$16 Billion Funding Ignites the Race! Waymo's Capital Surge and Tesla's Do-or-Die Speed Race

![]() 02/03 2026

02/03 2026

![]() 380

380

On February 2 (local time), Alphabet-backed autonomous driving giant Waymo officially announced the completion of a massive $16 billion funding round, with its post-investment valuation surging to $126 billion. This milestone not only sets new records for both funding scale and valuation in the global autonomous driving sector but also marks the industry's full transition from technical experimentation into the high-stakes realm of scaled commercial competition.

The funding lineup reads like a global capital extravaganza: Parent company Alphabet contributed over 75% of the capital, underscoring its strategic commitment. Dragoneer, DST Global, and Sequoia Capital co-led the round, with dozens of top-tier institutions including a16z and Temasek following suit. This collective bet by global capital reflects confidence in the ultimate outcome of the autonomous driving race. As the sector's "pacesetter," Waymo's funding success is no accident but a validation of its 2025 explosive growth trajectory—14 million paid trips annually and fully driverless operations across five cities.

The competition track is already white-hot. The technical rivalry between Waymo and Tesla, the race for commercialization speed, and industry-wide challenges like cost pressures and regulatory hurdles all cast shadows over this $126 billion valuation celebration.

01

Waymo's Funding Journey and Strategic Blueprint

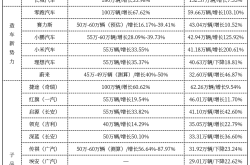

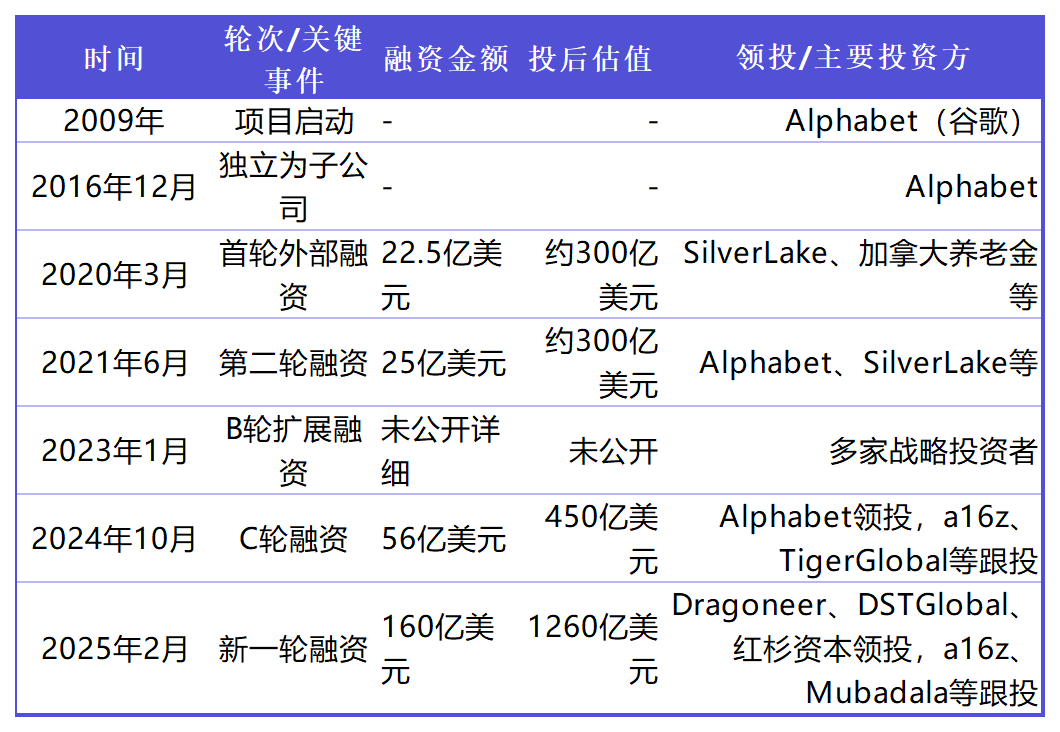

Waymo's funding history traces its evolution from an Alphabet incubator project to the world's most valuable autonomous driving unicorn.

From 2009-2019 as a Google X Lab project, Waymo relied entirely on Alphabet's financial support, receiving billions in unlimited funding to build its technical framework and conduct early testing.

In 2020, it introduced external capital for the first time with a $2.25 billion Series A round led by Silver Lake and Canada's Pension Plan Investment Board. Industrial capital from automotive parts giant Magna laid the groundwork for subsequent commercialization.

The 2021 Series B raised $2.5 billion, with Fidelity Investments and a16z joining the fray. Funds prioritized mass production of its fifth-generation autonomous system and expansion into logistics and ride-hailing.

After a $5.6 billion Series C in 2024, Waymo's valuation exceeded $45 billion. By then, its weekly order volume had surpassed 100,000, signaling the dawn of scaled operations.

Source: Collated from online sources

The current $16 billion will primarily flow into three areas: accelerating ride-hailing service rollouts in over 20 cities by 2026, including Tokyo and London; expanding its fleet with retrofitted Jaguar I-PACE models and new vehicle tests like Zeekr RT and Hyundai IONIQ 5; and optimizing its sixth-generation autonomous system to further reduce hardware costs and deployment cycles.

Notably, Waymo hired a new CFO ahead of the funding round, fueling speculation about a potential IPO. This round may serve as the final large-scale private financing before going public.

02The 2025 Scaled Sprint

2025 marks Waymo's "breakout year," with exponential growth in operational data, service coverage, and technical breakthroughs supporting its $100 billion valuation.

In terms of ridership, Waymo completed 14 million paid trips annually, a 3x increase from 4.5 million in 2024. Weekly paid rides surged to 450,000 by year-end, up 157% from 175,000 at the start of the year. Cumulative trips exceeded 20 million, with passengers spending 3.8 million hours in vehicles and reducing CO2 emissions by 18 million kg—all tripling 2024 figures.

Geographically, Waymo established a service network covering five U.S. hubs. Phoenix, its most mature market, spans 315 square miles with 24/7 airport shuttles, highway operations, and DoorDash autonomous deliveries. The San Francisco Bay Area expanded from 55 to 260 square miles, linking the city with Silicon Valley to create the world's largest contiguous autonomous service zone. Los Angeles, Austin, and Atlanta markets underwent multiple expansions, with Austin's coverage jumping 143% from 37 to 90 square miles in four months via a Uber partnership.

International expansion accelerated in 2025. On April 10, Waymo debuted in Tokyo's Takanawa Gateway, collaborating with Japan's largest taxi operator, Nihon Kotsu, for manual mapping.

On October 15, London was announced as Waymo's first European market, with testing commencing in December under Moove's fleet management. Commercial services are slated for 2026.

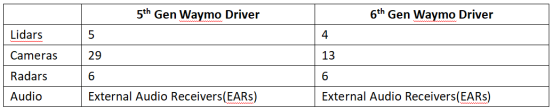

Technologically, Waymo surpassed 100 million fully autonomous miles in July 2025, doubling its 50 million miles by the end of 2024, with weekly autonomous miles exceeding 2 million. The sixth-generation system's full deployment proved pivotal, reducing cameras from 29 to 13 and LiDAR units from 5 to 4 while maintaining 360-degree, 500-meter coverage. This slashed hardware costs and halved deployment time compared to previous generations.

Source: Waymo

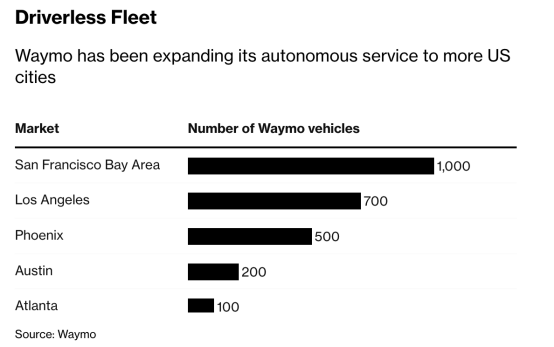

Fleet expansion kept pace, growing from 1,500 vehicles in April 2025 to 2,500 by November, with 1,000 in the San Francisco Bay Area, 700 in Los Angeles, and 500 in Phoenix forming a tiered coverage model.

Fleet distribution as of November 2025:

Source: Bloomberg

Profitability will likely extend beyond ride-hailing. Co-CEO Tekedra Mawakana stated plans to expand into local deliveries and long-haul trucking, followed by licensing its autonomous technology to automakers.

The October partnership with DoorDash for Phoenix autonomous deliveries hints at this strategic shift. For context, Uber's food delivery segment accounts for nearly one-third of its revenue and 40% of its operating profit (excluding stock-based compensation, depreciation, and amortization), growing faster than ride-hailing.

Another revenue stream could emerge from licensing its autonomous software to automakers, though this may materialize later.

03

The Clash of Paths: Waymo vs. Tesla

Waymo's rapid ascent inevitably draws comparisons to Tesla, with both embodying starkly different approaches to autonomous commercialization.

Technically, Waymo employs a "LiDAR + HD maps + cloud connectivity" redundant architecture, achieving a 90% lower severe accident rate than human drivers over 12.7 million fully autonomous miles. However, its reliance on cloud services proved a weakness during the December 2025 San Francisco blackout, when multiple Waymo vehicles stalled due to mismatches between real-time road conditions and preloaded maps, raising questions about system robustness.

Tesla adheres to a "pure vision + neural network" approach, using cameras and algorithms to mimic human driving cognition. While hardware costs are lower, its ability to handle complex scenarios remains unproven, with its autonomous taxi service still requiring human safety drivers in 2025.

Commercially, Waymo operates driverless services in 10 cities, including fully autonomous (no safety driver) operations in Miami, Dallas, Houston, San Antonio, and Orlando. It plans to expand to 15 U.S. cities and London/Tokyo by 2026, with high-margin venues like airports further boosting profitability.

Tesla pursues a vertically integrated model, aiming for limited CyberCab production by April 2026. Its strength lies in vehicle cost control—retrofitting a Model 3 as an autonomous taxi costs ~$50,000, far below Waymo's $175,000 per Jaguar I-PACE retrofit (Waymo claims $75,000 vehicle cost + $100,000 AV hardware). However, regulatory approvals lag behind Waymo's progress.

Both face significant challenges. For Waymo, its capital-intensive model poses the greatest risk, with cumulative funding exceeding $27 billion to date. The $175,000 per-vehicle cost and 2,500-vehicle fleet (expanding to 3,500 in 2026) strain profitability. While partnerships with Uber and DoorDash reduce customer acquisition costs, doubts linger about whether hardware cost reductions can keep pace with expansion.

Tesla confronts technical reliability hurdles. Its pure vision system's performance in adverse weather and complex traffic remains untested at scale, with prior accidents linked to recognition inaccuracies prompting stricter regulatory scrutiny that could delay commercialization.

From an industry perspective, Waymo represents the "steady expansion" camp, while Tesla embodies the "disruptive innovation" faction. Waymo's first-mover advantage and safety record make it more palatable to regulators and the public, suited for safety-critical urban mobility. Tesla, leveraging cost efficiency and user base, holds greater potential in personal autonomous driving.

In the near term, competition will center on the 2026-2027 scaled operations window—whoever achieves per-vehicle profitability and network effects first will dominate the smart mobility revolution.

-END-