Do Joint Venture Brands Still Stand a Chance?

![]() 01/26 2026

01/26 2026

![]() 410

410

The Race Begins Anew

The year 2025 marks a pivotal juncture for the automotive market, ushering in a host of significant transformations. These include the commencement of the latter half of the intelligent driving era, the inaugural year of autonomous driving, the profitability threshold for emerging automotive brands, and the turning point for the decline of traditional brands. However, as the year-end results were unveiled, they diverged somewhat from the prevailing online sentiment (translated as 'public opinion' but retained for contextual accuracy) and trend direction (translated as 'wind direction' but kept for context).

According to data released by the China Association of Automobile Manufacturers, in 2025, China's automotive production and sales soared to new heights, with sales volume reaching 34.4 million units, marking a year-on-year increase exceeding 9.4% and surpassing initial projections. Among these, passenger car sales hit 30.103 million units, up 9.2% year-on-year. Chinese-brand passenger cars witnessed a 16.5% year-on-year sales increase, capturing a 69.5% market share. Furthermore, NEV sales reached 16.49 million units, a 28.2% year-on-year surge, accounting for 47.9% of total new car sales, up 7 percentage points from the previous year.

Over the past few years, emerging automotive forces have garnered significant public attention and media coverage, continuously hyping up their potential to disrupt the traditional automotive industry. However, in 2025, while NEV sales soared to new heights, numerous emerging automotive brands gradually exited the market. Instead, 'unfinished vehicles' gained fleeting popularity due to their ultra-low prices. According to data from the China Passenger Car Association, among the top ten manufacturers in retail sales from January to December 2025, not a single emerging brand was featured.

Consequently, claims such as 'emerging brands will completely disrupt traditional brands in the NEV era' and 'joint venture brands will exit the historical stage amid unprecedented changes' have been debunked.

According to incomplete statistics, the cumulative sales of 18 mainstream multinational automakers in China surpassed 9 million units in 2025. While Chinese auto brands like BYD, Geely, Changan, Chery, and Great Wall firmly held positions in the top ten of manufacturer retail sales, joint venture brands such as FAW-Volkswagen, SAIC Volkswagen, FAW Toyota, and GAC Toyota still occupied half of the list. Notably, Toyota's sales performance in the Chinese market was remarkable: with annual sales exceeding 1.78 million units, it became the sole Japanese brand to achieve positive growth in China in 2025.

All-Round Competition

Over the past few years, phrases like 'fuel vehicles are doomed,' 'joint ventures must retreat,' and 'the rise of new forces' have frequently dominated online discussions. However, after a decade of rapid development and fierce competition, a significant number of emerging brands have failed, with some even vanishing overnight. Currently, brands remaining in the mainstream market are rare. The backbone forces competing in the mainstream market within the top ten list are still traditional brands.

BYD maintained its leading position, selling over 3.48 million units annually. Geely also achieved cumulative sales exceeding 2.6 million units, marking a 46.9% year-on-year increase. Changan Automobile sold 1.401 million units, and Chery reached 1.348 million units.

Additionally, Toyota sold over 1.78 million units in China in 2025, while Lexus sold over 180,000 units, achieving positive growth. Volkswagen (excluding the Audi brand) saw a 2.52% year-on-year decline but maintained annual sales of over 2 million units. Beyond these two giants, Nissan, Honda, Tesla, BMW, and Audi all experienced sales declines but still sold over 600,000 units annually in China. GM, Kia, and Hyundai rebounded after continuous declines in previous years, achieving positive growth.

Correspondingly, among mainstream emerging brands in 2025, neither wholesale nor retail sales exceeded 600,000 units. Currently, Leapmotor is on the verge of crossing this threshold, with cumulative wholesale sales of 596,600 units in 2025, a 103% year-on-year increase, and retail sales of 529,500 units. Meanwhile, Great Wall Motor, ranked tenth in manufacturer retail sales, sold 699,200 units annually.

This outcome starkly contrasts with the direction of daily online debates. However, in reality, whether in the NEV or fuel vehicle market, the top-selling models are still from traditional brands. Amid the 'disruptive' efforts of emerging brands, they have yet to create a 'legendary' model with enduring sales.

In the sedan market, the Geely Xingyuan ranked first with annual cumulative sales of 465,800 units. The Nissan Sylphy ranked fourth with 320,000 units annually, accounting for 52% of Dongfeng Nissan's total sales and even supporting half of Nissan's sales in China. Volkswagen's Lavida, Sagitar, and Passat, as well as Toyota's Corolla, Avalon, and Camry, followed similar patterns.

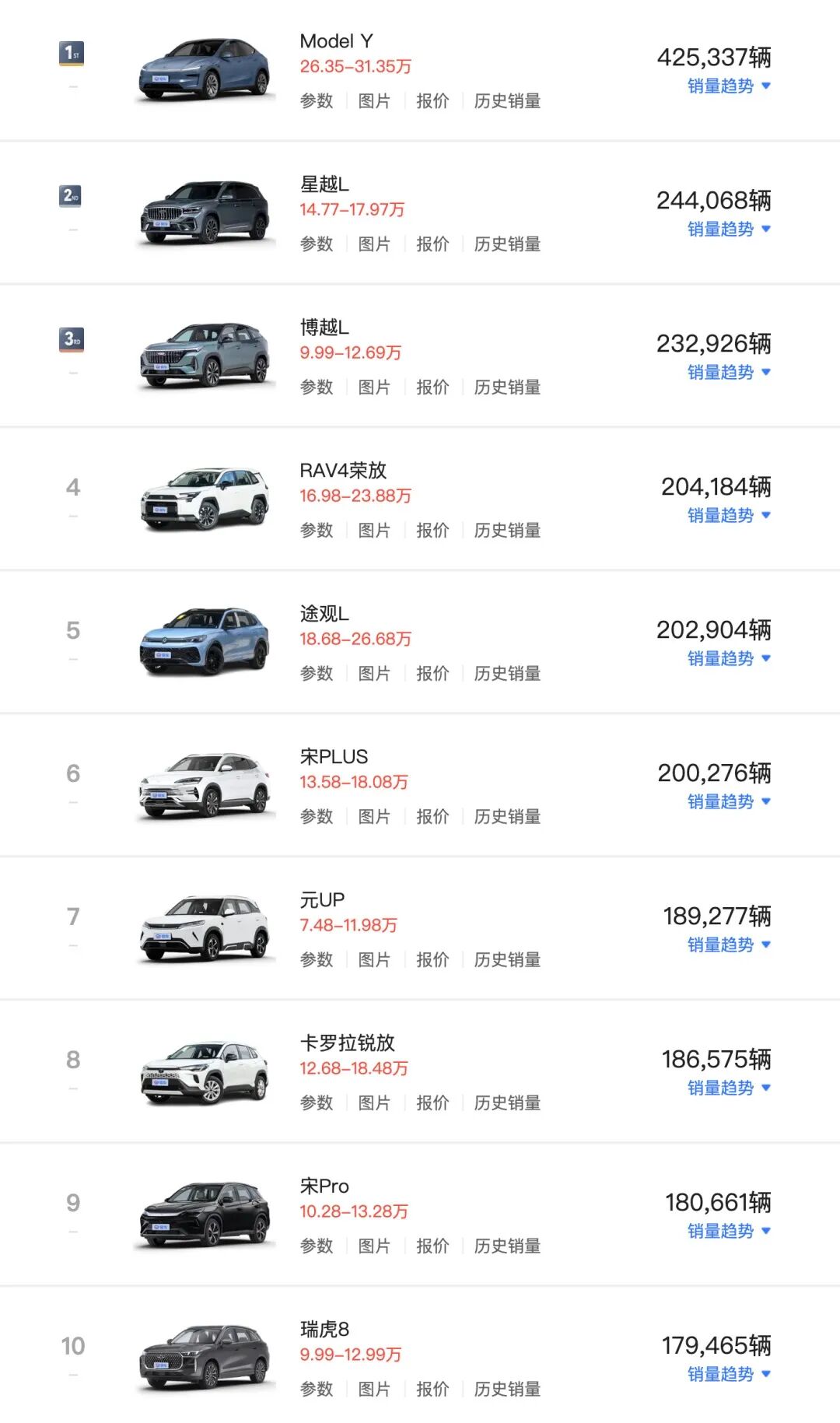

In the more competitive SUV market, the Model Y topped the list with 425,000 units sold. The Toyota RAV4 Rongfang and Corolla Cross supported FAW Toyota with 204,000 and 187,000 units sold, respectively. Leveraging their customer base and reputation for quality built over years in the Chinese market, they achieved year-on-year increases of 13% and 8% in 2025, respectively.

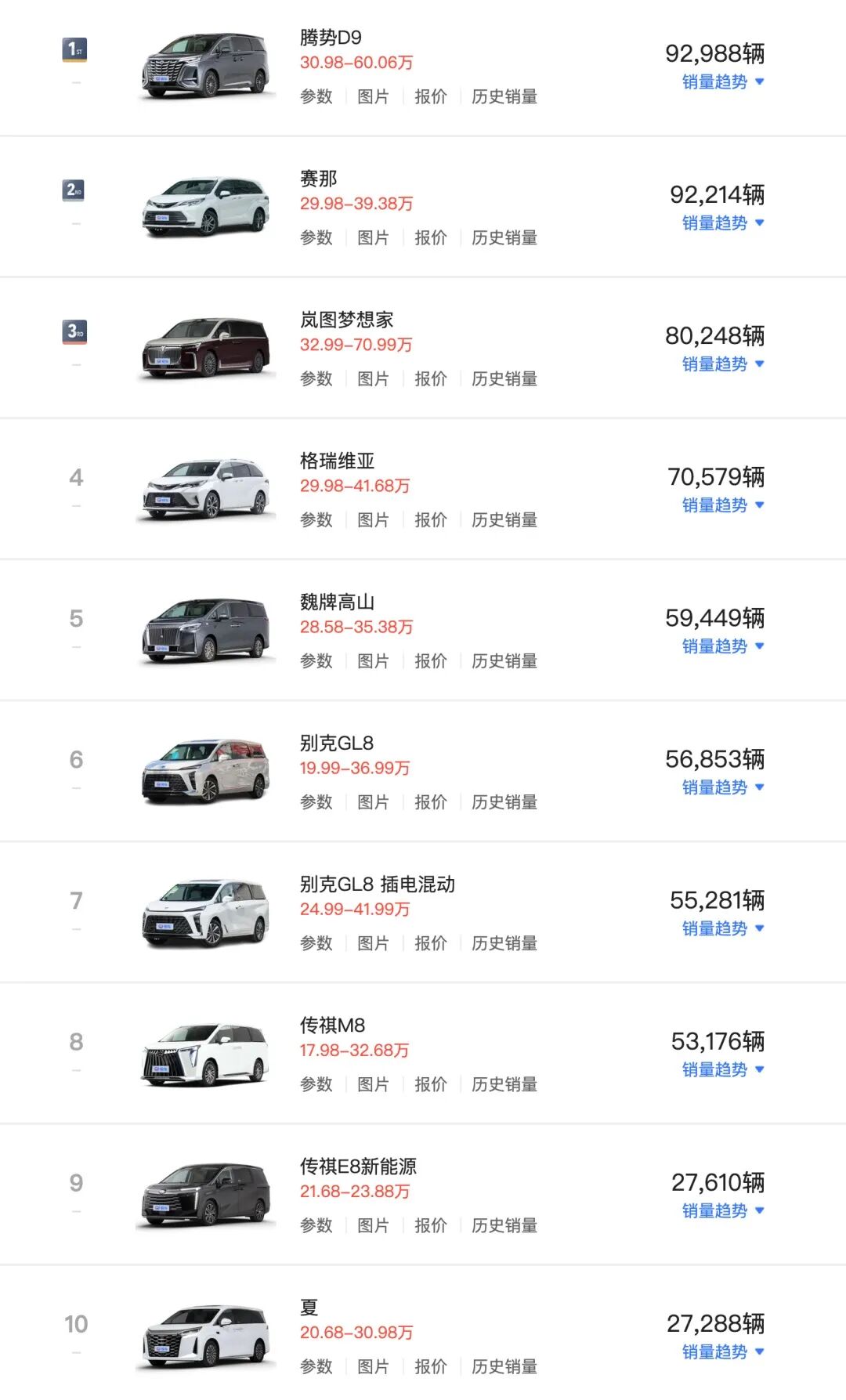

Additionally, the Denza D9 topped the MPV segment with 93,000 units sold annually. The Toyota Sienna followed closely, with a sales difference of just over 700 units. The Toyota Granvia ranked fourth with 71,000 units sold, while the Buick GL8 and Buick GL8 plug-in hybrid sold 57,000 and 55,000 units, respectively.

In the luxury car market, Audi, under Volkswagen, saw a 12.5% year-on-year decline, with sales of 626,000 units. BMW and Mercedes-Benz also experienced varying degrees of decline. Lexus, under Toyota, achieved over 180,000 units in annual sales despite selling only imported vehicles, becoming the sole imported luxury brand to achieve positive growth. To some extent, not blindly pursuing leapfrog development in pure electric vehicles and using hybrid technology to stabilize its fundamentals reflected an accurate understanding of the Chinese market.

It is evident that traditional brands still dominate the market. While Chinese auto brands continue to rise and break through, joint venture brands exhibit a clearer competitive landscape and hierarchical structure: Toyota and Volkswagen, with deep roots in the Chinese market, have leading models in various segments. Notably, Toyota achieved positive growth while maintaining its sales scale in China. The second-tier brands, including GM, Honda, Nissan, Hyundai, and Ford, remain under pressure and are undergoing difficult transformations.

Emerging brands face a 'critical juncture' in 2025: whether they can achieve profitability or quarterly profits becomes a dividing line in the race. Currently, financial report data from various companies has not been released, but based on annual performance, only a handful of emerging brands have reached break-even, while others face even more daunting survival challenges.

The Race Begins Anew

As the new year commences, multiple policies have been released or implemented, and many trends and changes in the automotive industry have become apparent.

The China Association of Automobile Manufacturers predicts that total automobile sales in 2026 will reach around 34.75 million units, a year-on-year increase of 1%.

NEVs have reached a significant milestone this year. According to the 'Announcement on the Continuation and Optimization of the Vehicle Purchase Tax Exemption Policy for New Energy Vehicles' jointly issued by the Ministry of Finance, the State Taxation Administration, and the Ministry of Industry and Information Technology in 2023, from January 1, 2026, to December 31, 2027, NEVs will be subject to a 50% reduction in vehicle purchase tax, with a maximum tax reduction of 15,000 yuan per NEV passenger vehicle.

This triggered a 'guarantee' war among automakers at the end of 2025, leading to a portion of automotive consumption being brought forward in the fourth quarter. Although some companies extended preferential policies into this year, the effect fell short of expectations. Additionally, the fourth quarter of last year was a critical moment for the profitability threshold of emerging brands, increasing pressure. Besides facing the pressure of consumer spending differences due to changes in the vehicle purchase tax policy, automakers also confront higher technical thresholds after policy adjustments.

Furthermore, the 'Guidelines for Compliance with Pricing Behavior in the Automotive Industry (Draft for Comments)' released on December 12, 2025, explicitly states that automotive production and sales enterprises face significant legal risks if they engage in 'selling vehicles at a loss' through various means.

The NEV market has already seen numerous uncertainties in 2026, and the market landscape may undergo a transformation. Meanwhile, fuel vehicles experienced a recovery and resurgence in 2025, with sales maintaining positive growth for several consecutive months. Amid continuous pressure on profit margins, fuel vehicles also usher in (retained for context, meaning 'face') new opportunities.

Over the past two years, more and more traditional brands have begun to strive for a balance between fuel vehicles and the intelligent demands of the new era. The consensus for future development is to pursue both fuel and electric vehicles and achieve equal intelligence in both.

Toyota, which has consistently adhered to a multi-path technology strategy encompassing fuel, hybrid, plug-in hybrid, extended-range, pure electric, and hydrogen energy, has precisely aligned with the pulse of the times in this regard. Building on this, Toyota is fully promoting the comprehensive upgrade and series of initiatives of its localization strategy, accelerating enterprise-wide transformations aligned with China's development pace, and deepening localization processes across the entire industrial chain, including management, research and development, products, production, sales, services, and cooperation. The Chinese market is evolving into Toyota's global innovation center and driving force. After more Chinese-style localization efforts, Toyota swiftly made deeper adjustments in its personnel layout, including at the decision-making and research and development levels. In the future, models launched by Toyota in China will have chief engineers who are Chinese engineers with a better understanding of Chinese consumers, incorporating elements such as electrification and intelligence from China into Toyota's model development. Additionally, Toyota will engage in in-depth cooperation with advanced Chinese technology companies to carry out comprehensive structural reforms.

It is evident that as the NEV market continues to mature, joint venture brands have also laid out more comprehensive strategies through diversified cooperation and transformational adjustments. In 2026, under the dual pressures of 'halting vehicle sales at a loss' and adjustments to NEV purchase tax incentives, the race begins anew.