“Survival” Shouldn’t Be Honda’s Goal in the Chinese Market

![]() 01/27 2026

01/27 2026

![]() 398

398

Introduction

The situations of Japan's three automotive giants differ, with divergences becoming evident.

Throughout the previous year, Toyota and Nissan actively sought breakthroughs to ensure their survival. In contrast, Honda, another prominent Japanese automaker, faced a challenging scenario in China that was apparent to all.

During this time, Honda introduced its latest electrification strategy, with Dongfeng Honda S7 and Guangqi Honda P7 entering the market with optimism. However, their subsequent market performance and Honda's adjustments for the Chinese market fell short of expectations.

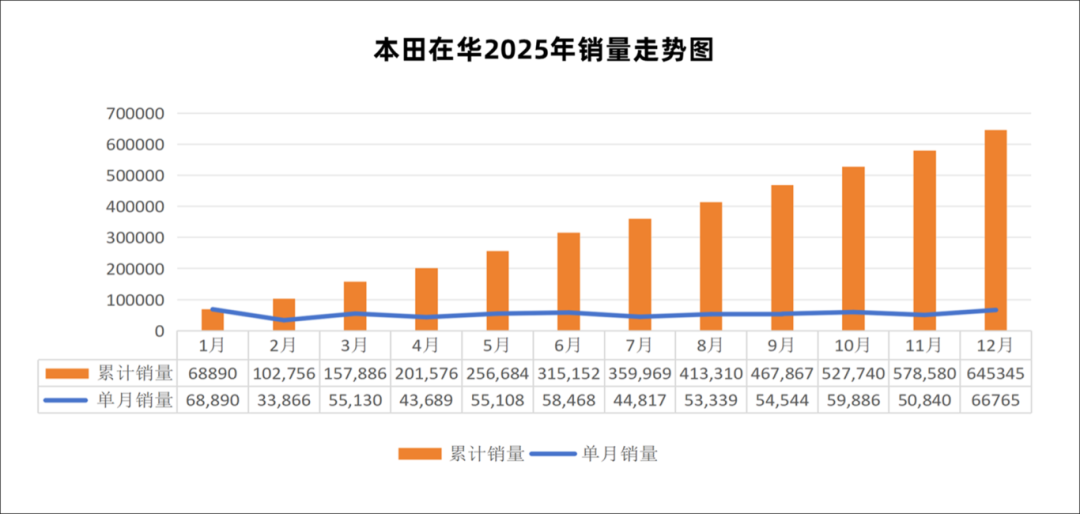

Honda's sales in China for the year totaled only 645,345 vehicles, marking a nearly 25% decline from the 852,269 vehicles sold in 2024. Except for the Accord and CR-V, all other Honda models lost their previous appeal across various market segments.

Is this truly the Honda we envision? Amid struggles faced by Toyota, Nissan, and even General Motors, Ford, and Mazda to find a foothold, this question resonates as an inquiry of our times.

After several rounds of industry shakeouts, numerous foreign brands have exited China due to outdated concepts or impure motives. New energy vehicle startups have also faced significant setbacks, which naturally do not warrant sympathy.

Honda stands as an exception. As a significant automaker with vibrant brand vitality and a leading voice in the automotive sector, “silence” is not the response it should exhibit in the face of China's turbulent market. How can the once-dominant Honda be hindered by industry transformation?

2025 marks Honda's 17th year of operation in the Chinese auto market. Past glories have added a splendid chapter to Honda's story in China.

As we enter the new year, starting with the limited-edition release of the Fit that stirred excitement, we hope Honda will decisively reorganize its thoughts, strive for dignity even without bread, and continue to write a new chapter in the industry narrative it has left in China over the past 20 years.

01. Accompanied by Hesitation and Anxiety

The current state of joint ventures is evident to outsiders. The vigorous development of the new energy industry has caught everyone off guard. Not only Toyota and Volkswagen but also luxury brands like BBA are feeling the chill in the Chinese market.

Last year, everyone devised new response plans with the determination to regain market share. However, a year has passed, and it seems that only a few companies, such as GAC Toyota and Dongfeng Nissan, are sustaining the momentum of joint venture recovery.

Not only Honda but also Beijing Hyundai, despite launching products like the EO, have received lukewarm market responses. Given this situation, we are increasingly drawing a conclusion: joint venture brands have not only lost their brand moat in the Chinese market but also, in the new round of offensive and defensive transitions, it has become particularly important to proactively learn from Chinese companies.

Of course, in an era when Toyota and Volkswagen must make decisions based on the movements of Chinese automakers, it is indeed difficult to answer whether the remaining joint venture brands still have a chance to turn things around.

The struggles and passivity of Korean and French brands have essentially set a final tone for the future of all joint venture automakers. With such a clear-cut case before us, to say that Honda would still turn a blind eye to this, I believe even Honda, with all its arrogance, would not go that far. However, with the Chinese automakers' highlight performances once again concluding in 2025, the window for Honda to turn things around is indeed gradually narrowing.

Looking back at Honda's moves over the past year, when launching the P7/S7, news about Honda's layoffs and production line closures in China never stopped. This indicates that even if Honda's headquarters can mask some flaws in its automotive sector with the thriving two-wheeler business, the impact of automotive market changes is still enormous in the eyes of Honda's joint ventures.

Furthermore, with Dongfeng Honda Engine Co., Ltd. officially transferring ownership to Guangqi Honda at the end of last year, it can be said that the good news coming from Honda last year was truly scarce, leading to significant concerns from the outside world about Honda's development in China.

Globally, Honda sold 3.85 million new vehicles throughout the year, surpassing Ford and Nissan in terms of scale and ranking 8th globally. From the perspective of automotive sales alone, who can say that Honda's revenue-generating ability has declined?

Therefore, when facing Chinese users, Honda often acts independently, which seems to pose no problem. Compared to its peers, Honda's mindset throughout 2025 has remained unchanged, emphasizing driving pleasure as the spiritual value of Honda as a joint venture brand. However, as sales have been declining every year and its business scope in China has been continuously shrinking, Honda's capriciousness is certainly unsustainable.

This year, the seismic changes in the Chinese auto market have posed newer requirements for all joint ventures, which is the need for everyone to separate their global paths from China. After years of brainwashing by new energy vehicle startups, Chinese users now view so-called historical accumulations and words of experience as constraints on development. Even if Honda intends to maintain its own tone, reality no longer allows it to be so stubborn.

On January 13, Honda officially announced that it would adopt a newly designed “H” logo as a new symbol for Honda's automotive business, representing Honda's automotive products and related business activities worldwide.

Honda stated that the design of the new “H” logo aims to reflect the company's firm determination to face the era of transformation. According to the plan, the new logo will be first applied to the next generation of pure electric vehicles and next-generation hybrid models, with a full-scale rollout planned for new models to be launched sequentially from 2027 onwards.

Just a week later, on January 20, Honda officially unveiled the new-generation power unit RA626H for the 2026 FIA Formula One World Championship in Tokyo. The new power unit will assist the Aston Martin team in competing in the 2026 F1 season.

We are clear that Honda is still the same young boy who loves chasing the wind. Amidst the world's rapid changes, only its passion for speed and machinery has never been extinguished.

However, in the new year, while it is correct for Honda to continue adhering to its technological path in specific areas, such as top-tier events like F1 or the research and development of hydrogen fuel cells, on the other hand, it should also collaborate in unprecedented ways in China to prove itself, demonstrating that it does not just want to muddle through in China.

02. The Darkness Before Dawn

As we enter the new year, what kind of stance will Honda adopt to compete in the Chinese market? With the poor performance of last year as a backdrop, the outside world has been waiting for Honda to provide a detailed and penetrating response plan.

Previously, when Honda confidently showcased its entire arsenal at the 2025 Tokyo Mobility Show, regarding subsequent product planning, Honda proposed that it would first start production of the 0-Series SUV in the United States in the first half of 2026, with the 0-Series sedan to be mass-produced in the second half of the year.

Meanwhile, at the 2026 International Consumer Electronics Show, with Sony Honda Mobility (SHM), a joint venture brand between Sony and Honda, bringing the pre-production version of the pure electric mid-size sedan AFEELA 1 and the all-new pure electric SUV concept car AFEELA Prototype into the public eye, it seems that Honda has not chosen to lie flat in terms of industry forward-looking development and is still actively engaging in the research and development of new technologies.

However, when we shift our focus back to Honda's plans in China, the information released by the two joint ventures is quite limited.

Especially regarding the investment in electrified products, Honda has hardly provided any concrete information. This inevitably makes people wonder: Is Honda really indifferent?

A few days ago, at the Dongfeng Honda Annual Business Conference, Igarashi Masayuki, Executive Managing Director of Honda Motor Co., Ltd. and China Regional Head, as well as Vice Chairman of Dongfeng Honda, provided a direction, stating, “In the future, we will strengthen collaboration with local partners to shorten development cycles, enhance intelligence levels, and strengthen price competitiveness through thorough cost optimization.”

Combined with Honda's painful decision to halt the mass production of the “Ye” GT, perhaps Honda has already secretly formulated a new plan to address the intense competition in the Chinese auto market. And boldly speculating, after the lessons learned from P7/S7, relying on the new energy technology of Dongfeng or GAC, Honda has let go of its stubbornness in seriously creating new energy vehicles for the Chinese market.

Of course, any company that is vigilant about reality has to bow to Chinese users when facing its own transformation path filled with numerous challenges.

Without surprise, Honda's next-generation electrified products in China will not make their debut until 2027. Before that, all Honda can do is to provide minor updates to existing products like the CR-V as support. In other words, 2026 may very well be a gap year for Honda's new products. Against this backdrop, Honda still needs to maximize its efforts to maintain the vitality of its brand.

“Strengthening fundamentals” is Honda's ideal phased goal. Therefore, before the launch of the next generation of products, events such as the limited-edition release of the new Fit unexpectedly triggering positive feedback in the terminal market can only be short-lived marketing events.

In comparison, from top to bottom, Honda needs to consider whether the “headquarters-led” model can be changed when facing its own China division, truly granting greater decision-making power to the Chinese team?

Facing the terminal market, how should Honda systematically repair and stabilize its dealer network, enhance channel confidence and terminal service experience, thereby preventing the vicious cycle of dealer network contraction and maintaining channel health in situations where new car profits are thin?

In the final analysis, there is a possibility for Honda to stabilize and stop declining in 2026, but achieving significant growth or a turnaround is extremely difficult. This is more like a tough “battle for survival” rather than an easy “battle for a comeback.” Relying on its global business, “living in China” is not a difficult task; the challenge lies in whether Honda has the determination to shed its burdens and truly understand the evolution of the Chinese auto market as competitors like Toyota and Nissan gradually find ways to cope with the crisis.

Editor-in-Chief: Cui Liwen Editor: Wang Yue

THE END