Geely 'lets go' of Lifan, new chairman appointed, big moves in the works

![]() 11/12 2024

11/12 2024

![]() 594

594

Introduction

Introduction

Where will Lifan be pushed by the three influential forces of Geely, Chongqing State-owned Assets, and Megvii?

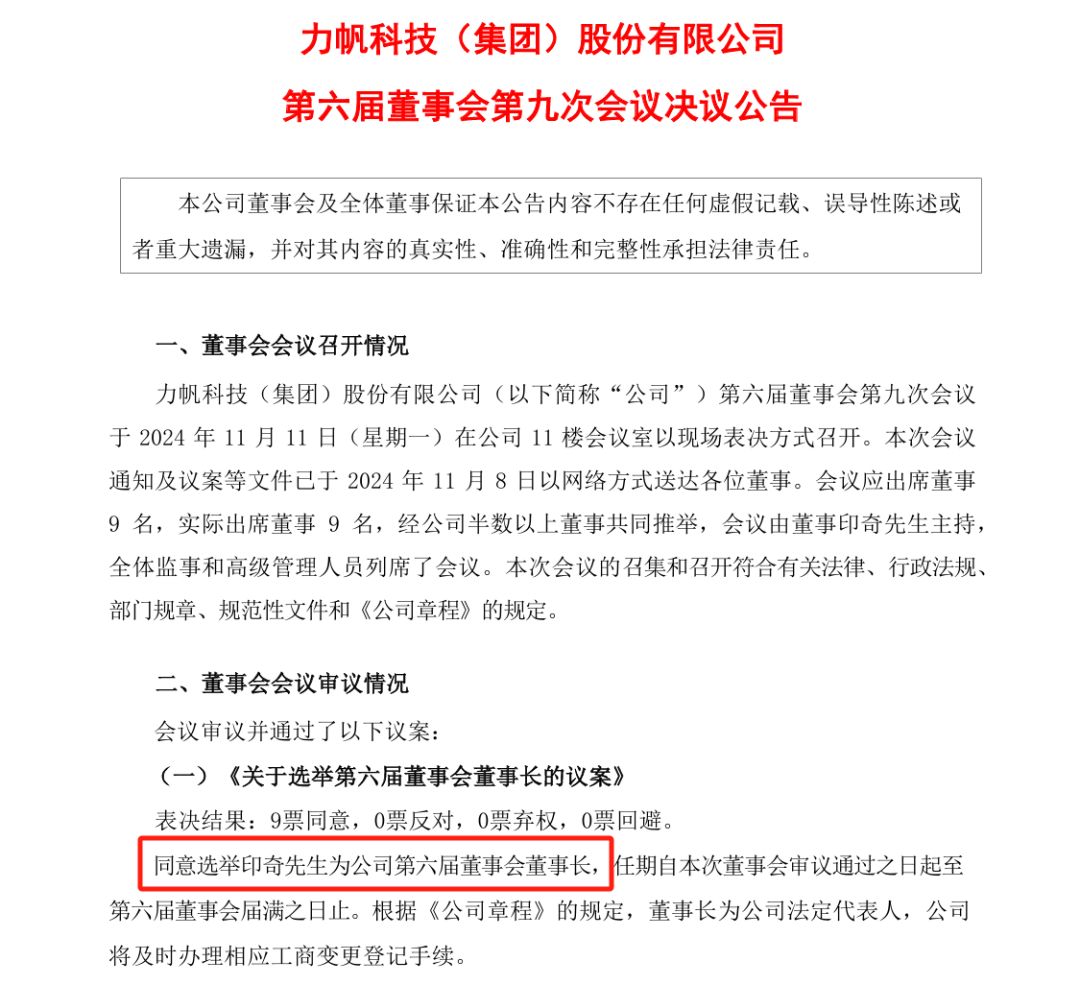

On the evening of November 11, Lifan Technology announced that Megvii CEO Yin Qi officially replaced Zhou Zongcheng as the new chairman and legal representative of the board of directors, marking a new stage of development for Lifan Technology.

The stock market reacts most swiftly to such positive news. Since the second half of this year, Lifan Technology's stock price has been on the rise, from less than 4 yuan to a high of 9.15 yuan, achieving a doubling growth. The core reason behind this lies in Megvii's investment in Lifan Technology four months ago.

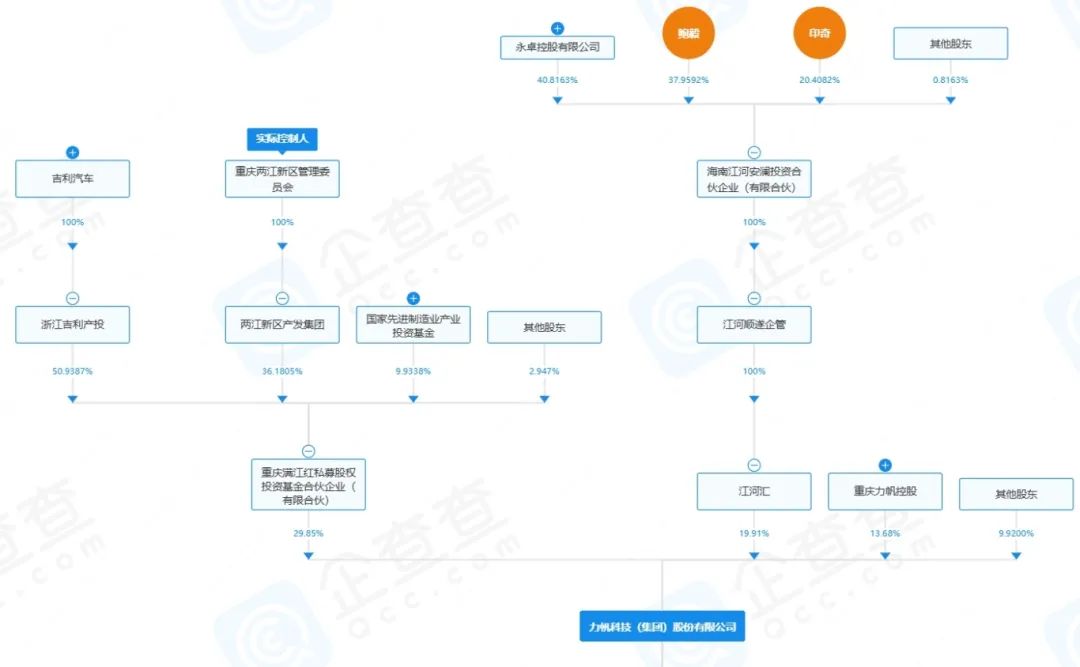

In early July, news that Megvii founder Yin Qi acquired some shares of Lifan Technology held by a company under Geely Group for 2.43 billion yuan caused a huge uproar. A month later, this substantial transaction was finalized, and Yin Qi indirectly held a 19.91% stake in Lifan Technology through Jianghe Hui, becoming the second-largest shareholder.

Three months later, Yin Qi became the helmsman of Lifan Technology, and the exit of Zhou Zongcheng, a veteran of the original Geely system, indicated that Geely was gradually letting go of its dominance in the operation and management of Lifan Technology. However, from the perspective of shareholding structure, Chongqing Manjianghong Equity Investment Fund, jointly held by Geely and Chongqing Liangjiang Industrial Group, still holds the position of the largest shareholder with a 29.85% stake.

Four years after acquiring Lifan, what is Geely's intention behind this change? What potential does Megvii value in Lifan? As the actual controller of Lifan Technology, what is the reason behind Chongqing State-owned Assets' promotion of Lifan's transformation? And what kind of automotive technology enterprise will Lifan Technology become?

There are both obvious and hidden aspects to the story, with ups and downs. But one thing is certain: Lifan's future is full of imagination.

From acquisition to letting go, what calculations is Geely making?

To trace back to the acquisition case between Geely and Lifan, we need to go back to September 2018, when there were rumors in the industry that Geely intended to acquire Lifan, and insiders indicated that the two parties were in contact. This was the first time that Geely, known for its resource integration, was rumored to have its sights set on Lifan.

Later, after rumors were debunked, Lifan, which had already been ST-listed, frequently hit the daily limit, and news of Geely's acquisition talks with Lifan spread in stock forums, gradually revealing the truth behind the acquisition. In January 2021, Lifan Technology (Group) Co., Ltd. was officially listed, with Geely sending a new core leadership team to take over Lifan, marking the official change of Lifan's surname to Geely.

In fact, as early as 2018, Li Shufu had publicly stated that he was actively seeking opportunities to prepare for a project to land in Chongqing, which also kicked off Geely's entry into Chongqing. It was around this time that news spread in the industry that Geely would take over Lifan.

Starting in 2020, Geely's cooperation with Liangjiang New Area intensified. Geely Holding Group's Saxo Bank (China) Financial Technology Project, Geely's high-end new energy vehicle (Chongqing) production base project, Geely Technology's smart battery swapping station, and Geely Industrial Internet's global headquarters project were successively launched in Liangjiang New Area, truly reflecting Geely's intensified layout in Chongqing and the southwest region. These are all part of Li Shufu's strategic plan to extend Geely's business operations to important cities in the southwest like Chongqing.

However, from a longer-term perspective, Geely's reorganization of Lifan is not just about acquiring a company and gaining some factories and land. With the successive launch of projects such as Geely Industrial Internet's global headquarters and financial technology in Chongqing, Geely may be aiming to ride on Chongqing's technological transformation journey and promote the transformation of Geely Technology Group and Geely Holding into technology companies.

After acquiring Lifan, Geely also made extensive layouts in Chongqing under the name of Geely Technology Group. Firstly, local capital from Chongqing was introduced to provide assistance and support to Lifan Technology. Secondly, new brands and products such as Maple Leaf and Rayblue were introduced, and Lifan's battery swapping system was integrated into the battery swapping race. At the same time, the management and organizational structure were adjusted to improve operational efficiency; the industrial ecosystem was laid out, with the establishment of a western headquarters and an innovation research institute, investment in the construction of a power battery factory, and improvement of the industrial chain layout.

However, Geely's efforts in Chongqing, especially regarding the Maple Leaf and Rayblue automotive brands, did not meet expectations. Especially with the intensifying pressure of new energy transformation and competition, Maple Leaf and Rayblue had to turn to the operating market. In 2022, Rayblue sold 58,000 vehicles, and in 2023, it sold 38,000 vehicles, falling short of Geely's expectations.

Soon, to optimize the performance of Geely Automobile's Hong Kong stocks, after Geely proposed a new strategic focus, Rayblue announced in February 2024 that it would officially be spun off from Geely's Hong Kong stocks. Although Geely sold Rayblue, it still held a significant amount of equity in Rayblue and Lifan, essentially moving assets from one hand to the other, and remained a major shareholder in Lifan Technology.

Perhaps due to concerns about the future or facing the new industrial direction of automobiles towards technology and AI, in early July of this year, Lifan Technology saw another change as Megvii founder Yin Qi acquired a 19.91% stake in Lifan for 2.43 billion yuan through Jianghe Shunsui Company, which acquired some shares of Lifan Technology held by a company under Geely Group. The equity transfer procedures were completed in August. As the actual controller of Jianghe Shunsui, Yin Qi became the second-largest shareholder of Lifan Technology.

In October, Zhou Zongcheng, the former chairman of Lifan Technology and a veteran from the Geely system, stepped down. In November, Yin Qi, the actual controller of the second-largest shareholder, was elected as the new chairman of Lifan Technology. Conventionally, a simple equity investment would only require appointing a director. However, Yin Qi rapidly became the chairman of Lifan Technology, and there is currently no candidate for vice chairman. This signifies that both Geely and Chongqing State-owned Assets have placed complete trust in Yin Qi, fully delegating authority and officially letting go of Lifan, entrusting its operation and management to this 36-year-old influential young leader in the technology and AI circles.

As for why Geely is doing this, on the one hand, it may be one of a series of strategic focusing actions. Geely's core automotive brands no longer require assets like Lifan. At the same time, handing over the reins of Lifan to a team led by Megvii undoubtedly signifies that Yin Qi has significant advantages, which is more conducive to the transformation of Lifan Technology into a technology company. For automobiles increasingly leaning towards AI intelligent driving, this is a direction for rapidly implementing cutting-edge technology.

On the other hand, although Geely has let go of Lifan, as one of the shareholders behind the scenes, it has not entirely let go of Lifan. With personnel from the Geely system still present in the current Lifan system and so many automotive upstream and downstream industrial resources, Geely will undoubtedly continue to empower Lifan Technology and support its transformation and reform.

Megvii Takes the Lead, Chongqing's Next Target

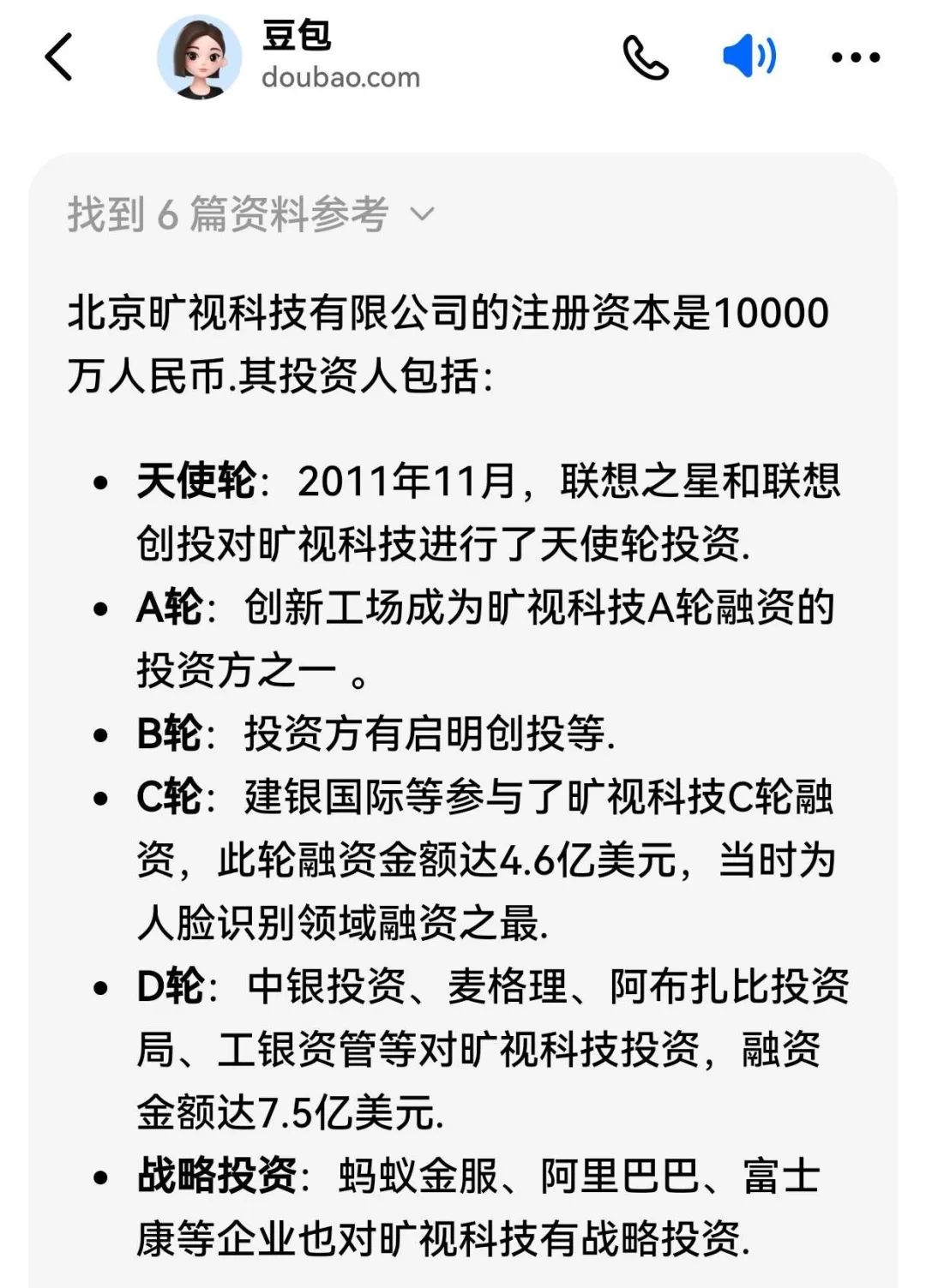

In the automotive industry, many may not be familiar with Megvii Technology and its CEO Yin Qi. Megvii Technology was founded in 2011, with Yin Qi as one of the co-founders of this technology company. He graduated from the Computer Science Experimental Class at Tsinghua University ("Yao Class") and was taught by Andrew Chi-Chih Yao, the only Chinese winner of the Turing Award and the founder of modern cryptography. He has also won the 28th China Youth May Fourth Medal, been selected for three consecutive years into Fortune's "China's 40 Under 40," and been named a Forbes Asia 30 Under 30 leader.

Benefiting from the booming development of artificial intelligence, Megvii Technology, along with SenseTime, CloudMinds, and Yitu Technology, is known as the "AI Four Little Dragons." With a deep accumulation in the field of computer vision technology, it is a supplier of facial recognition technology for most mobile phone manufacturers in the market, highly regarded by the industry and major investment institutions. The company was also included in the Entity List by the U.S. Department of Commerce in October 2019, demonstrating its industry status and influence.

In fact, following the development trend of the technology boom, Megvii Technology, with its strong technical strength and industrial applications, could have gone public independently. In 2019, Megvii Technology also submitted an IPO prospectus to the Hong Kong Stock Exchange, but ultimately failed to go public due to a combination of factors such as a single revenue structure, low gross profit margins, poor financial conditions, data security compliance, and macroeconomic and market stability considerations.

In 2021, Megvii Technology invested heavily in automotive intelligent driving solutions. Leveraging its technical advantages in computer vision, Megvii entered the visually-oriented technical route similar to Tesla's and has now formed a team of several hundred people. In 2023, it won first place in the International Autonomous Vehicle Competition.

Riding on the momentum of winning the competition, Megvii Technology officially released three differently configured mass-produced intelligent driving solutions last year: Standard, Professional, and Flagship editions, all targeting L2+ autonomous driving. Among them, the Standard and Professional editions do not include lidar and have relatively low costs but can still achieve high-speed NOP and urban NOP functions, mainly serving vehicle models priced between 100,000 and 300,000 yuan. The Flagship edition, targeted at models priced above 300,000 yuan, features enhanced urban NOP capabilities and stronger safety redundancy.

Megvii Technology emphasizes ultimate cost-effectiveness and focuses on mass-produced and scalable assisted driving solutions. By reducing the hardware costs required for the same technical indicators in intelligent driving kits to an unprecedented low, it has become one of the few manufacturers on the market that can provide intelligent driving solutions with standard high-speed NOP even for entry-level models. However, to quickly commercialize intelligent driving, it is necessary to find a leading automaker with a strong hardware manufacturing foundation as a support.

Focusing on the promising autonomous driving sector and choosing to cooperate with Geely and Chongqing, this is undoubtedly a very correct development path for Megvii, Geely, and the Chongqing government. It can accelerate the innovative development of "AI + Automobile" and stimulate market imagination.

For example, the currently popular Robotaxi unmanned taxi service, with Geely Group's leading domestic online car-hailing platform Caocao Chuxing, Megvii Technology's software and intelligent solutions, and Lifan Technology's closed industrial chain, the commercial launch of Robotaxi unmanned taxi services may become an important direction.

At least under the new system, Lifan Technology, supported by the forces of Megvii Technology, Geely, and the Chongqing government, represents a powerful alliance of intelligent technology, the automotive industry, and local governments, injecting new vitality into Lifan Technology's development.

Judging from Chongqing's current support for Deep Blue's independence from Changan and its autonomous development path, as well as its support for Thalys' cooperation with Huawei, which has become a rising star with soaring sales, stock prices, and market capitalization, second only to BYD and SAIC, the next step for Lifan Technology will also be towards becoming the next technology leader in the automotive industry. Many industry insiders predict that the attraction of Chongqing and Geely for Megvii Technology's involvement is likely to replicate Thalys' development path from motorcycles to automobiles and then to smart automobiles, potentially making Lifan Technology Chongqing's next "Thalys."