Just now, Zeekr and Lynk & Co officially merged! Executive: A historic moment

![]() 11/15 2024

11/15 2024

![]() 456

456

Comprehensive integration of two brands

Author | Wang Lei

Editor | Qin Zhangyong

Two major brands under Geely officially merged.

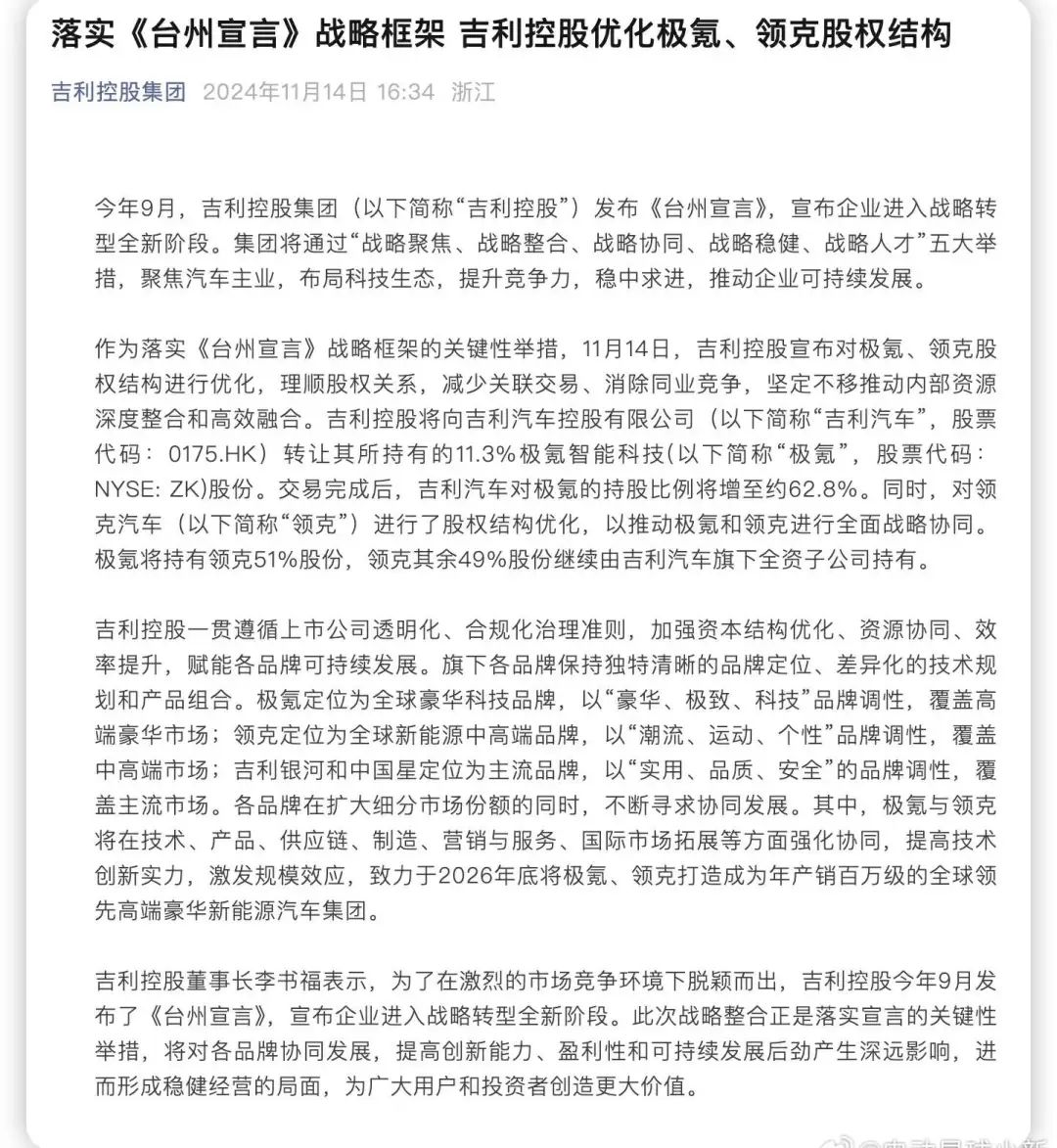

On the afternoon of November 14th, Geely Holding officially announced the optimization of the equity structure of Zeekr and Lynk & Co, as a key measure to implement the strategic framework of the "Taizhou Declaration".

In simple terms, through a series of equity transfers by Geely Holding, Zeekr holds 51% of Lynk & Co shares, while the remaining 49% of Lynk & Co shares continue to be held by a wholly-owned subsidiary of Geely Auto, thereby achieving the purpose of merging Zeekr and Lynk & Co.

In fact, early this morning, there were news reports that Geely's Zeekr and Lynk & Co may undergo strategic integration, aiming to achieve Zeekr's holding of Lynk & Co.

At the same time, it was also revealed that An Conghui, Chairman of Zeekr Technology, would succeed Shen Ziyu as Chairman of Polestar, which is also considered a harbinger of Polestar's future integration or collaboration with Zeekr.

Now that the news is confirmed, it should be noted that Geely's announcement did not mention any adjustments related to Polestar.

The previous release of Geely's "Taizhou Declaration" had already laid the groundwork for Geely Group's next tone, which is strategic integration. From the merger of Geometry and Geely Auto's new energy brand Yinhe, to the merger of Zeekr and Lynk & Co, Geely has made significant progress in the stage of strategic integration.

Who will be the next brand to merge?

01 A historic moment for Geely

The two sides officially announced the merger, and Geely Group gave the reason that it was to rationalize equity relationships, reduce related transactions, eliminate horizontal competition, and unwaveringly promote the deep integration and efficient fusion of internal resources.

Lin Jinwen, Vice President of Zeekr Intelligent Technology, posted that this was a "historic moment".

Specifically, Geely Holding will transfer 11.3% of its shares in Zeekr Intelligent Technology to Geely Auto Holdings Limited. After the transaction is completed, Geely Auto's shareholding in Zeekr will increase to approximately 62.8%.

At the same time, the equity structure within Lynk & Co was optimized to promote comprehensive strategic coordination between Zeekr and Lynk & Co. After the adjustments are completed, Zeekr will hold 51% of Lynk & Co shares, and the remaining 49% of Lynk & Co shares will continue to be held by a wholly-owned subsidiary of Geely Auto.

As for how the equity optimization within Lynk & Co was carried out, no details were disclosed. However, Reuters provided quite a bit of information on this part.

The key information is that after the merger, Volvo will exit the shareholder ranks of Lynk & Co. The 30% stake in Lynk & Co held by Volvo Cars will be acquired by Zeekr, and the shareholding ratio will be increased to 51% through continued capital injections, achieving the purpose of holding a controlling stake in Lynk & Co.

This transaction is expected to be completed by next June, and Zeekr's transaction values Lynk & Co at approximately $2.5 billion.

According to previous reports, after the merger, An Conghui, CEO of Zeekr, will oversee the management, and the Lynk & Co brand will be retained, but the team and strategy will be integrated with Zeekr. The specific plan is expected to be implemented by the end of the year.

During the merger process, the finance and procurement teams will be the first to complete the merger, and adjustments to product, R&D, and other departments will also be advanced from the end of this year to early next year.

An insider also revealed that the reason why Geely's senior management made the decision to integrate the two brands was the overlap between Lynk & Co and Zeekr products.

It is worth mentioning that one of the reasons given by Geely Group for the merger of the two sides was to "eliminate horizontal competition."

In fact, in the minds of many, Zeekr and Lynk & Co should have merged a long time ago. Especially in the past two years, these two brother brands have not only adopted the same design language but have also ventured into each other's main areas.

Zeekr and Lynk & Co originated from the same entity. Before Zeekr was born, Lynk & Co was a star brand under Geely, with sales exceeding one million units in six years.

Lynk & Co was established in 2017 as a joint venture between Geely Holding Group, Geely Auto, and Volvo Cars. The predecessor of Zeekr was the electric vehicle business group of Lynk & Co. In April 2021, the Lynk & Co ZERO CONCEPT concept car became the Zeekr 001, and in September 2021, it officially became a sub-brand under Geely Holding Group.

It is not difficult to understand the relationship; it is like that of a "father and son."

Moreover, Lynk & Co was initially established with a focus on the fuel and hybrid markets in the mid-to-high-end segment, while Zeekr focused on the pure electric market. The two complemented each other without interference, comprehensively covering the market.

Zeekr and Lynk & Co did not disappoint Geely, becoming the twin stars of Geely's passenger vehicle incubation and shining brightly in market performance. They are not only the pillars of sales but also play important roles in Geely's new energy transformation.

In October of this year, Lynk & Co and Zeekr sold over 30,000 and 25,000 units, respectively. In the first three quarters of this year, Lynk & Co sold 169,800 units, while Zeekr sold nearly 150,000 units, accounting for nearly 30% of Geely Group's total sales combined.

With the development of the new energy market, the routes of the two sides began to deviate, and there was even "conflict." In 2023, Lynk & Co launched the EM-P super extended-range electric solution, which significantly increased its sales.

While extended-range models were selling well, in September of this year, Lynk & Co also ventured into the pure electric field with the launch of its first pure electric sedan, the Z10. Priced at 180,800-313,800 yuan, sales after its launch were dismal compared to hybrid models, with total deliveries in two months being less than 5,000 units. Compared to extended-range models, Lynk & Co's pure electric models obviously did not get off to a good start.

The reason is that when comparing models, it is impossible to avoid Zeekr models. Not only does the appearance resemble that of the Zeekr X, but the Lynk & Co Z10 is also based on Geely's HAO HAO architecture. Under the same architecture, Zeekr also has two models that are very similar to the Lynk & Co Z10, the Zeekr 007 and Zeekr 001.

An insider once said, "Much of the pressure on the Z10 actually comes from its sibling brand, Zeekr."

In addition, Zeekr is no longer obsessed with pure electric vehicles. It was recently revealed that it will begin to deploy an extended-range route, and an internal project team has been established, covering SUV/MPV categories.

From this perspective, the relationship between Zeekr and Lynk & Co has also become overlapping, and their integration is not surprising.

02 Focusing on integration

The merger of Lynk & Co and Zeekr is not only to avoid internal friction but also aligns with Geely's latest strategic direction.

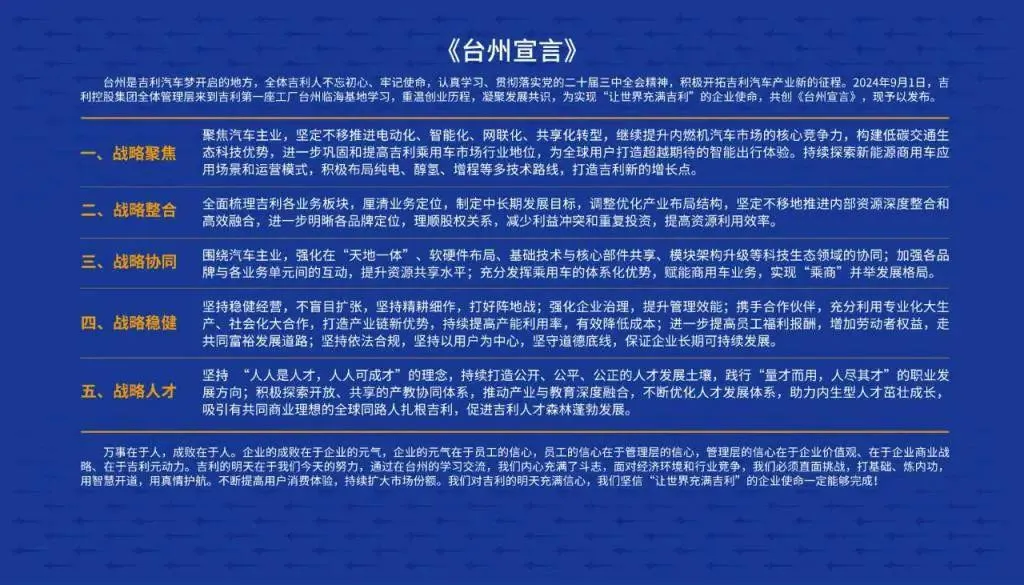

In September of this year, Geely Holding Group released the "Taizhou Declaration," clarifying that it will further clarify the positioning of each brand, reduce conflicts of interest and duplicate investments, improve group operational efficiency, and focus and integrate to become the main theme of Geely's next adjustment.

Over the past decade, Geely Group has been adhering to a multi-brand, multi-channel development strategy, with over ten automotive brands under its umbrella, such as Geely, Geometry, Zeekr, Lynk & Co, Raylian, Jiyue, Volvo, Polestar, Lotus, and other brands. These brands have different positioning and characteristics, covering almost the entire automotive consumer market from low-end to high-end.

Geely Group's business model has been jokingly referred to as "the more children, the better the fight" by outsiders. Indeed, the multi-pronged approach has brought significant growth to Geely.

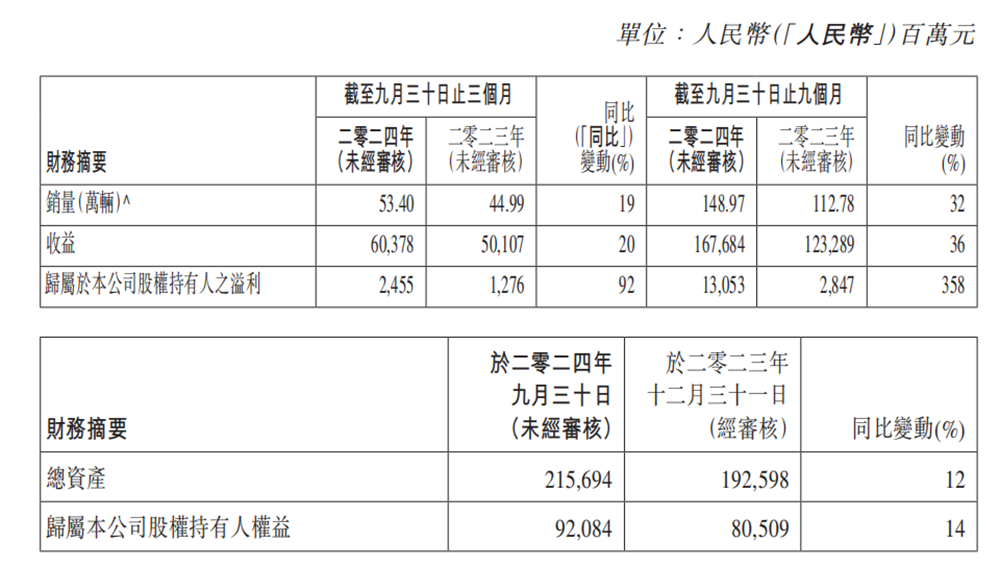

According to Geely's latest third-quarter financial report, Geely Auto achieved operating revenue of 60.378 billion yuan, a year-on-year increase of 20%, with quarterly revenue reaching a record high. Sales also reached a record high of 534,000 units, a year-on-year increase of 18.7%.

In the first three quarters, Geely Auto's operating revenue reached an unprecedented 167.7 billion yuan, a year-on-year increase of 36%, and the company's shareholders' attributable profit reached 13.05 billion yuan, a year-on-year increase of 358%.

It must be admitted that in the past few years, China's new energy vehicle startups and traditional automakers have been in an era of rapid expansion. Due to the inability of the main brands to cover sufficient markets, sub-brands and third brands have been launched, all hoping to capture the entire market.

However, this process inevitably leads to unnecessary expansion, resulting in internal competition within brands. For example, behind Geely's multi-brand and multi-channel strategy, the decentralized R&D and supply chain efficiency mean duplicated investments and internal competition among sibling brands.

Therefore, Geely has begun to shift from strategic expansion to strategic integration.

On October 9, Gan Jiayue, CEO of Geely Auto Group, announced that Yinhe had been upgraded from a new energy series to a brand. Geely New Energy will focus on building the Yinhe brand and officially merge Geometry into the Yinhe brand, with "GEOME" becoming Yinhe's series of intelligent compact cars.

In the official statement, this was done in response to the Group's "Taizhou Declaration."

From the perspective of brand layout, Geely Yinhe currently mainly produces "large vehicles." After the merger of Geometry, there will also be "small vehicles." Yinhe's product lineup will be more complete, basically covering A0 to C segments, with models including sedans, SUVs, and MPVs, covering several major markets.

Not long ago, according to a report by LatePost Auto, Radar Auto was also downgraded. Radar Auto, Geely Holding Group's new energy pickup truck brand, will also be integrated into Geely Auto Group. After the integration, Radar Auto will become a first-tier organization of Geely Auto Group, with its head, Ling Shiquan, reporting to Gan Jiayue, CEO of Geely Auto Group.

From this perspective, the merger of Lynk & Co and Zeekr is not surprising and becomes the second step in Geely's major brand adjustments. Interestingly, in addition to the integration of Zeekr and Lynk & Co, Polestar may also face integration.

For example, it was reported that An Conghui would succeed Shen Ziyu as Chairman of Polestar, which is also considered a harbinger of Polestar's future integration or collaboration with Zeekr.

Obviously, the era of large-scale expansion is coming to an end, and the era of large-scale integration or mergers is about to begin. This includes not only internal integration within enterprises but also possible external integrations, such as mergers and acquisitions among automakers, eliminating weaker brands, and entering the final stage of competition.

Geely can be considered as the pioneer of this major trend.