Great Escape of GAC Group! Farewell to the Era of Joint Ventures, Betting on Independent Brands for Self-Rescue

![]() 11/01 2024

11/01 2024

![]() 512

512

Recently, GAC Group has stirred up quite a commotion with an announcement that its headquarters will move from the GAC Center in Guangzhou CBD to Panyu Auto City from November 2nd!

The official statement from GAC Group is to improve management efficiency, "transforming the management mode of independent brands from strategic control to operational control," and making significant adjustments to its organizational structure.

Although it involves only a few hundred people, this migration signifies a comprehensive adjustment in GAC Group's development focus. Trumpchi and Aion, the two major independent automakers, will become the top priorities, while the status of the two joint ventures, Guangqi Honda and Guangzhou Honda, will be weakened.

From now on, GAC Group will shift from being a "big GAC" that emphasizes both joint ventures and independent brands to a new phase of a "small GAC" with independent brands at its core.

The Chinese automobile market has fully entered a new stage characterized by the rise of independent automakers and the overtaking of traditional automakers in the field of electric and smart vehicles. Automobile groups that once relied heavily on joint ventures are now on the decline.

Leading multinational automakers such as Volkswagen, Toyota, General Motors, and Honda have seen their joint ventures in the Chinese market comprehensively surpassed by independent automakers like BYD, Geely, and Chery. The market share of independent brands has exceeded 50%.

The brand and product advantages formed by joint venture automakers in the gasoline vehicle market have nearly disappeared, and even large-scale price wars cannot compete with independent automakers.

Facing pressure from the market penetration of luxury automakers such as Audi, BMW, and Mercedes-Benz and the upward push of independent automakers in terms of cost-effectiveness and quality, joint venture automakers are facing a severe test in the main sales market between 100,000 and 200,000 yuan.

The selling prices of multinational automakers such as Volkswagen, Toyota, and General Motors in the Chinese market have reached their lowest levels in history and globally. They have also launched electric smart vehicles that meet user needs, but these efforts seem to have had little effect.

As one of the mainstream automakers in the Chinese automobile market, GAC Group is also facing its darkest moment in history.

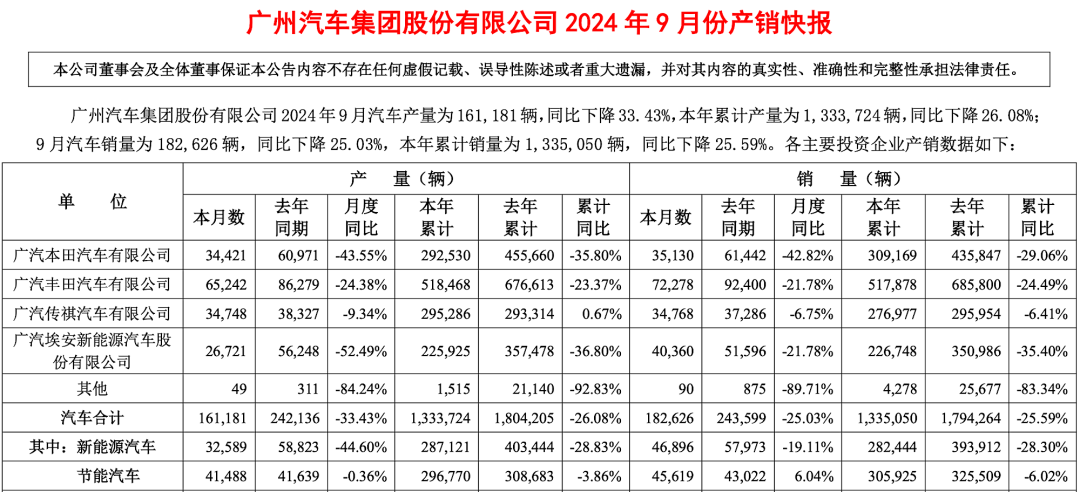

In 2022, GAC Group sold 2.4338 million vehicles, a year-on-year increase of 13.5%, with both joint ventures and independent brands growing synchronously. Among them, Guangqi Honda sold 1.005 million vehicles, Guangzhou Honda sold 741,800 vehicles, GAC Trumpchi sold 362,500 vehicles, and GAC Aion sold 271,100 vehicles.

In 2023, GAC Group sold a record-high 2.5049 million vehicles. However, sales of the two joint ventures began to decline year-on-year, with Guangqi Honda selling 950,000 vehicles and Guangzhou Honda selling 640,400 vehicles. In contrast, the two independent automakers saw significant growth, with GAC Trumpchi selling 406,500 vehicles and GAC Aion selling 480,000 vehicles.

In 2024, GAC Group entered a downward trend, with a total sales volume of 1.335 million vehicles from January to September, a year-on-year drop of 25.59%, and sales of all four automakers fell.

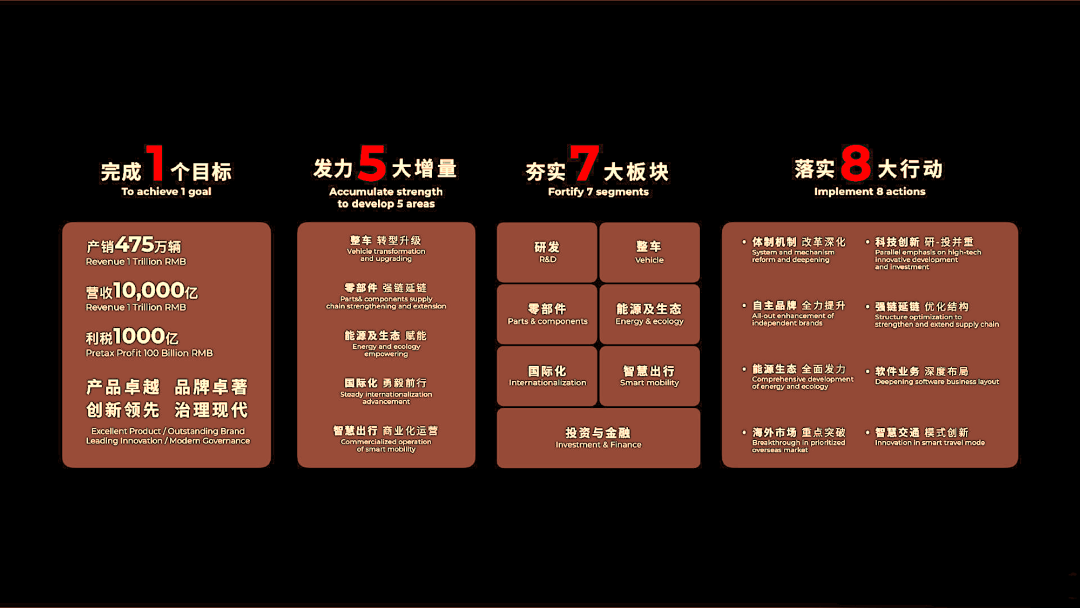

Faced with the strategic goal of "trillion GAC" by 2030, GAC Group must save itself!

As one of the few automotive groups that have achieved coordinated development of joint ventures and independent brands, GAC Group has a huge potential advantage over automotive groups such as Dongfeng and SAIC but also faces dual challenges from two markets.

As the cash cows of GAC Group and the strong backing for the development of independent brands, Guangqi Honda and Guangzhou Honda face the same challenges as all joint venture automakers. They seem unable to break through the overall market development trend, ultimately triggering the first life-or-death crisis for GAC Group since its failure with Guangzhou Peugeot.

From the establishment of Guangzhou Honda in 1998 to the rise of GAC Trumpchi and GAC Aion, GAC Group has entered a golden era of rapid development for joint ventures and independent brands spanning 25 years.

However, the successive failures of GAC Fiat Chrysler and GAC Mitsubishi marked a watershed in GAC Group's development, which it ultimately missed.

Many first-tier cities have a large automotive group, and their group headquarters buildings often become landmarks and the cornerstone of local economic development.

For example, when we visit downtown Hangzhou, we can see several buildings belonging to Geely Automobile Group, and the hexagonal building of BYD's Pingshan headquarters is impressive. The R&D center, comparable to Apple's headquarters, has officially commenced construction.

When the GAC Center in downtown Guangzhou ceases to exist or becomes deserted, it makes one deeply feel the harsh winter of 2024. Is this the darkness before dawn, or is it just the beginning of the night?

As of now, we have not seen what adjustments GAC Group's organizational structure will undergo. However, we are aware that merely moving the headquarters' functions forward and relocating the office to the GAC Research Institute is far from sufficient. Perhaps it also requires the simultaneous entry of Trumpchi and Aion.

In fact, the rapid development of major independent automakers and new carmakers in recent years has been driven more by a flat management system across various sectors rather than a centralized headquarters model. Decision-making power is delegated to subsidiaries, giving them greater flexibility and freedom to respond to market changes.

Of course, whether the headquarters adopts a centralized or decentralized approach is merely a choice of management system and is not right or wrong. The key is whether the new operating mechanism can cope with market challenges and opportunities. This time, it tests GAC Group's determination and wisdom.

When Guangqi Honda and Guangzhou Honda were at their peak in the early 2000s, GAC Group resolutely decided to launch independent brand construction. GAC Trumpchi emerged as a dark horse among independent brands, ultimately becoming the only Chinese automotive group to achieve integrated development of independent and joint venture brands.

Whether it's the introduction of Honda and Toyota or the creation of GAC Aion, which ranks among the top three in global pure electric vehicle sales, we believe GAC Group has sufficient wisdom to tackle every challenge in its development process.

Unlike in the past, the challenges facing GAC Group this time are comprehensive, encompassing the economic situation, its own strength, competition from rivals, and the global automotive industry landscape. Any misjudgment could be fatal.

FAW's independent brands are now limited to Hongqi, forcing it to fully tie up with Toyota and Volkswagen, the two major joint venture automakers. Changan Automobile has already marginalized joint ventures with Mazda and Ford, focusing instead on developing independent brands such as Changan, Deep Blue, and AITO.

However, GAC Group shares the concerns of Dongfeng and SAIC regarding the dual dilemmas faced by joint ventures and independent brands. Dongfeng Honda, Dongfeng Nissan, SAIC Volkswagen, SAIC GM, and SAIC Roewe, once leaders in their respective market segments, are now deeply mired and unable to extricate themselves.

On a more optimistic note, GAC Group has ample opportunities for a rebound.

GAC's independent electric and smart technology can empower joint venture automakers. Meanwhile, Honda and Toyota continue to grow globally, and their hybrid vehicles have greater development potential in the Chinese market. Additionally, Trumpchi and Aion, in the midst of their electrification transformation, have even greater development opportunities.

Judging from the development trend of the Chinese automobile industry in recent years, internal management within automakers is crucial for winning a competitive edge in the market. Amid increasing global economic uncertainty, rapid market changes, and the reshaping of the global automotive landscape, a more efficient and precise decision-making mechanism is needed.

While it's not our place to discuss whether GAC Group's decision to move its headquarters functions forward is appropriate, it is crucial that the adjustment reduces decision-making chains, speeds up market response, and addresses GAC Group's current issues with a more professional attitude and long-term perspective.

What significant moves will GAC Group make after fleeing the center of Guangzhou? We may find the answer at the Guangzhou Auto Show opening on November 15th. See you at the "GAC Pavilion"!