Trump 2.0 Era: The Automotive Industry in Various Guises

![]() 11/13 2024

11/13 2024

![]() 499

499

Compiled by | Yang Yuke

Edited by | Jane

Produced by | Bangning Studio (gbngzs)

In 1964, then-U.S. President Lyndon Johnson was outraged by European trade practices, particularly regarding chicken.

With the rise of large-scale factory farming of chickens in the United States, cheap American poultry became popular worldwide, and European chicken imports surged. France and West Germany began imposing tariffs on poultry, causing significant losses to the American poultry industry. The furious Johnson announced a 25% tariff on imported 'light trucks' (also known as the chicken tax).

Sixty years later, the chicken tax still exists. These tariffs have not only helped the Ford F-Series pickup trucks maintain their position as the best-selling vehicle in the United States for 42 consecutive years but have also kept European manufacturers out of this lucrative market.

The chicken tax is likely to serve as a model for Donald Trump's 2.0 era as the elected President of the United States.

Trump's love for tariffs is no secret. Trump, who calls himself a 'tariff man,' recently told Bloomberg, 'The sweetest word in the dictionary to me is tariff.' He has also clearly stated his intention to impose tariffs on European Union imports.

Trump has promised a baseline 10% tariff on all imported goods, which has sent shivers down the spines of manufacturers worldwide. Few industries have been affected more than German automakers—since Trump's victory in the U.S. presidential election, share prices of Volkswagen Group, BMW, Mercedes-Benz, and Porsche have fallen by 4% to 7%.

Volkswagen Group's already precarious situation will worsen. The United States is the second-largest export market for Volkswagen Group after China. In 2023, the group sold 713,000 vehicles in the United States, of which 243,000 were produced in Germany, mainly high-end and luxury models.

Japanese automakers, reliant on trade, are cautiously monitoring and preparing for Trump's return and any turmoil he may bring to their U.S. operations. During recent financial reporting events by Japanese automakers, a particularly popular topic was concern about new tariffs on auto parts or vehicles shipped to the United States from Mexico or other overseas markets.

While major companies like Toyota and Honda produce most of their products in the United States, smaller companies like Subaru, Mazda, and Mitsubishi still rely heavily on imports.

Trump's return also threatens the Canadian automotive industry. New tariffs, sudden changes in electrification policies, and renegotiations of the United States-Mexico-Canada Agreement could undermine the cross-border automotive consensus that has existed for 60 years.

Flavio Volpe, President of the Canadian Automotive Parts Manufacturers' Association, said, 'We are so closely connected. Half of the cars produced in Canada are made by U.S. companies.'

'If he [Trump] excludes Canada, pulls it out of [the United States-Mexico-Canada Agreement], and erects tariff walls, he is hurting GM, Ford, and then Stellantis' assets... He is hurting American parts companies, American material suppliers,' Volpe added.

Trump has also threatened to impose a 100% tariff on imports from Mexico, a free-trade partner of the United States. This threatens Detroit's Big Three automakers—General Motors, Ford, and Stellantis Group. According to MarkLines data, these three companies produced a total of 1.6 million vehicles in Mexico last year. European manufacturers produced 800,000 vehicles in Mexico, while Asian companies produced 1.4 million.

'Everyone hates taxes and tariffs,' said Adrian Mardell, CEO of Jaguar Land Rover. The UK's largest automotive employer exports a quarter of its output to the United States. 'This is the environment we are in. Of course, none of us like an environment with increased tariffs.'

Trump's tariff proposals have always been ironic: While European automakers will be affected by tariffs, Chinese competitors have been largely kept out of the U.S. market, and American companies will also face high costs, potentially leading to price increases for consumers. This is the impact of the chicken tax. European automakers may be sidelined in favor of American workers' interests, but Americans pay higher prices for their pickup trucks. If a 10% tariff is imposed on the Audi Q5, the best-selling model in the United States, American consumers will incur an additional cost of $3,500. Porsche or other luxury automakers 'might become even more expensive.'

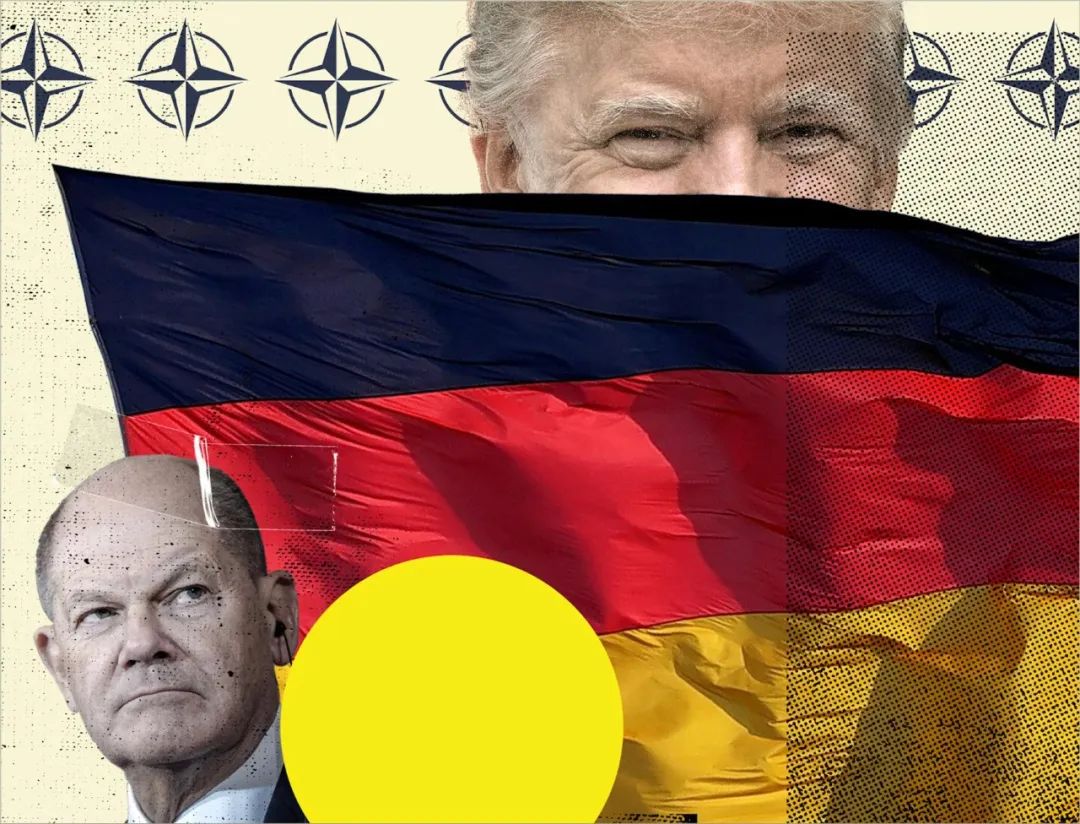

Germany: The Epicenter of the Storm

For Germany, Trump's return is an outright disaster.

'German automakers will be at the epicenter of the storm,' said Jacob Kirkegaard, Senior Fellow at Bruegel and the Peterson Institute for International Economics. 'German automakers will truly become Trump's target—look at what he has said before, that he will "end them."'

There is no doubt that Trump's victory poses risks to European automakers, especially German brands that export large volumes of cars to the United States. During his first term, Trump attempted to impose a 25% tariff on cars imported from Europe.

According to data from the German Association of the Automotive Industry (VDA), Germany exported about 400,000 cars to the United States in 2023, and the United States was the largest buyer of German car exports in the first half of 2024.

Automakers' responses to tariffs depend partly on their factory footprints. Oliver Zipse, CEO of BMW Group, seems unfazed by the U.S. tariff threat.

Zipse said BMW Group is well-positioned to withstand any new tariffs because about two-thirds of its U.S. sales are produced at its assembly plant in Spartanburg, South Carolina. The Spartanburg plant is BMW Group's largest globally and also exports cars to the UK, China, and Germany.

He said, 'In the United States, we are almost perfectly prepared for the future.' He believes BMW already produces the most popular cars in the United States.

A BMW Group spokesperson said, 'If the U.S. government imposes additional tariffs, our local factories will put us in a more favorable position compared to some European competitors.' Mercedes-Benz also has a large assembly plant in Alabama, U.S., employing 11,300 people. A spokesperson described Mercedes as an 'integral part' of the U.S. economy.

However, the reality may not be that simple. German automakers' existing factories in the United States do not seem to have readily available idle capacity to simply absorb production shifted from Germany to avoid tariffs.

According to data from automotive data company MarkLines, Volkswagen Group's only U.S. factory in Chattanooga, Tennessee, produced 160,000 vehicles last year and currently has a capacity of 20,000 more vehicles.

Audi and Porsche, subsidiaries of Volkswagen Group, have significant sales in the United States but no factories there, importing thousands of smaller, cheaper cars from Germany. Credit rating agency Morningstar DBRS said starting more production in the United States would be 'a transition that could be costly and take years to become operational.'

Mercedes also has similar idle capacity in Alabama, where it produced 280,000 vehicles in 2023. BMW may produce an additional 40,000 vehicles in South Carolina on top of last year's 410,000.

Even if automakers can overcome difficulties and shift production to the United States, it will be a daunting task and cause fear among many Germans. About 780,000 people are employed in the powerful German automotive industry. They will not allow jobs to be transferred abroad.

'This will lead to a shift in production,' said Rico Luman, an economist at investment bank ING. 'From a strategic perspective, it may become more regionalized. This is not good news for the German industry.'

The tariff threat comes at an inopportune time for German workers, as manufacturers worldwide complain of declining profits, and Europe is grappling with a flood of electric vehicles from China. Volkswagen Group, which has already planned to close its first German plant, is particularly vulnerable.

Mexico as a production location may also pose problems. Trump has previously targeted Mexican car production, threatening a 200% tariff on Chinese electric vehicles produced in Mexico, although Chinese automakers have avoided the U.S. market due to existing prohibitive tariffs.

Volkswagen, BMW, and Audi all have major production bases in Mexico, while the Mercedes-Nissan joint venture produces a smaller number of cars there.

Japan: Pretending to Be Brave

Japanese automakers, reliant on trade, are cautiously monitoring and preparing for Trump's return and any turmoil he may bring to their U.S. operations.

For now, however, Japanese executives are putting on a brave face.

In recently released financial reports, a particularly hot topic was concern about new tariffs on auto parts or vehicles shipped to the United States from Mexico or other overseas markets.

Some Japanese executives said potential changes in trade policy under Trump's second term would not affect their long-term corporate strategies. Others expressed optimism that harsher measures being feared might be gradually implemented or develop positively through industry lobbying.

Certainly, some Japanese automakers are more vulnerable to tariffs than others.

While major companies like Toyota and Honda produce most of their products in the United States, smaller companies like Subaru, Mazda, and Mitsubishi still rely heavily on imports.

The import percentages cited below are based on data from Automotive News Research & Data Center. However, all Japanese manufacturers except Mitsubishi source some U.S. products from Mexico, making them affected.

Here is how various Japanese companies have responded so far:

First, Toyota.

About 25% of vehicles sold in the United States are imported. The Tacoma and Tacoma Hybrid pickup trucks are produced in Mexico.

Toyota will take a wait-and-see approach to policy changes and respond calmly.

'Regardless of national policy or government, as far as Toyota is concerned, our goal and aspiration are to be the 'best company' in the local community or nationwide,' said Yoichi Miyazaki, Chief Financial Officer of Toyota, during the U.S. election count. 'This is the foundation we will continue to uphold, and there will be no changes.'

However, a source close to Toyota said Trump's imposition of high tariffs on Mexican imports might prompt the automaker to shift production of vehicles like the Tacoma pickup truck to San Antonio, Texas. A Toyota spokesperson declined to comment.

Second, Honda.

Imported vehicles account for about 9% of U.S. car sales. The HR-V subcompact crossover and Prologue crossover are produced in Mexico.

Honda exports about 160,000 vehicles annually from Mexico to the United States and is prepared to readjust production scale if policy changes bring long-term adverse effects. 'It could affect 160,000 vehicles subject to tariffs. That's a significant impact,' said Shinji Aoyama, Executive Vice President. 'Perhaps we will produce elsewhere that is not affected by U.S. tariffs.'

Third, Nissan.

Imported vehicles account for about 17% of U.S. car sales. The Sentra, Versa subcompact, Kicks subcompact crossover, and Infiniti QX50 and QX55 crossovers are produced in Mexico.

Nissan hopes to rely on lobbying to influence short-term policies but says its medium- to long-term strategy will remain unchanged. It exports about 300,000 vehicles from Mexico.

'We are exporting a large number of cars from Mexico to the United States,' said CEO Makoto Uchida. 'I have heard some policies about tariffs. But it's not just us. Many automakers produce in Mexico. We are willing to do a lot of lobbying. In the medium to long term, this direction will not change. We will observe carefully and find the right direction.'

Fourth, Subaru.

Imported vehicles account for about 49% of U.S. car sales. No production in Mexico.

Subaru sells half of its products in the United States from Japan, but 70% of its global sales depend on the United States. The company has kept a low profile so far.

CEO Atsushi Osaki said, 'We have predicted various scenarios and conducted several simulations. I don't want to comment. We only hope that the government can lead policies in a stable manner.'

Fifth, Mazda.

Imported vehicles account for about 56% of U.S. car sales. The Mazda3 compact sedan and CX-3 and CX-30 subcompact crossovers are produced in Mexico.

Mazda only produces one model in the United States—the CX-50 crossover. The company said it is already planning to streamline its supply chain to minimize cross-border transportation, cut costs, and hedge risks. Mazda hinted that the new trade regime may prompt the company to adjust its global production layout.

'We cannot change or decide our policies based solely on campaign rhetoric. We must face the facts, gather information, and propose the correct countermeasures,' said CEO Masahiro Moro. 'In the supply chain, some components are transported back and forth domestically and internationally, causing unnecessary stratification. By eliminating the movement of these components and flattening the structure, our goal is to reduce unnecessary costs.'

Sixth, Mitsubishi.

100% of vehicles sold in the United States are imported. No production in Mexico.

As the only Japanese brand where all sold vehicles rely on imports, Mitsubishi is preparing for possible changes and may rely on alliance partner Nissan for help with local production.

"As we are engaged in export, we will be affected to some extent," said CEO Takao Kato a few days before the presidential election on November 5. "Ultimately, as I mentioned earlier, the key will be how effectively we can collaborate with our partners."

Canada: Flattery + Threat

An analysis report released by TD Economics in October showed that if Trump's 10% general tariff is implemented, it will reduce Canada's GDP by tens of billions of dollars, with the automotive industry suffering the "deepest negative impact".

Such tariffs may also threaten the half-century-old automotive integration between Canada and the United States, which dates back to the 1965 Auto Pact. Brian Kingston, CEO of the Canadian Vehicle Manufacturers' Association (CVMA), said maintaining the absence of trade barriers along the 49th parallel is "critical" to the automotive industry in both countries. "There are no so-called American cars, no so-called Canadian-made cars, we make cars together." About 80% of vehicles and half of automotive parts are produced in Canadian assembly plants and ultimately sold in the United States.

In addition, Canadian policymakers will face a joint review of the United States-Mexico-Canada Agreement (USMCA) in 2026. In October, Trump said he would use the built-in review clause of the trade agreement to renegotiate it.

David Adams, CEO of the Global Automakers of Canada, said it may be more difficult for Canada to "stay in the tent" for the second time. The association represents overseas automakers in Canada.

He said that federal and provincial politicians and bureaucrats have been making preparatory plans and laying the groundwork for the results of the U.S. election, but it is "not yet conclusive" how difficult the USMCA negotiations will be.

Canadian Prime Minister Justin Trudeau congratulated Trump on his election victory on November 6 and said that the economies of the two countries are "closely intertwined". A day later, Trudeau reformed the Cabinet Committee on Canada-U.S. Relations to address "critical" cross-border issues.

Ontario Premier Doug Ford also congratulated Trump, saying in a press release, "We have enormous potential to provide the critical minerals needed for electric vehicle batteries and other new technologies, and to serve as a safe and reliable source of clean, reliable energy needed to drive U.S. economic growth."

Vic Fedeli, Minister of Economic Development, said on November 6, "I call it a charm offensive, reminding them that we need each other to promote economic growth in both countries." He will visit Washington, D.C. in December and three states in January. He emphasized, "We have something they always want, and that is our critical minerals and energy."

However, any U.S. policy decision to limit the popularization of electric vehicles will have a significant impact on Canada. In the past three years, Canada has received more than $50 billion in electric vehicle-related investments, largely driven by anticipated demand in the United States.

The Trump administration's electric vehicle policy may also affect the product and investment plans of the Detroit Three, all of which have significant footprints in Canada.

Unifor, which represents thousands of unionized autoworkers at Ford, General Motors, and Stellantis in Canada, as well as a range of component suppliers, said it will "positively address any and all challenges posed by the policies of Trump's second administration."

"We must be prepared for everything," Lana Payne, national president of Unifor, told Automotive News Canada. "This means being prepared for potentially catastrophic tariffs on the automotive industry, as one of the Republicans' promises is to impose import tariffs of 10% to 20% on all goods, including those from Canada."

Kingston said that both Canada and the United States have imposed punitive new tariffs on electric vehicles produced in China this fall. With the Trump administration sure to continue pressuring China, Canada should market itself as an indispensable ally.

He said the election results should "ignite" the "flames" of Canadian policymakers to "align perfectly" with the United States on China policy and the development of the North American electric vehicle and battery supply chain.

He added that the Canadian government has had "many discussions" on building infrastructure, operating key minerals, and processing plants for battery materials. Fulfilling these commitments will help us avoid tariffs and "ensure we stay in the tent."

"You simply cannot decouple from China without Canada, but we must show the Americans that we are ready," Kingston added. In addition, sources familiar with the matter said BYD has suspended its plans to enter the Canadian electric vehicle market.

Throughout the summer, BYD met with dealers across Canada to discuss establishing a potential distribution network and hired lobbyists to advise the federal and Ontario governments on the "expected market for BYD's entry into Canada to sell passenger electric vehicles."

But public documents show that BYD's dialogue with the Canadian government ended after Ottawa followed the United States' lead in imposing punitive tariffs on electric vehicles imported from China on August 26. According to dealers and industry insiders, who requested anonymity, negotiations with potential dealers are currently on hold.

In July and August of this year, Cameron Doherty, a Toronto-based lobbyist, arranged six exchanges between BYD and senior officials from the Canadian Department of Finance, Global Affairs Canada, Transport Canada, and Innovation, Science, and Economic Development Canada.

Communication between the two sides was interrupted in mid-August as the federal government prepared to impose tariffs on Chinese-made electric vehicles. By the end of October, Doherty and several other consultants officially ended their outreach efforts, canceling their lobbying files in Ottawa and Ontario.

(Part of this article is based on reports from Automotive News, Reuters, and Bloomberg, and some images are from the internet)