2025 Nordic Auto Market: Norway Achieves Full Electrification, Chinese Brands Reshape the Landscape

![]() 01/16 2026

01/16 2026

![]() 354

354

In 2025, the Nordic auto market reached a historic turning point in its shift towards electrification. Norway, at the vanguard, has seen electric vehicles transition from a forward-thinking option to an overwhelmingly dominant force in the market. Meanwhile, the emergence of Chinese brands has injected fresh competitive energy into this mature automotive landscape.

Core Driver: Norway's Pioneering Role in Full Electrification

Norway has undeniably established itself as a global leader in electric vehicle (EV) adoption. According to the latest data from the Norwegian Road Traffic Information Council, new passenger vehicle registrations in 2025 hit a record 179,550 units. Electric vehicles accounted for an astonishing 95.9% of these registrations, with the proportion reaching 97.6% in December, signaling near-total market electrification.

This achievement is the result of sustained, resolute, and targeted policy measures. By the end of 2025, a notable 'last-minute' surge in sales occurred due to the anticipated adjustment of value-added tax policies in early 2026. More critically, the stock of electric vehicles has now surpassed that of diesel vehicles, becoming the largest powertrain segment in the overall passenger vehicle fleet.

Nordic Landscape: Electrification Progress Varies Across Regions

Despite a unified push towards electrification, the pace and market performance of this transition differ among Nordic countries, creating a tiered landscape:

Leaders (Norway, Denmark): Norway is leading the charge, with Denmark following closely behind. In November, Denmark registered 15,910 new passenger vehicles, approximately 75% of which were electric, indicating a high adoption rate.

Adjustment Phase (Sweden, Finland): Sweden experienced a sales decline due to supply chain disruptions and model transitions. Finland's passenger vehicle market saw a slight decrease, but commercial vehicle (van) registrations surged significantly (+12.8%), highlighting different market dynamics.

These disparities underscore variations in industrial foundations, policy intensity, and market acceptance across countries. Nevertheless, the consensus that 'the green transformation is underway' has become a regional norm.

Brand Competition: Tesla's Dominance and the Rise of Chinese Brands

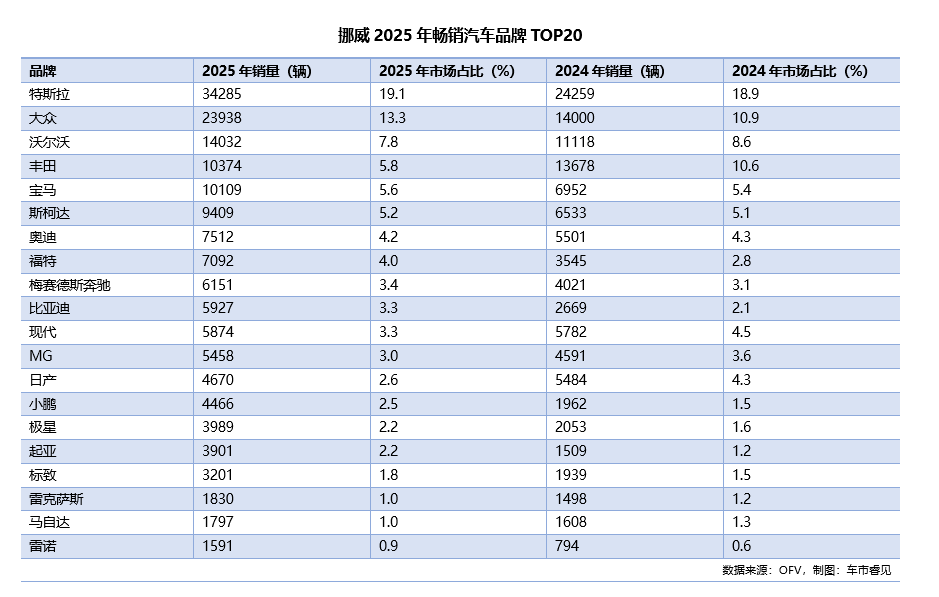

The brand competition landscape in the 2025 Nordic market is characterized by Tesla's dominance and the growing influence of Chinese brands. In Norway, Tesla led with a 19.1% market share, registering a total of 34,285 new passenger vehicles annually. The Model Y set a new annual sales record for a single model in Norway, with 27,621 registrations, demonstrating its strong product appeal and brand strength.

Simultaneously, Chinese manufacturers have firmly established themselves as a formidable 'second force.' In 2025, Chinese brands captured a 13.7% market share in Norway (24,524 vehicles), a 3.3 percentage point increase year-on-year. BYD, in particular, stood out, ranking among the top ten brands with models like the Sealion 7 (domestic model: Haishi 07EV). In December, the market share of Chinese brands soared to 17%, indicating robust growth momentum and increasing competitiveness. This not only provides consumers with a wider range of choices but also intensifies competition in mainstream market segments.

Market Segmentation: Accelerated Electrification in the Commercial Sector

In the Nordic market, the electrification trend is rapidly extending from passenger vehicles to the commercial sector. Electric van registrations in Norway and Finland surged significantly at the end of the year, reflecting commercial fleet operators' active transition to electrification to meet environmental standards and address operational cost challenges. The heavy-duty vehicle market, however, showed varied performance due to differences in national business cycles and policies.

Norway's success clearly demonstrates that long-term, stable tax incentives and policies are the most effective means of driving a complete market transformation. The entry of Chinese brands, with their cost-effective and rapidly evolving electric vehicle models, has disrupted traditional brand landscapes. This has enriched the market's electric vehicle options and expanded the competitive dimension from mere range to intelligence, cost, and service.

With the 2026 tax policy adjustments, the Nordic electric vehicle market will enter a new phase, one more reliant on product competitiveness itself. Norway's present may well foreshadow the future of other Nordic countries and even broader European markets. A profound electrification transformation, driven by policy leadership, led by top brands, and influenced by emerging forces, continues to deepen across the Nordic region.

Layout | Zheng Li

Source | OFV

Image Source | Qianku Network