Have BYD and other Chinese automakers already achieved counterattacks through China's high-speed rail?

![]() 10/30 2024

10/30 2024

![]() 508

508

For more financial information, please visit BT Finance Data Channel The main text contains a total of 4,951 words and is expected to take 13 minutes to read

"Tariffs are effective against low-value-added products, but not against high-value-added products."

In early October, the European Union approved a proposal to impose a five-year countervailing duty on electric vehicles imported from China. The European Commission stated that the proposal to impose tariffs on pure electric vehicles imported from China had received the necessary support from EU member states. Following the approval of the proposal, China's Ministry of Commerce, the EU Chamber of Commerce in China, and the China Council for the Promotion of International Trade have all expressed their strong opposition. Even European automakers such as Mercedes-Benz and BMW, which are located within the EU, have expressed strong dissatisfaction with the proposal.

However, when it comes to imported pure electric vehicles, the EU has adopted a double standard. Tesla, which applied for separate examination, was imposed the lowest tariff, an additional 7.8% on top of the standard 10% EU automobile tax, resulting in a total tariff of 17.8%. In contrast, the EU has clearly brandished the "tariff stick" against Chinese automakers. According to information previously released by the European Commission, SAIC Motor, Geely, and BYD are the main Chinese automakers targeted by the EU. SAIC Motor faces the highest additional tariff rate of 35.3%, meaning that its pure electric vehicles will be subject to a total tariff of 45.3% in Europe. Geely and BYD will face additional tariffs of 18.8% and 17%, respectively, resulting in total tariffs of 38.8% and 37% in the European market. The tariff on SAIC Motor is 2.55 times that on Tesla, while those on Geely and BYD are 2.2 and 2.1 times higher, respectively.

However, this move by the EU has not received the support of all EU member states. Germany believes that the EU's actions are detrimental to the transformation and development of the global automotive industry, and major German automakers such as Mercedes-Benz and BMW have expressed their opposition. Oliver Zipse, the CEO of BMW, stated that imposing a 45% tariff on Chinese electric vehicles would be a "fatal signal" for the European automotive industry. Mercedes-Benz also expressed concern that countervailing tariffs would undermine the competitiveness of the industry in the long run, which could lead to far-reaching negative consequences.

In addition to automakers, politicians have also expressed their positions. Olaf Scholz, the German Federal Minister of Finance, stated that the European Commission was wrong to propose provisional countervailing duties in this manner, as a trade war with China would do more harm than good to the European automotive industry. Viktor Orbán, the Prime Minister of Hungary, also expressed opposition to the EU's proposal to impose punitive tariffs on Chinese electric vehicles.

The Chinese automakers involved have also responded promptly. Geely issued a statement expressing its deep disappointment with the European Commission's decision, stating that the imposition of countervailing duties is not constructive and will hinder economic and trade relations between the EU and China, ultimately harming the interests of European businesses and consumers.

The approval of this EU proposal is actually a continuation of the proposal against CRRC in 2022. However, the question arises: has the EU forgotten about CRRC's counterattack?

1

China's high-speed rail has also been subject to countervailing investigations

The EU's decision to impose countervailing duties on Chinese electric vehicles has sparked widespread discussion, but it is just the tip of the iceberg of EU sanctions against China. In fact, in 2022, the EU also initiated a "countervailing investigation" against CRRC's high-speed rail and the CRRC Group.

The EU believes that CRRC's low bidding prices are due to massive subsidies from the Chinese government, which would otherwise result in losses or unprofitable operations. The EU argues that such practices would severely impact fair competition in the EU market.

At that time, the bidding price of China Railway Engineering Corporation (CREC) was highly competitive, at only 310 million euros, less than half of the 623.7 million euros quoted by a Spanish company. However, this low price was not a result of unprofitable subsidies but rather a reflection of CRRC's sophisticated supply chain, efficient cost control, and optimized technical processes, which allowed it to secure more international orders.

The bidding was participated in by CRRC Qingdao Sifang Co., Ltd., a core subsidiary of CRRC. As a leading player in the global high-speed rail industry, the company boasts the world's most advanced high-speed rail research and production technologies and Bringing together the most professional industrial workers .

In terms of technology, China's high-speed rail technology far surpasses that of Spain in terms of global influence and maturity, having received public recognition from multiple overseas countries. CRRC Qingdao Sifang eventually realized that this was yet another politically motivated suppression of Chinese enterprises by the West, aimed at curbing China's development. Recognizing this, CRRC Qingdao Sifang decided to withdraw from the bidding, and the Bulgarian high-speed rail project was subsequently taken over by a Spanish high-speed rail company.

Bulgaria originally favored CREC but was ultimately forced to choose a Spanish company due to EU intervention. By opting for the relatively less cost-effective Spanish Talgo company instead of the affordable and high-quality Chinese high-speed rail, Bulgaria spent an additional several hundred million euros. For Bulgaria, which had a GDP of only 101.584 billion USD in 2023 and ranked 68th globally, this additional cost was significant. With a GDP per capita of 20,900 USD and a ranking of 21st among the 27 EU member states, Bulgaria failed to join the ranks of developed countries despite its location in Europe.

However, the development exceeded the expectations of the Bulgarian government. In October 2024, the Spanish Talgo company announced that it would be unable to deliver on schedule and would need at least three more years. The Bulgarian government regretted its decision.

Many Bulgarian netizens expressed their frustrations, questioning why the government did not choose to cooperate with Chinese enterprises. After all, the Jakarta-Bandung High-Speed Rail project undertaken by a Chinese high-speed rail company had already been completed and widely praised in Indonesia. Bulgaria's decision to abandon Chinese high-speed rail in favor of more expensive Spanish high-speed rail sparked strong public outrage.

Following Talgo's winning bid, large-scale protests broke out in Sofia's central square. Many Bulgarian netizens held up posters of the Jakarta-Bandung High-Speed Rail to criticize the government's decision not to choose Chinese high-speed rail. Maria, a university student participating in the protest, said excitedly, "We need advanced transportation facilities to drive economic development, not be constrained by political considerations. The Chinese solution is clearly more favorable. Why do we have to spend more money on inferior products?"

Not only college students were confused by this decision, but ordinary citizens also expressed their dissatisfaction. Ivan, the owner of a coffee shop, said that everyone knew how powerful Chinese high-speed rail was and how it had helped many countries build high-speed rail projects like the Jakarta-Bandung High-Speed Rail and the China-Laos Railway, solving transportation problems and creating numerous job opportunities. Bulgaria could have had such opportunities, but they were ruined. Ivan's words were filled with helplessness and regret.

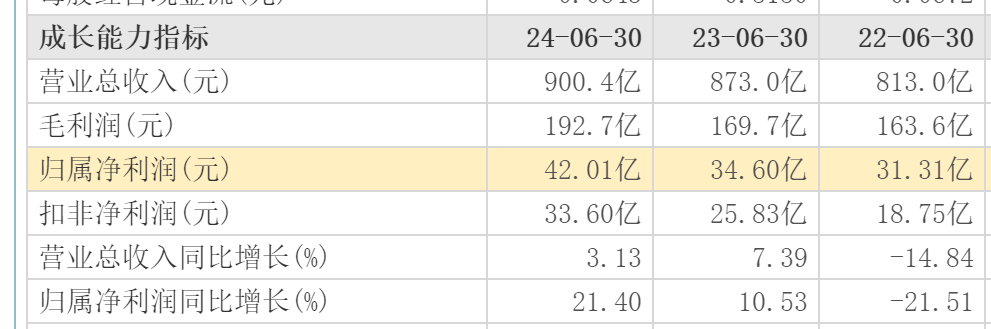

In contrast, CRRC was unaffected by these developments. In 2023, CRRC's revenue reached 234.3 billion yuan, an increase of 5.08% year-on-year, halting a two-year decline in revenue. Net profit attributable to shareholders was 11.71 billion yuan, an increase of 0.5% year-on-year. In the first half of 2024, CRRC's revenue was 90.04 billion yuan, an increase of 3.13% year-on-year, and net profit attributable to shareholders was 4.201 billion yuan, an increase of 21.40% year-on-year. Although revenue growth slowed compared to the same period last year, net profit growth far exceeded the 10.53% increase seen in the same period last year. It is clear that the temporary loss of the Bulgarian order had minimal impact on CRRC.

2

Counterattacks from China's high-speed rail

The anger and protests of Bulgarian citizens are justified, as high-speed rail technology is not something that can be mastered by just any country. From its first export to Turkey and the construction of the Mecca-Medina High-Speed Rail in Saudi Arabia to the opening of the Jakarta-Bandung High-Speed Rail, China's high-speed rail has long been renowned globally. China's high-speed rail technology has withstood the test of different terrains in various countries and proven its capabilities with its strength.

Bulgaria, which abandoned CRRC, has not fared well in its high-speed rail project. Although Talgo won the bid, it encountered numerous obstacles during project implementation. Due to inadequate technical capabilities, Talgo was unable to deliver the trains on schedule. In fact, Bulgaria's overall project demand was not significant, requiring only 20 electric trains, but even so, Talgo was unable to meet the delivery deadline. Talgo, which lacked the necessary expertise but still took on the project, ended up becoming a laughingstock despite edging out the Chinese bidder.

It was not that Bulgaria did not want Chinese high-speed rail; it was the EU that rejected it. As an EU member state, Bulgaria had no choice but to comply with the EU's decision. The EU was concerned that if China and Bulgaria reached a high-speed rail cooperation agreement, more European countries would rush to introduce Chinese technology in the future. If all countries adopted Chinese high-speed rail technology and standards, it would inevitably weaken the EU's influence in the high-speed rail sector.

In 2023, China ranked first globally in high-speed rail mileage with 42,000 kilometers. Germany ranked second with 6,226 kilometers, approximately one-seventh of China's total. Spain ranked third with 5,705 kilometers but lagged far behind China in total mileage, which may indicate a significant technological gap between the two countries. This technological gap was fully demonstrated in Bulgaria's high-speed rail project.

Although Talgo is not a small company, its technology is not outstanding. With nearly 80 years of history, its supply chain is not well-established, and a large number of components need to be imported. In recent years, due to geopolitical factors, ensuring timely delivery of components has been challenging. Additionally, Talgo encountered multiple critical technical issues during the project, leading to delays and stagnation.

Talgo cited production line adjustments and supply chain issues as reasons for its inability to deliver on time. Ultimately, the Bulgarian government decided to cancel its contract with Talgo, disrupting Bulgaria's high-speed rail plans. The project, which was originally scheduled to be completed within five years, had to be restarted from scratch. The high-speed rail construction plan, which was originally Bulgaria's biggest hope for economic recovery, was forced to be shelved.

As we all know, high-speed rail is not just about improving domestic transportation; it also carries the dream of national economic takeoff. Bulgaria's high-profile high-speed rail project, hindered by EU interference, has shattered Bulgaria's vision for economic prosperity. Talgo's inability may prompt Bulgaria to reconsider CRRC, and CRRC is poised to achieve a complete counterattack.

There have been similar examples in the past. For instance, Vietnam initially rejected Chinese high-speed rail but later realized that only Chinese high-speed rail could complete their project and turned to China for cooperation. However, by that time, China had gained the upper hand in negotiations.

3

Counterattacks by BYD and other Chinese automakers

Nine Chinese automakers, including BYD, Wenjie, GAC Group, FAW Hongqi, SAIC MAXUS, Dongfeng Fengxing, NIO, XPENG, and Skyworth, participated in the recent Paris Motor Show, accounting for 20% of all exhibitors. Another automaker, Geely, which was also subject to a countervailing investigation, did not attend the show. These exhibitors performed well, particularly BYD's booth, which attracted long queues of visitors from German and Japanese automakers. According to the Austrian newspaper Der Standard, BYD received 2,000 orders for its U8 model within one minute, priced at 1.098 million yuan.

The New York Times described BYD's presence in the overseas market as follows: At the BYD booth, a large screen displayed landmark buildings from around the world, from the Christ the Redeemer statue in Rio de Janeiro to the Arc de Triomphe in Paris - a testament to BYD's ambition.

BYD's "Sea Lion 07" electric vehicle, launched for the European market, has a starting price of 45,000 pounds (approximately 420,000 yuan). Within 24 hours of its exhibition, orders exceeded 10,000. As a direct competitor to Tesla's Model Y, the Sea Lion 07 EV boasts a top speed of 215 km/h and a maximum battery capacity of 91.3 kWh, offering a longer range than its domestic counterpart. However, its price range is only 35,000-40,000 euros, compared to over 50,000 euros for the base Model Y. The European version of the Song PLUS DM-i, known as the Seal U DM-i, starts at less than 40,000 euros.

It is worth noting that BYD does not just sell cars; it also addresses charging issues. At this year's Paris Motor Show, BYD and its partner Shell announced that they would open access to approximately 300,000 Shell charging stations across Europe for BYD owners.

BYD, Wenjie, and Geely have performed exceptionally well in the European electric vehicle market. In particular, Geely's Volvo brand sold 123,955 new energy vehicles in the first half of the year. Wenjie also received over 13,000 orders for its 70,000-euro model during the Paris Motor Show. The rising sales of BYD, Geely, Wenjie, and other Chinese automakers have gradually increased the market share of Chinese new energy vehicles. According to market research firm RhoMotion, China's share of the EU new energy vehicle market was less than 1% in 2018 but reached 8% in 2023 and is expected to exceed 12% this year.

The International Energy Agency (IEA) reported in April that electric vehicle sales in China will exceed 10 million units in 2024, accounting for approximately 45% of total domestic sales. This means that over 10 million new energy vehicles will flow into overseas markets. According to the report, global electric vehicle sales surged by 35% in 2023 to a record high of nearly 14 million units. Sales are expected to reach 17 million units this year, accounting for more than one-fifth of global automobile sales. BYD's sales data slightly exceeded the growth trend in the European market, with total sales reaching 21,409 units from January to July this year, up 37% year-on-year from 15,644 units in the same period last year.

An anonymous source from a new energy vehicle brand stated that EU tariffs are effective against low-value-added products but not high-value-added ones. "The approval of this EU proposal will ultimately harm the interests of EU consumers. Although it may have a short-term impact on the export of Chinese new energy vehicle brands, it will hinder the development of the entire automotive industry in the long run. This is why automakers like Mercedes-Benz and BMW oppose the proposal," the source said.

In the first half of this year, BYD's revenue reached 301.1 billion yuan, up 15.76% year-on-year, with a net profit of 13.63 billion yuan, up 24.44% year-on-year. Geely's revenue reached 107.3 billion yuan, up 46.63% year-on-year, with a net profit of 10.6 billion yuan, up 574.71% year-on-year. Although the European market is a fast-growing region, it is not the primary source of revenue for BYD and Geely. Therefore, this "countervailing investigation" is unlikely to cause substantial harm to these companies.

Although the European Union has passed this proposal, which protects its automobile enterprises to some extent, it violates the normal market competition mechanism and is not conducive to the healthy competition of EU automobile enterprises. In the case that China's new energy automobile enterprises have taken the lead in technology, the EU's move is undoubtedly "self-imposed isolation". This unfair behavior is even expected to promote China's new energy automobile enterprises to widen the gap with EU automobile enterprises. BYD and other enterprises are likely to "counterattack" the EU like CRRC. By then, the EU may realize how foolish its decision is at this time.