Intelligence and Performance in Harmony: Has There Been a Resurgence of Chinese Car Chassis in the Past Year?

![]() 02/05 2026

02/05 2026

![]() 412

412

Author | Jason

Editor | Dexin

To encapsulate the development trend of domestic automotive chassis over the past year: The fierce competition in the Chinese automotive market in 2025 has spurred systematic advancements in domestic chassis technology.

Before delving into the evolution of chassis technology, let's first examine some data.

In 2025, the Chinese market alone will witness a total passenger car sales volume of 30.103 million units, marking a year-on-year increase of 9.2%. New energy vehicles will constitute 47.9% of this total, with domestic brands representing 69.5%.

Three key insights can be gleaned from this data:

The market is experiencing rapid expansion; new energy vehicles are making swift strides; and domestic brands are on the rise.

Behind the thriving market of 2025, numerous intriguing narratives have unfolded within the automotive industry.

For instance, government intervention to curb internal competition. According to publicly available information, from the tone set at the 'China Automotive Chongqing Forum' in June of the previous year to the release of the 'Guidelines for Compliance with Pricing Behavior in the Automotive Industry (Draft for Comments)' by the State Administration for Market Regulation in December, the national team conducted four rounds of research interviews to solicit opinions from various industry players.

The aforementioned serves to illustrate a single point: In 2025, competition within the Chinese automotive industry has intensified significantly. Whether it pertains to product configurations and pricing, industry technology, sales channels, or marketing strategies, major automakers are going to great lengths to propel the entire industry into a profound developmental phase.

Under such an industry trend, the development of the chassis sector is naturally deeply influenced. Specifically, it necessitates discussion from two perspectives: 'fundamental chassis capabilities' and 'the development of new chassis technologies.'

I. Amidst Fierce Competition, Chassis Technology Development Delves Deeper

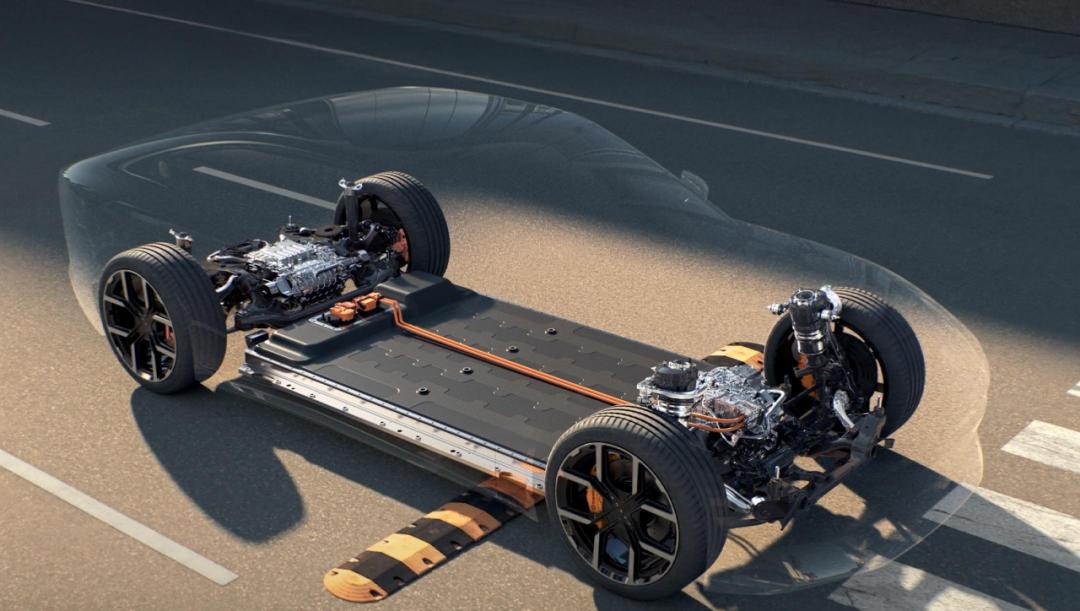

In terms of fundamental chassis capabilities, the Chinese automotive industry has made substantial strides, particularly among new entrants. The most typical representatives include the Li Auto i series, the new-generation XPENG G6/9, and the new-generation NIO ES8.

The handling and comfort performance delivered by the chassis of these models launched last year have significantly improved. They have effectively dispelled negative labels such as 'heavy boat-like feel,' 'loose,' 'cheap,' and 'poor texture' that were previously associated with Chinese electric vehicle chassis.

Consider a simple example in suspension structural design.

In earlier years, even in 2023/2024, even if NIO, XPENG, and Li Auto utilized the same suspension structure, the performance of their vehicles in terms of handling, vibration isolation, comfort, and other aspects still lagged significantly behind BBA models.

However, in 2025, these gaps have been drastically narrowed, and in some performance aspects, they have even surpassed BBA models. The root cause of this phenomenon lies in the demand for quality improvement driven by intense industry competition.

The foundation for quality improvement rests on the understanding and accumulation of capabilities by industry practitioners in a series of fundamental aspects of chassis design, development, tuning, validation, and production.

II. High-End Configurations Become More Accessible, and Cutting-Edge Pre-Research Surges

On the other hand, two phenomena have emerged in the development and application of new chassis technologies:

High-end technologies are becoming more accessible, and cost-effectiveness has become the mainstream of competition; pre-research of entirely new technologies is flourishing, whether among OEMs or Tier 1 suppliers.

Let's first discuss the first phenomenon, taking 'air suspension,' a configuration familiar to most automotive users, as an example. Five years ago, this configuration was primarily found in high-end passenger cars in Europe and the United States, an optional feature available only on executive sedans like the BMW 7 Series, Mercedes-Benz S-Class, and Audi A8. Of course, a few high-end domestic brand models, such as the NIO ES8, also offered this configuration, but the prices remained high, around the 500,000 yuan mark.

It wasn't until the end of 2021 that Geely introduced this configuration to models in the 300,000 yuan range with the Zeekr 001; by the end of 2024, the configuration had stabilized in the 250,000-350,000 yuan range.

However, in 2025, the application landscape for this high-end chassis configuration has changed again.

XPENG's new P7, launched in August last year, directly brought the price of models equipped with standard air suspension down to 219,800 yuan. Moreover, this was a typical strategy of increasing quantity while reducing price, as it featured a dual-chamber air suspension system with variable stiffness, which is more advanced than the single-chamber technology optionally available in early BBA models and the Zeekr 001.

Not only this configuration but also magnetorheological dampers, rear-wheel steering, fixed calipers, and other configurations have seen a price drop in a leap-like manner this year.

The fundamental reason for this phenomenon is the immense pressure on major mainstream automakers to increase sales volumes. Whether adopting a product price war strategy or a cost-effectiveness route to create incremental strategies, both will drive the aggressive downscaling of high-end chassis technologies.

On the other hand, the automotive industry, or rather the new energy vehicle industry, has been 'hijacked' by the 'technology' label in the past year. The market's demand for the application of new technologies has been amplified by this label, leading to a flourishing pre-research trend for new chassis technologies.

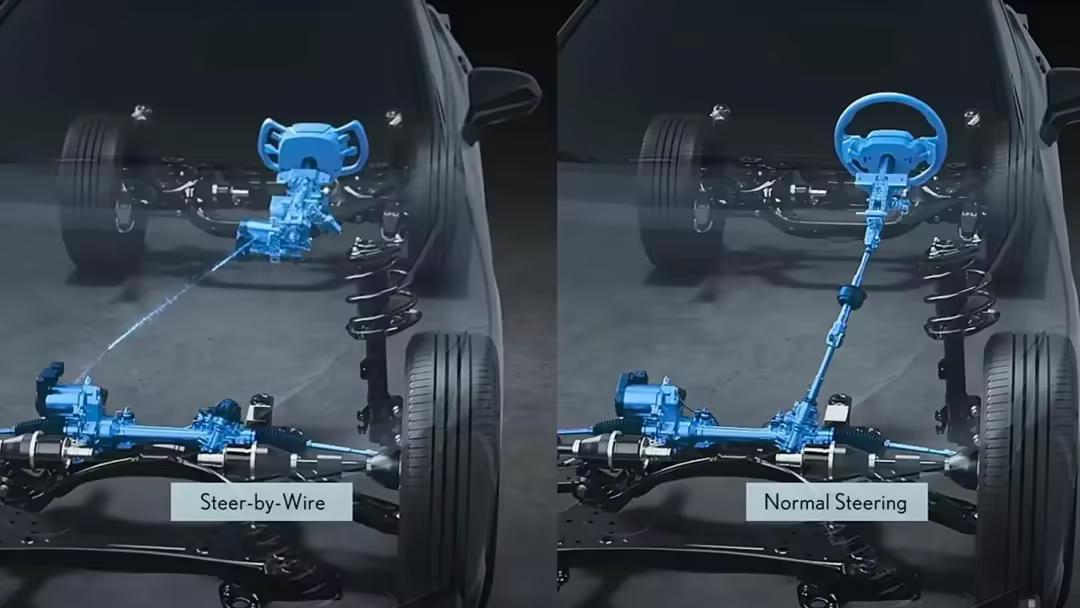

Take steer-by-wire, for example. This technology was first conceptualized by steering system supplier 'TRW' in the 1950s. It wasn't until the 2010s that the daring Infiniti implemented a crippled version for small-scale mass production trials.

However, due to various factors such as technology, regulations, experience, and cost, it remained in a semi-stagnant state for the next decade, or only pilot-researched by a small number of financially well-off automakers and Tier 1 suppliers.

But in the past two years, especially in 2025, the pre-research and application pace of this technology in China have significantly accelerated.

Early last year, the mass production and delivery of the NIO ET9 further fueled the enthusiasm for this new technology. By the end of 2025, almost all OEMs had participated in the mass production development of this technology. On the supply chain side, the number of suppliers specifically investing in the research and development of this technology had tripled. The total industry investment in this field had increased by over 90% compared to a decade ago.

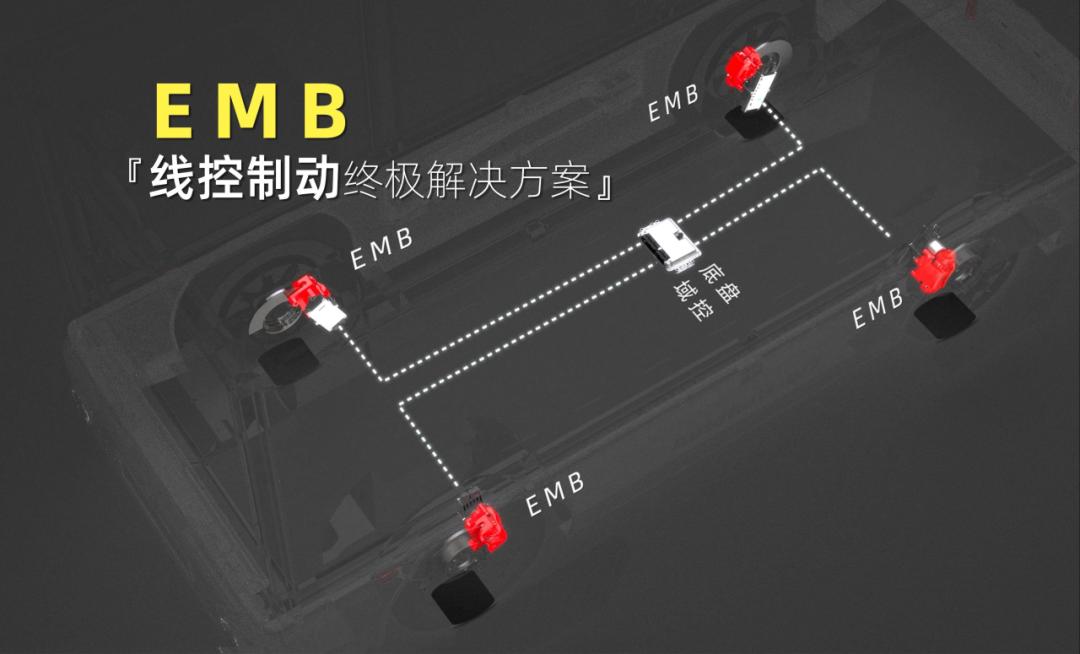

Besides steer-by-wire, other typical chassis technologies such as brake-by-wire and fully active suspensions have also pushed the industry's research enthusiasm, resources, and participants to historical peaks during this year.

However, for the development of chassis technology itself, both phenomena are positive and constructive.

The downscaling of high-end technologies yields incremental benefits. With larger quantities, technologies can be more thoroughly validated, and reliability will evolve more robustly. The emergence of pre-research for new technologies further lays a solid foundation for future development.

III. Competitiveness of Chinese Chassis Technology in the Global Automotive Market

As we all know, European and American markets have long been leading in chassis capabilities.

As early as 2017, mainstream Chinese automotive forces, represented by Geely Automobile, began laying out in Europe to learn relevant capabilities and integrate European chassis supply chain resources. After undergoing fierce market competition, what are the differences in strength between domestic and international players now?

Let's analyze and compare from the two aspects mentioned earlier: 'fundamental chassis capabilities' and 'the development of new chassis technologies.'

In the first aspect, the comprehensive strength of major domestic automakers still lags somewhat behind that of European automakers, which is an undeniable fact. However, this gap has been narrowing at an accelerated pace over the past year.

The Li Auto Mega and i series models have objectively demonstrated the real gap in chassis strength between domestic and international players on the path of comfortable chassis development. The Xiaomi Su7 series and the new XPENG P7 have almost achieved parity with their European and American counterparts in the sports sedan segment—track performance remains a key criterion for measuring the comprehensive strength of sports sedan chassis.

A deeper analysis reveals that the gap in chassis design, development, and tuning capabilities between domestic and international players is actually quite small. However, there is still a certain gap in manufacturing, craftsmanship, and supply chain quality control. This is because these three areas require rapid improvement after a surge in production volume. Clearly, the Chinese automotive industry has not yet entered or has just begun to enter this phase.

In the second aspect, the speed of development and application of new chassis technologies in China is indeed much faster than abroad.

Take dual-chamber air suspensions with variable stiffness and magnetorheological dampers, for example. It may have taken Europe and the United States nearly half a century to apply these technologies to mass-produced models, and even then, they could only be equipped on high-priced, low-volume models. However, in China, it only takes a short one to two years for such high-end or new chassis technologies to reach mass production, and on a large scale.

The same goes for pre-research of new technologies; the research and development speed between domestic and international players is as vast as the difference in high-speed rail speeds between China and abroad today.

Fully active suspension technology (the 'dancing suspension' promoted by BYD's Yangwang U9) took half a century of research and development and implementation abroad. However, with Chinese speed, it only took three years.

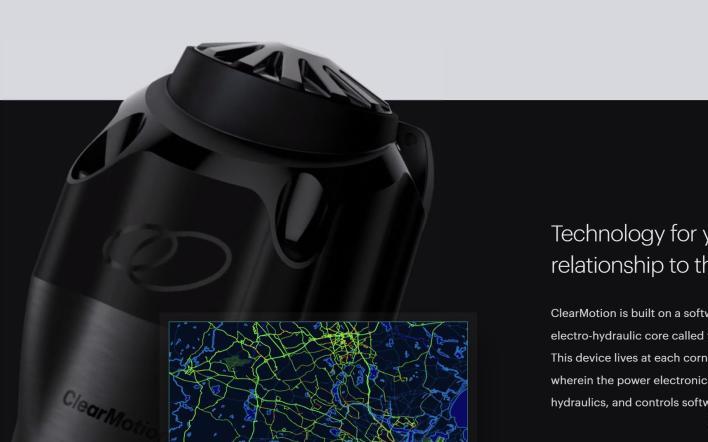

Here, we must mention a supplier developing active suspension technology—Clearmotion.

Its core active suspension technology, 'Soundactive suspension,' began pre-research as early as 1970. After several twists and turns, it was introduced to China through capital guidance in 2021, forming a strategic development cooperation with NIO. After arriving in China, it completed the leap from pre-research to mass production in just four years and achieved mass production and delivery with the NIO ET9 in 2025.

This case sufficiently proves that China has surpassed Europe and the United States in terms of the speed and strength of developing and applying new chassis technologies.

IV. Inertial Force Propulsion: Analysis of Development Trends and Breakthrough Points in the Global Chassis Sector in 2026

After discussing the development of the global chassis industry in 2025, we must discuss the development trends in 2026.

For China, the chassis sector might be aptly described by the phrase: 'the culmination of hardware, the beginning of intelligence,' to characterize its development stage.

In terms of fundamental chassis capabilities, a foundational development will undoubtedly be completed in 2026, with basic design, development, and tuning capabilities on par with the leading players and forming a stable state. However, the demand for 'technology-driven' chassis will become increasingly strong. Under this premise, the chassis will embark on a long and arduous journey of intelligent exploration.

Therefore, the industry's focus will shift to the field of 'multi-dimensional domain control' related to the chassis next year.

The core of 'multi-dimensional domain control' development lies in three dimensions:

The highly integrated development of controllers; the development of new high-load, low-latency electronic control actuators; and the empowerment of AI and big data.

Let's discuss each of these three points in detail:

Controller Integration

Controller integration comprises two parts:

The first is the highly integrated development of controller hardware. In the past, the braking, steering, and suspension domains of the chassis all had independent controllers. These will now be thoroughly integrated into a single controller, eliminating traditional gateway controllers and independent power distribution controllers.

The essence of the development of brake-by-wire is to revolutionize this aspect.

Because with the development of brake-by-wire, OEMs will no longer be forced to accept control units imposed by Tier 1 suppliers on braking actuators.

The second is the highly integrated development of software architecture. In the vehicle's electronic and electrical architecture, the chassis and powertrain domains still have independent CAN buses for high-security signal communication. However, the next step is to integrate the underlying communication of all vehicle domains into a single communication backbone. This includes highly integrating the functional carriers of the application layer into a single controller.

Advancements in Hardware Actuator Technology

In the realm of intelligent chassis development, beyond the challenges posed by software development, a significant performance bottleneck arises from the capabilities of hardware actuators.

Consider the brake caliper within a brake-by-wire system as an illustrative example. Its operational mechanism diverges from that of traditional hydraulic brakes. Rather than being actuated by high-pressure brake fluid to press the brake pads, it is powered by a low-speed, high-torque motor, imposing stringent demands on the motor's performance.

The erstwhile 12V vehicle power supply is no longer adequate to fulfill its torque requirements, necessitating the future development of motors and motor drivers operating at higher voltages. Consequently, this represents a critical area where the intelligent chassis must undergo profound enhancement.

AI and Big Data Integration in Intelligent Chassis Systems

Since the introduction of the AI-driven intelligent vehicle P7+, championed by He Xiaopeng in 2024, the question of how to effectively apply AI capabilities to chassis control remains unresolved.

In the forthcoming year, the entire industry is poised to continue its quest for this elusive answer. By leveraging AI as the cognitive core and chassis actuators as the physical embodiment, the technological allure of new energy vehicles can undoubtedly be amplified. Hence, intelligence will emerge as the central focus, demanding the automotive chassis's unwavering commitment and dedication in the years ahead.