In-Depth Analysis of the 2025 Chinese Auto Market: Standing Tall at 34.4 Million Units, Navigating the Industry's 'Qualitative Shift' and 'Underlying Challenges'

![]() 01/16 2026

01/16 2026

![]() 418

418

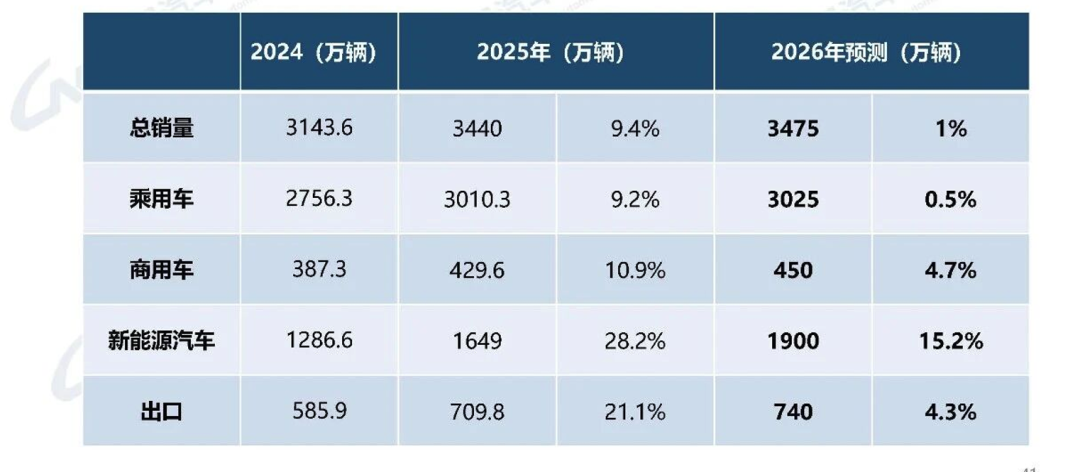

According to the latest full-year data for China's automotive industry in 2025, released by the China Association of Automobile Manufacturers (CAAM), annual automobile production and sales volumes reached 34.531 million and 34.4 million units, respectively. This marks year-on-year growth of 10.4% and 9.4%, setting a new historical record for production and sales scale and elevating China's automotive industry to an unprecedented level.

Referring to the official figures for 2024, China's GDP stood at RMB 134.8 trillion. Rough estimates suggest that automobile sales revenue in 2025 exceeded RMB 10 trillion, with the automotive industry's production, supply, consumption, and service output value likely accounting for over 10% of GDP.

However, as industry experts, we must look beyond the sheer volume growth. Analyzing the structure behind these 34.4 million units reveals profound changes in market dominance, powertrain evolution, and globalization strategies.

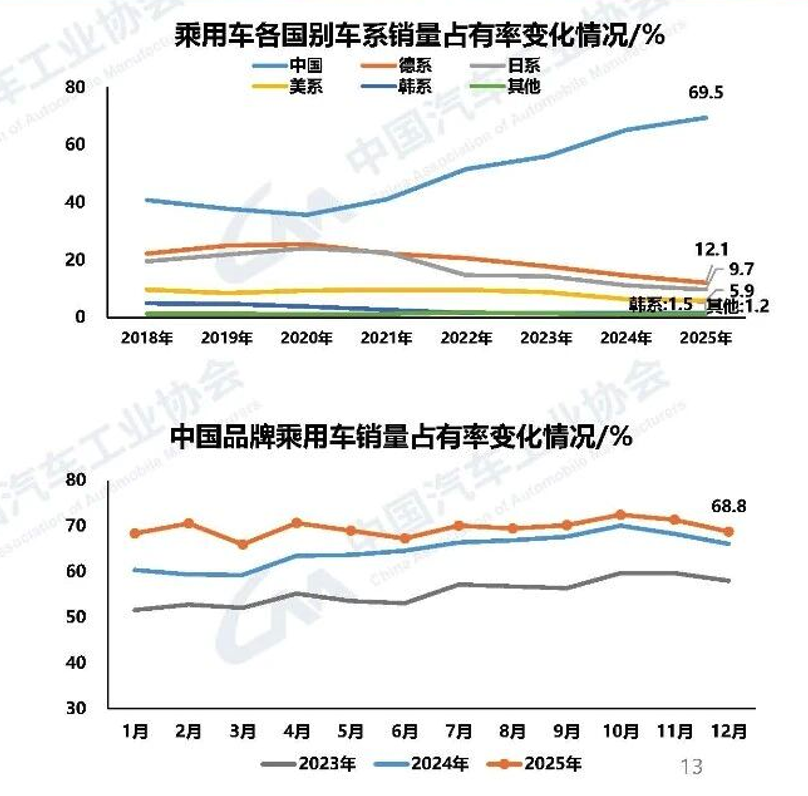

I. Market Dynamics: Domestic vs. Foreign Brands at a 7:3 Sales Ratio

Data indicates that in 2025, domestic brand passenger vehicle sales reached 20.936 million units, up 16.5% year-on-year. More notably, domestic brands' market share climbed to 69.5%, a 4.3 percentage point increase from 2024. In stark contrast, domestic brands accounted for less than 30% of the market in 2012, while foreign brands held over 70%.

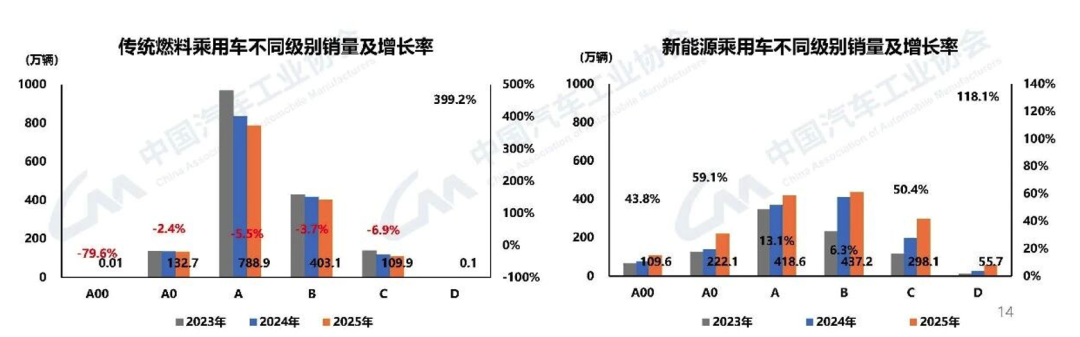

This signifies a compression of joint venture brands' market share to around 30%, thoroughly dismantling the once-discussed '50:50' defensive line. From a detailed data perspective, traditional fuel passenger vehicle sales are primarily concentrated in the RMB 100,000-150,000 price range and are trending downward. Meanwhile, domestic brands, leveraging their early advantage in the new energy sector, are penetrating the high-end market from the A-class and B-class segments.

For joint venture automakers, 2025 has been a challenging year; for domestic brands, it marks a historic shift from 'followers' to 'dominators'. However, as noted in Vehicle's previous article, 'Resilience and Cost of the Elephant's Turn: In-Depth Review of Volkswagen Group's 2025 Global and Chinese Performance,' Volkswagen has already mobilized local forces starting from 2026, preparing a robust lineup of new energy intelligent products tailored for the local market. This suggests a potential scenario of intense competition and uncertainty in 2026.

II. Powertrain Transformation: New Energy's 'Market Dominance' and Hybrid's 'Global Appeal'

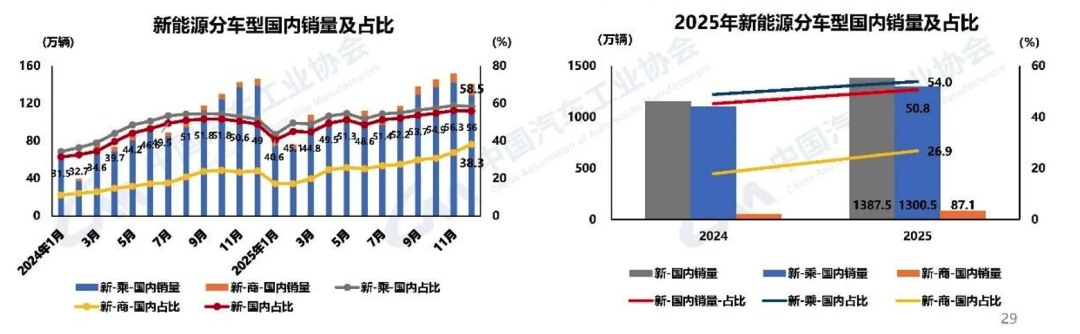

The growth of new energy vehicles (NEVs) is no longer novel, but the 2025 data represents not just a quantitative surge but a qualitative leap.

Penetration Rate Milestone: In 2025, NEV production and sales exceeded 16 million units, with sales reaching 16.49 million units, a 28.2% year-on-year increase. NEV sales accounted for 47.9% of total annual sales, with December's penetration rate surpassing 52.3%. This signals the substantial onset of an era where fuel vehicles are the minority.

High Market Concentration: The 'head effect' (where a few large players dominate) in the NEV market is increasingly pronounced. The top fifteen enterprise groups accounted for 95% of total NEV sales. Among them, BYD emerged as the dominant player, with annual sales of 4.602 million units, capturing a 27.9% market share. The market has entered the initial phase of 'oligopolistic competition.'

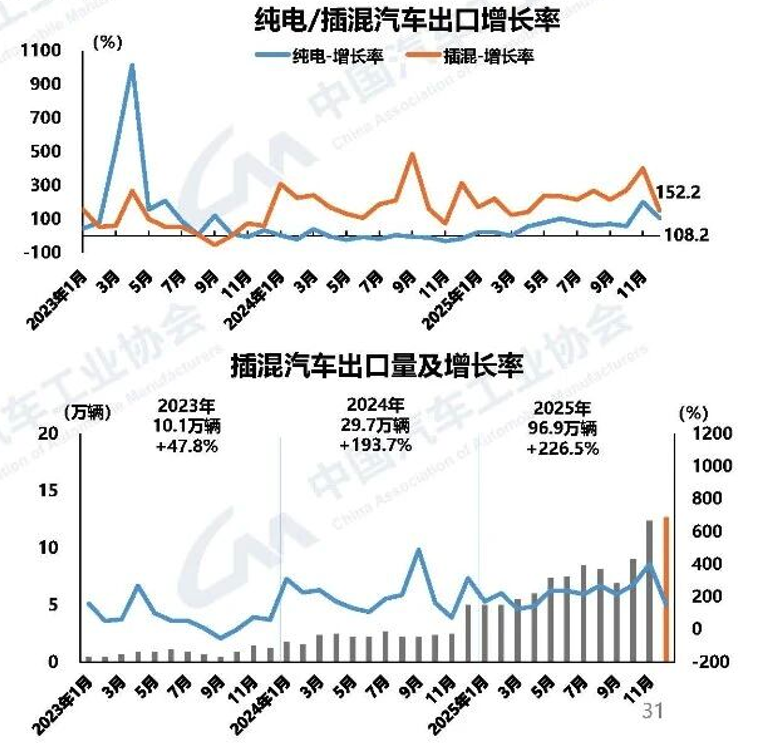

Plug-in Hybrid's Global Surge: Notably, on the export front, while pure electric vehicle exports at 1.646 million units still exceed those of plug-in hybrids, the export growth rate of plug-in hybrid electric vehicles (PHEVs) has been remarkable, reaching 2.3 times, with a total of 969,000 units exported throughout the year.

This indicates that, amid incomplete global infrastructure and the EU's tax increase policy on electric vehicles, PHEVs are becoming the 'special forces' for Chinese automakers to conquer overseas markets.

III. Globalization Journey: 'Underlying Challenges' and 'Transformation' Beyond the 7 Million Unit Milestone

In 2025, China's automobile export volume surpassed the 7 million unit mark, reaching 7.098 million units, a 21.1% year-on-year increase. Commercial vehicle exports also exceeded 1 million units for the first time.

Chery (1.344 million units), BYD (1.054 million units), and SAIC (950,000 units) have emerged as the 'three pillars' of exports.

However, from an industry perspective, we must approach this prosperity with caution:

Slowing Export Growth: Compared to the 57.8% export growth rate in 2023, the 21.1% growth rate in 2025 has clearly declined.

Trade Barrier Risks: In 2026, China faces a severe export environment marked by 'global geopolitical uncertainty and intensified economic and trade disputes.' For instance, recent negotiations between China and the EU may lead to an exemption from the EU Commission's additional anti-subsidy tariffs, but applying companies are required to limit import quantities and commit to minimum prices. Thus, the current trade export model is unsustainable for high growth, and China's automobile export model is transitioning from 'pure trade exports' to 'localized production.'

As globalization operations deepen, localized production will replace pure exports, potentially leading to a slowdown or even a decrease in export growth rates in statistical data.

This means that 2026 will be a pivotal year for Chinese automakers' 'Overseas Expansion 2.0'—focusing not just on selling cars but also on building factories, transferring supply chains, and enhancing management capabilities.

IV. 2026 Outlook: Farewell to High Growth, Embracing Intense Competition in the 'Slight Increase' Era

Based on the high base in 2025, the CAAM's forecast for 2026, while not as pessimistic as our previous article 'Morgan Stanley's 2026 Prediction for the Chinese Auto Market: When 'Growth Inertia' Fails, How Can We Navigate Through the Cycle?', is notably cautious and pragmatic:

Total Sales Forecast: 34.75 million units, a mere 1% year-on-year increase.

Passenger Vehicle Forecast: 30.25 million units, a 0.5% year-on-year increase.

New Energy Forecast: 19 million units, a 15.2% year-on-year increase.

Insights from Industry Practitioners:

This forecast data conveys a harsh reality—the era of incremental growth has ended, and competition for existing market share will intensify.

For instance, the 2026 passenger vehicle forecast of 30.25 million units, compared to 30.1 million units in 2025, represents an increase of only 150,000 units. This incremental growth is expected to come from exports. Therefore, domestic market passenger vehicle sales in 2026 are likely to see no growth or even a slight decline.

At this juncture, any enterprise's growth must be based on capturing market share from competitors.

In 2026, the industry will face multiple challenges:

Policy Rollback: The new energy vehicle purchase tax policy will undergo adjustments featuring 'halved tax collection + technical restrictions,' potentially reducing consumer purchases.

Intense Competition Governance: Although the state has begun to address 'intense competition' and promote price transparency, in the context of sluggish demand growth, price wars are unlikely to completely subside.

Conclusion

In 2025, China's automotive industry concluded with impressive results of '34.4 million units' and 'a new energy penetration rate nearing 50%'. However, all industry practitioners should be acutely aware that the days of easy success driven by policies and demographic dividends are over.

In 2026, it will be a 'knockout phase' in deep waters, testing endurance, globalization operational capabilities, and technological hard power. For Chinese automakers, having already stood at the pinnacle of the world, the only choice is to adapt to the harsh winds and snows at high altitudes and continue climbing upwards.

References and Images

CAAM: December 2025 Automotive Industry Production and Sales Situation and 2026 Market Forecast

*Unauthorized reproduction and excerpting are strictly prohibited.