From Elon Musk to Li Xiang, the Auto Industry Embraces 'Diversification'

![]() 02/06 2026

02/06 2026

![]() 413

413

Since last year, at least 17 major automakers worldwide have announced their entry into the robotics sector, including foreign companies like Tesla, Mercedes-Benz, Toyota, and Hyundai, as well as domestic players such as BYD, Xiaomi, XPENG, GAC Group, Li Auto, and Chery. This number continues to grow.

In 2025, the global automotive industry is embroiled in a fierce price war, and the market landscape has undergone significant changes. Former 'sales champions' no longer dominate, as more rising stars emerge, intensifying competition in the auto sector.

In response to these changes, some companies choose to face the competition head-on, while others opt for a completely different path—telling stories beyond automobiles.

Recently, Tesla released its Q4 2025 report, showing an 8.6% year-on-year decline in annual vehicle deliveries to 1.64 million units. However, Tesla's stock price surged more than 4% after the earnings release, suggesting the market is indifferent to the decline in its automotive business.

Similarly, Li Xiang, Chairman of Li Auto, recently held a company-wide meeting that surprised many by focusing entirely on AI rather than deeply discussing car sales or product iterations. Li Xiang firmly stated, 'We must develop robots.'

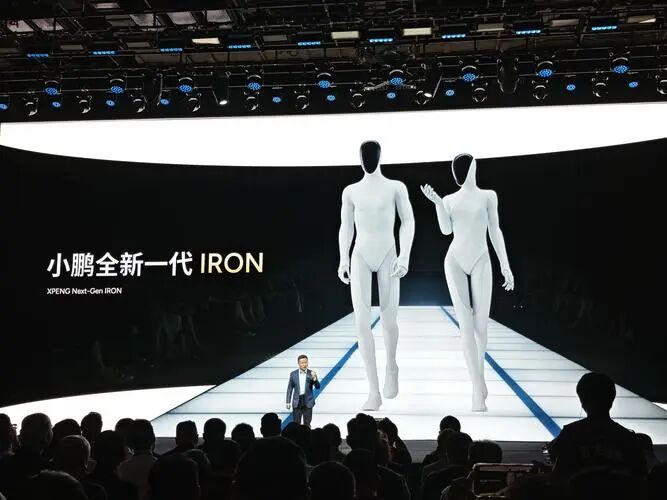

Tesla and Li Auto are not isolated cases. In recent years, when consumers discuss the automotive market, there is a sense that automakers are increasingly resembling tech companies: XPENG unveiled a humanoid robot mistaken for a 'real person in disguise,' and BYD established a future lab dedicated to embodied artificial intelligence. Suddenly, automakers seem to be collectively 'diversifying.'

As traditional automakers shift from solely 'building cars' to transforming into AI tech companies, is this a trend to chase, a label to attach, or a necessity for survival in the next decade of the automotive industry?

1

Automakers' Collective 'Diversification'

It's not just Elon Musk—domestic automakers all harbor a 'tech dream.'

XPENG was the earliest new automotive force to fully pivot toward AI. In 2024, XPENG upgraded its brand to 'XPENG AI Automobile Company' and, in November of the same year, redefined its positioning as 'an explorer of mobility in the physical AI world and a global embodied intelligence company.'

During a 2024 interview, Li Xiang, Chairman of Li Auto, officially announced the company's transition from a 'smart electric vehicle enterprise' to an 'artificial intelligence enterprise.' In January of this year, Chery Automobile also declared its transformation into a 'global AI tech company.'

Over the past few years, AI has deeply penetration (can keep this pinyin as it represents a specialized term that may not have a direct equivalent) into the DNA of nearly all automakers, driving every aspect of automotive R&D, manufacturing, sales, and even services—from smart cockpits to assisted driving, from AI-integrated intelligent systems to data-defined development—acting as the 'operating system' for the entire automotive value chain.

In this process, AI not only empowers smart vehicles but also embodies intelligence. Since last year, at least 17 major automakers worldwide have announced their entry into the robotics sector, including foreign companies like Tesla, Mercedes-Benz, Toyota, and Hyundai, as well as domestic players such as BYD, Xiaomi, XPENG, GAC Group, Li Auto, and Chery. This number continues to grow.

The automotive industry seems increasingly 'diversified,' but this shift is welcomed by capital markets.

Take Tesla as an example: despite its weakening automotive business, its total market capitalization has rebounded to the trillion-dollar threshold, reaching a historic high. The market no longer cares how many cars Tesla sells but is willing to pay for its AI, robotics, and commercial aerospace ventures.

Similarly, XPENG's stock price surged last year, hitting a new high since July 2022. Capital markets are bullish not just on XPENG's sales but also on its AI, technology, and Robotaxi ecosystem integration.

Behind this trend lies the harsh reality that the automotive market is shifting from 'incremental competition' to 'survival of the fittest.' According to the China Passenger Car Association, the profit margin for China's automotive industry fell to 4.1% in 2025, its lowest level ever.

Gong Min, Head of Automotive Research at UBS China, stated, 'Too many automakers have been established in recent years. While this has driven innovation and matured the supply chain, it has also led to disorderly competition and thin profits. Everyone is struggling to make money, and consolidation is inevitable.'

Thus, while the automotive business remains the foundation for automakers, they must also prepare for the future by seeking new growth avenues and narratives to pave the way for the next decade.

Currently, AI technology is not just a 'money pit' but also opens up entirely new profit models.

For example, XPENG's technology licensing business with Volkswagen has become a significant revenue stream. In Q3 2025, XPENG's service and other revenues reached RMB 2.33 billion, contributing 42.4% of its total gross profit.

Moreover, automakers venturing into AI large models and robotics have inherent advantages.

On one hand, the technical capabilities accumulated by smart vehicles in areas like autonomous driving and smart cockpits, along with their advantages in manufacturing and supply chain procurement, can be relatively smoothly transferred to robotics and other smart hardware. Calculations by the China Electronics Technology Group Corporation's Fifth Institute show that automakers' R&D costs for humanoid robots are about one-third lower than those of ordinary robotics companies.

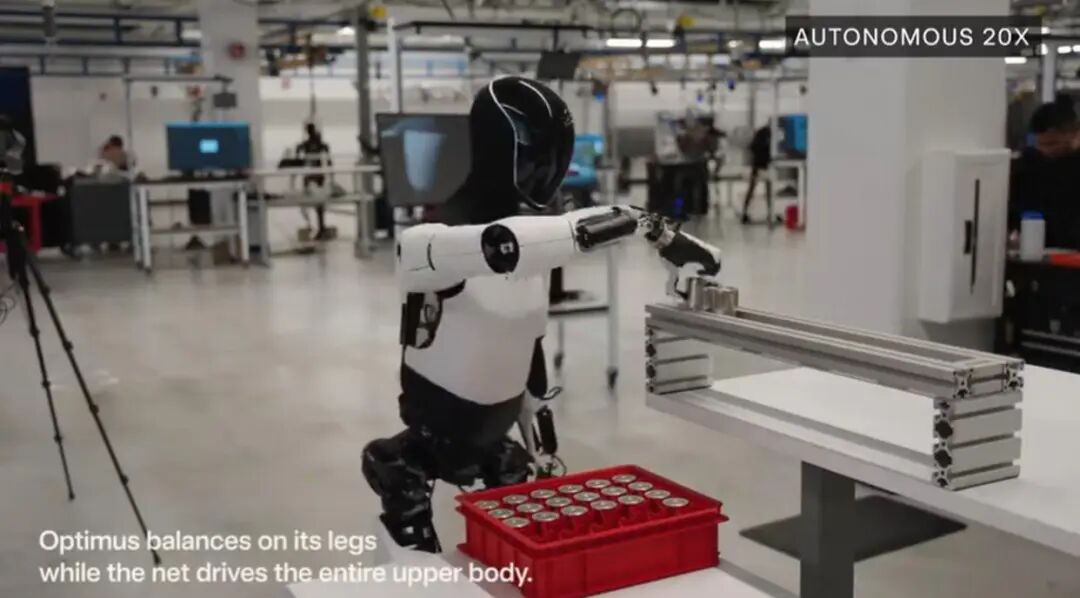

On the other hand, automobile manufacturing itself is a clear application scenario for robotics. UBTECH's Walker S has entered factories like FAW-Volkswagen to perform vehicle quality inspections and seatbelt checks; Tesla's Optimus sorts battery cells in its own factories; and Chery's humanoid robot 'Moyin' assists sales at Chery 4S stores.

For automakers, shifting from 'competing on car-building' to 'competing on technology' is not just a wild attempt but a natural extension of their commercialization paths. Only by breaking free from traditional car-building mindsets can they find the narrow path from 'manufacturing' to 'intelligent manufacturing.'

2

The Auto Industry's Shift Toward Ecosystem Competition

Meanwhile, the ultimate battleground for automakers is to dominate industry discourse in the 'next decade.'

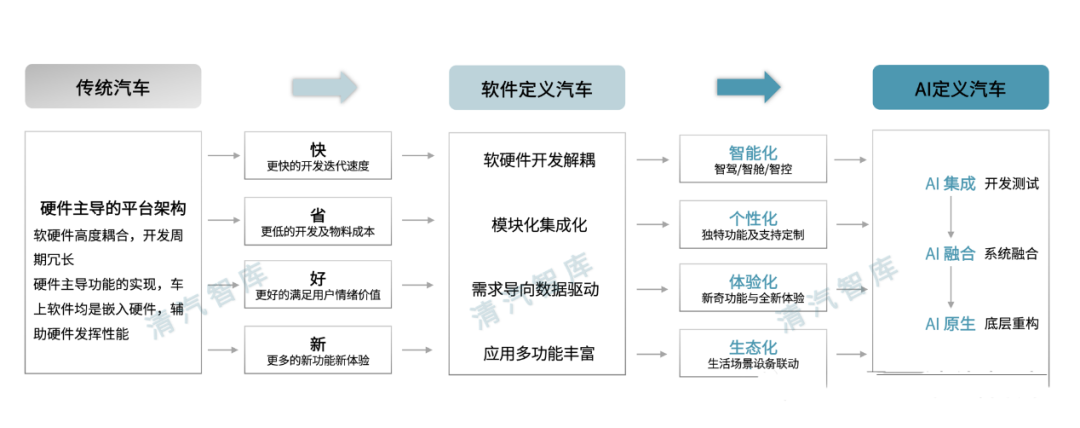

As AI technology continues to fuse with smart vehicles, the automotive industry is evolving from 'software-defined vehicles' to 'AI-defined vehicles.' This shift moves from software-driven functionalities, system development, and hardware updates to AI applications providing comprehensive support for efficient vehicle development and operation.

AI not only enables seamless collaboration between chips, sensors, and low-level driver software but also empowers smart cockpits, autonomous driving, and even vehicle-cloud integrated service ecosystems. More importantly, it reshapes automotive R&D logic, manufacturing processes, and business models through the vast amounts of data generated in real-world scenarios.

Simply put, in the past, automakers competed on engine power, chassis robustness, and aesthetics; in the electric vehicle era, the focus shifted to batteries, range, and screen size.

However, in the future AI era, competition in the auto sector will elevate to a more abstract level—comparing whose vehicles are smarter and more user-centric, and whose ecosystems are more powerful, enabling technological empowerment of vehicle manufacturing and attracting more partners.

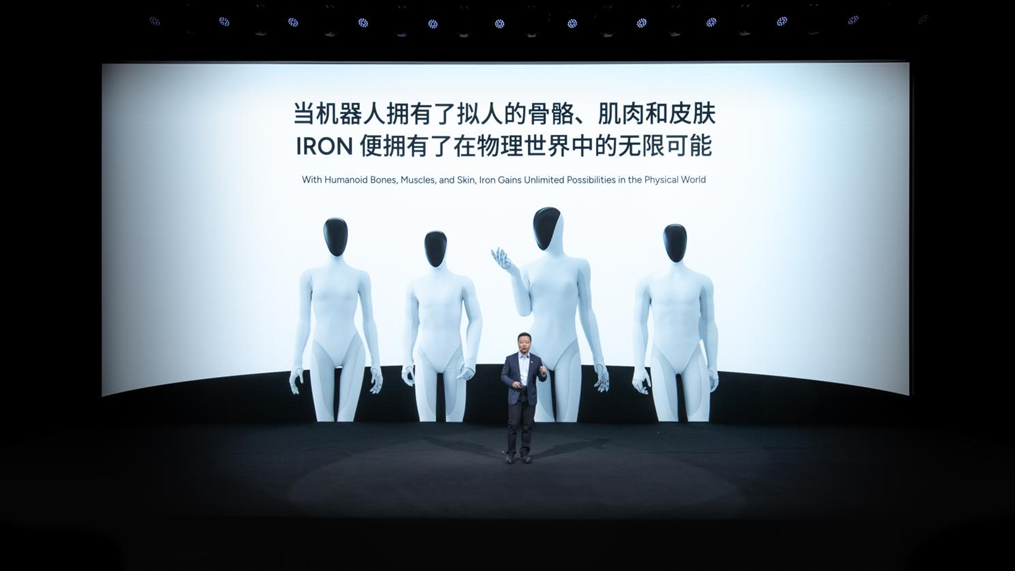

Against this backdrop, automakers 'building humans' are essentially creating 'next-generation smart devices'—the most promising direction in the current AI industry: 'physical AI.' AI will transcend screens and permeate urban environments, factories, homes, and other scenarios in physical form.

He Xiaopeng, Chairman of XPENG, once stated that AI's practical value would be extremely limited without interaction with the physical world. Only by giving AI a 'body'—enabling it to walk, see, and interact—can AI truly transform human production and lifestyles.

Li Xiang, Chairman of Li Auto, also shared his vision for future smart vehicles, arguing that if product competition remains at the electric vehicle level, it will devolve into a specs war. Focusing solely on smart terminals would merely transfer smartphone functionalities to vehicles. Instead, embodied intelligence is the product that can truly transform users' lives.

Tech leaders worldwide frequently mention 'physical AI': Jensen Huang, CEO of NVIDIA, believes 'physical AI will dominate the next phase of AI'; Wu Yongming, CEO of Alibaba, states that 'AI's greatest potential lies in the physical world.'

This makes it easier to understand why automakers aspire to become AI companies. Future smart vehicles will merely serve as carriers; the functions they enable and the value they create will depend on the connected smart ecosystem.

While selling smart hardware like cars or robots can still be profitable, the most lucrative revenue streams will come from data services, software subscriptions, and other income generated by the intelligent ecosystem behind the entry point.

Whoever first establishes open and compatible technical standards and ecosystems will attract more brands to join their 'circle,' sharing technology, data, and user resources. As the ecosystem grows, so will their competitive barriers.

3

Who Will Secure the Next Ticket?

To win the ultimate battle in the auto industry's ecosystem war, automakers are accelerating their technological transformations through three main paths: full-stack self-research, ecological cooperation, and mergers and acquisitions.

Companies like Tesla and XPENG, which possess full-stack self-research capabilities, insist on developing everything in-house—from AI chips and operating systems to large models and smart hardware—giving them strong technical controllability and rapid iteration capabilities.

New energy automakers like Geely, GAC Group, and Chery, which already have self-research capabilities for core components, quickly establish technical barriers and enter practical application scenarios by collaborating with suppliers and tech companies to complement resources.

Traditional automakers like Hyundai and BMW acquire core technologies through acquisitions or partnerships to minimize the costs and risks of independent R&D.

While automakers' transformation paths vary, the underlying principle is that 'the best fit is what works.'

New-force automakers, with their stronger technological DNA, can better attract capital market recognition through full-stack self-research. Traditional automakers, moving at a slower pace, can more quickly address shortcomings through cooperation and acquisitions—after all, staying in the game matters most.

However, there is another side to automakers' proactive transformations: doing the right thing is often the hardest thing.

First is the commercialization challenge. New technology R&D often requires massive investments and long cycles. Tesla has invested tens of billions of dollars in AI; BYD plans to invest hundreds of billions in intelligent driving.

These investments are unlikely to yield clear commercial returns in the short term and will continue to squeeze automakers' already thin profits due to market competition. Without a strong core business to 'fund' new ventures, investments in new businesses could become a burden.

Second, smoothly transitioning roles is no easy feat. Cutting-edge tech R&D is a capital-intensive, talent-intensive marathon that tests corporate strategic resolve and organizational capabilities.

For traditional automakers accustomed to manufacturing management models, reconstructing organizational structures and corporate cultures to align with the agile, error-tolerant, and flat cultures of tech companies will be no small challenge.

Finally, automakers' ambitions must be validated by technological achievements—a point of significant external skepticism.

Tesla has repeatedly delayed the mass production of its third-generation Optimus humanoid robot, with technical challenges remaining unresolved. XPENG's IRON humanoid robot stumbled during a runway show, reflecting the 'growing pains' of embodied intelligence moving from labs to real-world scenarios.

While such 'mistakes' are inevitable trial-and-error costs in technological iteration, and the market is willing to give explorers leeway, this does not mean the market will pay for concepts that remain stuck in PowerPoint presentations.

When all automakers are rushing into AI, competing on technology is not the goal but the means.

Automakers must ultimately answer the question: What kind of company are they? What problems are they solving with AI and robotics? Without tangible value beyond grand narratives, their 'tech dreams' will be shattered by reality.

The path to the forefront of technology is inevitably a 'lonely journey.' There are no shortcuts; automakers must persevere through repeated failures. Only by taking steady steps can they go farther and more securely.