Claiming 2.3 Billion Yuan in Compensation! Why Did Zeekr and Sunwoda Have a Falling-Out?

![]() 12/29 2025

12/29 2025

![]() 452

452

Lead-in

Introduction

Is the issue rooted in a product quality defect from the battery supplier, or is it a failure in system integration and quality control by the vehicle manufacturer?

On December 26, Sunwoda released an announcement that brought itself and the power battery issues that have drawn significant attention in the new energy industry into the spotlight.

Sunwoda's subsidiary, Sunwoda Electric Vehicle Battery Group, has been sued by VREX Electric, a 51%-owned subsidiary of Zeekr responsible for packaging and the three-electric systems (battery, motor, and electronic control). The lawsuit alleges quality issues with cells delivered from 2021 to 2023, and the claim for compensation amounts to a staggering 2.314 billion yuan, equivalent to two years' net profit attributable to shareholders of Sunwoda.

This figure not only sets a new record for the claimed amount in a case involving a "host manufacturer's affiliate suing a supplier" in China's new energy sector but also, as the "first case of an automaker suing a battery company," is poised to become a significant event that will shake the entire upstream and downstream supply chain in the current new energy vehicle sector.

Following the disclosure of this information, it has sparked heated discussions among netizens. Many voices condemn the battery quality of Sunwoda and extend their doubts to all automakers and brands using Sunwoda batteries. There are also numerous voices questioning Zeekr's supply chain management and motives for "shifting blame." However, Zeekr's move to provide free battery replacements for a group of 001 owners starting at the end of 2024 has received relatively widespread approval.

Of course, the ultimate escalation of this matter from negotiation between the two parties to a legal battle, along with the heated discussions among netizens, points directly to the core conflict of the issue: Is it a "product quality defect" from the battery supplier or a "failure in system integration and quality control" by the vehicle manufacturer? Currently, there is no clear answer.

However, the initiation of this dispute will trigger in-depth discussions and reflections among the upstream and downstream industry chains and the public on the responsibility boundaries and the cost-quality balance within the new energy vehicle industry chain.

01 Why Did Zeekr Tear Off the Cooperative Veil?

In the automotive industry chain, the relationship between OEMs (Original Equipment Manufacturers) and suppliers has always been close-knit. The former relies on the latter's production capacity and technology to ensure timely delivery, while the latter depends on the former's orders for scale expansion. Even when occasional quality frictions occur, they are mostly resolved through private negotiations and after-sales compensation.

In this particular lawsuit, for leading players like VREX Electric (affiliated with Zeekr and backed by the Geely system, a major automaker) and Sunwoda (a top-ten global power battery company), "safeguarding reputation" is a fundamental principle for maintaining industry standing. However, Zeekr's decision to confront Sunwoda with legal means this time may stem from unbearable actual losses and a collapse of trust.

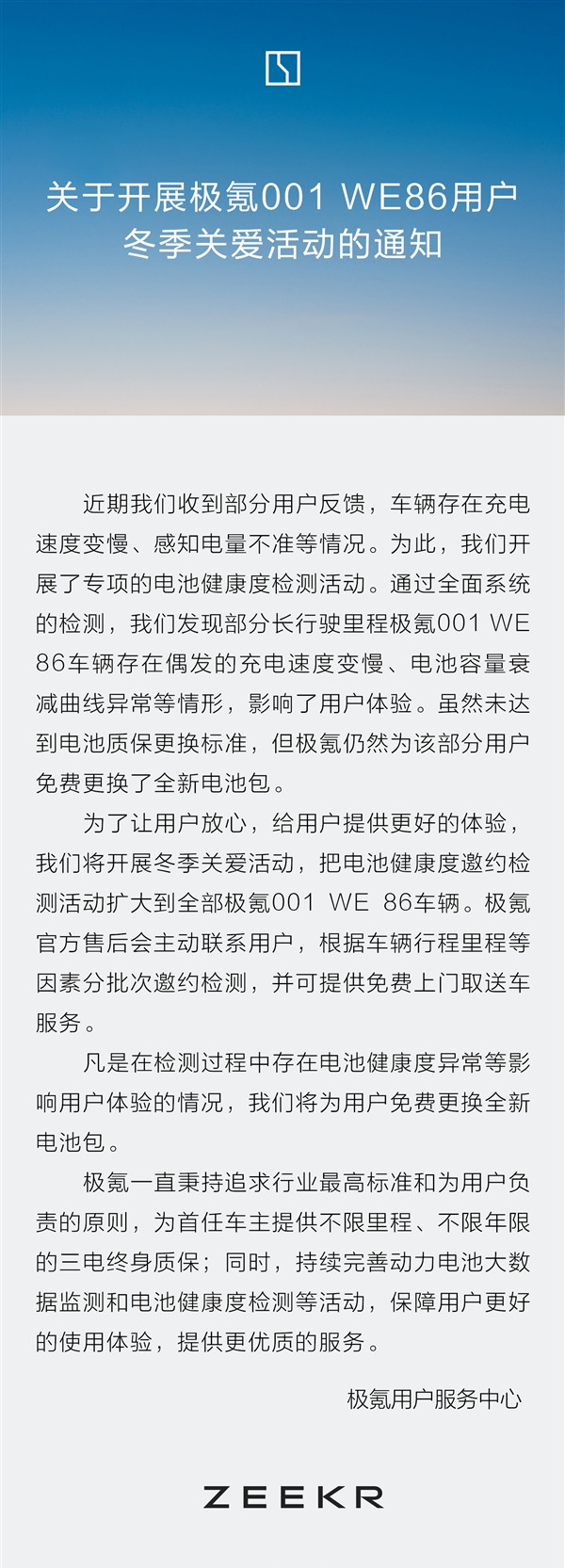

The most direct evidence is Zeekr's "Winter Care Campaign" launched at the end of 2024 for the 001 We 86 model. This campaign essentially involved free battery pack replacements for this batch of models equipped with Sunwoda cells due to identified issues.

According to widespread feedback from owners, this batch of Zeekr 001 models generally experienced issues such as a sharp drop in charging speed, unstable voltage, battery capacity degradation, and inflated range claims. Considering the immense negative public opinion pressure Zeekr 001 faced in 2024 due to "three major upgrades in one year," Zeekr had to "passively cover" for the cell quality issues, possibly to mitigate the impact while balancing user experience and supply chain relationships.

However, when the scale of losses from battery replacements exceeds a critical threshold, legal claims become an inevitable choice. According to industry estimates, the 86kWh battery pack used in the Zeekr 001 We 86 costs approximately 150,000 yuan per replacement. With cumulative sales of over 80,000 units from its launch in 2021 to 2023, although only the low-end trim used Sunwoda cells, at least nearly 10,000 vehicles require battery replacements, incurring costs in the billions of yuan.

Additionally, the "zero spontaneous combustion" record was terminated due to cell quality issues, disrupting product development and launch schedules, along with subsequent negative effects. Zeekr's direct setting of commercial losses at 2.314 billion yuan seems somewhat justifiable.

In fact, signs of issues with Sunwoda cells could be detected from Zeekr's abnormal product iteration logic starting in 2024. Beginning with the 2024 new Zeekr 001 model, Zeekr directly excluded Sunwoda cells, upgrading the starting trim's power battery to CATL's lithium iron phosphate battery, thus cutting ties with the problematic cells.

However, some netizens raised doubts, questioning why the root cause couldn't be attributed to VREX's battery packaging process or battery management system issues. Shouldn't the responsibility be entirely "shifted" to the supplier? This argument overlooks Geely's deep expertise in the power battery sector. Distinguishing whether the root cause lies in cell quality defects or packaging process errors is not technically difficult.

Of course, both macro and micro issues contributed to this outcome. For instance, from 2021 to 2023, the new energy industry was in the midst of a "capacity frenzy." During this period, global battery cathode material prices soared due to supply-demand imbalances. Some companies, if slightly careless, could easily fall into an irrational state of "shipping products regardless of consistency."

The core safety logic of power batteries precisely relies on cell consistency. When a batch of cells has differences in voltage, capacity, and internal resistance, local overloading can easily occur during charging, leading to thermal runaway and fires. During discharging, it may result in a sudden drop in range, power interruption, or even triggering the manufacturer's backend "battery locking" protection, which aligns perfectly with the issues reported by Zeekr 001 WE86 owners.

More crucially, in the more than one year from detecting vehicle abnormalities and initiating free battery replacements for owners in 2024 to the formal lawsuit at the end of 2025, Zeekr and Sunwoda must have engaged in private negotiations. After all, they are also good partners with a cooperative foundation through the Shandong Geely Sunwoda joint venture.

The author believes that both parties' ultimate decision to go to court indirectly confirms the severity of the issue. On one hand, Geely may have gathered sufficient evidence to prove cell quality issues, but Sunwoda refused to assume compensation liability commensurate with the losses. On the other hand, the scale of losses may have far exceeded the capacity for internal negotiation, with both parties unable to reach a consensus on the compensation amount and liability allocation ratio, effectively closing the negotiation channel.

02 Industry Anxiety and Sunwoda's Dual Test

Reviewing Geely's past litigation cases, in 2023, it sued WM Motor for infringement with a claimed amount of 2.1 billion yuan and ultimately won a compensation of 650 million yuan. This shows that Geely typically possesses substantial evidence before initiating large-scale lawsuits, implying that Zeekr's 2.3 billion yuan claim this time is not "groundless."

After the case was exposed, the two most concerning questions from the outside world are: Will other automakers using Sunwoda batteries (such as Li Auto and Nissan) be affected?

Based on current information, there is no need to excessively amplify this anxiety. On one hand, the cells involved in this incident are from specific batches delivered from 2021 to 2023. Sunwoda supplies cells to different automakers from different production lines, and technical standards vary across brands. It is incorrect to negate all products based on "one batch's issues."

However, from a reputation standpoint, Sunwoda currently does not rank among the top players, with an industry share of only 3-4%, lacking a strong leading position.

Nevertheless, the current true test is also one that Sunwoda must face in its own development process. Many netizens believe that this incident is at least a significantly unfavorable factor for Sunwoda's stock price and may trigger a decline over a certain period. The intertwining of short-term stock price volatility and long-term operational uncertainty makes investment decisions challenging. After all, from a financial perspective, the claimed compensation amount of 2.314 billion yuan is close to the combined net profit attributable to shareholders for Sunwoda in 2023-2024 (2.544 billion yuan). If ultimately found liable, it would directly erode over a year's profit for the company.

Sunwoda also stated in its announcement: "This lawsuit has not yet gone to court, and the outcome of subsequent judgments is uncertain. It is temporarily impossible to assess the impact on the company's current or future profits." From a market confidence perspective, Sunwoda's stock price previously surged to 37.9 yuan per share due to positive news about solid-state battery research but had fallen to 29.75 yuan by the close on December 26, 2025.

As for concerns about whether Zeekr's legal battle with its supplier will trigger subsequent and current worries about cooperation with Zeekr from the outside world, Geely's battery system has already established itself as a distinct entity. With the growing strength of Geely's Jiyao Tongxing battery system, it is not merely a consideration of cost optimization but also embodies a deep alertness and preventive wisdom towards battery quality risks. This lawsuit can also serve as a quality and safety wake-up call for the supply chain and system.

Currently, the case has not gone to court yet. Whether Sunwoda has cell quality issues and if the 2.3 billion yuan claim holds up still requires professional judgment from the court. The subsequent litigation process is unlikely to be short. Similar to the international supply chain lawsuit between Rivian and Bosch over motor supply, which has dragged on for over a year without a resolution so far.

However, one thing is certain: Regardless of the outcome, this lawsuit will become a "milestone event" in the new energy supply chain. It will force battery companies to re-examine their quality control bottom lines, prompt OEMs to pay more attention to "risk clauses" in supply chain cooperation, and accelerate the layout of independent core technologies, ultimately driving the industry from a "scale competition" to a "quality competition."

Will Sunwoda face compensation, reach a settlement, or clear its suspicions? This industry-shaking dispute has just begun.

Editor-in-Chief: Li Sijia Editor: Chen Xinnan

THE END