Can Geely compete with BYD this year?

![]() 07/01 2024

07/01 2024

![]() 654

654

Geely Automobile (0175.HK) released its 2024 first-quarter report after the Hong Kong stock market closed on June 28, 2024, Beijing time. The key points are as follows:

1. Gross margin declined quarter-on-quarter: The company's overall gross margin for the first quarter was 13.7%, a decline of 2.3% compared to the second half of 2023, which is expected to be due to the decline in the gross margin of new energy brands. New energy vehicles were generally in a sales trough in the first quarter, and the scale effect was not released. At the same time, competition in the new energy vehicle market intensified, and both ASP and gross margin of new energy vehicles are expected to be under pressure.

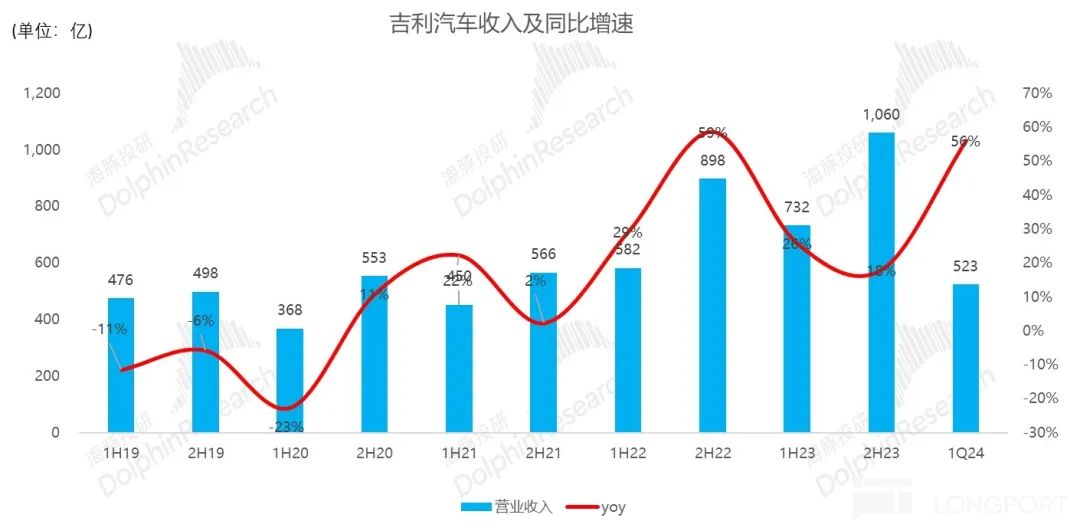

2. Both sales volume and price increased, driving overall revenue growth year-on-year: In the first quarter, the company achieved total sales revenue of 52.3 billion, an increase of 56% year-on-year. On the sales side, due to the low base of Geely's new energy vehicles during the first quarter of last year, as well as the hot sales of the Chinese Star series in the first quarter, sales increased by 48% year-on-year. According to Dolphin's estimates, ASP per vehicle was basically flat compared to the second half of 2023. Among them, the ASP of Geely's main brand increased, which is expected to be due to the hot sales of Geely's relatively high-priced Chinese Star series and the increase in overseas sales, offsetting the price reduction impact of Geely's new energy vehicles.

3. However, the sales progress of new energy vehicles is still slower than the annual target: From January to May 2024, Geely's new energy brand sales only reached 254,000 vehicles, only 31% of the annual target of 810,000 vehicles. The main models Galaxy L7 and Lynk & Co 08, which sold over 10,000 units last year, have only fallen back to around 6,000 units, and the speed of new energy transformation is still slower than expected.

4. Geely's hybrid strategy in the second half is relatively passive, focusing on pure electric vehicles: Compared to BYD's new product cycle powered by DMI5.0 technology, Geely's new generation of hybrids will not be mass-produced until 2025. Therefore, Geely's hybrid strategy is in a passive state, and the models launched in the second half will mainly be pure electric vehicles.

5. R&D expenses have been controlled, and operating expense ratio has declined: Sales expenses in this quarter were relatively rigid, mainly used for the launch of new models from Geely's new energy brands Zeekr, Lynk & Co, and Galaxy. R&D and management expenses were relatively restrained, mainly due to the significant reduction in Zeekr's R&D expenses in the first quarter. The operating expense ratio declined from 13.4% in the second half of 2023 to 12.3% in the first quarter of 2024.

6. Net profit per vehicle declined, but joint ventures brought profit increments: The decline in net profit was lower than that of the core main business profit, mainly due to the reduction in losses of the joint venture Lynk & Co and the profit increment from the divestiture of the affiliated company Ruilan.

Overall view: From Geely's first-quarter report, the revenue side is basically in line with Dolphin's expectations, but the gross margin is lower than Dolphin's expectations. The gross margin in the first quarter was only 13.7%, down about 2.3% from the second half of 2023. Dolphin speculates that this may be due to the decline in the gross margin of Geely's new energy brands. In the first quarter, Zeekr's gross margin was only 12%, down 3% from 15.2% in the second half of 2023. Due to the price reduction of the Galaxy Longteng version, Galaxy's gross margin is also expected to show a downward trend quarter-on-quarter. However, the overall revenue performance was good, driven by the increase in both sales volume and ASP. Dolphin believes that this is mainly due to the hot sales of Geely's relatively high-priced Chinese Star series and the increase in overseas sales, offsetting the adverse impact of price reductions of its new energy brands. However, in terms of sales, from January to May 2024, Geely's new energy brand sales only reached 254,000 vehicles, only 31% of the annual target of 810,000 vehicles. The main models Galaxy L7 and Lynk & Co 08, which sold over 10,000 units last year, have only fallen back to around 6,000 units, and the speed of new energy transformation is still slower than expected.

From a full-year perspective, compared to BYD's new product cycle powered by DMI5.0 technology, Geely's new generation of hybrids will not be mass-produced until 2025, meaning that Geely's new product cycle will not start until at least 2025. This year's hybrid strategy is still in a passive state. Geely will mainly launch pure electric models in the second half, but competition in the pure electric market is fierce, and there have been no more blockbuster models since Zeekr 001. It is expected that Geely's sales of new energy brands will still find it difficult to have a significant increase this year. Currently, Geely's 2024 PE ratio is at a relatively reasonable level of 14-15 times, but given the difficulty in achieving significant sales growth of its new energy brands this year, the upside potential may be limited.

The following is a detailed analysis:

I. Gross margin declined 2.3% quarter-on-quarter, expected to be due to the decline in the gross margin of new energy brands

In the first quarter of 2024, the company's overall gross margin was 13.7%, a decline of 2.3% compared to the second half of 2023, which is expected to be due to the decline in the gross margin of new energy brands. In the first quarter, new energy vehicles were generally in a sales trough, and Geely was no exception. In the first quarter, Geely's new energy brand sales were only 144,000 vehicles, and the proportion of new energy vehicles declined slightly from 33% in the second half of 2023 to 30% in the first quarter of 2024. However, due to the lack of scale effect of new energy vehicles and intensified competition in the new energy vehicle market, Dolphin expects that the gross margin of Geely's new energy brands will decline quarter-on-quarter. In terms of brands, Zeekr's gross margin in the first quarter was only 12%, down 3% from 15.2% in the second half of 2023. Due to the price reduction promotion of the Galaxy Longteng version in March (with a price reduction of 10,000-20,000 yuan), Galaxy's gross margin is also expected to show a downward trend quarter-on-quarter.

Source: Company financial report, Dolphin Investment Research

II. Revenue increased by 56% year-on-year, jointly contributed by sales volume and ASP increases

In the first quarter of 2024, the company achieved total sales revenue of 52.3 billion, an increase of 56% year-on-year, mainly contributed by increases in both sales volume and ASP per vehicle. In terms of sales volume, total sales in the first quarter of 2024 were 480,000 vehicles, an increase of 48% year-on-year. On the one hand, the first quarter of 2023 was during Geely's new energy transition period, when the base of new energy vehicles was low. On the other hand, the sales performance of Geely's gasoline-powered vehicles in the first quarter of 2024 was good, with the Chinese Star series selling well and achieving year-on-year growth. In terms of ASP per vehicle (Dolphin estimates ASP per vehicle based on the proportion of automotive sales revenue to total revenue remaining the same as in the second half of 2023), ASP per vehicle of Geely is estimated to be about 106,000 yuan in the first quarter, basically flat compared to the second half of 2023. In terms of brands, due to intensified competition, the price of the new Zeekr 001 decreased by 31,000-57,000 yuan compared to the old model, and the proportion of high-priced Zeekr 009 declined, resulting in a decline in ASP per Zeekr vehicle from 273,000 yuan in the second half of 2023 to 247,000 yuan in this quarter. However, ASP per vehicle of Geely's main brand (including Emgrand, Geometry, Galaxy, and Geely) increased by about 3,400 yuan to 94,000 yuan quarter-on-quarter (according to Dolphin's calculations), exceeding Dolphin's expectations. Dolphin believes that this is mainly due to the hot sales of Geely's relatively high-priced Chinese Star series and the increase in overseas sales, offsetting the adverse impact of price reductions of the Galaxy brand (due to the price reduction of BYD's Glory version, Galaxy reduced the price of the Longteng version by 10,000-20,000 yuan in March).

III. Sales progress of new energy vehicles is still slower than the annual target

From January to May 2024, the company's cumulative sales reached 790,000 vehicles, an increase of 42% year-on-year. The company's annual sales target for 2024 is 1.9 million vehicles, and 42% of the annual sales target has been completed. Dolphin expects that the annual sales target will be achieved without hindrance based on the current sales progress. However, in terms of new energy vehicle business, the company sold 158,000 new energy vehicles from January to May 2024, an increase of 44% year-on-year. However, compared to Geely's 2024 sales target of 810,000 new energy vehicles, the completion progress is only 31%, and it is expected to be difficult to achieve. In terms of brands: 1) Galaxy: The Galaxy brand is mainly positioned in the 100,000-200,000 yuan new energy vehicle market, currently focusing on plug-in hybrid models. Its price range overlaps with BYD, making it a direct competitor. Due to the impact of BYD's Glory version being launched at a reduced price in February, Galaxy has also reduced the prices of the Galaxy L6 and Galaxy L7 in March and April, with a price reduction of 20,000-25,000 yuan. However, the starting price of the Galaxy L6 is still nearly 20,000 yuan more expensive than BYD's Qin Plus DMI, a direct competitor. Although the Galaxy L7 has a slight price advantage over BYD's Song DMI Glory version, its sales are still showing a downward trend, falling back after achieving monthly sales of over 10,000 units in 2023. Currently, price reductions have had a limited impact on L7 sales, with only 5,600 units sold in May, which is expected to be due to the impact of BYD's Song DMI Glory version being launched. 2) Lynk & Co: The Lynk & Co brand also prioritizes plug-in hybrid SUV strategies, successfully creating the hit product Lynk & Co 08 PHEV in 2023, achieving sales of over 10,000 units. However, it is also facing a situation where sales are difficult to sustain, with sales in May 2024 falling to only 6,000 units. 3) Zeekr: The Zeekr brand is mainly positioned in the over 200,000 yuan pure electric vehicle market, with the Zeekr 001 currently being the best-selling model. After the price reduction of the new Zeekr 001 (with a price reduction of 31,000-57,000 yuan compared to the old model), sales quickly rebounded, reaching 13,500 units in May 2024. The refreshed Zeekr 001 still has strong competitiveness compared to competitors, and it is expected that the sales momentum will continue. However, the performance of the Zeekr 007 is relatively average, with sales of only around 4,000 units in the first six months since its launch. Zeekr still urgently needs to create the next hit model to take over.

IV. Geely's hybrid strategy in the second half is relatively passive, focusing on pure electric vehicles

From the perspective of Geely's new models launched this year, only the Lynk & Co 07 and Galaxy L5 hybrid models have been introduced. Compared to BYD's new product cycle powered by Dmi 5.0, Geely's hybrid strategy is relatively passive. As BYD released the DMI 5.0 technology in May 2024, the DMI 5.0 technology can achieve a fuel consumption of 2.9 liters per 100 kilometers (under NEDC conditions) and a full range of 2,000 kilometers with a full tank and full charge, which is expected to have a huge impact on gasoline-powered vehicles and direct competitors. BYD is currently in a major new product cycle. Geely's hybrid strategy has always been a follow-up strategy to BYD. Geely will soon launch the Leishen hybrid system, which is expected to achieve a maximum range of over 2,000 kilometers with a full tank and full charge, and a fuel consumption of less than 2 liters per 100 kilometers. However, Geely's Leishen hybrid system will not start mass production until 2025, and Geely's hybrid strategy is still relatively passive this year. Geely will mainly launch pure electric models this year, including the Lynk & Co Z10 and Galaxy E8, which are pure electric sedans launched by Lynk & Co and Galaxy for the first time. However, there is some overlap in the price range of pure electric models with Zeekr, which is expected to cannibalize some sales. At the same time, competition in the pure electric vehicle market is more intense, and Geely has not had another hit model since successfully creating the Zeekr 001. It is expected that Geely will also find it difficult to achieve significant growth in sales of pure electric vehicles.

V. R&D expenses have been controlled, but net profit per vehicle declined

In the first half of 2023, Geely Automobile achieved a net profit attributable to shareholders of 1.57 billion yuan, a year-on-year increase of about 1%, slightly exceeding market expectations of 1.51 billion yuan. However, the net profit margin declined from 2.7% in the first half of 2022 to 2.2% in the first half of 2023, and the net profit per bicycle also decreased from 2529 yuan to 2317 yuan. Geely's net profit for the first quarter of 2024 was 142000 yuan, which basically met the expectations of Dolphin King. Sales expenses were relatively rigid, and marketing expenses were mainly used for the launch of Geely's new energy brands, such as Jike, Lynk&Co, and Galaxy. R&D and management expenses were relatively restrained, with Jike's R&D expenses significantly reduced in the first quarter, and the operating expense ratio decreased by 1% from 13.4% in the second half of 2023 to 12.3% in the first quarter of 2024. Due to a significant decline in gross profit margin, the core operating profit margin decreased by 1.2% month on month from 2.5% in the second half of 2023 to 1.3% in the first quarter of 2024. However, the net profit margin only decreased by 0.8% to 2.7%. The net profit per vehicle decreased from 3800 yuan in the second half of 2023 to 3300 yuan in the first quarter of 2024, mainly due to the loss reduction of the joint venture company Lynk&Co and the profit increase brought by the divestment of the joint venture company Ruilan.

Dolphin King Geely Automobile (0175. HK) Historical Article: Extreme Krypton: Financial Report Interpretation: June 11, 2024 Financial Report Interpretation: "Car Second Generation" Extreme Krypton: Will It Be a Pure Electric Black Horse? "Depth: June 14, 2024 Extreme Krypton: Is Your Father Too Petted, Toxic or Beneficial?" June 19, 2024 Extreme Krypton: "Negative" Second Generation or Awaiting Exploding Black Horse? "Geely Financial Report Interpretation: August 22, 2023 Geely Automobile: Finally Has Hope to" Survive? "August 18, 2022 Financial Report Interpretation: Geely: Continuously Expecting and Disappointing On March 23, 2022, the financial report interpreted" Geely fractures and then fractures, the darkness before dawn is the hardest to endure. "On November 3, 2021," The "Thunder God" emerged, and next year's Geely will be this year's BYD? " On September 6, 2021, "Geely Automobile (Part 1): Under Heavy Pressure, Is the King Returning?" On September 9, 2021, "Geely Automobile (Part 2): With the rise of domestic goods in the automotive industry, is it finally Geely's turn to be blessed?"