Geely vs. Sunwoda: The Business Realm Transcends Conflict, Embracing Relationships

![]() 12/29 2025

12/29 2025

![]() 474

474

VREX Electric Vehicle Technology (Ningbo) Co., Ltd., a subsidiary of Geely, has filed a lawsuit against Sunwoda Electric Vehicle Battery Co., Ltd., a subsidiary of Sunwoda, with a staggering claim amounting to RMB 2.314 billion.

The crux of the matter lies in the substandard quality of the power battery cells supplied by the latter.

Geely is not the inaugural new energy vehicle manufacturer to take legal action against a power battery producer. In 2021, General Motors, grappling with widespread recalls triggered by power battery malfunctions, sued LG Chem for a hefty US$1.9 billion in damages. However, by 2024, the two parties had reached a settlement and established a compensation fund.

Interestingly, post-lawsuit, General Motors and LG Chem have continued to foster a cordial and cooperative relationship beyond the courtroom.

This scenario evokes a line from Li Xuejian's portrayal of Zhang Zuolin, as recalled by Xingkong Jun: The business world is not merely about clashes; it's about forging relationships.

The outcome of the Geely-Sunwoda lawsuit remains uncertain. There's a plausible scenario where both parties might reach an out-of-court settlement, resolving their dispute in a dignified manner that satisfies all stakeholders.

After all, the two entities have a joint venture established in 2021: Geely Sunwoda Power Battery Co., Ltd.

Headquartered in Zaozhuang, Shandong, this venture sees Geely holding a 70% stake, while Sunwoda Power retains a 30% share.

The joint venture envisions annual sales surpassing RMB 5 billion, a testament to the vibrant era of their partnership.

Sunwoda contends that the cells supplied to other clients were flawless. Xingkong Jun opines that determining responsibility could be intricate and may not be resolved swiftly.

This serves as a poignant reminder to both new energy vehicle manufacturers and power battery producers about the imperative of establishing clear responsibility boundaries.

01

Sunwoda's Web of Relationships

In June 2009, Steve Jobs unveiled the revolutionary iPhone 3GS, a smartphone that laid the foundation for Apple's global dominance in the smartphone market for over a decade. Sunwoda was the supplier of its battery.

Soon, Apple's next phenomenal product, the iPhone 4, was slated for release.

However, Jobs, in a surprising move, opted to partner with Desay Battery this time, abruptly severing ties with Sunwoda.

Xingkong Jun notes that Apple's supplier turnover rate is exceptionally high, at one point exceeding 30%. Nearly one-third of its suppliers are phased out annually, making it a business akin to "accompanying the emperor is like accompanying a tiger."

Despite this setback, Sunwoda later re-entered Apple's supply chain, leveraging its robust product capabilities. The experience, however, prompted the company to diversify and develop "backup" industries over the years.

At Sunwoda's nadir, Lei Jun, having just sold Joyo.com and poised to embark on a new venture with substantial cash, approached them.

The specifics of their discussion remain a mystery. However, Xingkong Jun speculates that relationships must have played a pivotal role.

The outcome was that Sunwoda began supplying batteries for Xiaomi's consumer electronics, including smartphones and laptops, at extremely low gross margins. Later, they even became a contract manufacturer for Xiaomi's robotic vacuums for an extended period.

Sunwoda's inception was fraught with challenges. In 1995, the Wang brothers, along with classmates and friends, ventured into the battery sector. However, profit distribution issues led to their eventual parting of ways. By 1997, having learned from the failures of their previous ventures, the brothers established Sunwoda, with only two shareholders at the time: the elder brother, Wang Mingwang, as the general manager, and the younger brother, Wang Wei, as the sales director, one managing internal affairs and the other external.

When it comes to battle, brothers fight side by side; when it comes to war, fathers and sons go to war together. In critical moments, blood relations prove to be the most reliable, as Xingkong Jun remarks (a sentiment that Li Jiancheng and Li Yuanji would undoubtedly concur with).

Today, Sunwoda's shares are overwhelmingly controlled by the Wang brothers. The third-largest shareholder, excluding funds, holds a mere 1.04% stake.

Behind these tumultuous lessons lie tales of relationships.

02

A Surprising Third-Quarter Report

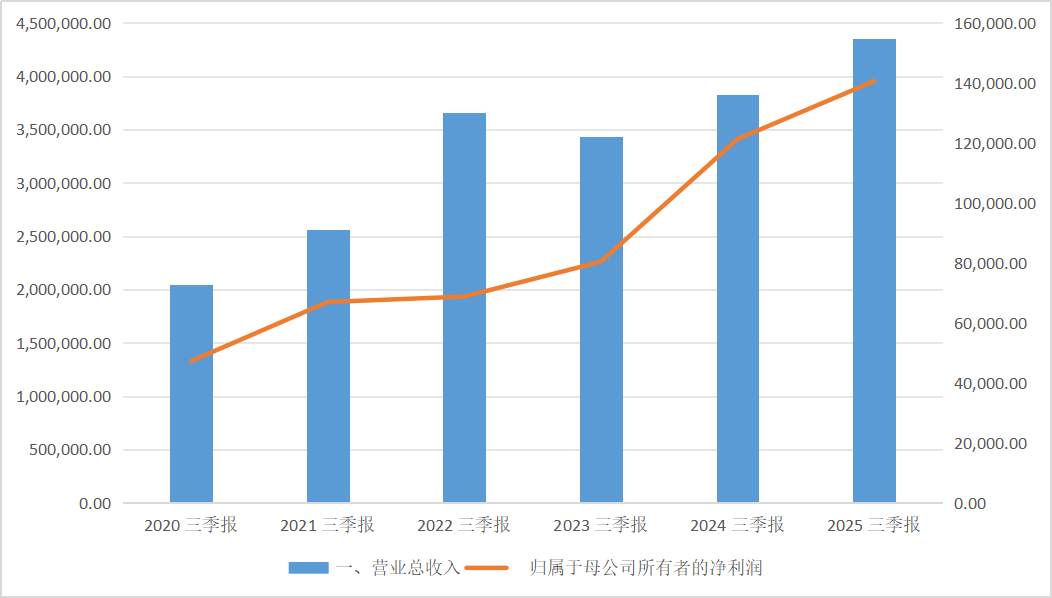

The third-quarter report for 2025 reveals that Sunwoda achieved revenue of RMB 43.534 billion from January to September, marking a year-on-year increase of 13.73%. Net profit attributable to shareholders stood at RMB 1.405 billion, up 15.94% year-on-year. However, net profit attributable to shareholders excluding non-recurring items decreased by 12.74% year-on-year to RMB 1.015 billion.

Data Source: iFind

Data Source: iFind

Nevertheless, Xingkong Jun is more intrigued by the company's annual report. How will the RMB 2.314 billion claim be addressed? Let's first clarify two concepts: estimated liabilities and contingent liabilities.

1. Estimated Liabilities

Estimated liabilities are potential obligations that may arise from contingent events. According to the contingent events standard, an enterprise should recognize an obligation as a liability if it simultaneously meets the following three conditions:

Firstly, the obligation is a present obligation of the enterprise.

Secondly, the fulfillment of the obligation is likely to result in the outflow of economic benefits from the enterprise. Here, "likely" denotes a probability of occurrence greater than 50% but less than or equal to 95%.

Thirdly, the amount of the obligation can be reliably measured.

The crux lies in reliable measurement. Since the lawsuit has not been adjudicated yet, the exact compensation amount remains unknown, rendering measurement unreliable.

2. Contingent Liabilities

Contingent liabilities refer to potential obligations arising from past events, whose existence is confirmed solely by the occurrence or non-occurrence of one or more uncertain future events not entirely controlled by the entity (the enterprise).

Firstly, it is a present obligation arising from past transactions or events.

Secondly, the fulfillment of the obligation is not likely to result in the outflow of resources representing economic benefits from the enterprise.

Thirdly, or the amount of the obligation cannot be reliably measured in its entirety.

It is evident that this lawsuit should be classified as a contingent liability. According to accounting standards, contingent liabilities do not necessitate recording in the accounts but require disclosure.

Furthermore, when a contingent liability is converted into an estimated liability (for instance, upon lawsuit adjudication), it needs to be recognized (recorded in the accounts). Therefore, this lawsuit has not yet exerted a substantial impact on the company's performance at this juncture, and the company's 2025 annual report remains secure.

03

Implications for the Industry

The lawsuit filed by Geely's subsidiary against Sunwoda's subsidiary marks the inaugural instance in China where a new energy vehicle manufacturer has taken legal action against a power battery producer.

However, it is certain not to be the last.

With the burgeoning popularity of new energy vehicles, similar cases are anticipated to surge.

This serves as a wake-up call for both new energy vehicle manufacturers and power battery producers regarding the significance of effectively delineating responsibilities.

In fact, Xingkong Jun believes that major new energy vehicle manufacturers might eventually follow BYD's path: constructing their own power battery production lines.

On one hand, the new energy vehicle industry chain is becoming increasingly competitive, prompting automakers to extend upstream into the supply chain to reduce costs. On the other hand, the larger the production volume, the greater the likelihood of accidents, and consequently, the higher the chances of disputes with power battery manufacturers. Instead of engaging in protracted disputes, it might be more prudent to build their own production lines.

-END-

Disclaimer: This article is based on the public company attributes of listed companies and the information disclosed by them in compliance with their legal obligations (including but not limited to interim announcements, regular reports, and official interaction platforms) as the core basis for analysis and research.

Shiyu Xingkong endeavors to ensure the fairness of the content and viewpoints presented in the article but does not guarantee their accuracy, completeness, or timeliness.

The information or opinions expressed in this article do not constitute any investment advice, and Shiyu Xingkong shall not be held responsible for any actions taken based on this article.

Copyright Notice: The content of this article is original to Shiyu Xingkong and may not be reproduced without authorization.