Can the Entry-Level Model 3, Priced at Over 100,000 Yuan, Help Tesla Reverse Its Fortunes in China?

![]() 01/27 2026

01/27 2026

![]() 404

404

Lead

Introduction

As the allure of its offerings continues to fade, Tesla finds itself with no alternative but to rely on 'affordable pricing' as its strategy.

2025 proved to be a somewhat 'disheartening' year for Tesla.

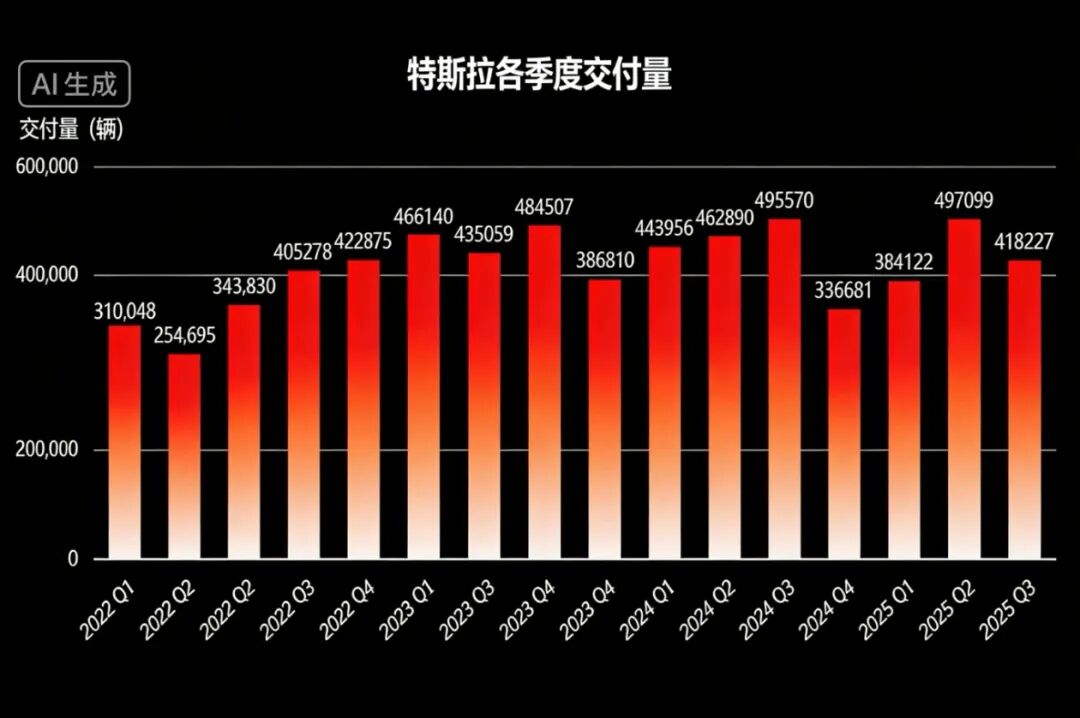

The primary cause lies in its global delivery tally of 1.636 million vehicles, which, after 2024, once again witnessed a year-on-year decline exceeding 8%. The gap from the peak of 1.808 million vehicles in 2023 is even more pronounced.

A deeper examination reveals that Tesla's loss of momentum in China, North America, and Europe—its three primary markets—has sounded a clear alarm for this American electric vehicle (EV) manufacturer.

Take China, for instance. Since establishing local production, Tesla has flourished in the world's largest automotive market, securing a wealth of domestic orders while leveraging stable production to cater to international markets.

However, over the past year, its rapid expansion has come to a standstill.

According to data from the China Passenger Car Association, Tesla's retail sales in China reached only 625,000 vehicles, marking a 4.78% year-on-year decrease. Including exports, wholesale sales stood at 851,000 vehicles, down 7.08% from the previous year.

Evidently, the aggressive maneuvers by numerous domestic brands have intensified competition at the product level, leaving Tesla, with its relatively sluggish self-iteration, in a precarious position. More bluntly, the era of exclusively opting for the Model 3 or Model Y has ended. Whether for mid-size pure electric sedans or mid-size pure electric SUVs, a plethora of new options are emerging.

From Tesla's vantage point, this scenario is undeniably challenging and urgent. Because if it continues to slide into a deeper downturn in China and forfeits the strategic support of this pivotal market, the ensuing chain reaction would be catastrophic.

Perhaps precisely against this backdrop, Tesla has exhibited clear signs of 'urgency' as it enters 2026. In essence, it is striving to achieve a 'strong start' through various incentive policies.

The initial move came on January 6 (Beijing Time), when Tesla unveiled a 'five-year interest-free' plan for the six-seater Model Y L. Concurrently, it introduced a 'seven-year ultra-low-interest' plan for the rear-wheel-drive, long-range rear-wheel-drive, long-range all-wheel-drive versions of the Model 3 and Model Y, as well as the six-seater Model Y L.

The latter, in particular, swiftly ignited heated discussions.

For instance, consider the Model 3 rear-wheel-drive version, currently priced at 235,500 yuan on the official website. Without any optional add-ons, with a down payment of 79,900 yuan and a loan of 155,600 yuan, the monthly payment amounts to 1,918 yuan over 84 installments. The annualized interest rate stands at 0.5%, equivalent to an annual percentage rate (APR) of 0.98%, resulting in annual principal and interest payments of merely around 800 yuan and a total interest of just over 5,000 yuan over seven years.

Undoubtedly, Tesla's 'seven-year ultra-low-interest' plan has once again substantially lowered the so-called threshold for car purchases, making it highly appealing to consumers with tighter upfront budgets who seek low monthly payments and plan for long-term ownership. It is also attractive to users who can better utilize their funds for wealth management, given that the 0.98% APR is significantly below the typical 4%-8% range for auto loans in the market.

Meanwhile, although several domestic brands have followed suit with similar policies, Tesla remains the most sincere in terms of APR, further underscoring this American EV maker's determination to swiftly emerge from the shadows in China.

Recently, Tesla made its second strategic move.

On January 24 (Beijing Time), Tesla officially announced that from now until February 28, purchasing certain Model 3 variants would entitle buyers to an 8,000-yuan limited-time insurance subsidy.

In reality, this American EV manufacturer has long favored such promotional tactics, even making them a conventional weapon for stimulating sales.

The underlying rationale is straightforward: if Tesla were to directly reduce official prices, it would undoubtedly trigger dissatisfaction and protests from existing owners. In contrast, employing methods like insurance subsidies and installment interest subsidies not only benefits new users but also minimizes the impact on brand image and pricing structure.

Of course, the trade-off entails sacrificing some gross margin. However, at this critical juncture of intensifying competition, for Tesla, retaining and expanding its market share in China is far more crucial than temporary declines in profitability efficiency.

In 2026, its most pivotal move in the Chinese market essentially hinges on the performance of the 'budget-friendly' Model 3 and Model Y.

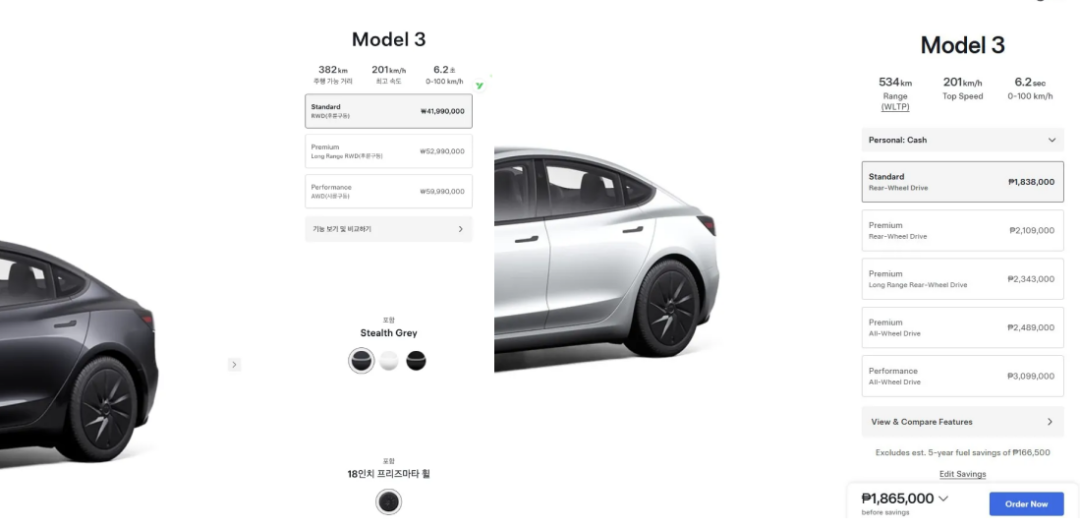

As early as the end of 2025, these two 'precisely targeted' new models had already generated considerable anticipation. Little did people know that just recently, the 'budget-friendly' Model 3, serving as the vanguard, made a surprise launch in multiple Asian countries, including South Korea, Thailand, and the Philippines.

According to reports, this variant, produced at Tesla's Shanghai factory, has undergone significant simplification in configuration: reduced range, smaller battery, downgraded power, and the removal of comfort features like premium audio, power-adjustable seats, and ambient lighting, retaining only core safety functions.

In many eyes, the standard Model 3 is already a 'bare-bones' vehicle, rendering the 'budget-friendly' Model 3 akin to an 'ultra-bare-bones' version. Nevertheless, the same straightforward principle applies: 'Thanks to the brand's strong appeal, as long as the final pricing is competitive, many will still be willing to pay for Tesla.'

"From the results, the 'budget-friendly' Model 3 is currently priced at 41.99 million won in South Korea, equivalent to approximately 198,000 yuan. After local subsidies, the actual purchase price drops directly to 174,000 yuan. In Thailand, it converts to 254,800 yuan, while in the Philippines, it is 217,000 yuan.

Besides these three countries, the 'budget-friendly' Model 3 has also been launched in the United States, the United Kingdom, and the Middle East. This raises another highly anticipated question: 'When will it officially arrive in China?'

The answer suggests it is imminent.

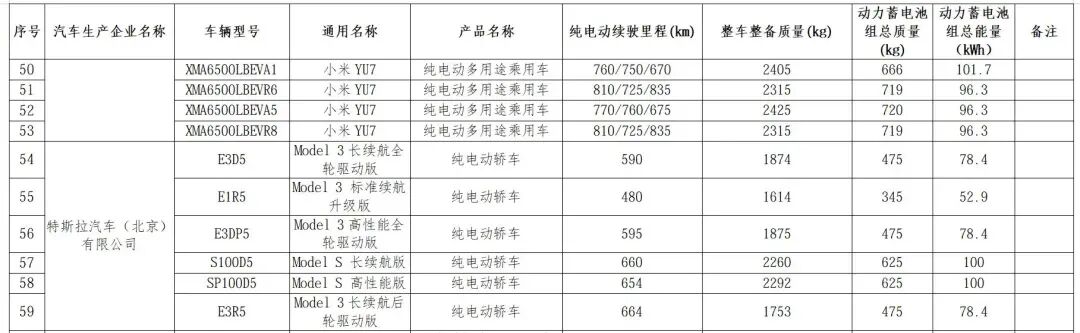

Because this month, according to relevant leaks, the 'budget-friendly' Model Y briefly appeared on Tesla China's official website under the home charging section, while the 'budget-friendly' Model 3 quietly surfaced in the latest tax-exempt catalog from the Ministry of Industry and Information Technology, listed as the 'Standard Range Plus' version.

Based on my understanding of this American EV manufacturer, the former is likely still some time away from release, while the latter has entered the final countdown stage. Boldly guessing, it is highly possible that the 'budget-friendly' Model 3 will meet Chinese consumers before or shortly after the Spring Festival holiday.

So, how will it be priced?

Referring to the current 233,500-yuan price of the Model 3 rear-wheel-drive version, it is expected that the 'budget-friendly' variant could be priced below 200,000 yuan. As another benchmark, in the North American market, the price difference between the two exceeds 38,000 yuan.

Moreover, China has consistently been the market where Tesla's global average product pricing is the lowest. Logically and reasonably, the heavily anticipated 'budget-friendly' Model 3 should demonstrate sufficient pricing competitiveness.

Only in this manner can there be hope for this American EV manufacturer to stage a comeback in China in 2026.

Additionally, it is worth noting that at the recently concluded Davos Forum, Musk dropped a major bombshell: 'We hope to obtain supervised approval for fully autonomous driving in Europe, ideally next month, and China may follow around the same time.'

"In other words, besides the 'budget-friendly' Model 3, we may soon also witness the rollout of the 'full-spec' FSD. Whether Tesla can leverage its leading intelligent driving experience in 2026 to re-establish product appeal and freshness will also be a critical factor.

Whether acknowledged or not, automotive manufacturing remains the driving force behind the advancement of Tesla's other new ventures. Over the past two years, sluggish global sales have made it difficult for Tesla to enter the virtuous cycle it had anticipated, even giving the impression of neglecting one area while focusing on another.

In 2026, it's time to reclaim what has been lost...

Editor-in-Chief: Cui Liwen Editor: He Zengrong

THE END