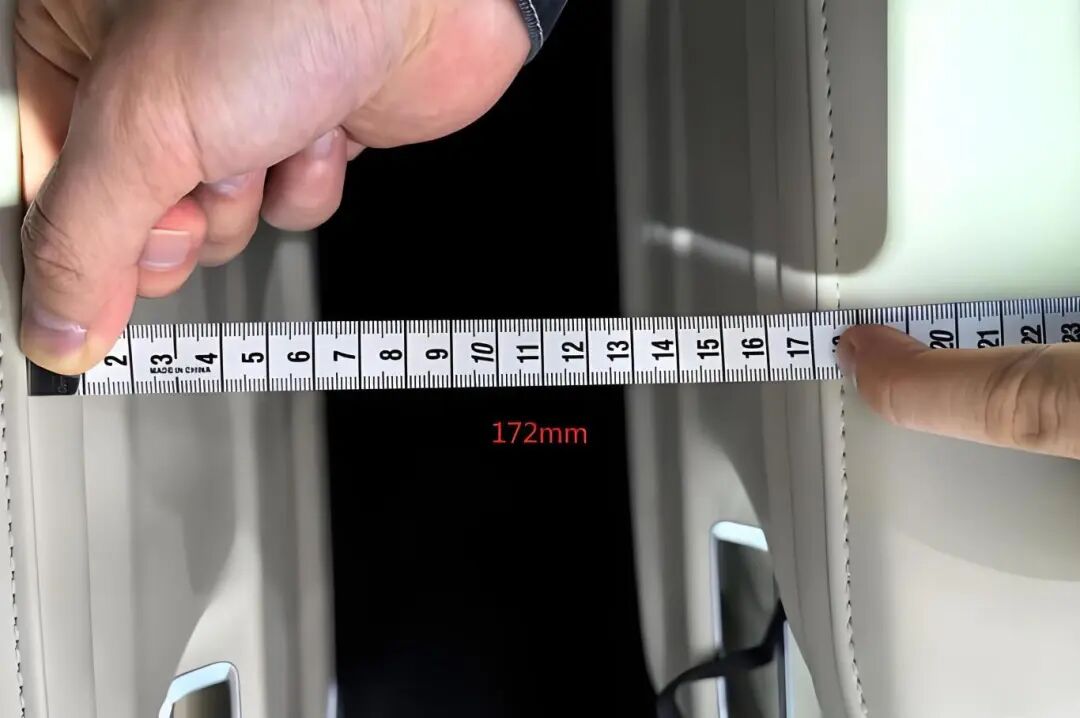

From the Geely Galaxy M9 and NIO ES8 to the Denza N9, a series of six-seater SUV models covering the 100,000 to 500,000 yuan price range have flooded the market, precisely meeting family users' demand for 'comfort for all.' These models not only address the pain point of the cramped and inconvenient third row in traditional seven-seater SUVs but also attract consumers who were previously undecided between MPVs and SUVs with their more stylish designs, car-like driving experiences, and inherent SUV off-road capability.

The rise of large six-seater SUVs is essentially a precise strike targeting 'unmet demand.'

Early seven-seater SUVs, while offering more seats, failed to meet the expectations of multi-child families for 'respect for every member' due to their narrow third row and inconvenient access. Traditional MPVs, despite their spaciousness and comfort, often struggle to shed their 'business vehicle' or 'nanny car' image, lacking the appeal for family users who seek style and driving pleasure.

Thus, the 'true six-seater' segment was born. It cleverly bypasses the design limitations of MPVs, achieving MPV-level comfort and space flexibility through independent second-row seats, wide central aisles, and flat floors. At the same time, it retains the SUV's stance, higher ground clearance, and stronger road adaptability, fulfilling users' comprehensive expectations for a 'versatile vehicle.'

As a result, we have witnessed the market's response: in less than a year, large six-seater SUVs have rapidly evolved from an untapped blue ocean to a fiercely competitive red ocean. Some users even joke, 'I'd rather endure tears in a large six-seater SUV than experience a mere smile in an MPV.' This slightly exaggerated remark reflects the deep-seated shift in consumer preferences.

02 The 2026 Counteroffensive and Standoff

Faced with the erosion of market share, the MPV camp is not sitting idly by. In 2026, a series of high-profile MPV models are poised to launch, ready to make a new impact on the market.

For example, the Luxeed V9 from HIMA is expected to feature Huawei's latest intelligent cockpit and autonomous driving technologies; the Buick Electra, a pure electric version, will build on the legacy of traditional American luxury MPVs; the XPENG X9 Pure Electric, leveraging XPENG's tech DNA, will attract younger users; and the Mercedes VLE will stir up new waves in the high-end luxury MPV segment.

These new models collectively signal that MPVs are striving to break free from the 'business vehicle' stereotype and evolve towards greater technology, style, and family orientation. They not only continue to excel in space and comfort but also fully upgrade in terms of intelligence, electrification, and design aesthetics, aiming to launch a 'value counteroffensive' against large six-seater SUVs at the product level.

However, on the other side of the battlefield, the offensive from large six-seater SUVs shows no signs of slowing down.

Based on current information, a large number of new large six-seater SUV models are also set to debut in 2026, including the IM LS8, Zeekr 8X, Leapmotor D19, SAIC Volkswagen ID.ERA 9X, and the Loxtone ADAMAS, which was launched at the end of 2025. These models encompass new energy vehicles from emerging brands, high-end traditional automakers, and joint ventures.

Against the backdrop of a thriving large six-seater SUV market, these vehicles will continue to explore comfort and flexibility while engaging in more intense competition in terms of intelligent cockpits, driving range, driving experience, and even price ranges.

Clearly, this 'war' is no longer a simple competition between MPVs and SUVs but has escalated into an ultimate showdown of 'multi-person travel solutions.' Regardless of how the battle unfolds in 2026, one thing is certain: intense market competition will ultimately benefit consumers.

Because the mutual 'intense competition' between MPVs and large six-seater SUVs will compel automakers to continuously innovate in product design, space utilization, comfort configurations, intelligent technologies, and cost control. Family users will have more abundant and higher-quality options than ever before. Whether they choose the ultimate space and comfort of an MPV or the all-around balance and style of a large six-seater SUV, the decision lies entirely in the hands of the users.

This category competition triggered by changing demand will undoubtedly make the future automotive market even more vibrant. While the 'golden age' of MPVs may face challenges, a more diverse, segmented, and user-centric 'new era of multi-person travel' is accelerating its arrival. The show has just begun.

Editor-in-Chief: Li Sijia Editor: Chen Xinnan

THE END