Robotaxi and Business Travel: Are These Caocao Chuxing's Double Guarantees?

![]() 02/03 2026

02/03 2026

![]() 384

384

Source | Benyuan Finance

Author | Zhang Yexing

The online ride-hailing industry has undergone significant evolution over more than a decade. Each stage—from initial operations and compliance efforts to eventual listing and pursuit of profitability—has posed substantial challenges.

After four attempts, Caocao Chuxing successfully navigated the hearing process and secured its position as the industry's second-largest player. Launched by Geely Holding Group in 2015, Caocao Chuxing is a ride-hailing platform aiming to revolutionize travel through manufacturing, characterized by its 'asset-heavy, tightly controlled, and superior experience' approach.

Early on, Geely Chairman Li Shufu set a high bar for Caocao's management team, stating, 'If you can't outperform Didi in this industry, you haven't achieved success.'

However, Didi's dominant market position proved too formidable to overcome. In 2022, Caocao Chuxing took an unconventional path by integrating with Didi's discounted services, becoming a third-party brand on Didi's platform and effectively abandoning hopes of surpassing its rival.

On June 25, 2025, Caocao Chuxing successfully listed on the Hong Kong Stock Exchange, securing the second-largest position in the industry. Nevertheless, its market share remains modest at 5.4%. Despite owning China's largest B2C fleet—37,000 custom vehicles—its efforts to enhance cost-efficiency are offset by heavy reliance on aggregated platform traffic, resulting in an actual profit margin of just around 0.5%.

To tackle current profitability challenges, Caocao Chuxing is venturing into the high-potential Robotaxi sector. On January 27, the company announced an ambitious goal of deploying a cumulative total of 100,000 custom Robotaxis by 2030, positioning itself for the future of autonomous driving.

Beyond custom vehicles and Robotaxis, Caocao Chuxing has identified a third strategic focus: corporate business travel.

Recently, Caocao Chuxing announced the full acquisition of 100% of Weixing Technology (Yaoxing) and revealed plans to acquire 100% of Geely Business Travel. This marks the company's first strategic acquisition since its listing, targeting the lucrative trillion-dollar business travel market.

The question remains: Which path—Robotaxi or corporate business travel—holds the true solution for Caocao Chuxing?

Robotaxi: Lightening the Load

From its inception, Caocao Chuxing has carried the burden of 'digesting inventory' for Geely.

Unlike other asset-light platforms, Caocao Chuxing requires substantial capital investment to purchase vehicles for operations. As of the end of June 2025, the company had deployed over 37,000 custom vehicles across 31 cities.

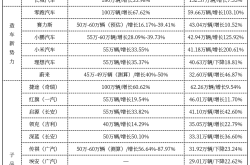

The primary models purchased are the Maple 80V and Caocao 60, both sourced from Geely's ecosystem. Data from 2024 indicates that their total cost of ownership (TCO) is 0.53 yuan/km and 0.47 yuan/km, respectively, which are 33% and 40% lower than typical pure electric vehicles.

After purchasing vehicles, Caocao Chuxing either recruits exclusive drivers to provide travel services or leases/sells the vehicles to transportation partners, fleet operators, and individual drivers to expand its service network.

This B2C custom vehicle approach offers advantages, such as cost control through Geely's support and standardized service experiences.

However, the disadvantages are also apparent. The asset-heavy model results in long payback periods, compounded by high driver subsidies, commissions to transportation partners, and vehicle depreciation costs, leading to a high asset-liability ratio. From 2022 to 2024, its operating cash flow remained negative, only turning positive in the first half of 2025.

Profitability pressures are starkly reflected in its financial performance. From 2021 to 2024, Caocao Chuxing accumulated losses exceeding 8 billion yuan. In the first half of 2025, it reported a loss of 468 million yuan, a 39.8% improvement year-on-year, but its profitability foundation remains unstable.

From a cost perspective, Caocao Chuxing's primary expenses are driver income and subsidies.

From 2022 to the first half of 2025, driver income and subsidy costs were 6.285 billion yuan, 8.146 billion yuan, 10.715 billion yuan, and 6.951 billion yuan, respectively, decreasing from 84.2% to approximately 78.5% of travel service revenue, showing some improvement.

To restructure the cost dynamics of the ride-hailing industry, Caocao Chuxing is turning to autonomous driving, often seen as the future. Benchmarking against Tesla's CyberCab, it aims to tell a more compelling story.

In its prospectus, Caocao Chuxing estimated that driver net income accounts for about 39.42% of travel service revenue. Robotaxis, primarily operated with remote safety officers managing multiple vehicles, offer significant potential for labor cost optimization.

Theoretically, compared to traditional taxis and ride-hailing services, Robotaxis also promise longer operational hours, higher efficiency, and enhanced safety.

Building on its custom vehicle foundation, Caocao Chuxing's Robotaxi fleet eliminates the need to recruit drivers for transportation partners, whose primary task may shift to fulfilling platform vehicle sales KPIs—a scenario Geely likely welcomes.

In February 2025, Caocao Chuxing launched the Zhixing Autonomous Driving Platform, initiating Robotaxi services in Suzhou and Hangzhou on a pilot basis. Its Robotaxi fleet has completed 15,000 km of testing in these cities, with plans to introduce L4-level custom models by the end of 2026.

Recently, Caocao Chuxing CEO Gong Xin upgraded the Robotaxi strategy, proposing a 'Decade, Hundred Cities, Hundred Billion' goal, planning to establish five global operation centers, expand services to 100 cities, and achieve a cumulative gross transaction value (GTV) of 100 billion yuan over the next decade.

At Geely Holding Group's strategic analysis meeting, Caocao Chuxing further announced plans to deploy a cumulative total of 100,000 fully custom Robotaxis by 2030, initiating global commercial operations. Developed jointly with Geely, the model will debut this year.

However, Robotaxi's path to large-scale commercialization remains lengthy and capital-intensive, facing numerous challenges. Caocao Chuxing lacks the first-mover advantage of players like Apollo Go, Pony.ai, and WeRide. It also does not possess the vast user and operational data of ride-hailing platforms like Didi or map service providers like Gaode, making it difficult to support profitability in the short term.

Business Travel: Seeking Growth

Operating in the consumer (C-end) market is challenging, prompting a shift toward the business (B-end) sector, which offers stable demand, high customer loyalty, and superior per-order revenue and margins.

From an order source perspective, Caocao Chuxing's heavy reliance on aggregated platforms limits its bargaining power. Any adjustments to commission rules by platforms like Gaode, Meituan, Tencent Maps, and Baidu Maps could leave it vulnerable.

From 2022 to 2024, the proportion of orders and GTV from aggregated platforms increased from 51.4% and 49.9% to 85.7% and 85.4%, respectively.

During the same period, commissions paid to aggregated platforms were 322 million yuan, 667 million yuan, and 1.046 billion yuan. In the first half of 2025, these commissions surged by 70% to 738 million yuan.

These 'toll fees' account for the majority of Caocao Chuxing's sales expenses, rising annually from 50% in 2022 to 87% in the first half of 2025, eroding profits.

Notably, these sales expenses are essential operational costs for transaction completion, further reducing Caocao Chuxing's actual profit margins. For example, in 2024, with a gross margin of 8% and commissions at 7.5%, the actual profit margin for travel services was just around 0.5%.

Caocao Chuxing has invested 290 million yuan to acquire two companies, temporarily avoiding direct competition in the C-end market and betting on the business travel sector with a focus on B2B operations.

According to Caocao Chuxing CEO Gong Xin, 'Acquiring Yaoxing and Geely Business Travel are key strategic moves to build a one-stop tech travel platform.'

Yaoxing is a premium travel brand launched by Mercedes-Benz and Geely, offering mature high-end ride-hailing services. Geely Business Travel is a professional travel management platform under Geely Holding Group, providing end-to-end travel solutions.

The consideration for both transactions was slightly below the acquired companies' valuations, indicating a deliberate effort by multiple parties to facilitate these deals.

Yaoxing's final transaction price was 225 million yuan, while its valuation report showed a fair value of 245 million yuan for 100% equity as of October 31, 2025. Geely Business Travel's proposed transaction price was 65 million yuan, with a fair value of 75.322 million yuan.

Officially, this represents a strategic transformation to 'complete high-end capabilities and integrate group resources.'

Essentially, it resembles a 'reallocation of internal assets' by major shareholder Geely.

Yaoxing has accumulated losses exceeding 115 million yuan over the past two years, representing a financial burden. Geely Business Travel's profit in 2024 declined sharply by 47.87% year-on-year from 2023, indicating significantly weakened profitability.

Caocao Chuxing's long-standing focus on mass-market travel creates misalignment with high-end business travel in terms of cost structure and customer positioning, posing greater customer acquisition costs.

Source: Tianyancha and announcements

While the trillion-dollar business travel market is enticing, Caocao Chuxing still struggles with insufficient profitability and cash flow pressures. Acquiring loss-making assets from its major shareholder at a premium undoubtedly shoulders significant risks for Geely.

Another notable development is that following the acquisition, Caocao Chuxing promptly raised capital through a share placement, expecting net proceeds of approximately 383 million Hong Kong dollars, with over 60% (about 259 million Hong Kong dollars) earmarked for Robotaxi business expansion. The ultimate flow of these funds may also benefit major shareholder Li Shufu's Geely ecosystem.

Compliance: Challenges Ahead

Whether pursuing short-term revenue through B-end business travel or telling long-term stories about autonomous driving, Caocao Chuxing must first address an industry-wide challenge: compliance and user experience.

Regulations require platforms, drivers, and vehicles to operate with proper licenses, yet compliance remains widespread in the ride-hailing industry. According to Zhejiang Government Services, Caocao Chuxing's operating entity, Hangzhou Youxing Technology Co., Ltd., received over 300 administrative penalties in Zhejiang Province in 2025, primarily for 'providing services with unlicensed drivers.'

A Caocao Chuxing driver told Haibao News that obtaining a professional license is not difficult, as it can be done through online practice tests. Drivers without licenses can still operate but face restricted order access.

According to the latest data from the Ride-Hailing Regulatory Information Exchange System, in the order compliance ranking for December 2025, Caocao Chuxing ranked eighth among leading platforms.

User experience also poses challenges for ride-hailing services. As of this report, Black Cat Complaints has logged 13,917 complaints about 'Caocao Chuxing,' focusing on issues like 'opaque pricing,' 'surge pricing and detours,' 'slow after-sales resolution,' and 'unclear driver-passenger dispute resolution.' Some drivers also reported declining hourly wages and restricted order access, indicating insufficient support for driver income and autonomy.

These issues reflect not just service flaws at Caocao Chuxing but also long-standing industry-wide contradictions in pricing transparency, driver incentive mechanisms, and platform governance.

Industry regulatory policies, data security compliance requirements, and user experience issues will only become stricter and more complex in the Robotaxi and business travel sectors, imposing new demands on Caocao Chuxing.

In the aggregation era, platforms have opportunities for rapid growth and IPOs but face structural challenges like reliance on traffic entry points, profitability pressures, and compliance governance. Scale is not a safeguard; 'user experience' is.

Caocao Chuxing has a long road ahead in building sustainable competitive moats.

References:

[1] 'Caocao Chuxing's First Post-IPO Acquisition: Absorbing Major Shareholder's Loss-Making Assets' Economic Reference

[2] 'After Listing in Hong Kong, Caocao Chuxing Faces Three Key Challenges Under Capital Spotlight' Guancha.cn

*All rights reserved. Reproduction without authorization is prohibited.

end