Is 100,000 Vehicle Sales Volume the Make-or-Break Point for Joint-Venture Brands, and 500,000 the Key for New Car Manufacturers?

![]() 01/26 2026

01/26 2026

![]() 411

411

One represents the "fatal threshold" for joint-venture brands, while the other marks the "safety threshold" for emerging car manufacturers.

In the automotive sector, there exists an undeniable truth: "Operating without scale is akin to slow suicide."

In the fiercely competitive Chinese market, where a ruthless version of "Darwinian evolution" is at play, two critical sales thresholds are currently squeezing automakers: 100,000 and 500,000 vehicles. The former is the "fatal threshold" for joint-venture brands, whereas the latter is the "safety threshold" for new car manufacturers.

The Perilous Edge of 100,000 Vehicles

The 100,000-vehicle sales mark was once a critical milestone that new car manufacturers desperately aimed to achieve, as it was crucial for their survival.

Huang Hongsheng, the founder of Skywell Automotive, once revealed that the company's annual sales target was 100,000 vehicles to reach the breakeven point. Shen Hui, the former chairman of WM Motor, echoed this sentiment, stating that if a new car manufacturer's annual sales could not reach 100,000 vehicles, it would face extinction.

An automotive industry analyst pointed out, "100,000 vehicles is the survival threshold for new car manufacturers because only by reaching this scale can they cover fixed costs such as research and development, production, and sales networks."

Indeed, WM Motor, which consistently failed to reach 100,000 vehicles in sales, ultimately did not survive. As for Skywell Automotive, its fate is best left unmentioned. Given the numerous brands that entered the market with a bang only to fade into obscurity, 100,000 vehicles is indeed a fatal threshold. Once sales fall below this mark, the question shifts from whether one can "thrive" to how close one is to "survival or demise."

Now, it is not just the "new forces" in car manufacturing who tremble at the thought of this threshold. The blade of 100,000 vehicles now looms ominously over the heads of joint-venture brands that have long operated in the Chinese market.

In 2025, the Chinese auto market achieved a relatively robust result. Total sales surged to 30 million vehicles, marking the third consecutive year of breaking this milestone. This time, the dominant players were new energy brands, with a penetration rate of 60%, primarily Chinese auto brands.

Cornered joint-venture brands began to strategize on how to "achieve 100,000 vehicles" in sales. Data showed that last year, joint-venture brands delivered a "negative growth" performance, which was not surprising.

According to statistics, nearly 20 joint-venture brands collectively sold 9.12 million vehicles, with their market share declining to 38.2%. Among them, Volkswagen and Toyota emerged as the top two, with 2.02 million and 1.78 million vehicles sold, respectively.

This data is somewhat disheartening. During their peak, the combined sales of FAW-Volkswagen and SAIC-Volkswagen exceeded the current total of Volkswagen and Toyota. However, those glory days are gone. Among the remaining brands, Nissan stands out with 650,000 vehicles sold, while the combined sales of the two Honda brands are less than Nissan's. The competitive landscape of the three Japanese giants has become clearly distinct.

Once a dominant player in the Chinese market with 2 million vehicles sold, SAIC-General Motors (SGM) only managed to sell 118,000 vehicles last year. This performance is unlikely to please Mary Barra, especially considering that "average monthly sales of less than 10,000 vehicles" is a stark contrast to the heyday when a single model could sell 20,000 to 30,000 vehicles per month.

A greater crisis looms: whether SGM can maintain sales of over 100,000 vehicles in the even more challenging year of 2026 is a cause for concern. After all, a precedent has already been set in 2025.

Changan Ford, established in 2001 and which achieved a record 957,000 vehicles sold in 2016, fell just short of the 1 million mark. Nine years later, in 2025, it only managed to sell 99,400 vehicles, falling below the 100,000-vehicle survival threshold.

This trend is both surprising and unsurprising. What is unsurprising is that Changan Ford, which has been on a downward trajectory since its peak, has become accustomed to the pain. In 2019, its sales fell below 200,000 vehicles for the first time, prompting the need for change.

In 2021, sales briefly rebounded to over 300,000 vehicles, and in 2024, it achieved 240,000 vehicles sold. Although still far from its peak, Changan Ford gradually found a balance between profit and revenue.

However, the market's cruelty is straightforward and does not reward effort with corresponding returns. Changan Ford's predicament exemplifies this. From 200,000 vehicles to below 100,000 vehicles, Changan Ford's woes are also common among joint-venture brands.

Heavy reliance on a single model is a major issue. In 2025, nearly half of Changan Ford's sales came from the Mondeo model. This implies weak risk resistance. The same problem plagues Honda, as three fuel-powered models—Accord, Breeze, and CR-V—contributed about 68% of Honda's sales in China.

Another common issue is the inability of core electric models to shoulder the burden. Ford's Mustang Mach-E no longer discloses sales data. As the market shifts towards plug-in hybrid vehicles, Changan Ford still adheres to hybrid vehicles. The "big fish in a small pond" strategy has failed to gain recognition, resulting in sales falling below the 100,000-vehicle survival threshold.

Once annual sales fall below 100,000 vehicles, factory capacity utilization drops below the red line, and research and development costs skyrocket. Dealers facing a shortage of vehicles often choose to withdraw from the network. The discreet exit of French brands, the retreat of Korean and American brands, and the losses incurred by American brands are not uncommon sights in recent years.

For any brand, 100,000 vehicles represent a cruel dividing line that makes joint-venture brands restless. Market penetration, cost competition, intelligent investment, and policy guidance—crossing any one of these four thresholds is essential for survival.

Using the metaphor of Mercedes-Benz CEO Ola Källenius, it boils down to nine words: "Survival of the fittest, elimination of the unfit."

500,000 Vehicles as a Safety Threshold

While giants struggle on the fringes, new leaders under the spotlight dare not let their guard down.

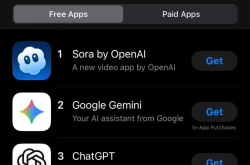

Because only a few new car manufacturers have crossed the red line of 100,000 vehicles in sales. In 2025, only Leapmotor, Xiaomi, and XPeng achieved their annual sales targets. Behind this "passing grade" lies the failure of nearly half the players.

Even brands that have crossed the survival red line are still hovering around the safety threshold. What is the scale of this safety threshold?

When XPeng was first established, He Xiaopeng did not set his sights as high as "3 to 5 million vehicles in annual sales over the next decade as the threshold for advancement." He once said, "When we reached 100,000 vehicles, we realized that 100,000 vehicles is not the basic threshold for today's smart electric vehicles. This threshold might be around 400,000 vehicles."

Market analysts once believed that 400,000 vehicles is not a safe number and still insufficient for achieving a "transformation from burning money to generating profits."

Zhu Xichan, a professor at Tongji University, once argued, "Companies with an annual production of less than 2 million vehicles will not survive. The scale is too small, and research and development costs are too high. They need to cooperate and form joint ventures in various ways. If research and development investment is reduced, technological progress will halt. With such high research and development costs and such low production volumes, they are waiting to 'die.'"

His argument faced criticism for two reasons. First, by his standard, only BYD and Geely exceeded 4 million vehicles in sales in 2025, while Changan and Chery reached 2.9 million and 2.8 million vehicles, respectively. Second, he claimed, "None of NIO, XPeng, or Li Auto will survive within three years, with a survival rate of 0," which, while not fully substantiated, is not entirely alarmist either.

As core new car manufacturers like Leapmotor, Li Auto, XPeng, and NIO released their 2025 sales and profitability data, it became clear that 500,000 vehicles represent the breakeven point, known as the "iron law of scale effects."

It is widely known that the development of new car manufacturers consists of three stages. The first stage is expansion through burning money, building infrastructure through financing. The second stage is scale expansion, covering fixed costs by increasing sales. The third stage is profit growth, achieving profitability through scale effects. Currently, most new car manufacturers are still in the first or second stage and have not yet achieved self-sufficiency.

From the sales data of Li Auto and Leapmotor, it is evident that "scale effects are the key support for vehicle manufacturing companies to achieve profitability." The decisive factor for profitability is orders and sales. As delivery volumes continue to rise, the research and development, marketing, and management costs allocated per vehicle decrease.

Among these, 500,000 vehicles form a breakeven point that breaks through the financial model, gradually moving away from the state of "selling one vehicle and losing money on one vehicle."

Li Auto was the first new car manufacturer to achieve annual sales of 500,000 vehicles, reaching this milestone in 2024. It successfully transitioned from a "new player" to an "industry leader" and became the "envy of others."

In 2025, due to setbacks in electrification, Li Auto's sales fell to 406,000 vehicles, presenting a situation of "declining sales and ending profitability." The net loss of 624 million yuan in the third quarter of 2025 ended Li Auto's previous 11 consecutive quarters of profitability.

Leapmotor, often referred to as "half-price Li Auto," serves as an excellent comparison. In 2025, Leapmotor achieved leapfrog growth, delivering 596,600 vehicles annually. It reached a milestone on the profitability front, achieving three consecutive quarters of profitability. The net profit for the first three quarters was 180 million yuan, and the gross profit margin rose to 14.5%, successfully embarking on the path of "self-sufficiency." Zhu Jiangming calculated that maintaining a monthly sales rhythm of 40,000 vehicles, coupled with incremental sales from new models, would continue to expand profitability.

XPeng achieved annual sales of 429,000 vehicles, a year-on-year increase of 126%, surpassing its 2025 target. It successfully rebounded from a low of just over 100,000 vehicles in 2024, achieving a remarkable turnaround. The comprehensive gross profit margin exceeded 20%, but the gross profit margin for the automotive business was only 13.1%.

For XPeng, which continues to increase its investment, a scale of 400,000 vehicles has not fully allowed the company to escape losses. Profitability remains an unformed cycle.

The first automotive press conference of 2026 was NIO's 1 millionth vehicle rollout ceremony. At that time, co-founder Qin Lihong said, "Reaching 1 million vehicles in the automotive industry is an important milestone for a company's growth and a crucial indicator of long-term survival. However, in the entire industry, 1 million vehicles is a negligible achievement. This is when we truly cross the starting line."

NIO has not yet crossed the distance from the starting line to the safety threshold. In 2025, NIO set an annual sales target of 440,000 vehicles but only delivered 326,028 vehicles, falling short by 120,000 vehicles. However, founder Li Bin remained confident, stating, "The company's final financial data is not yet available, but we are confident in achieving profitability in the fourth quarter."

In 2026, whether NIO can turn "potential profitability" into "actual profitability" over the course of a year depends on whether it can achieve its desired sales scale. Meanwhile, NIO's "cost control issues" remain prominent. Although Li Bin claims not to set broad blueprints anymore, the targets he has set are not easily achievable.

"We will not provide a specific annual target for 2026. There is nothing particularly grand about it. We are still a small company, so we will just work diligently and aim for annual growth of 40-50%." The sales target is also moving towards the goal of 500,000 vehicles.

From various data analyses, it is evident that crossing the 500,000-vehicle mark is truly stepping over the safety threshold. Because after 500,000 vehicles, the real war begins.

This war is called "getting off the table."

Note: The images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-