Behind Li Auto's "Leading" Position: Propping Up Profits with Financial Management

![]() 07/11 2024

07/11 2024

![]() 704

704

According to a July 9th message on the official account of Li Auto-W (02015.HK, hereinafter referred to as "Li Auto"), during the 27th week of 2024 (July 1st-7th), Li Auto's weekly sales reached 8,000 units, making it the top-selling new energy vehicle brand in the Chinese market for 11 consecutive weeks.

Despite leading the pack in sales among new energy vehicle brands, Li Auto faces several hidden concerns. Operationally, the company found itself in a dilemma of increased revenue but decreased profits in the first quarter, with net profits declining by double digits year-on-year, and revenue growth significantly slowing down. While the company remained profitable, the largest contributor to its profits was interest and investment income, amounting to RMB 1.069 billion.

In terms of sales, as Li Auto's first foray into the pure electric vehicle market, the launch of MEGA encountered a cold reception, with current sales falling short of 10% of expectations. Under the influence of MEGA's poor performance, the launch of three pure electric SUVs originally scheduled for the second half of this year has been postponed to the first half of next year. Despite being at the forefront of new energy vehicle sales, Li Auto's sales this year have fallen short of expectations, prompting the company to successively lower its quarterly and annual sales targets and implement price cuts to stimulate sales.

Stockstar notes that Li Auto's Hong Kong-listed shares have also performed weakly, with the share price having retreated by more than half since hitting an annual high at the end of February. The company's total market value has evaporated by over HKD 223.7 billion, equivalent to approximately RMB 208.3 billion.

01

Increased Revenue but Decreased Profits in Q1

Net Profit Declined by 90% Quarter-on-Quarter

Recently, Li Auto has delivered impressive sales results. According to its published sales rankings for new energy vehicle brands in the Chinese market, the company delivered a total of 189,000 new vehicles in the first half of the year, with weekly sales reaching 8,000 units from July 1st to 7th, both topping the sales rankings of new energy vehicle brands in the Chinese market.

While leading in sales, Li Auto's performance has been far from ideal. After ending 2023 with triple-digit growth in revenue and net profit, the company found itself in a dilemma of increased revenue but no corresponding increase in profits in the first quarter.

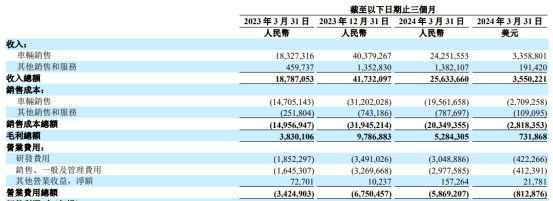

The first-quarter report showed that Li Auto generated revenue of RMB 25.634 billion, an increase of 36.4% year-on-year. Notably, this growth rate marked the company's worst quarterly performance since Q4 2022. The revenue growth rates for Q4 2022 and Q1-Q4 2023 were 66.2%, 96.5%, 228.1%, 271.2%, and 136.4%, respectively. It can be seen that the revenue growth rate in the first quarter was only a fraction of that in Q4 last year.

In terms of revenue segments, Li Auto's vehicle sales revenue amounted to RMB 24.252 billion, an increase of 32.3% year-on-year but a decrease of 39.9% quarter-on-quarter. The decrease in quarterly revenue was primarily due to seasonal factors related to the Spring Festival and lower-than-expected vehicle deliveries caused by weaker-than-expected sales orders in March. In addition, about RMB 1.382 billion in revenue came from other sales and services, with year-on-year and quarter-on-quarter growth rates of 200.6% and 2.2%, respectively.

Stockstar notes that while Li Auto's revenue still achieved double-digit year-on-year growth, this performance fell far short of expectations. When announcing its 2023 financial results, Li Auto had projected first-quarter revenue of RMB 31.25 billion to RMB 32.19 billion, representing an increase of 66.3% to 71.3% over the first quarter of 2023.

On the other hand, Li Auto's significant investments in sales and research and development (R&D) led to a 71.4% increase in operating expenses to RMB 5.869 billion. Among them, R&D expenses increased by 64.6% year-on-year to RMB 3.049 billion, while sales, general, and administrative expenses increased by 80.97% year-on-year to RMB 2.978 billion.

As gross margins failed to effectively cover the surge in operating expenses, Li Auto's operating profit returned to negative territory in the first quarter, with an operating loss of RMB 585 million and an operating margin of -2.3%.

Stockstar notes that while operating losses weighed on performance, a closer look at Li Auto's profit sources reveals that its investment and financial management also contributed significantly. Li Auto held cash and cash equivalents, restricted cash, time deposits, and short-term investments totaling approximately RMB 98.9 billion, generating interest income and investment income of RMB 1.069 billion, more than doubling from the same period in 2023.

Ultimately, Li Auto relied on investment and financial management to achieve a net profit of RMB 591 million in the first quarter, a year-on-year decrease of 36.7% and a quarter-on-quarter decrease of 89.7%.

02

MEGA Sales Continue to Decline

Pure Electric SUVs Delayed

Data shows that Li Auto's main business includes designing, developing, manufacturing, and selling luxury smart electric vehicles, with listings in both Hong Kong and the United States. The company began mass production in November 2019 and currently offers four extended-range SUVs (Li L9, Li L8, Li L7, and Li L6) and one pure electric MPV (Li MEGA).

At its Q4 2023 earnings conference, Li Auto stated that 2024 would be an unprecedented year of product launches for the company. According to the original plan, the company would release Li MEGA and the 2024 models of Li L9, L8, and L7 in the first half of the year, with L6 to follow in the second quarter. Three additional pure electric SUV models were scheduled for release in the second half of the year. By the end of the year, the company would have a product portfolio of four extended-range electric vehicles and four high-voltage pure electric vehicles.

However, the highly anticipated MEGA encountered a setback. On March 1st, MEGA was officially launched with an official price of RMB 559,800. Positioned as a pure electric MPV, the new vehicle aimed to achieve monthly deliveries of 8,000 units. The official promotion claimed that MEGA would become the top-selling passenger vehicle priced above RMB 500,000.

But MEGA faced controversy over its design soon after its launch, with sales in the first month reaching only 3,229 units, mainly due to a backlog of orders accumulated over about six months before the launch, far from the original monthly sales target. Since then, monthly deliveries have continued to decline, with sales in April and May falling by half to 1,145 and 614 units, respectively. According to the June MPV market sales rankings by Autohome, MEGA's sales further slipped to 589 units, less than 10% of the monthly sales target.

Reflecting on the situation, Li Auto stated that the company had made a mistake in timing the launch of MEGA, mistaking its stage from 0 to 1 (commercial validation period) for the stage from 1 to 10 (rapid development period). Li MEGA and high-voltage pure electric vehicles must go through a similar stage from 0 to 1 as Li ONE and extended-range electric vehicles.

The failure of the first pure electric model dealt a significant blow to Li Auto. Originally planning to launch four pure electric models this year, the company quickly adjusted its product lineup after MEGA's setback. In the first-quarter earnings call, Li Xiang, CEO of Li Auto, stated that the company would not release any pure electric SUV products this year and would instead postpone them to the first half of next year.

At the same time, Li Xiang set two important conditions for the launch of pure electric SUVs: first, selling mid-to-high-end pure electric SUVs requires a sufficient number of self-operated fast-charging stations; second, the company needs to upgrade and increase the number of dealerships and mall stores.

03

Downgrading Annual Sales Targets and Cutting Prices to Boost Sales

Li Auto reached its peak in sales in 2023, delivering over 376,000 new vehicles, an increase of 182.2% year-on-year.

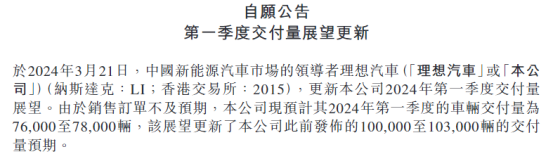

In the first quarter, Li Auto continued its sales growth, with sales increasing by 52.9% year-on-year to 80,400 units. However, even so, the company failed to meet its initial expectations. The company had previously projected first-quarter deliveries of 100,000 to 103,000 units, representing year-on-year growth rates of 90.2% to 95.9%. Due to weaker-than-expected sales orders, Li Auto lowered its first-quarter delivery target to 76,000 to 78,000 units in March, a reduction of about 24%.

Given its outstanding performance last year and misjudgment of MEGA's timing, Li Auto had to adjust its strategy this year, lowering its original annual sales target of 800,000 units to 560,000 to 640,000 units.

In the first half of this year, Li Auto delivered a total of 188,981 new vehicles. Based on the minimum target of 560,000 units, Li Auto's completion rate is only 33.75%, with a sales shortfall of over 370,000 units. This means that Li Auto needs to maintain monthly sales of around 60,000 units in the second half of the year to meet its target. However, the company's highest monthly sales this year were only 47,774 units in June.

In its first-quarter report, Li Auto also provided a sales outlook for the second quarter, projecting vehicle deliveries of 105,000 to 110,000 units, representing an increase of 21.3% to 27.1% over the second quarter of 2023. Based on Li Auto's published data, its second-quarter sales are estimated to be approximately 108,600 units.

Behind this, Li Auto has repeatedly resorted to price cuts to boost sales. According to incomplete statistics, at the beginning of this year, Li Auto offered discounts on its entire 2023 lineup of Li L7, L8, and L9 models, with price reductions ranging from RMB 33,000 to RMB 38,000 depending on the model version.

On April 22nd, Li Auto announced a new pricing system, with price cuts across its entire lineup except for the newly launched L6. Specifically, the starting prices of Li L7, L8, and L9 were reduced by RMB 18,000 to RMB 20,000, while MEGA's price was cut by RMB 30,000 to RMB 529,800.

Apart from sales challenges, Li Auto's Hong Kong-listed shares have also performed poorly. Since 2024, the company's share price has exhibited significant volatility, with an annual high of HKD 182.9 per share (adjusted for dividends) on February 28th before entering a downtrend. As of July 10th, the share price stood at HKD 77.5 per share, down 1.46%, with a total market value of HKD 164.5 billion. Currently, the share price has fallen by about 57.6% from its annual high, with a total market value evaporation of approximately HKD 223.7 billion, equivalent to approximately RMB 208.3 billion. (First published on Stockstar, Author: Lu Wenyan)

- End -