Tesla's gross margin in the third quarter exceeded expectations. Did the First Principles help with the “bottoming out and rebound”?

![]() 10/29 2024

10/29 2024

![]() 458

458

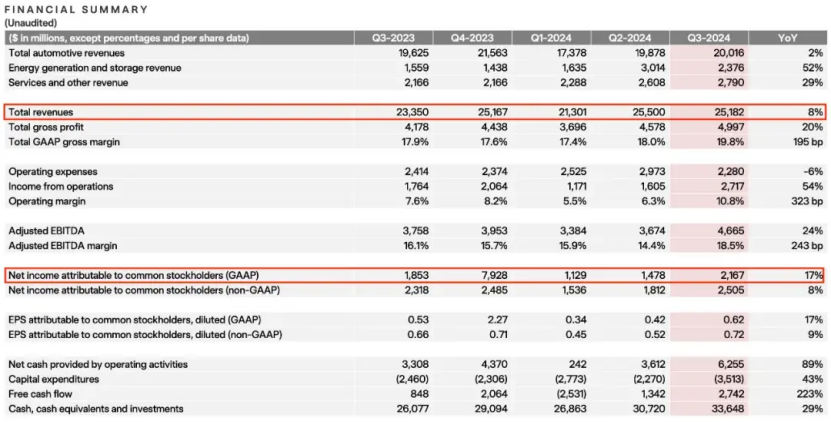

Recently, Tesla released its financial results for the third quarter of 2024. The data showed that after experiencing four consecutive quarters of declining profits, Tesla's profitability rebounded, with third-quarter revenue reaching $25.182 billion, an 8% year-on-year increase. In the third quarter, the Chinese market contributed significantly to Tesla's growth. According to statistics, Tesla sold 249,135 electric vehicles in China in the third quarter of this year, an increase of 21.09% month-on-month.

Regarding the improvement in net profit, Tesla mentioned that its cost of goods sold (COGS) per vehicle fell to an all-time low of approximately $35,100. Additionally, Tesla's gross margin in the third quarter increased to 19.8%, up approximately 2 percentage points year-on-year. Operating profit margin was 10.8% in the third quarter, and free cash flow was $2.7 billion.

Wall Street analysts generally agree that Tesla's Robotaxi project has received a tepid reception, and its share price briefly declined due to concerns about the Robotaxi. However, with the release of Tesla's third-quarter earnings report, Wall Street analysts believe that Tesla's "worst days are behind it," and the market has responded with confidence, with Tesla's share price surging 13.48% after the earnings release.

▍'Unexpected' Q3 Financial Results

According to Tesla's third-quarter earnings report, revenue for the quarter was $25.2 billion (approximately RMB 179.57 billion), an 8% year-on-year increase but a slight 1.2% decrease quarter-on-quarter from the previous quarter's $25.5 billion. GAAP net income for the quarter was $2.167 billion, a 17% year-on-year increase and a substantial 46.6% quarter-on-quarter jump. Non-GAAP net income for the quarter was $2.5 billion (RMB 17.81 billion), with an operating profit margin of 10.8%. Cash and investments increased by $2.9 billion (RMB 20.67 billion) in the third quarter, reaching $33.6 billion (RMB 239.43 billion). The cost of goods sold (COGS) per vehicle fell to an all-time low of approximately $35,100 (around RMB 250,000).

In terms of production, Tesla manufactured a total of 469,796 vehicles in the third quarter, including 443,668 Model 3 and Model Y vehicles, representing a 6% year-on-year increase. Other models accounted for 26,128 vehicles, a significant 91% year-on-year increase. Deliveries totaled 462,890 vehicles, with 439,975 Model 3 and Model Y vehicles, a 5% year-on-year increase, and 22,915 other models, a 43% year-on-year increase.

Furthermore, in September, Tesla sold over 72,000 electric vehicles in the Chinese domestic market, a 66% year-on-year increase, marking the best sales performance of the year so far. With the increase in sales in September, Tesla's electric vehicle sales in the Chinese market grew by 12% from July to September.

This year, amidst the backdrop of a shrinking global electric vehicle market, Tesla's sales performance and financial results have raised concerns among investors, leading to a 14% annual decline in its share price. Prior to the release of the third-quarter earnings report, analysts pointed out the high uncertainty surrounding Tesla, suggesting that with the entry of low-cost electric vehicles into the market, Tesla might be forced to continue lowering prices, impacting its profits.

However, despite the continuing decline in vehicle prices, Tesla has achieved a significant improvement in its automotive gross margin through a series of cost-cutting and efficiency-enhancing measures. Tesla has reduced production costs from multiple dimensions, including supply chain optimization, raw material cost reductions, and production efficiency improvements. These cost-saving measures have enabled Tesla to maintain a high gross margin despite declining prices. According to the earnings report, excluding the impact of carbon credits, Tesla's automotive gross margin reached 17.1% in the third quarter, a 2.4 percentage point increase quarter-on-quarter.

Under the strategy of strictly controlling operating expenses and increasing gross margin per vehicle, Tesla achieved an operating profit of $2.7 billion in the third quarter, significantly exceeding Wall Street's expectations of $2.2 billion. Although revenue fell short of Wall Street analysts' previous expectations, Tesla's ability to rebound in profitability in the third quarter surprised analysts.

▍'Exciting' Growth Plans

It is worth noting that some investors and analysts are not fully satisfied with the revenue growth figure, arguing that while it is growing, it still falls short of market expectations. They point out that in the face of increasing competition, Tesla needs to be more proactive in launching new models and strengthening marketing efforts to maintain its market share.

In response to these concerns, Elon Musk, in addition to discussing Tesla's performance, also revealed the company's future growth plans. Notably, Tesla plans to begin production of a new generation of affordable vehicles in the first half of 2025. Market analysts believe that this model is expected to be priced significantly lower than the existing Model 3 and Model Y, which will help Tesla further expand its global market share.

With the launch of this new model, Tesla expects its automotive sales to grow by 20% to 30% in 2025, or approximately 360,000 to 550,000 vehicles. For reference, Tesla delivered approximately 1.81 million vehicles in 2023, and this forecast undoubtedly provides significant confidence to Tesla investors.

Regarding the mass production plan for the autonomous taxi Cybercab, Musk revealed that the model is expected to enter mass production in 2026, with plans to produce “at least” 2 million vehicles annually across multiple Tesla factories. In Musk's view, the workload required to manufacture low-cost vehicles is “extremely high,” and extracting a 20% profit margin from vehicle costs is more challenging than designing and building the entire factory from scratch.

Additionally, it is worth mentioning that the day before the release of the third-quarter earnings report, Tesla produced its 7 millionth vehicle globally. In the same month, Tesla's Shanghai Gigafactory produced its 3 millionth vehicle. Meanwhile, Tesla is actively deploying its energy storage business globally as a new growth area, with Tesla Energy experiencing a 52% surge in revenue. The Shanghai Gigafactory for energy storage is Tesla's first such facility outside the United States, with production expected to commence in the first quarter of 2025 to supply the Chinese and global markets.

For Tesla, which has not introduced a new model in a while and still faces production constraints with the Cybertruck, the cost improvements in the third quarter, particularly the lack of successful competitors to the Model Y and Model 3 in the market, were key drivers of its strong performance. In Musk's view, the only reason people don't buy a Tesla is that the cars are not cheap enough. A significant portion of consumers believe that reliability and price are still important considerations when purchasing a car, which remains a mode of transportation from point A to point B. This belief underpins Tesla's solid foundation for future growth.

Typeset by Yang Shuo | Image Source: Shutterstock, Tesla