EU gangs up on Chinese automakers, SAIC stands alone, but what about BYD?

![]() 10/08 2024

10/08 2024

![]() 651

651

Woodcutter Works People Cars River Lake Together Witness the Rise of China's Automotive Industry

During the National Day holiday, the European Union (EU) approved a five-year anti-subsidy tax scheme on Chinese electric vehicles (EVs). This is essentially the EU's gang-up on China's automotive supply chain.

Faced with external threats, SAIC can be considered a "lonely hero," but what about BYD?

1. EU gangs up on China's automotive supply chain

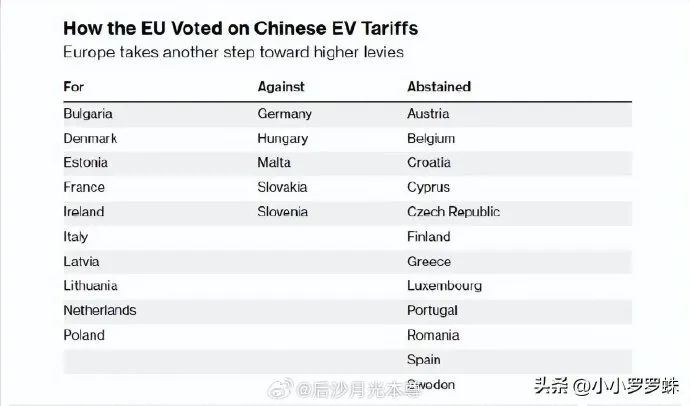

On October 4, the EU held a vote on whether to impose a five-year anti-subsidy tax on Chinese EVs.

10 countries voted in favor: France, Italy, the Netherlands, Poland, Denmark, Ireland, Bulgaria, Estonia, Lithuania, and Latvia. (45.99% of the EU population)

12 countries abstained: Belgium, Czech Republic, Greece, Spain, Croatia, Cyprus, Luxembourg, Austria, Portugal, Romania, Sweden, and Finland. (31.36%)

5 countries voted against: Germany, Hungary, Malta, Slovenia, and Slovakia. (22.65%)

Tax rate details: Tesla: 7.8%, BYD: 17%, Geely: 18.8%, SAIC: 35.3%.

While we cannot stop the EU from imposing discriminatory anti-subsidy taxes on Chinese EV makers, the differing reactions of Chinese automakers are intriguing.

In this round of confrontation, we see SAIC, as a state-owned enterprise, step up to the plate and become a "lonely hero," bearing the highest tariff rate.

Geely, on the other hand, has clearly stated its opposition to the EU's tariff plan on its official website.

BYD, as a leader in EVs, should logically be the biggest potential victim of the EU's targeted anti-subsidy scheme for EVs, yet it has not made a clear official stance so far.

2. The ultimate goal of the EU's high tariffs

Beyond generating tax revenue and protecting domestic industries, the EU's ultimate goal in imposing high tariffs on Chinese EVs is to steal EV technology under the guise of tariffs.

For example, the EU has demanded that SAIC provide the formula for its battery cells, down to the precise amounts of each major raw material such as lithium iron phosphate, graphite, copper, and aluminum. As battery technology is crucial for EVs, the EU's intentions are clear.

Furthermore, the EU has demanded that companies provide critical production information such as: [the company's five-year production capacity, output, and a list of all fixed assets], [plans for new production capacity in China, the EU, or third countries in the future], [information on all components and raw material inputs, energy consumption, labor costs, and equipment depreciation], [sales models, sales terms, and pricing strategies], and [names and contact information of all customers in the EU].

Faced with the EU's bullying tactics, SAIC has stood firm and become a "lonely hero," earning the highest anti-subsidy tariff rate.

BYD, as China's largest EV manufacturer and seller, has been assigned a 17% tariff rate.

3. The fiction of subsidies: Who receives more subsidies, SAIC or BYD?

The EU's anti-subsidy tariffs, as the name suggests, are punitive tariffs imposed on Chinese automakers for receiving subsidies. This is a fiction.

Public information shows that BYD received subsidy inflows of 10.3 billion yuan in 2023 and 9.95 billion yuan in 2022 (cash flow basis). For SAIC, public data does not reveal the exact amount of subsidy inflows, but government grants recorded in profit and loss for 2023 amounted to 4.1 billion yuan, and 3.59 billion yuan in 2022. Grants not recorded in profit and loss are not publicly available.

In terms of product sales, SAIC's subsidies are unlikely to exceed BYD's, yet the EU's tariff on BYD is significantly lower than that on SAIC, which is puzzling.

Conversely, the EU's imposition of discriminatory tariffs on different Chinese automakers under the guise of subsidies suggests that subsidies are merely a pretext. The level of "cooperation" shown by automakers is an important factor in determining the tariffs they receive.

What efforts has BYD made to secure a tariff rate half that of SAIC? From an industry perspective, it would be beneficial for Mr. Wang to share his insights with competitors and encourage them to follow suit.

Today, BYD is making significant gains while pushing SAIC back.

But who says only those in the spotlight are heroes?