Can New Core Navigation, Backed by SAIC and Chery with 45 Shareholders Onboard, Revolutionize the Intelligent Driving Chip Industry?

![]() 01/27 2026

01/27 2026

![]() 465

465

Editor | Zhang Lianyi

The race for dominance in intelligent driving technology is heavily reliant on algorithms, yet ultimately determined by the prowess of chips.

In January 2026, the intelligent driving sector witnessed a significant milestone: data from Qichacha revealed that New Core Navigation (Suzhou) Technology Co., Ltd. successfully completed a new round of capital infusion.

Among those boosting their stakes were industry giants SAIC Motor and Joyson Electronic, through their subsidiaries. Newcomers to the shareholder roster included Chery Automobile Co., Ltd. (hereafter referred to as 'Chery Automobile') and Guokai Technology Venture Capital Co., Ltd. Post-funding, New Core Navigation's registered capital soared to RMB 18.7169 million. The company now boasts a diverse shareholder base, including leading automakers SAIC and NIO, component leaders like Joyson Electronic, and numerous minor investors, totaling a staggering 45 shareholders according to Qichacha.

This tech firm, established in December 2023 and independently financed and nurtured by Momenta's chip team, is rapidly gaining traction in both the investment and industrial realms.

Reports indicate that New Core Navigation is poised to witness customers formally initiate mass production and vehicle integration this year, potentially driving up its overall market valuation.

01

A Strategic Move Amidst Algorithm Profitability Challenges

The inception of New Core Navigation was no mere coincidence but a calculated response to industry-wide challenges following Momenta's extensive and in-depth (shēn gēng, a term denoting profound engagement) foray into the intelligent driving sector.

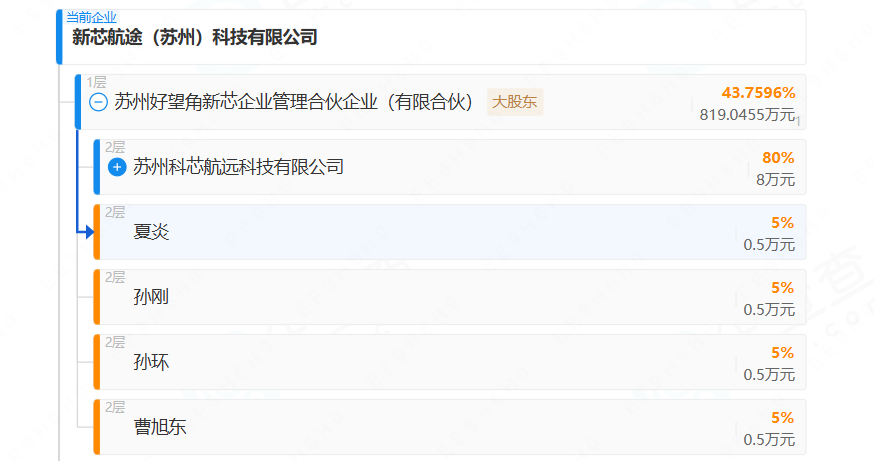

From a shareholding perspective, New Core Navigation shares deep-rooted connections with Momenta. Business registration records reveal that Suzhou Cape of Good Hope New Core Enterprise Management Partnership holds a substantial 43.758% stake in the company, with its shareholders comprising key Momenta figures such as founder Cao Xudong and Xia Yan.

Concurrently, investors previously involved with Momenta, including SAIC Motor, Shunwei Capital, ZhenFund, and Suzhou High-Speed Rail New Town, have extended their support to New Core Navigation's chip endeavors, reflecting the capital market and industry's endorsement and anticipation of this chip venture.

Source: Qichacha

The driving force behind this strategic move could be the prevailing profitability dilemma faced by algorithm providers. Currently, OEMs are only willing to foot the bill for hardware, not the software development costs.

Media reports highlight that in Momenta's bid for the Tengshi U8 project, BYD initially earmarked RMB 20 million for the tender but ultimately settled for a mere RMB 1.8 million in upfront development fees, severely compressing algorithm suppliers' profit margins.

In terms of collaboration models, even if OEMs allocate a RMB 200 million budget for development systems, they seldom fully compensate algorithm suppliers. Some may forgo development fees altogether, while others pay a fraction, around RMB 20 million, upfront. The remaining RMB 180 million funding gap necessitates algorithm suppliers to recoup through per-vehicle license fees and subsequent replication of solutions across repeated vehicle models.

Under this profit model, the profitability of pure algorithm solution providers hinges heavily on vehicle sales volumes. Momenta founder Cao Xudong has publicly stated that software algorithms must achieve a sales volume threshold of 4 million units to attain economies of scale. Falling short of this figure, the algorithm business is destined to incur losses.

More notably, such cases are not isolated; other OEMs also exercise stringent control over upfront development costs during algorithm procurement.

Against this industry backdrop, Momenta resolved to venture into the chip sector, with New Core Navigation serving as its strategic expansion vehicle. To bolster chip-making capabilities, Momenta began recruiting a large cohort of senior executives from Zeku as early as July 2023, amassing core talent for chip R&D and laying the groundwork for New Core Navigation's successful launch.

02

Software-Hardware Synergy: Forging Core Competitiveness

As a company dedicated to intelligent driving chip R&D, New Core Navigation's core competitiveness must first and foremost be reflected in the robustness of its products.

Media reports indicate that within its core product lineup, New Core Navigation has unveiled the high-performance single-core, high-computational-power chip BMC X7 for advanced urban NOA (Navigate on Autopilot), boasting an impressive 272 TOPS of computational power. A single chip can cater to the full-spectrum demands of urban NOA functions, directly challenging industry benchmark NVIDIA Orin-X.

Of course, as an alternative product, its highly integrated 'chip + algorithm' software-hardware synergy solution with Momenta maximizes product performance, which is the key reason behind its rapid acquisition of global first-to-market vehicle models.

This software-hardware synergy model represents the most competitive development path in the current intelligent driving industry.

Momenta (via New Core Navigation) and Horizon Robotics have taken divergent paths but arrived at the same destination—the former entered the chip arena from algorithms, leveraging years of algorithm accumulation to optimize chip design and achieve seamless software-hardware matching; the latter commenced with chips and gradually extended into algorithms, driving software solution implementation through hardware advantages.

NVIDIA is also a quintessential example. In the intelligent driving sector, NVIDIA does not merely peddle hardware but integrates software-hardware solutions based on platforms like the NVIDIA DRIVE AGX Hyperion 10 autonomous driving platform.

An industry insider opines that software algorithms primarily rely on human resources and computational power, both of which can be rapidly augmented through financial investment. Hence, pure software solutions lack an insurmountable barrier and can be easily overtaken or surpassed by competitors. In contrast, competition in the hardware sector can yield functional benefits through vertical integration synergy in the short term, aligning with the current market reality where OEMs 'only want to pay for hardware.' In the long run, if a company can construct an ecosystem akin to NVIDIA CUDA, it can establish an impregnable industry moat and achieve sustained, stable profitability.

From this vantage point, developing chips is far more arduous than developing algorithms. Chip R&D necessitates massive capital investment, extensive technological accumulation, and confronts multiple challenges in supply chains and manufacturing processes. Thus, Horizon Robotics, as an early entrant in the intelligent driving chip sector, enjoys a more pronounced first-mover advantage.

Of course, as a rising star, New Core Navigation, armed with Momenta's algorithm resources and talent pool, along with industrial capital support, holds a promising future.

03

Full-Stack Capabilities: The Gateway to Breakthrough

Automakers' capital infusion and equity participation in New Core Navigation not only provide financial support but also underscore their urgent need for autonomous intelligent driving chips.

Currently, foreign chips still dominate the intelligent driving market, with companies like NVIDIA and Qualcomm leveraging mature products and ecosystems to monopolize chip supply for most advanced intelligent driving vehicle models. Automakers' enthusiasm for deploying intelligent driving chips and even directly investing in chip companies largely stems from a desire to reduce reliance on foreign chips, gain control over core intelligent driving technologies, and ensure supply chain security and stability.

For automakers, intelligent driving has emerged as a core selling point for product differentiation, and chips, as the 'brains' of intelligent driving systems, directly determine the performance and stability of intelligent driving functions. Long-term dependence on foreign chips not only exposes automakers to supply chain risks and exorbitant costs but also hampers technological iteration. Domestic automakers struggle to secure customized chip support and achieve differentiated innovation in intelligent driving functions.

Thus, investing in or even self-developing intelligent driving chips has become an inevitable choice for automakers to forge core competitiveness. New Core Navigation, as a chip company with a robust algorithm background, naturally becomes a prime target for automaker collaboration.

Another core advantage of New Core Navigation lies in the full-stack capability support from Momenta, enabling targeted optimizations during the initial chip architecture design phase (e.g., memory bandwidth, on-chip cache, computational unit ratios) rather than resorting to post-hoc adaptations. Moreover, Momenta's technological roadmap and market space have already been validated, ensuring that its chips have predefined implementation scenarios and clear scale expectations from the outset.

As companies like NVIDIA, Horizon Robotics, and Momenta gradually converge towards full-stack solutions, the intelligent driving market is evolving into a 'software-hardware integration' full-stack competition trend globally.

Full-stack capability refers to core technological capabilities spanning the entire industrial chain, encompassing chips, algorithms, and system integration. The ultimate barrier in the intelligent driving industry lies precisely in full-stack capabilities. Achieving seamless coupling between chips and solutions is no mean feat—it requires chip design to align with algorithm demands and algorithms to optimize for chip performance, forming a virtuous cycle to elevate product performance to optimal levels while possessing differentiated competitiveness.

Therefore, Momenta's incubation of New Core Navigation represents a highly forward-looking strategic move. It is not merely about gaining an edge in the current battle but also about holding the 'core platform' as a critical asset in future scale wars.

-END-