European Auto Titans Finally See the Light

![]() 02/05 2026

02/05 2026

![]() 461

461

Introduction

Software development has grown too intricate and costly for any single entity to tackle alone.

There was a time when German engineering, Italian flair, and British heritage were the crowning glories of the European automotive sector, acting as formidable barriers to entry (Note: 'barrier' is used here for clarity, though 'moat' was an interesting metaphorical choice). In the age of combustion engines, these proprietary technologies and brand allure, honed over centuries, indeed placed European automakers atop the global automotive hierarchy.

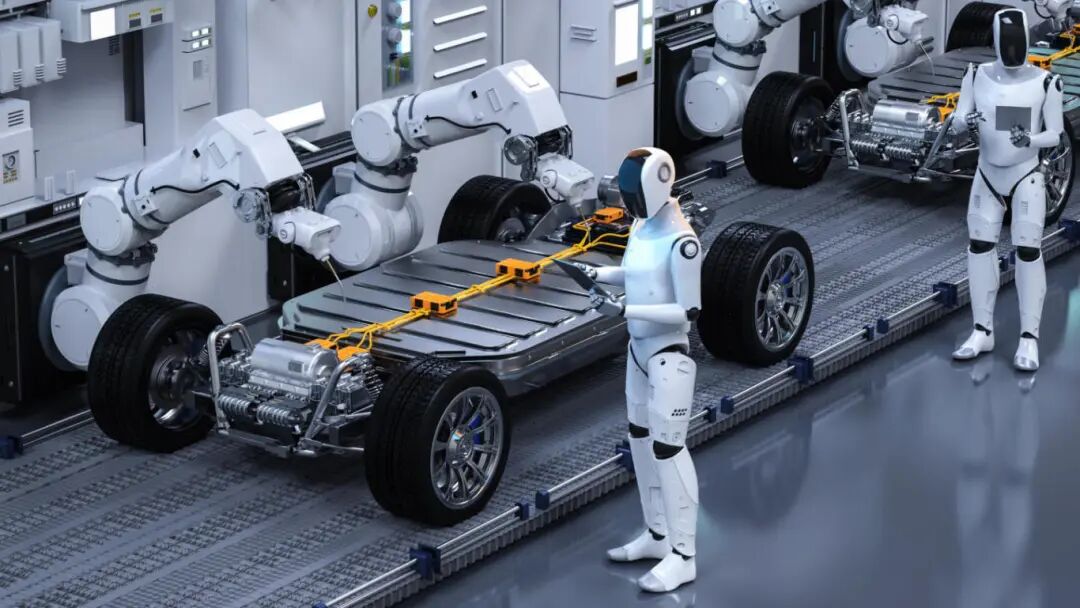

However, as the essence of automobiles subtly shifted from engines and chassis to chips and computing prowess, a profound crisis loomed. European behemoths, stubbornly clinging to in-house development, frequently foundered in the software-defined vehicle wave, with project delays, cost overruns, and system failures becoming the norm.

Now, they have finally humbled themselves, casting their gaze eastward, particularly towards the Chinese firms surging ahead in the intelligent electric vehicle (IEV) race. They've come to realize that the era of isolated car manufacturing is over, and that openness and collaboration are the keys to the future.

From Volkswagen's alliance with XPeng to Stellantis's pursuit of external tech infusion, a realization born of hard lessons is sweeping across the European automotive landscape. They now grasp that in the high-stakes, rapidly evolving software race, going solo not only fails to confer an advantage but may also undermine their entire empire.

01 European Automakers' Setbacks and Awakening

European automakers once believed that competitive edge stemmed from absolute control over core technologies. This mindset, rooted in the industrial age, spurred them to respond to the software-defined vehicle revolution by establishing vast in-house software departments, aiming to fully internalize software capabilities.

Volkswagen Group's high-profile launch of Cariad Software in 2020 epitomized this approach. Its ambition was to become the automotive world's second SAP, unifying software platforms across all group brands and securing autonomous control.

Yet, ideals were lofty, and reality harsh. Cariad swiftly became mired in project delays, internal coordination chaos, and cost overruns, directly causing the postponement of major models like Porsche's all-electric Macan and Audi's Q6 E-tron. The planned new software platform supporting L4 autonomous driving remained elusive, hampering the group's electrification transformation.

Similarly, Stellantis Group faced a major setback in its in-house development of advanced driver-assistance systems. Its inaugural L3 autonomous driving initiative, 'AutoDrive,' was shelved in August last year due to 'high costs and technical challenges.' Originally a cornerstone of the group's 'STLA Brain' electronic architecture strategy, Stellantis now relies on aiMotive, a startup acquired in 2022, to develop the next-generation system, with no clear timeline.

These harsh realities unveil a truth: for traditional automakers, the complexity of software development, the specialization (Note: 'specialization' is used to convey the depth of expertise required) of talent, and the demands for rapid iteration far exceed the limits of their traditional organizational structures and R&D systems.

Continuous failures, like a cold shower, forced European automakers to fundamentally rethink the logic of self-reliance. A 2025 study by consulting firm MHP revealed that over 52% of European automakers now view partnerships as vital to their future survival.

Gartner Vice President of Research Pedro Pacheco bluntly stated, 'The proprietary software strategy has failed.' Automakers developing software in-house are 'too slow and too expensive.' Albert Vaz of Boston Consulting Group (BCG) also noted that while automakers traditionally serve as integrators, in the software realm, they've reached their limits and must seek external help.

This consensus has sparked an unprecedented wave of collaboration, with European automakers abruptly shifting their strategic focus from stubborn inward R&D to open external alliances.

Landmark events of this shift are emerging frequently (Note: 'frequently' is used to convey the sense of many events happening in a short period), and the choice of partners is highly symbolic. Volkswagen Group has acted most decisively. After Cariad's setbacks, it swiftly adopted a multi-pronged collaboration model: First, in the Chinese market, its Chinese subsidiary forged a deep partnership with XPeng Motors to jointly develop a regional controller-based electronic-electrical architecture.

Notably, XPeng provided the crucial underlying software platform, while Volkswagen contributed engineering and large-scale manufacturing expertise. This collaborative model marks a crucial step for Volkswagen in its software-defined vehicle journey in the Chinese market.

Secondly, Volkswagen invested 5 billion euros to form a joint venture with Rivian, an emerging U.S. electric vehicle manufacturer, to gain access to Rivian's advanced regional architecture and software stack technologies, with plans to sell future jointly developed technologies to third parties.

These moves clearly indicate that Volkswagen is abandoning the fantasy of a single standard answer and instead adopting a pragmatic, diversified 'imported strategy.' As long as the technology is advanced and can address urgent needs, whether from Chinese new forces or U.S. startups, all can become partners.

Meanwhile, BMW Group established a 50-50 joint venture, 'BMW TechWorks India,' with India's Tata Technologies, aiming to tap into India's rich software talent pool to develop key software-defined vehicle (SDV) technologies like autonomous driving and digital entertainment for its new generation of Neue Klasse models. Stellantis, after shelving its in-house plans, explicitly stated it will rely more on supplier networks, including aiMotive, to acquire software capabilities it once hoped to develop in-house.

02 The Advanced Nature of a Win-Win Collaboration Ecosystem

The strategic awakening of European automakers is, to a large extent, a stress response and a path reference to the rapid development of China's intelligent electric vehicle (IEV) industry. Unlike their European counterparts' initial attempts at closed-door development, Chinese automakers, from the outset, have embraced the Eastern wisdom that 'going alone is fast, but going together is far,' pioneering a development strategy centered on open collaboration and ecological win-win.

This strategy not only accelerates their own technological iteration and product rollout but also fundamentally reshapes the competitive landscape of the automotive industry, demonstrating significant advancement. This collaboration is not a simple supplier-purchaser relationship but a multi-dimensional linkage penetrating the technological R&D layer, platform-sharing layer, and ecological application layer.

At the technological R&D layer, Chinese automakers actively ally with top tech companies. For instance, numerous automakers have engaged in deep cooperation with Huawei through the Huawei Inside (HI) model or the Smart Selection Vehicle model, directly incorporating Huawei's full-stack intelligent vehicle solutions, including computing platforms, intelligent driving, and intelligent cockpit software, greatly shortening the development cycle of intelligent functions.

Changan, Dongfeng, FAW, and others jointly invested with CATL to establish a cell joint venture, securing next-generation battery technologies. At the platform-sharing layer, Chinese automakers exhibit greater vision. Geely's SEA Architecture, BYD's e-Platform 3.0, and other advanced pure electric platforms have all expressed openness to sharing with other brands, including foreign ones.

At the ecological application layer, Chinese automakers extensively integrate with internet ecosystems like Baidu Apollo, Tencent TAI, and Alibaba Banma, opening up in-car system interfaces to thousands of developers. This focused strategy enables automakers to concentrate limited resources on their most proficient areas while rapidly integrating the world's best software and hardware capabilities through the ecosystem, forming a powerful innovation synergy.

Indeed, the advanced nature of the Chinese model lies in its ultimate (Note: 'ultimate' is retained to convey the highest degree) user orientation and agile iteration speed, achieved through open ecological collaboration. Software updates under traditional vertical integration models often occur annually, whereas Chinese intelligent electric vehicles, supported by ecological partners, can now achieve OTA iterations on a monthly or even weekly basis.

This rapid response to market and user demands builds strong product competitiveness. The lengthy closed development cycles of European automakers in the past are entirely unsuited to the era of software-defined vehicles. Chinese automakers, through collaboration with ecological partners, truly embody the internet product thinking of quickly integrating and developing what users need.

More importantly, China is emerging as a global supply hub for core intelligent vehicle components and software solutions. From Horizon Robotics' and Black Sesame's autonomous driving chips to Hesai Technology's LiDAR, and to Thundersoft's intelligent cockpit solutions, Chinese supply chain enterprises are honing their technologies through deep cooperation with Chinese automakers and jointly going global.

In contrast, the current collaborations of European automakers are more often point-to-point project-based collaborations driven by self-preservation, lacking the deeply intertwined and vibrant industrial ecosystem network seen in China. Chinese automakers, through bold early open collaborations, not only swiftly filled their intelligence gaps but also brought higher user stickiness and broader profit imagination spaces.

It can be said that the awakening of European automakers is their first step in learning from their Chinese counterparts after bowing to reality. They see the necessity of collaboration, but what Chinese automakers demonstrate is a more mature, systematic, and forward-looking philosophy of win-win ecological competition. In the incredibly complex systemic engineering of intelligent vehicles, no single enterprise can dominate all links.

The most efficient strategy is to clarify the core, open the boundaries, attract the best partners to jointly build the ecosystem, expand the industrial pie through co-creation and sharing, and in the process, establish one's own ecological dominance. To truly win the future, European automakers not only need to continue expanding the breadth of collaborations but also think about how to deepen them.

Editor-in-Charge: Li Sijia Editor: He Zengrong

THE END