Xiaomi doubles deliveries, but Geely Zeekr and IM Motors fail to encircle Tesla

![]() 11/04 2024

11/04 2024

![]() 565

565

Golden September and Silver October, “setting new records” becomes the keyword for many automakers.

In September this year, several emerging automakers simultaneously targeted Tesla's Model Y and launched their respective products with clear intentions to encircle Model Y. These included Zeekr 7X, the new IM Motors LS6, Jiyue 07, Ledo L60, and IM Motors R7, all attempting to carve out a significant share from the world's best-selling model.

Almost immediately after each product's official launch, the marketing departments began promoting how impressive the order volumes were. A month later, after a full delivery month, these companies that tried to use orders as a cover would also unveil their true sales figures.

On the evening of November 1, several new energy automakers, including Xiaomi Automobile, Li Auto, NIO, XPeng, and more, unveiled their October "report cards", with "setting new records" becoming the keyword for many automakers.

Overall, almost all brands entered the "10,000-unit club" in October this year, including AVATR and IM Motors, which broke the 10,000-unit mark for the first time. Even if IM Motors sold 10,001 units in October, it still crossed the threshold. It can be said that this year's Golden September and Silver October were highly successful for new energy vehicles.

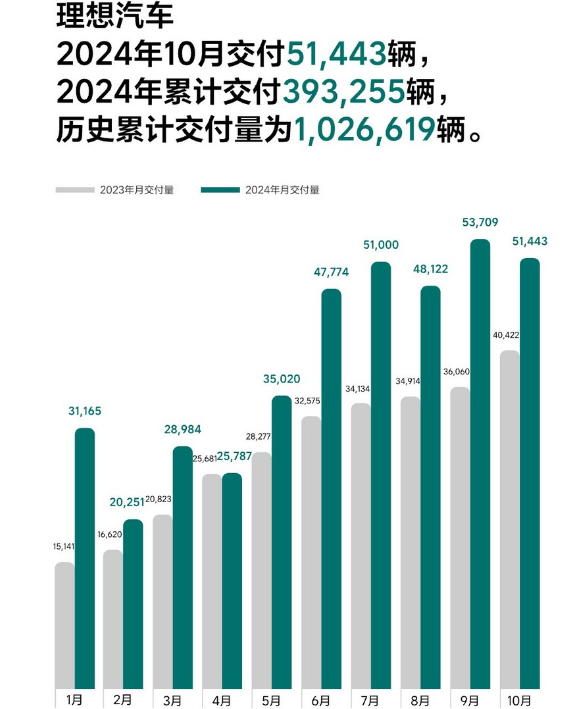

Huawei's ecosystem experiences a concentrated outbreak

In October this year, Li Auto's deliveries continued to exceed 50,000 units, reaching 51,443, a year-on-year increase of 27.3%. As of October 31, Li Auto's 2024 deliveries had reached 393,300 units, with a cumulative historical delivery volume of 1,026,600 units. At this point, Li Auto became the first Chinese emerging automaker brand to achieve 1 million deliveries.

Li Xiang said, "One million deliveries is a milestone, but also a new beginning." Although many people are reluctant to admit it, the objective fact is that Li Auto has become the first Chinese luxury automotive brand with an average price of over 300,000 yuan and cumulative sales exceeding 1 million units.

Earlier this year, Li Auto set a sales target of 800,000 units, but with the setback of the MEGA model, the annual target was reasonably adjusted to 480,000 units. Based on this trend, Li Auto's completion of this year's sales target is within sight.

In the past, present, and for a long time to come, Li Auto and Huawei's HarmonyOS Intelligent Connected Vehicle will remain the top two in emerging automaker sales. However, for HarmonyOS Intelligent Connected Vehicle, the rapid expansion of its ecosystem has significantly contributed to its sales growth.

The AITO M9 model has consecutively won the monthly sales champion title for vehicles priced over 500,000 yuan in the Chinese market. Since its launch 10 months ago, cumulative orders have exceeded 160,000 units, with 16,004 units delivered in October. The new AITO M7 sold 15,836 units in October 2024, with over 20,000 units ordered in October. As of the end of October, over 170,000 units of the new AITO M7 had been delivered.

The recently launched coupe SUV, Chery IM Motors R7, saw over 30,000 orders in just 33 days after its launch, but delivered only 4,730 units in October.

At the delivery ceremony, Chery's Yin Tongyue and Huawei's Yu Chengdong both attended, attempting to elevate sales of this model to a new height. For Huawei, AITO is a showcase project, but one successful showcase is not enough. Huawei needs replicable success to convince its automaker ecosystem partners.

At the recently established Yinwang company, SAIC Motor's first equity payment of 2.3 billion yuan has been received. Although other companies have signed cooperation agreements, they are also available on the official website.

In addition to the AITO M9, M7, and M5 models, HarmonyOS Intelligent Connected Vehicle also has IM Motors S7, IM Motors R7, and Enjoy S9, but none of them exceed 5,000 units per month in sales. AITO's sales still account for over 80% of the entire HarmonyOS Intelligent Connected Vehicle ecosystem.

Judging from JAC's upcoming million-yuan MPV, it is not a high-volume model either. For HarmonyOS Intelligent Connected Vehicle to reach the next level in sales, it must focus more on Chery IM Motors. Only a concentrated outbreak within the ecosystem has the potential to become the sales champion among emerging automakers. It remains to be seen how SAIC Motor's AITO will feel after resources are tilt towards IM Motors.

NIO Automobile, one of the "three strong runners" in the extended-range electric vehicle (EREV) segment, also welcomed a new sales high in October.

In October 2024, NIO Automobile delivered 38,177 units, setting a new monthly delivery record for five consecutive months, with a year-on-year increase of over 109%. The NIO SUV family, including the NIO C16, C10, and C11, achieved coordinated growth. NIO Automobile not only set a new delivery record but also surpassed 210,000 units in cumulative sales.

Zhu Jiangming, founder, chairman, and CEO of NIO Automobile, revealed on social media: "In October, we once again set a new order record, with over 10,000 orders for each of the C10, C11, and C16 models."

It is understood that the B10, the first global model of the new B series, made its debut at the Paris Motor Show and will reappear at the Guangzhou Auto Show in November. According to Zhu Jiangming, the compact SUV NIO B10 and two other models from the B series will be launched globally next year.

After listing on the Hong Kong Stock Exchange and partnering with Stellantis, NIO Automobile officially went on the right track. Its product roadmap almost follows the Li Auto model, reducing trial-and-error costs and quickly filling the market demand for 150,000-250,000 yuan household EREV SUVs. Currently, NIO Automobile is beginning to "stabilize at third and compete for second" in the rankings of emerging automakers.

When will the second brand make a breakthrough?

After NIO and XPeng successively launched their second brands, the outside world is also eagerly anticipating the delivery performance of Ledo and MONA.

Two months since its announcement, the delivery situation of XPeng MONA remains a mystery. Officially, XPeng MONA M03 has delivered over 10,000 units consecutively in its first two months on the market. However, objectively speaking, the visibility of M03 on the road is still low, and some users have already reported delivery issues.

Some netizens have stated that their M03, ordered on September 26 with an original delivery date of December 26, has had its delivery time changed to January 20, 2025, with the delivery interface prompting continuous updates, suggesting possible further delays. Additionally, multiple MONA M03 reservation holders from September were informed of delayed deliveries, with delivery times ranging from December 10, 2024, to January 2025.

In terms of delivery data, XPeng MONA M03 only dares to announce a vague figure of over 10,000 units, similar to Xiaomi. Overall, XPeng delivered 23,917 units in October, a year-on-year increase of 20% and a month-on-month increase of 12%. Cumulative deliveries for the first ten months totaled 122,478 units, a year-on-year increase of 21%. Currently, XPeng ranks fifth in sales among emerging automakers.

From the perspective of data announcement, NIO is remarkably honest. On the evening of November 1, NIO was one of the last brands to announce its delivery data, with an official announcement not coming until 6 PM. The data was also disappointing, with NIO delivering 20,976 units in October, a year-on-year increase of 30.5%. A total of 170,257 units have been delivered so far in 2024, a year-on-year increase of 35.1%.

On paper, the numbers seem passable, but a closer look reveals that NIO brand deliveries were 16,700 units, actually a significant month-on-month drop. The Ledo brand, specifically the Ledo L60, delivered 4,319 new units.

Unlike XPeng, which kept its data hidden, NIO honestly revealed the new car delivery data for the L60, even though this exposed a year-on-year decline in NIO brand sales. After all, last month, before the introduction of the Ledo brand, NIO had achieved a stable sales volume of over 20,000 units for multiple months.

If not for capacity constraints, despite the significant differences in price and positioning between the Ledo L60 and NIO brands, there is still a competitive relationship between them.

The outside world hopes to see a significant increase in NIO's sales after the delivery of the Ledo L60. However, the actual situation has been somewhat unexpected. NIO has not yet officially responded to this sales question, but it should be of concern internally.

Failed encirclement of Tesla

With IM Motors R7 and Ledo L60 delivering less than 5,000 units per month, this encirclement of Tesla can be declared a failure.

After all, the remaining models, including AVATR 07, the new IM Motors LS6, and Jiyue 07, lacked the courage to disclose specific sales figures. The grandiose announcements made at the launch events dissipated amidst vague sales data.

In October this year, AVATR sold 10,056 units, a year-on-year increase of 150%, breaking the 10,000-unit mark for the first time. Compared to other brands, AVATR's sales figures are highly credible, as previously detailed sales data has been released.

AVATR 11 sold 831 units in September. Based on the sales data of 1,000 units for AVATR 11 in October, and assuming AVATR 12 sold 2,500 units in October (up from 2,156 units in September), the total October sales for AVATR 11 and AVATR 12 would be approximately 3,500 units. Therefore, according to AVATR's announcement, the remaining 6,556 units would be attributed to other models, which is actually quite high compared to other products targeting Tesla's Model Y, thanks in part to the EREV technology.

Similarly, IM Motors also successfully joined the "10,000-unit club" in October with a one-unit advantage, but the delivery volume of the new LS6 remains vague. Officially, the new IM Motors LS6 received over 33,000 orders within 30 days of its launch and delivered over 6,000 units in its first month.

If the data is accurate, IM Motors is almost on par with AVATR.

Unfortunately, although AVATR and IM Motors both broke the 10,000-unit mark for the first time, Hozon Auto's sales of 10,157 units set the bottom line for the top ten emerging automakers. Although the gap is small, it determines the ranking among the top ten emerging automakers in sales. In October this year, NIO, which was once the sales champion, was also squeezed out of the top ten.

It is foreseeable that for a long time to come, brands like IM Motors, Hozon Auto, AVATR, and NIO will compete to enter the top ten in sales among emerging automakers, representing the last tier of this segment.

Returning to the topic of encircling Tesla's Model Y, perhaps among this batch of products, only Zeekr 7X can truly claim a foothold.

Zeekr Automobile officially announced that it delivered 25,049 new vehicles in October, a year-on-year increase of 92% and a month-on-month increase of 17%, setting a new monthly sales record. Additionally, cumulative sales for the first ten months of this year reached 167,922 units, a year-on-year increase of 82%.

Zeekr 7X also delivered its 10,000th unit on October 16. With over 17,000 units delivered in just 40 days since its launch, Zeekr 7X accounted for almost all of Zeekr's overall sales growth, successfully carving out a share from Tesla's market.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.