The CEO drives a Xiaomi SU7, but Ford still can't make good electric cars

![]() 11/04 2024

11/04 2024

![]() 544

544

"The money earned from fuel vehicles all goes to subsidize electric vehicles."

The CEO who has been driving a Xiaomi SU7 for six months and doesn't want to change it has decided to cut bonuses for Ford management.

Recently, after releasing the third-quarter financial report, Ford Chief Executive Officer Jim Farley told an employee meeting, "Due to the company's declining performance, Ford plans to reduce management bonuses to 65% of total bonuses."

However, regarding the third-quarter financial report, Ford Motor's Chief Financial Officer John Lawler gave a "robust" evaluation, but there was only one reason for reducing bonuses: "The money earned from fuel vehicles all goes to subsidize electric vehicles."

After the financial report was released, Ford's share price fell by more than 10%, mainly due to excessive losses in electric vehicles, which were not attractive to the capital market.

Electric Business Constraints

From the data, Ford's third-quarter performance was not bad and could be described as "robust".

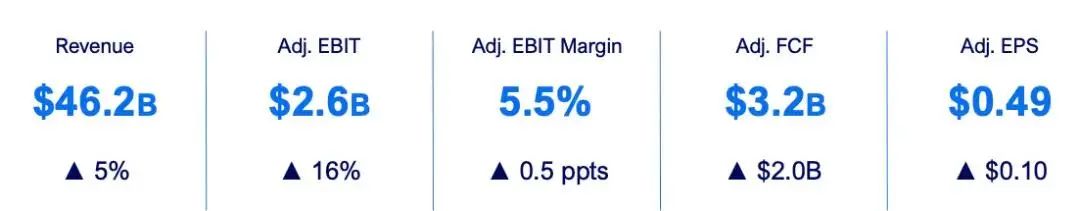

The third-quarter financial report showed that total revenue for the quarter was $46.196 billion, an increase of 5.47% year-on-year, slightly less than the $47.8 billion in the second quarter. It is reported that this is Ford's tenth consecutive quarter of year-on-year growth, and the industry evaluates that "there are no major fluctuations in fundamentals".

From a business segment perspective, Ford's commercial vehicle division, Ford Pro, and traditional fuel vehicle division, Ford Blue, performed well. Revenue growth was mainly driven by the launch of new models, with Ford Pro's Super Duty trucks and Transit vans, as well as Ford Blue's all-new Explorer and Lincoln Aviator, boosting performance in the global market.

However, the overall segment profit performance left Ford's crisis exposed. Adjusted EBIT was $2.6 billion, an increase of $352 million year-on-year, but net profit fell to $90 million, a decrease of $30 million year-on-year. A major reason for the decrease was the pressure on net profit from expenses related to the electric vehicle business.

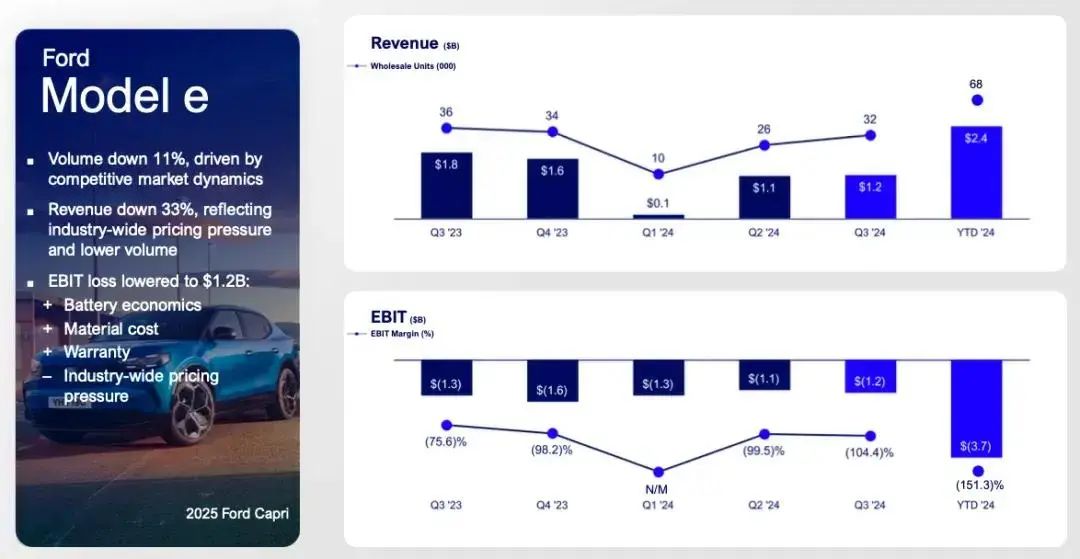

Overall, Ford's main revenue still relies on the sale of traditional fuel vehicles. Ford Model e, the electric vehicle business segment, is Ford's weakest link, with sales of 32,000 vehicles in the third quarter but a pre-tax loss of $1.2 billion. The money earned from fuel vehicles is almost not keeping up with the speed at which electric vehicles are losing money.

The company's profits are offset by the pressures brought about by the transition to electric vehicles. Jim Farley said, "The electric vehicle division is the main factor dragging down the entire company. He expects the company to lose about $5 billion on electric vehicles this year alone, as it is difficult to achieve a significant increase in overall performance without solving the problem of electrification."

Ford is helpless and has to find a solution. Reducing production costs may be one of the main solutions.

The first step is to reduce labor costs. At the financial report conference, Jim Farley said, "I am proud of the progress we have made, but we are still not satisfied." He also said that bonuses may change based on the company's fourth-quarter performance. In other words, bonuses under the new performance system are directly linked to progress towards key goals.

The second step is to scale back electric vehicle plans. In August, Ford decided to cancel plans to launch a three-row electric SUV. On November 1, it announced that it would stop producing the F-150 Lightning electric pickup truck for up to six weeks. Additionally, Ford's factories in the United States will be closed during the holiday week in December.

However, these measures can only be considered symptomatic rather than curative.

"My team and I are not naive"

Jim Farley is not unaware of the cure. However, the cure is a long process.

He once said in a live broadcast, "Over the past year, the company has discussed the most about how we compete, where we want to compete, how we can win, what rights we have to win, and what capabilities we need to compete and survive."

The anxiety about survival discussions peaked after Jim Farley's two visits to China. "Only by coming to China did I realize how far behind we were."

From the data, Ford's electric vehicles lag far behind Chinese brands. The Wall Street Journal once described Jim Farley's visit to China as a "humble journey," and he recalled that these two experiences could be described as "enlightening."

At the beginning of 2023, Jim Farley sat in the driver's seat of an electric SUV from joint venture partner Changan Automobile, with Ford Chief Financial Officer John Lawler in the passenger seat. After the drive, Lawler told Jim Farley, "These people are ahead of us."

In May of this year, Jim Farley's wording became even more "urgent." He claimed to a Ford board member that the Chinese automotive industry posed an "existential threat."

"The global new car market is 90 million vehicles, with Japan at 4-5 million and South Korea even less, while China accounts for one-third, or 30 million vehicles, which is twice the combined total of Europe and the UK." He also did some calculations, which intensified his sense of crisis.

"Currently, with a production capacity of 58 million vehicles already built, China can export 28-29 million vehicles, which is more than the combined total of the entire Europe, the entire UK, most of Mexico, and parts of the US." If it weren't for tariffs blocking China's electric vehicle exports, Jim Farley might not have been able to sleep soundly.

In a podcast, Jim Farley spoke with host Robert Llewellyn. Llewellyn mentioned that two of his relatives in Australia who were not interested in cars had switched to BYD. Jim Farley pointed out that Chinese electric vehicles have stood out in global competition due to their superior technology, low-cost supply chain, and quick response.

"When you are five times larger in scale, it will be difficult to beat Chinese automakers on cost." He had to admit that with a well-established battery supply chain, China accounts for about 70% of global battery capacity, becoming a core force in the new energy vehicle field.

Jim Farley believes that at least at this stage, if Ford encounters direct competition from Chinese electric vehicles in its US stronghold, it may not even have the ability to fight back. Therefore, Jim Farley decided to change the strategy for electric vehicles.

One noticeable change is knowing oneself and the enemy. In April of this year, after visiting China, Jim Farley shipped several domestic electric vehicles to Michigan, including brands like Xiaomi and Lixiang.

"I've been driving the Xiaomi SU7 for six months, and I still don't want to drive any other car."

Regarding this, Jason Isaac, CEO of the American Council for an Energy-Efficient Economy, expressed dissatisfaction. He said that Ford received billions of dollars in subsidies from American taxpayers to support American electric vehicle production, but the CEO chose Chinese products, which was a slap in the face to thousands of hardworking Ford Motor Company employees.

Jim Farley explained it as "knowing oneself and the enemy." He hoped that in the process of experiencing these vehicles, he could find a way to achieve the goal of "meeting Chinese standards will become the most important priority."

"This is our challenge, and my team and I are not naive."

Dilemma and Swing

The delayed transformation of electric vehicles has made Ford dare not be naive.

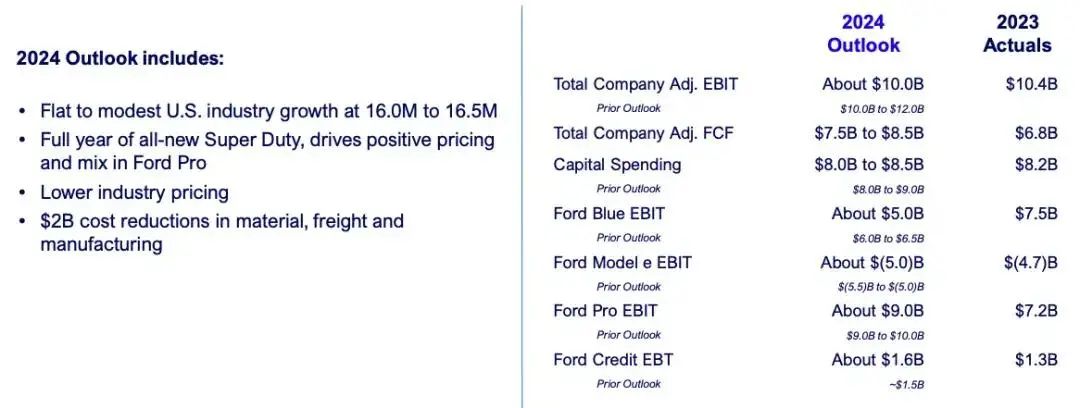

The electric vehicle business has become a black hole that devours profits. Unfortunately, Ford had to once again lower its 2024 earnings forecast, expecting adjusted EBIT of approximately $10 billion, lower than the previously given forecast of $12 billion.

This sent a clear signal to the outside world that Ford's electric vehicle business is facing unprecedented challenges. Therefore, when Ford lowered its future earnings expectations, market confidence was greatly reduced, directly leading to a drop in share price. Wall Street analysts pointed out that Ford's slow pace in the global new energy transition still overly relies on traditional fuel vehicles to maintain market share.

Jim Farley also knows that solving the electric vehicle dilemma cannot avoid the Chinese market. However, Ford's presence in the Chinese market can be "negligible." As Ford's first pure electric model in China, the Mustang Mach-E, which was positioned to compete with the Tesla Model Y, was once highly anticipated, but it has consistently disappointed Ford since its launch.

With sales of less than 5,000 units for the entire year of 2022, the independently operated Ford Mustang Mach-E was incorporated into Changan Ford in 2023. However, even with Changan's support, sales of the Mustang Mach-E remained dismal, with only 795 units sold from January to August this year.

In the global market, Ford sold a total of 36,000 electric vehicles in the first half of the year. The good news is that Ford became the second-largest manufacturer in the US electric vehicle market, second only to Tesla. The bad news is that while Tesla is profitable, Ford loses $69,400 for every electric vehicle sold. Even NIO, once a major loss-making company, had to admit, "You can't lose more than us." Ford sold 32,000 electric vehicles in the third quarter, but losses did not slow down.

However, Ford remains highly committed to the transition to electrification, stating that annual electric vehicle production will exceed 2 million units by 2026. With cumulative electric vehicle sales of less than 100,000 in 2024, it has to be said that achieving 2 million in two years is indeed "ambitious."

But how to do it? Ford decided to take it step by step.

On the one hand, it announced a temporary suspension of the electrification transition process. To reduce pressure, it began to shift to hybrid models and increase production of fuel vehicles.

On the other hand, it is developing a low-cost electric vehicle platform with the goal of launching an affordable small pure electric vehicle. A century ago, Ford established its position in the global automotive industry with the cost advantage of the Model T. Today, can Ford bring back a "Model T for electric cars" to achieve a revival? Without the support of a complete industrial chain, it is probably difficult.

Ford also knows it will be difficult. Therefore, Ford is very contradictory.

On the one hand, there is an ambition of 2 million units, and on the other hand, to achieve more profits, Ford has reduced capital investment in pure electric models, from 40% to 30% previously, with the reason given being "slowing demand for electric vehicles."

The dilemma and swing were seen by American netizens as words to save face. Some were frustrated, saying, "After so many years without innovation, as competitors are about to kick down the door, has Ford reflected on itself?" Others have moved on, saying, "Even if the US imposes a 100% tariff, I'm willing to pay double the price for a BYD!"

The common belief among many netizens is that American automakers will eventually have to face competition from Chinese electric vehicles in the domestic market. If they are not prepared to defend, the story of Detroit's bankruptcy may be repeated.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.