Resilience and the Cost of the Pivot: A Comprehensive Review of Volkswagen Group's 2025 Global and Chinese Market Performance

![]() 01/16 2026

01/16 2026

![]() 374

374

2025 stands as Volkswagen Group's (VWG) "year of consolidation and strategic strengthening." Amidst fierce competition from Chinese automotive titans like BYD, Volkswagen Group made a calculated sacrifice in its Chinese market sales volume, prioritizing "robust operational quality" and "the execution of localized R&D initiatives."

Contrasting with its reactive stance in 2024, Volkswagen in 2025 exhibited a sharper strategic focus: moving away from a blind pursuit of market share, it harnessed profits from its fuel vehicle lineup to "buy time" and fortify its position for the product-intensive year of 2026.

I. Vertical Analysis: From "Sales Frenzy" to "Value-Centric Approach"

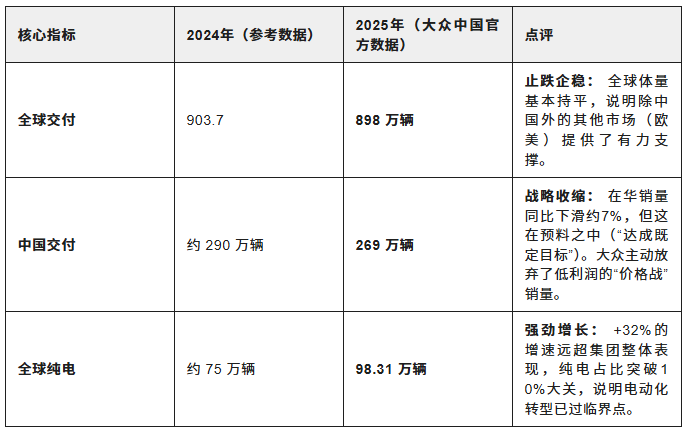

A comparative analysis of Volkswagen's 2025 performance against its 2024 results reveals a clear trajectory of strategic realignment:

Review: In 2024, Volkswagen grappled with intense price war pressures in the Chinese market, facing the paradox of "rising revenues but dwindling profits." By 2025, the group had clearly shifted its priorities to "value." Despite a dip in Chinese sales below 2.7 million units, it maintained a 22% stake in the fuel vehicle segment and secured Audi's premier position in the luxury car market. This strategic move ensured Volkswagen safeguarded its high-margin business, steering clear of the precipitous declines witnessed by some Japanese automakers.

II. Horizontal Benchmarking: Carving Out a Niche

Positioning Volkswagen within the 2025 global and Chinese automotive market framework elucidates its strategic stance:

1. VS Industry Leaders (BYD/Tesla):

Paradigm Shift: In 2025, BYD's global sales of pure electric vehicles eclipsed Tesla's (approximately 2.26 million vs. 1.64 million), with a substantial lead in total sales. Volkswagen, with nearly 900,000 pure electric vehicle sales, while showing significant growth, remained in the "chasing" pack, with volumes roughly 40% of BYD's pure electric sales.

Differentiated Survival: Volkswagen's strength lies in its adaptability. While Tesla grappled with product obsolescence and an 8.6% sales decline in 2025, Volkswagen maintained a stable global footprint, leveraging a mix of fuel, hybrid, and pure electric vehicles.

2. VS Joint Venture/Foreign Competitors (Toyota/General Motors, etc.):

Excelling Amidst Adversity: In the 2025 Chinese market, mainstream joint venture brands faced significant setbacks (e.g., Toyota, General Motors, Nissan). Volkswagen Group's ability to retain its status as the "top foreign brand in China" with a relatively stable market share was no small feat.

Key Differentiator: Unlike other joint ventures that retreated into their shells and adopted technologies from Chinese parent companies, Volkswagen's "localized R&D" (VCTC, Coolridge) emerged as a lifeline in 2025. The rollout of L2++ intelligent driving systems and the deployment of self-developed chips positioned Volkswagen as the sole traditional giant in sync with China's smart technology trends.

III. In-Depth Strategic Analysis: Three Pivotal Signals in 2025

Volkswagen signaled three notable strategic shifts in 2025:

Product Definition's "De-Germanization":" Range extenders/plug-in hybrids took center stage, with plans for "range extender" models in 2026. This marked Volkswagen's most pragmatic concession to the Chinese market, acknowledging that "pure electric is not the sole path." It implied a delegation of authority from the German headquarters, empowering the Chinese team to lead the charge.

Supply Chain's "Reverse Export":" The export strategy kicked off, with vehicles from Chinese factories shipped to the Middle East, not only to absorb excess capacity but also to validate China's manufacturing cost advantages. This signified Volkswagen's Chinese factories evolving from "dedicated supply bases" to "global export hubs."

Technology Infrastructure's "Catch-Up Complete":" Cost reduction and efficiency gains were evident, with a 30% shorter development cycle and 40% cost optimization. These figures underscored Volkswagen's response to the core competitiveness of China's emerging automotive forces. The implementation of the CMP platform and CEA architecture meant Volkswagen's 2026 lineup was poised to engage in price wars with renewed confidence.

IV. Summary and Outlook

Performance Verdict: Retreating to Advance, Navigating Through the Darkest Hour.

In 2025, Volkswagen Group resembled a seasoned captain who voluntarily slowed down to reinforce his vessel amidst a tempest.

Successes: Volkswagen demonstrated remarkable clarity in safeguarding fuel vehicles and Audi as "cash cows," avoiding excessive losses in a futile price war. Simultaneously, its electrification transition accelerated (+32%), outpacing the market.

Challenges Ahead: Despite rapid advancements in smart technology, Volkswagen faces a fiercely competitive Chinese landscape. The success of its "20 new energy vehicles" in 2026, amidst a sea of competitors, remains uncertain.

One-Sentence Review: Volkswagen proved in 2025 that it "won't collapse," but to demonstrate in 2026 that it "can still lead," hinges on whether several "China-exclusive" models, equipped with self-developed chips and range extender powertrains, can truly captivate discerning Chinese consumers. The 2026 Chinese automotive market promises to be enthralling, with Volkswagen-led joint venture brands poised for a major counteroffensive in the new energy foreign brand segment.

References and Images

Data sourced from Volkswagen China

Volkswagen Group 2025 Chronicles PPT

*Unauthorized reproduction and excerpting strictly prohibited*