Stock market surges, is extended-range the biggest winner again?

![]() 10/10 2024

10/10 2024

![]() 460

460

Entering the stock market provides opportunities for gains, while staying out leads to asset dilution - this is the ironclad rule of seigniorage.

Expectations for a rising Chinese stock market have taken shape, but individual decisions made by each person and company mean that not everyone will win.

With Hong Kong's Triata Capital, which focuses solely on China, achieving a 44% return rate in September, its 1-9 month return rate reached 56%. Goldman Sachs estimates that hedge funds focused on Chinese stocks returned 6% during the week of September 23-27, marking the best weekly return rate on record. Asian equity hedge funds have returned 12% year-to-date, outperforming global counterparts.

During the National Day holiday, Chinese automakers were in a frenzy of sales, with some people marveling at how everyone seemed to have suddenly become wealthy overnight.

Globally, stock trading has always been about betting on the future, and whenever expectations change, the stock market reacts in advance.

Currently, while the large-scale algorithms of top high-frequency quantitative trading firms that rake in billions of dollars annually are not shared with the public, a series of economic stimulus policies have been implemented, giving more people the willingness to consume, whether it's buying a new car or a new home.

The fourth quarter of 2024 may set a new sales record for the Chinese auto market, undoubtedly linked to the new trend of allowing limited capital expansion. Since the end of September, A-shares have soared, and after the National Day holiday, the market opened with a trading halt and then narrowed its gains, with historic rallies continuing. The stock market has embarked on a new surge since 2008. This surge in capital has simultaneously driven changes in consumption.

As of the close on October 8, the Shanghai Composite Index rose by over 4%, the Shenzhen Component Index rose by over 9%, and the ChiNext Index rose by over 17%, setting a record for the largest single-day gain. Over 5,000 stocks on the A-share market rose, with nearly 800 stocks hitting their daily limits and over 2,000 stocks gaining more than 10%. Trading volume surged, reaching a record high of RMB 3.48 trillion.

No one can predict exactly how individual stocks will rise or when the overall market will peak, but a series of actions indicate that sentiment towards continued gains in A-shares is strengthening. For example, ETF trading funds are continually experiencing excess inflows. Before the National Day holiday, USD 5.2 billion in new assets flowed into these funds, and Ping An Insurance even turned a profit through a wave of capital inflows.

The capital market continues to rise, but gasoline-powered vehicles are left out.

There are numerous favorable policies stimulating gains in A-shares. Globally, the US Federal Reserve has cut interest rates, causing many capital flows to seek higher returns in other markets. A-shares had previously fallen sharply, reaching relatively low levels.

As ETFs become more prevalent, more capital is injected into A-shares and tied up in long-term holdings, theoretically pushing up the lower limit of the stock market. Domestically, the reserve requirement ratio was reduced by 0.5%, releasing RMB 1 trillion in long-term liquidity, with potential for an additional 0.5% reduction in the future. Commercial loans no longer distinguish between first and second homes, with a uniform minimum down payment of 15%, squeezing out the last potential of the real estate market, and reducing existing mortgage interest rates.

With increased capital liquidity, the focus of the new round of policies is clear: to generate a capital multiplier effect, ultimately driving consumption and industry profits and scale. However, it is clear that in the automotive sector alone, during the 2024 year of soaring stock markets and the National Day holiday, the decline of gasoline-powered vehicles is becoming more pronounced.

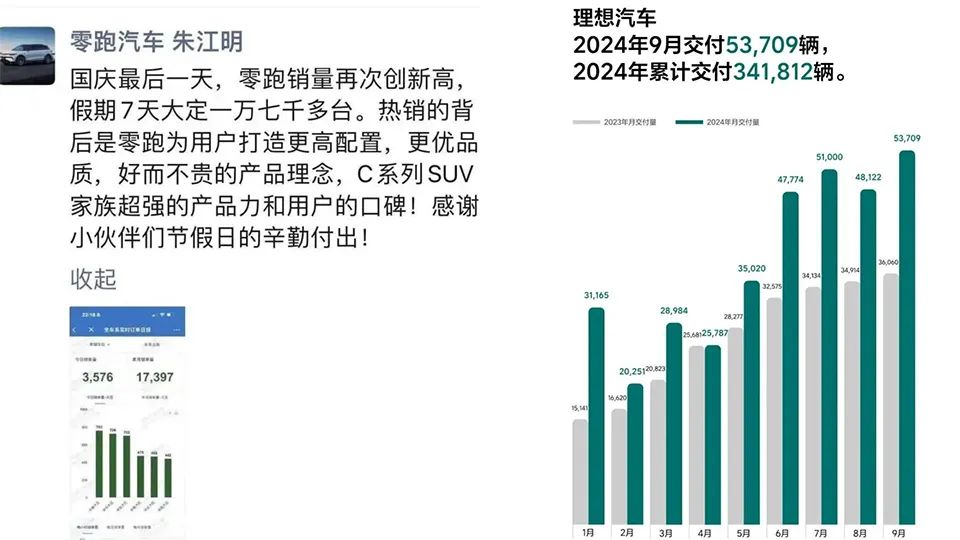

Among the series of battle reports released during the National Day holiday, the automakers that performed well and released their results promptly were HarmonyOS Intelligent Drive (by Huawei), Lixiang Auto, Leapmotor, XPeng, ZEEKR, and Xiaomi Automobiles, in that order.

Among them, HarmonyOS Intelligent Drive accumulated 28,600 orders during the holiday, with the AITO Askey R7 selling 9,600 units, exceeding the 9,000 units of the AITO Askey M7. It was surprising to see a higher-priced pure electric vehicle outsell an extended-range model of the same size. Meanwhile, the AITO Askey M9, with a starting price of RMB 469,800, received 7,800 orders.

Lixiang Auto received over 20,000 orders during the National Day holiday, while XPeng received over 16,000 new orders.

Leapmotor's Zhu Jiangming directly shared a screenshot of their sales system, revealing over 17,000 orders during the National Day holiday, including 3,576 new orders on October 7, breaking the single-day record.

ZEEKR received over 10,000 orders during the National Day holiday, with the ZEEKR 7X exceeding 20,000 orders and expected deliveries exceeding 10,000 in October.

Lei Jun announced on Weibo that Xiaomi SU7 received over 6,000 locked-in orders during the holiday.

SAIC-GM-Wuling's Brand and Communication General Manager Zhou Xing tweeted, "The stock market is up, and so is the auto market! This National Day Golden Week was our highest sales week in years!"

Referencing a series of sales reports and announcements released by various automakers around October 1, BYD sold over 419,000 vehicles in September, with its Dynasty and Ocean series breaking the 400,000-vehicle monthly sales record for the first time. New orders in September are expected to exceed 450,000. Geely and Chery both sold over 200,000 vehicles in September, with Geely's new energy vehicles exceeding 91,000 and Chery's exceeding 50,000. Lynk & Co. set a monthly sales record of 25,800 vehicles, with a new energy penetration rate of 67% and 17,000 new energy vehicle sales.

The only gasoline-powered vehicle-related news during the same period came from SAIC-GM, with the new generation of the Cadillac XT5 receiving 5,000 orders in the first two days of the National Day holiday after a significant price reduction of over RMB 120,000 compared to the previous model. After the holiday, the official announcement was that over 2,000 orders were received during the holiday. Buick reduced the price of the Envision PLUS before the holiday, bringing the price of the 2.0T mid-size SUV below RMB 170,000, resulting in over 1,000 orders in a single day.

According to Cui Dongshu's latest report, from January to September 2024, 29 plug-in hybrid models saw price reductions, with an average reduction of RMB 24,000 or 13.7%. For pure electric vehicles, 69 models saw price reductions, averaging RMB 23,000 or 13.5%. For extended-range models, 13 models saw price reductions, averaging RMB 14,000 or 7.6%. For hybrid models, 13 models saw price reductions, averaging RMB 15,000 or 8.4%. For conventional gasoline-powered models, 71 models saw price reductions, averaging RMB 15,000 or 9.3%.

Automakers focusing on gasoline-powered vehicles have been engaged in an intense price war for 18 consecutive months and are now starting to reduce discounts to ensure profits. In other words, they have recognized the new market reality and realized that it is difficult to regain dominance from new energy vehicles through any means.

Will the new energy sector make extended-range vehicles the biggest winners?

As the stock market surges towards 4,000 points, capital becomes more liquid, and consumption is stimulated. From a series of new popular car models, it is clear that the new logic of the consumer market has become, "prices must be lower, and the best value for money in niche markets."

XPeng's MONA M03 has driven down prices for vehicles with similar range to match those of BYD's Qin PLUS EV.

Tesla Model Y challengers like Ledao L60, ZEEKR 7X, AITO Askey R7, AVATR 07, and IM Motor LS6 have all set new low prices. A series of policies have created more consumer expectations and potential, and in the next round of new vehicle launches, only a handful of plug-in hybrids and a large number of extended-range vehicles will be able to significantly reduce prices. From a broader perspective, only a few leading companies in the industry can afford to sell pure electric vehicles at lower prices without incurring losses, rather than being a common phenomenon.

The few plug-in hybrids currently refer specifically to BYD's DM, Chery's C-DM, and Geely's Leiyin Hybrid. This is because a series of recently launched new vehicles have demonstrated cost reduction and price reduction capabilities. Geely Geometry L6's entry-level model starts at RMB 99,800, Chery Tiggo 8 PLUS's C-DM plug-in hybrid version starts at RMB 129,900, and BYD's Glory Edition includes both the Qin PLUS at RMB 79,800 and the Qin L at RMB 99,800. However, besides these, few other mainstream plug-in hybrids have demonstrated significant cost reduction capabilities.

In terms of extended-range vehicles, the current situation is one of flourishing diversity. Moreover, this is not just about new forces like XPeng and ZEEKR gradually shifting from pure electric to extended-range, nor is it solely driven by the influence of Lixiang Auto and HarmonyOS Intelligent Drive.

At the World New Energy Vehicle Congress 2024 before the National Day holiday, Geely and Changan released more signals about new transformations in extended-range technology.

Changan signaled that extended-range vehicles will continue to develop in parallel over the next 5-10 years and are expected to significantly reduce prices. The reason for this downward trend is primarily due to the current initial surplus of power batteries. With CATL working to reduce inventory, global lithium mine shutdowns and production cuts, lithium prices falling below RMB 80,000 per ton, and the gradual flattening of pure electric vehicle sales growth, power batteries will undergo price and functional shifts, with extended-range vehicles serving as a good landing point.

Geely signaled that it will launch a new generation of Leiyin Hybrid System in 2024. Its technical achievements include a full range of over 2,000 kilometers on a full tank and full battery, extreme low-fuel consumption entering the 2L/100km level, and a thermal efficiency of over 46% for the hybrid generator. In terms of motors, Geely currently has the world's first 30,000 RPM motor test bench.

Currently, the industry is developing similar verification benches capable of rotating at up to 25,000 RPM. It can be seen that while Geely's entire new solution relies heavily on plug-in hybrids to achieve 2L fuel consumption and 2,000km range, many new technologies undoubtedly will benefit extended-range vehicles, as evidenced by the successive announcements of extended-range models from Lynk & Co. and ZEEKR.

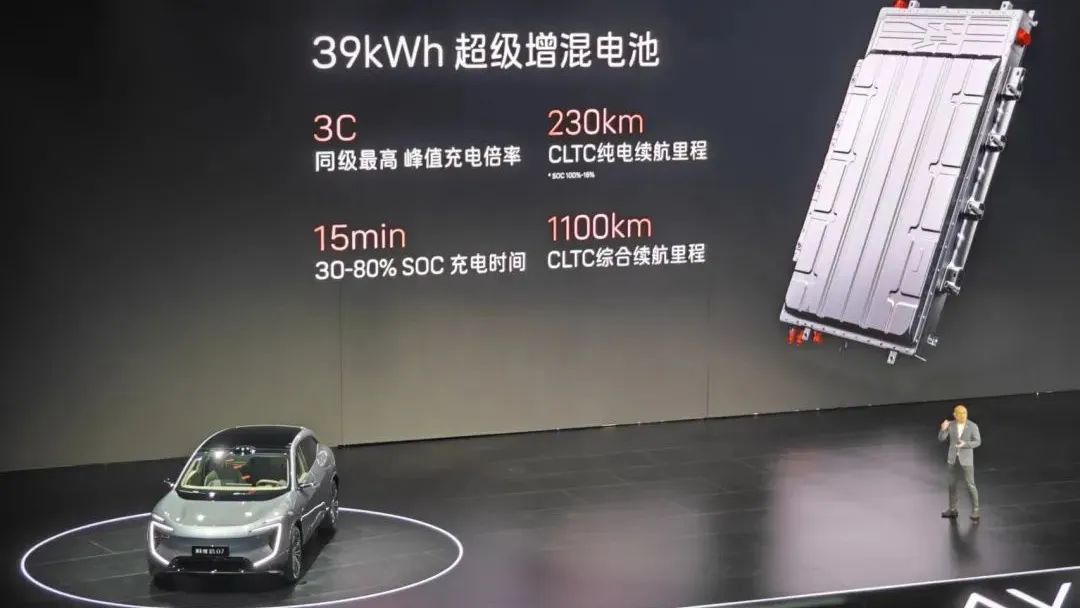

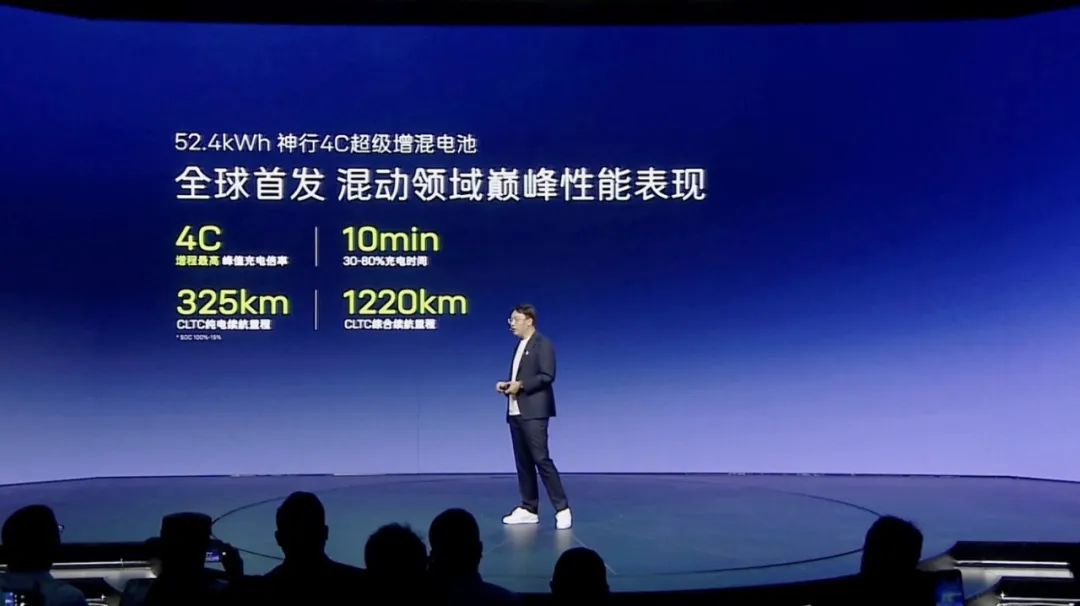

In fact, this is not all. In the latest batch of 2025 flagship new vehicle plans, extended-range vehicles have become more important than plug-in hybrids and pure electric vehicles. A typical example is that Changan recently announced it will launch CATL's 4C dedicated extended-range hybrid battery in 2025. With technical specifications such as a CLTC range and the ability to charge from 30% to 80% in 10 minutes, these extended-range models can be priced up to RMB 50,000 lower than pure electric vehicles, and without range anxiety, they can solve the embarrassment of fighting for charging stations during holidays or long-distance travel.

And the internal competition continues. Similarly, before the National Day holiday, at the press conference of GAC Trumpchi, although the limelight was stolen by the in-depth cooperation with Huawei on ADS3.0, the news was also released that in 2025, it will launch the world's first 800V fast-charging 5C extended-range dedicated battery pack, with a pure electric range of over 300 kilometers for a 56kWh battery. It is clear that with features such as 800V and 5C rate, its charging speed will also be around 10 minutes. The price of the entire vehicle will also be lower than that of pure electric and plug-in hybrid vehicles.

In fact, today's major manufacturers are all deploying similar technological features, including 800V, 4C or 5C extended-range dedicated batteries, reduced fuel consumption, lower prices, and charging within 15 minutes, which will be gradually introduced in 2025. And it is clear that with today's quantitative easing of capital and the promotion of consumption, their 2025 layouts relative to pure electric and plug-in hybrid vehicles are more attractive.

Final Thoughts

The transformation of consumer preferences is difficult to resist. Whether it's Yu Chengdong's statement at the end of the AITO Aska R7 press conference that he would rather sell a car at a loss of 30,000 yuan, or the new popular models from Li Bin and He Xiaopeng, the new monthly sales of over 50,000 units for Lixiang, and Huawei HarmonyOS Intelligent Driving System's challenge to Mercedes-Benz, BMW, and Audi in the over 400,000 yuan price range with extended-range vehicles,

All these demonstrate that under continuous stimulation, consumer expectations have been raised, but actual consumption outcomes are more cautious. Amidst this sentiment, more and more automakers are entering the extended-range market, and extended-range vehicles are gradually replacing pure electric vehicles in many functions. These all indicate that extended-range vehicles will be the new winners in the short to medium term, and may even become the sole winner surpassing plug-in hybrids and pure electric vehicles.

Everything will be verified by sales growth rates.