Yutong leads, Sunwin and King Long keep pace, October new energy bus sales figures released

![]() 11/15 2024

11/15 2024

![]() 528

528

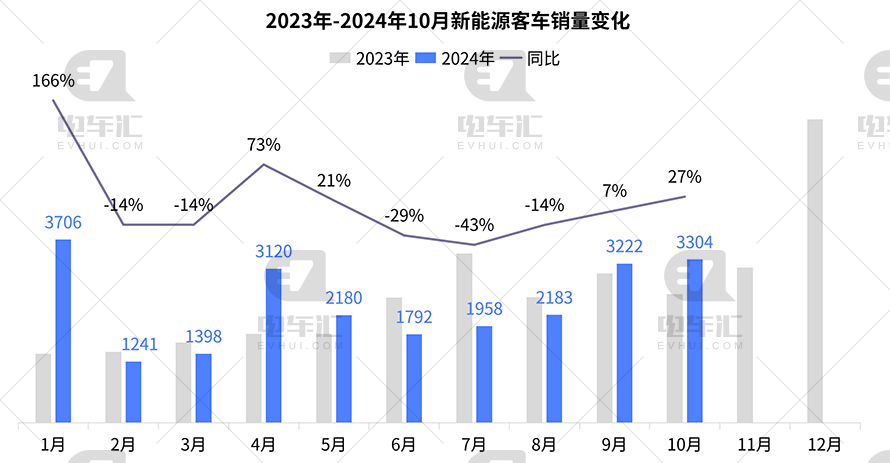

According to the latest end-sales data statistics from Dianchehui, domestic new energy bus sales in October this year reached 3,304 units, representing a year-on-year increase of 27% and a month-on-month increase of 3%. Cumulative sales for the first 10 months were 24,104 units, marking a cumulative year-on-year increase of 9%.

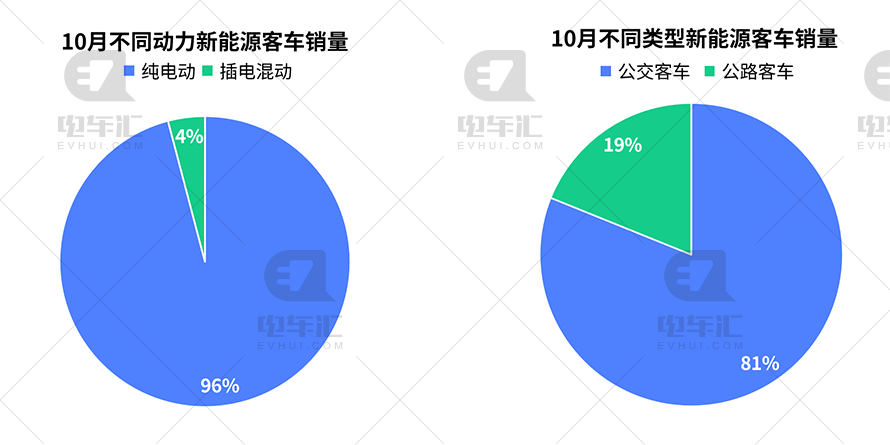

In October's sales, 3,169 units were pure electric buses, accounting for 96% of total sales for the month; 135 units were plug-in hybrid buses, accounting for 4%, mainly due to the delivery of 126 plug-in hybrid buses by Sunwin in Shanghai; there were no sales records for fuel cell buses. In terms of vehicle types, 2,680 units were sold as bus buses, accounting for 81%, and 624 units were sold as coach buses, accounting for 19%.

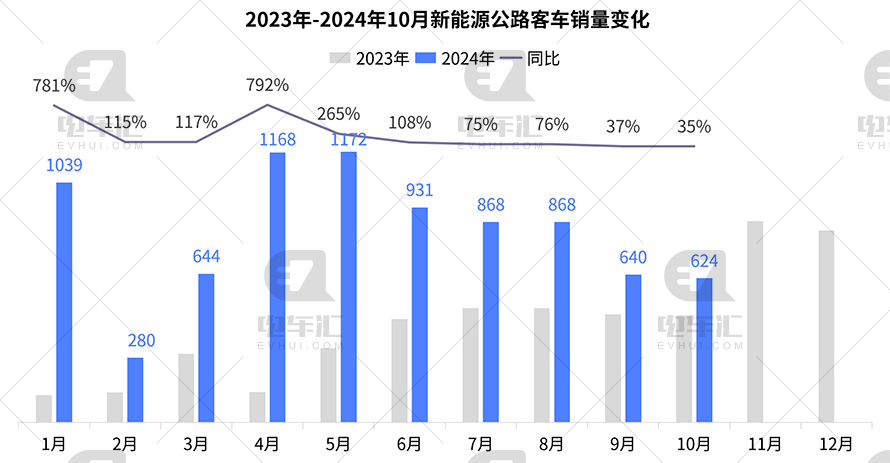

It is noteworthy that coach buses have become the main source of growth in the new energy bus market this year. In the first 10 months of this year, cumulative coach bus sales reached 8,234 units, representing a cumulative year-on-year increase of 145%, accounting for 34% of new energy bus sales in the first 10 months, compared to only 15% for the same period last year.

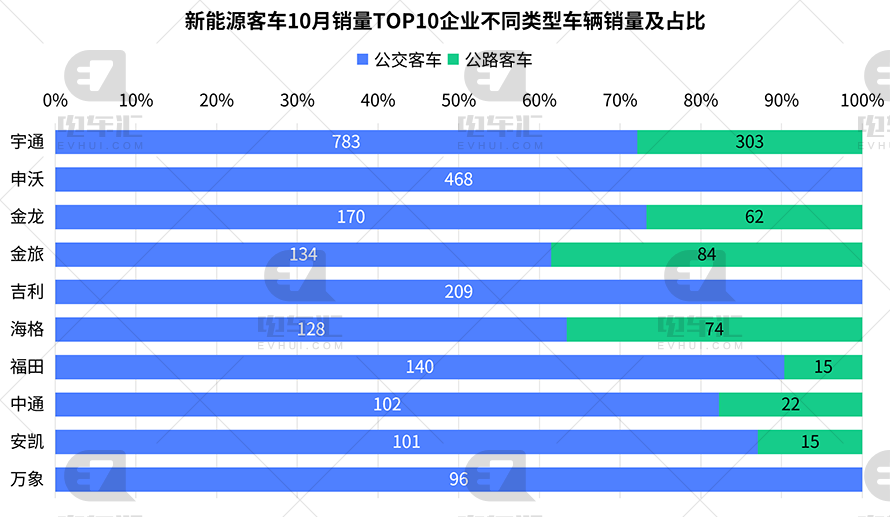

Although coach bus sales in October were lower compared to the first half of the year, coach buses still occupied an important position in the sales of some enterprises. Taking Yutong as an example, Yutong sold 303 coach buses in October, while King Long, which ranked third in sales, sold a total of 232 units. Yutong's coach bus sales alone exceeded those of the third-place enterprise in the industry. Additionally, the proportion of coach bus sales of King Long, King Long Travel Service, and Higer accounted for more than 20% of their total sales for the month.

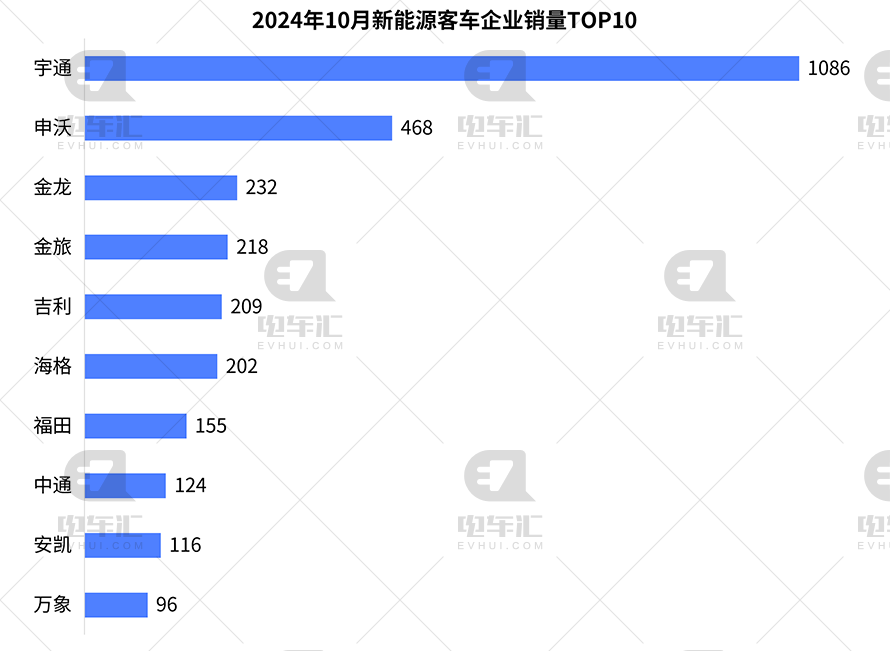

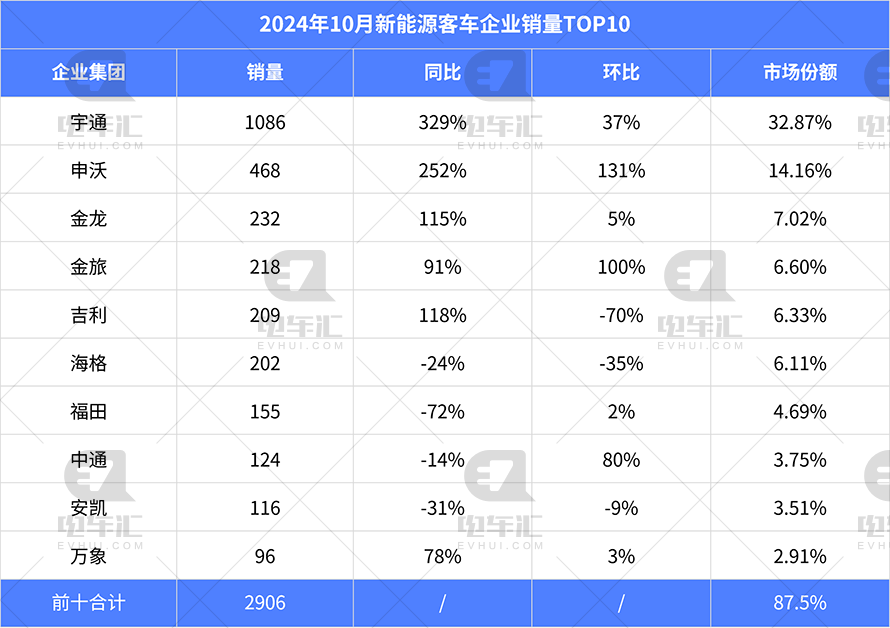

Specifically, regarding enterprise sales, in the new energy bus market in October 2024, Yutong topped the list with sales of 1,086 units, not only widening the gap with other competitors but also demonstrating its strong market competitiveness with a year-on-year growth rate of 329%. Close behind was Sunwin, with sales of 468 units and a month-on-month growth rate of 131%, which was also impressive. In addition, enterprises such as King Long, King Long Travel Service, and Geely also occupied a place in the market by leveraging their respective advantages. From the perspective of market share, Yutong led the pack with a share of 32.87%, not only consolidating its position as a market leader but also setting an example for other enterprises. Although enterprises such as Sunwin and King Long had relatively lower market shares, they were also striving to expand their markets.

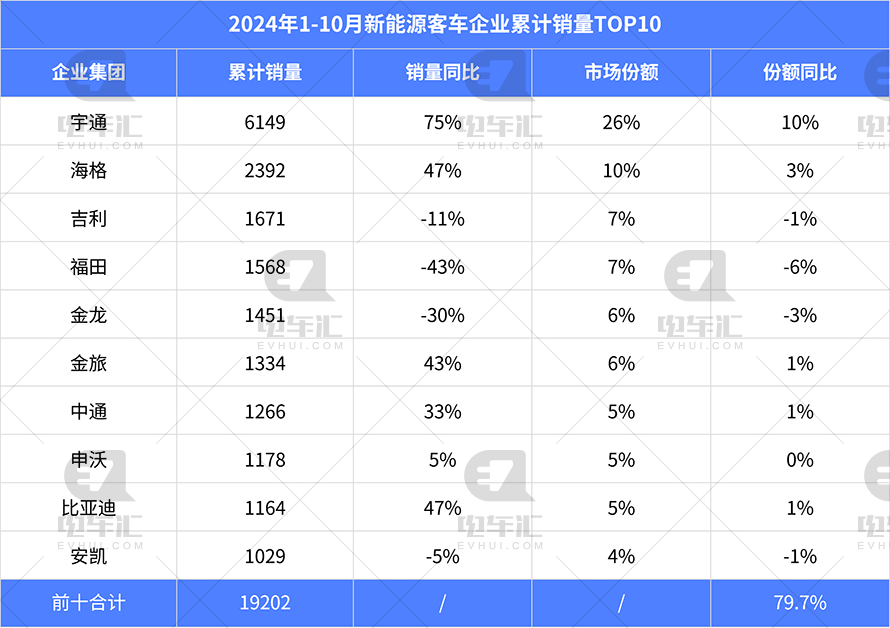

Extending the view to January-October, the cumulative sales of the new energy bus market presented a different picture. Yutong remained in first place with cumulative sales of 6,149 units, representing a year-on-year increase of 75% and a market share of 26%, further consolidating its market position. Higer, Geely, Foton, and King Long followed closely behind. It is worth noting that changes in market share also reflect the intensity of market competition. Yutong's market share increased by 10 percentage points year-on-year, demonstrating its sustained market expansion capabilities. Meanwhile, enterprises such as Foton, King Long, Geely, and Ankai faced the challenge of declining market share and needed to take effective measures to cope with market competition. Judging from the bid-winning information recently announced by enterprises such as Yutong, King Long Travel Service, CRRC Electric, Higer, and Zhongtong, with the gradual delivery of ordered vehicles, end sales of new energy buses are expected to continue to rise before the end of the year.