Hefei vs. Jinan: GDP Parity, but Which City Holds the Key to the Future?

![]() 02/03 2026

02/03 2026

![]() 385

385

Recent data indicates that by 2025, the GDP of Hefei, the capital city of Anhui Province, and Jinan, the capital of Shandong Province, will both reach a staggering 1.421 trillion yuan.

Despite the identical GDP figures, considering the anticipated surge in memory prices in 2026 and historical trends, the outcome is far from a stalemate; the future is already taking shape.

Naturally, comparing just these two cities is somewhat unfair. Shandong boasts 16 prefecture-level cities with relatively balanced development, not to mention the exceptional presence of Qingdao. Shandong's strategy of bolstering its provincial capital has not been fully implemented. In contrast, Anhui's development outside of Hefei is relatively weaker.

Nevertheless, it's undeniable that Hefei's high-tech industrial chain has flourished in recent years, reaching top-tier levels both nationally and globally. From memory chips to new energy vehicles, Hefei has nurtured a plethora of high-tech industries. With the advent of the AI era, Hefei is poised for a transformative leap.

According to reports, Gotion High-Tech and iFLYTEK, both headquartered in Hefei, have officially inked a strategic cooperation agreement. Under this pact, the two entities will leverage their respective strengths to engage in comprehensive strategic cooperation across multiple domains, including intelligent enterprise management, smart manufacturing, and AI-assisted power trading. The objective is to establish a joint innovation mechanism and create a model for AI-empowered new energy industries.

01

Hefei: The Emerging Wolfsburg

Some time ago, while tidying up, Xingkong discarded what appeared to be a useless memory stick.

When memory prices skyrocketed, it felt like throwing away a fortune.

The reason for discarding it was that during the period when memory prices were at their lowest, Xingkong had stocked up on several domestically produced Changxin memory sticks.

A decade ago, in 2016, the Hefei municipal government made the initial investment to kickstart the construction of Hefei Changxin. Today, the memory industry chain in Hefei has reached fruition.

Five years ago, in 2020, the Hefei municipal government made a substantial investment to bring in NIO, which was on the brink of collapse. When many were skeptical about NIO's prospects, Xingkong proposed the theory of 'investing heavily to attract a major player.'

Attracting NIO wasn't the ultimate goal; the real aim was to lure new energy vehicle companies to Hefei and even Anhui.

With Volkswagen investing in JAC (with Volkswagen and the Anhui SASAC each holding a 50% stake) and BYD establishing one of its largest factories in Hefei, the new energy vehicle industry chain in Hefei has gradually strengthened.

Especially noteworthy is Volkswagen's acquisition of Gotion High-Tech, located in Hefei.

As the sole European new energy vehicle company, Volkswagen has been struggling to compete with Tesla and BYD in Europe and chose to venture into the land of hope for new energy vehicles: China.

In a way, Hefei has become Volkswagen's new Wolfsburg. People often ponder when Chinese citizens will enjoy a lifestyle akin to that of Europeans and Americans, with high salaries and no need for overtime.

Have you ever considered why Europeans and Americans can afford such a lifestyle?

Volkswagen provides an insightful case study.

Volkswagen employs approximately 700,000 people globally, with 300,000 in its home country and only 70,000 in China. Yet, at its peak, these 70,000 Chinese employees contributed nearly half of Volkswagen's sales and profits.

In essence, Volkswagen's 70,000 Chinese employees, with relatively lower salaries but outstanding performance, support 300,000 employees in its home country. Can German employees not afford high salaries?

Xingkong summarized this high-salary model as the 'colonial model.'

Some may argue that while BYD's sales have surged, its employees' salaries haven't seen a corresponding rise.

This issue should be viewed from a macro perspective. A decade ago, BYD had 200,000 employees; now, it boasts 1 million, with most new factories situated in second-, third-, fourth-, and fifth-tier counties, primarily hiring employees with junior college degrees. Enabling 800,000 young people from small towns to earn salaries of 6,000, 8,000, or even higher locally—isn't this a broad-based salary increase?

Common prosperity doesn't entail doubling the income of those earning 500,000 annually; it means enabling those earning 3,000 monthly to earn 6,000 or 8,000.

If every county in China has a BYD factory, then true common prosperity will be within reach.

When Volkswagen locates high-tech positions like R&D in Hefei, China, then Hefei truly becomes Volkswagen's new home.

02

Gotion High-Tech's Remarkable Performance

It's widely acknowledged that China's economic development is propelled by three engines.

When many lament the overall economic environment, Xingkong recommends scrutinizing the composition of exports.

This is a period of economic transformation, not decline. Traditional forces, exemplified by real estate, are crumbling, while emerging industries, represented by new energy vehicles, are quietly amassing fortunes.

Take Gotion High-Tech, for instance. The company released its 2025 performance forecast, projecting profits of 2.5 billion to 3 billion yuan, marking a year-on-year increase of 107.16% to 148.59%.

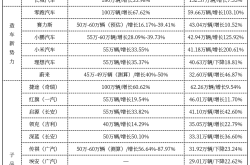

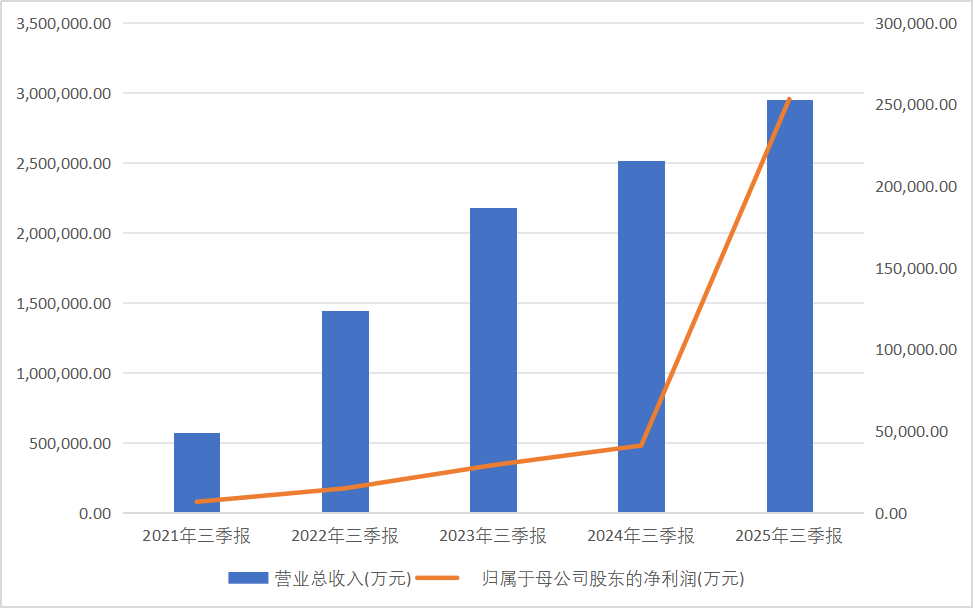

Since the company has yet to release its 2025 annual report, we can infer trends from its third-quarter report.

Data source: iFind

The third-quarter report reveals that from January to September 2025, the company achieved total operating revenue of 29.508 billion yuan, marking a year-on-year increase of 17.21%; net profit attributable to shareholders was 2.533 billion yuan, a substantial year-on-year increase of 514.35%.

The third quarter was particularly outstanding: revenue reached 10.114 billion yuan, a year-on-year increase of 20.68%; net profit attributable to shareholders was 2.167 billion yuan, a year-on-year increase of 1,434.42%.

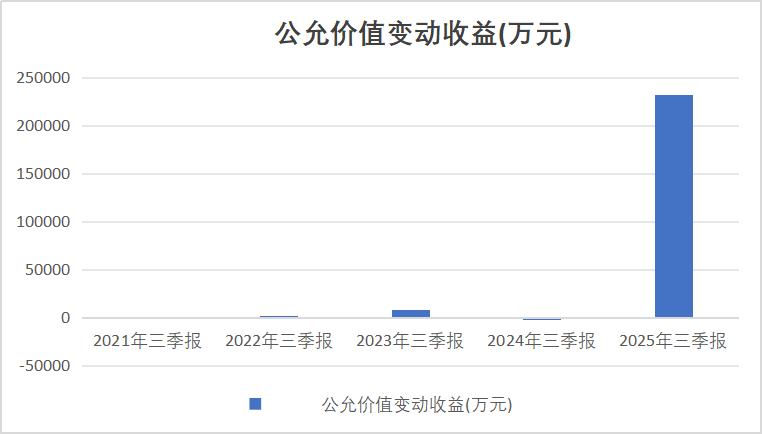

However, the company's remarkable performance wasn't solely driven by its main business but was significantly influenced by substantial changes in the fair value of its holding in Chery Automobile due to its listing in Hong Kong.

Data source: iFind

The gain or loss from this part was approximately 2.436 billion yuan in the first three quarters and about 2.439 billion yuan in the third quarter alone.

After excluding the gain from changes in the fair value of Chery, the company's net profit attributable to shareholders from continuing operations in the first three quarters was 85.3777 million yuan, a year-on-year increase of 49.33%.

03

Collaboration with Volkswagen

Following Volkswagen's acquisition of Gotion High-Tech, the two entities transitioned from cooperation to synergy.

At the Hefei base, the company supplies 63% of Volkswagen's production lines, with a capacity of 80GWh, catering to models such as Volkswagen's ID.UNYX, ID.4/ID.6, with 100% order coverage.

At the Gottingen factory in Germany, Phase I boasts an 80% capacity utilization rate of 20GWh, supplying Volkswagen's ID.7; Phase II's 40GWh plant main structure is complete, with commissioning scheduled for the first quarter of 2026, supporting Porsche's all-electric Macan.

The Volkswagen Anhui project is progressing smoothly. In October 2025, Volkswagen Anhui's new model, "Zony 07," equipped with Gotion High-Tech's LFP batteries, marked the official commencement of the company's collaboration project with Volkswagen.

Regarding the European supply chain, the company's joint venture project with Slovak battery manufacturer InoBat was designated as a national strategic investment in May 2025, with a planned capacity of 60GWh to cater to the European market.

-END-

Disclaimer: This article is based on the public company attributes of listed companies and the information they disclose in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms) as the core basis for analysis and research. Shiyu Xingkong strives for fairness in the content and viewpoints presented in the article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Shiyu Xingkong is not responsible for any actions taken based on the use of this article. Copyright Notice: The content of this article is original to Shiyu Xingkong and may not be reproduced without authorization.