Select Mercedes Models See Price Cuts of Up to 10%: Adapting to Market Shifts, Mercedes Embraces 'China Logic' | Ming Jing Pro

![]() 02/03 2026

02/03 2026

![]() 508

508

Following in BMW's footsteps, Mercedes has also made adjustments to the prices of certain models. On February 2, four Mercedes models, including select versions of the Mercedes C-Class, GLB, GLC, and GLC Coupe, underwent official price reductions. These cuts amount to approximately 10%, or up to RMB 69,020. This price adjustment by Mercedes serves a dual purpose. On one hand, it is a proactive move in response to dealer feedback, aiming to maintain a healthy distribution channel. On the other hand, it can be viewed as a refinement of the product pricing strategy tailored to the Chinese market.

From the perspective of the current automotive market, the overall fuel vehicle sector has entered a phase characterized by reduced premium levels. Whether it's Mercedes, BMW, or ultra-luxury brands like Porsche, their ability to command premiums has been impacted. This shift is attributable to several factors:

Firstly, the emergence of new energy vehicles has disrupted the traditional value assessment criteria for fuel vehicles, leading to a decline in their premium status. Secondly, emerging luxury brands are offering novel luxury experiences, enriching the connotations of luxury cars and diversifying the very definition of luxury. Thirdly, the rise of direct sales models has transformed the traditional dealer-based, one-price-per-dealer purchasing approach. Now, nationwide uniform pricing is becoming more appealing to consumers.

Under the influence of these multifaceted factors, the pricing systems of traditional luxury brands are undergoing a reshaping process. In 2025, numerous traditional luxury car brands are adjusting their prices, directly reflecting terminal discounts in their selling prices. For instance, last year, Volvo implemented this strategy across its entire lineup, starting with the XC90. The newly launched XC90 was priced RMB 160,000 lower than the 2025 models already on the market. Volvo executives stated that the current price war in the luxury car market is intense, and Volvo does not intend to participate excessively or expend energy maintaining high guide prices. Instead of offering in-store discounts, they believe it's better to provide direct consumer benefits.

In fact, Audi and Mercedes made similar attempts with their electric vehicles last year.

The Audi E5 sportback, which hit the market in September last year, is targeted at the luxury entry-level segment, with prices ranging from RMB 235,900 to RMB 319,900. On its launch day, it announced a RMB 10,000 insurance cash bonus, effectively reducing the price by RMB 10,000. As a result, the entry-level model starts at RMB 225,900. As a mid-size pure electric vehicle, the E5 sportback's entry-level model offers a CLTC pure electric range of 618km. Higher trims feature quattro intelligent all-wheel drive and advanced driver assistance systems co-developed with Momenta, showcasing strong appeal.

Subsequently, the Mercedes CLA pure electric model was launched. Traditionally, following Mercedes and BMW's pricing strategies, it would have been priced slightly higher than Audi. However, considering the E5 sportback's entry into the RMB 220,000 range, the new all-electric CLA was potentially priced around RMB 240,000. The vehicle was offered at a nationwide uniform exclusive price ranging from RMB 249,000 to RMB 299,900, a first in Mercedes' history. At this price point, the new all-electric Mercedes CLA is highly competitive among both traditional luxury brands and new energy vehicle startups.

From the perspective of the luxury car market, traditional luxury brands' electric models generally adopt high pricing strategies, with starting prices above RMB 300,000. This is significantly higher than mainstream consumer expectations for electric vehicles. The new all-electric CLA breaks away from self-imposed and industry pricing norms, demonstrating Mercedes' determination and sincerity in fully embracing electrification. Its cost-effectiveness surpasses that of Tesla's mainstream models, marking a true start to Mercedes' electric counteroffensive.

Mercedes can even be considered the first luxury brand to rethink and change its electric vehicle pricing strategy in China—after all, Audi was merely following suit.

Therefore, for Mercedes, adjusting the prices of these models was an inevitable choice. In 2026, whether it's Mercedes, BMW, or Audi, they must all reevaluate their positioning in the Chinese luxury car market in conjunction with their product offerings. The first to adapt will gain a competitive edge.

Mercedes currently focuses on and maintains its strengths in the core luxury and high-end luxury segments. Throughout 2025, Mercedes delivered over 575,000 new vehicles to Chinese customers, maintaining a leading market share in the core luxury segment priced at RMB 400,000 and above, as well as in the high-end luxury car market priced at RMB 1 million and above. Notably, the Mercedes-Maybach GLS SUV saw a nearly 14% increase in annual deliveries.

Industry data also reveals that despite an overall decline in the market for vehicles priced above RMB 300,000, Mercedes remains the top brand in this price range, with approximately 339,000 units sold. Its advantage stems not only from the scale of its domestically produced models but also from its continued leadership in the imported vehicle sector. In the first 11 months of 2025, Mercedes sold approximately 91,000 imported vehicles, ranking first in the RMB 300,000 and above market segment (a niche market segment), ahead of brands like Lexus, BMW, Land Rover, and Porsche. High-value models such as the Maybach series and G-Class form crucial pillars for Mercedes in the high-end and ultra-luxury segments.

Mercedes is further solidifying its stronghold in the high-end market. Recently, the all-new Mercedes S-Class made its debut. Officials claim this generation of the S-Class represents the most comprehensive refresh yet, with over 50% of its components newly developed or optimized. This will undoubtedly strengthen Mercedes' competitiveness in the Chinese market. In addition to the S-Class, Mercedes has unveiled products like the all-new all-electric GLC. As the first production model from the MB.EA platform, the all-new all-electric GLC SUV will introduce a domestically produced long-wheelbase version within the year, equipped with advanced chassis technologies including AIRMATIC air suspension. The new domestically produced long-wheelbase GLE SUV is also poised for launch.

In terms of intelligence, Mercedes plans to roll out multiple over-the-air (OTA) updates for all models equipped with the MB.OS operating system in 2026. Over the next 12 to 18 months, AI-empowered smart cockpits and pilot assist driving systems will gradually be integrated into major product lines.

Reflecting on Mercedes' development trajectory in the Chinese market over the past year reveals both the common challenges faced by traditional luxury brands in their transformation and their attempts to break through by leveraging global resources and local expertise. As the electrification wave in the Chinese automotive market irreversibly sweeps through every market segment, even luxury brands that once set industry standards must confront this profound consumer and manufacturing revolution. The most critical aspect is understanding and adapting to the logic of the Chinese market.

Luxury brands must make systematic and forward-looking adjustments based on structural changes in the Chinese market, evolving consumer demands, and the sustainability of their distribution channels. For instance, Audi has implemented a second-brand strategy in China through its 'audi' brand, fully adopting the product development rhythms and strategies of Chinese new energy vehicle startups. Audi is also the first German luxury brand in China to utilize Chinese brand platform technologies and intelligent driving technologies. In terms of pricing, it directly competes with Chinese new energy luxury brands, representing a commendable exploration overall.

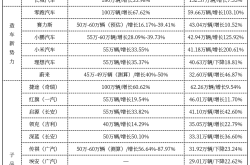

In 2025, the Chinese luxury car market exhibited distinct characteristics of a 'shrinking high-end market and expanding low-end market.' The market share of models priced above RMB 400,000 declined from 6.3% to 5.2%, and the RMB 300,000-400,000 segment dropped from 9.0% to 8.4%. Currently, the challenges faced by BBA (Mercedes-Benz, BMW, Audi) are largely similar. Luxury automakers must recognize that the Chinese market is no longer a stronghold that can be defended through routine measures; only proactive adaptation can stabilize their position.

In the RMB 200,000-400,000 price range, new energy vehicle startups are fiercely competing for market share. To compete against these rivals, BBA brands not only need to update their products but also evolve in terms of pricing strategies and service systems. In 2026, the overall market has encountered a 'tough start,' with intensifying competition. Against this backdrop, proactive adjustment and market adaptation may be the inevitable path to victory. The core logic of all these evolutions is straightforward: 'What does the Chinese market need?'