Pix Exclusive | Volvo Adjusts China Strategy: Geely Assists in R&D, Introduces Xingji Meizu

![]() 11/20 2024

11/20 2024

![]() 882

882

Unsurprisingly, Volvo is also developing a "China-only" model. Geely is assisting in the development of the vehicle's hardware, while Xingji Meizu is assisting with the development of software such as the intelligent cockpit.

Written by Gu Pengpeng

Edited by Mao Shiyang

Original content by Auto Pixel (ID: autopix)

01.

Volvo Expands R&D in China

Auto Pixel (ID: autopix) has exclusively learned that Volvo is developing a new energy vehicle codenamed V446, with an expected mass production (SOP) date in 2025, to be produced at Volvo's Taizhou factory.

Unlike other existing and upcoming Volvo models, the hardware and software development of the new V446 model is led by Volvo's R&D team, with support from Geely as the primary operator. The intelligent cockpit is being developed with assistance from Xingji Meizu and Ecarx, and the development is currently in a critical phase.

Xingji Meizu's in-car product is Flyme Auto. According to the Xingji Meizu official website, a total of 17 models are equipped with Flyme Auto, almost all of which are under Geely, including 8 pure electric and hybrid models from Lynk & Co., Geely Yinhe, Geely Xingyuan, and Polestar 4. In October of this year, the monthly sales of new vehicles equipped with Flyme Auto were 62,000 units, with Lynk & Co. contributing the majority.

This is the first time Volvo and Xingji Meizu have collaborated on a complete vehicle. Considering the equity and business overlap between Volvo and Geely, Volvo is the closest automotive brand to Xingji Meizu outside of the Geely system.

Despite the relationship with Geely, it was still not easy for Volvo and Xingji Meizu to facilitate this collaboration.

Volvo does not want to directly apply Flyme Auto like Lynk & Co. and Geely Yinhe but rather make some adaptations and modifications based on the framework of the system. A person close to Volvo Asia Pacific told us that Volvo Asia Pacific R&D Center has added a large number of intelligent cockpit designers to collaborate with Ecarx to complete these modifications, aiming to make it "more Volvo."

Many specific developments still need to be executed by the Xingji Meizu and Ecarx teams. In October of this year, Jim Rowan, President and CEO of Volvo Cars, and Yuan Xiaolin, Senior Vice President of Volvo Cars, President, and CEO of Volvo Asia Pacific, visited Ecarx Technology together.

A person close to Volvo Asia Pacific told us that the "Flyme Auto" logo is unlikely to appear directly on Volvo-branded models, but becoming a supplier to Volvo means that Xingji Meizu has the opportunity to gradually become a supplier of Volvo's intelligent connected solutions. "Most of Volvo's designs are universal, and once a project is done well, many projects will refer to it."

▍Volvo Flagship Pure Electric SUV EX90

Currently, Volvo's in-car system development is primarily handled by its European team, which is not very efficient. Volvo's software has strong versatility, and new products of the same series in the same year can often share the same software. For example, the EX series, S series, and XC series, although involving six to eight completely different models, require only about three sets of software, which is not as cumbersome as the software development work of domestic new forces.

A person in charge of Volvo Asia Pacific's R&D system told us that after receiving feedback from the European software team, it takes about a week to produce a new version, which is much slower than the feedback cycle of domestic software teams. Additionally, the nearly 7-hour time difference between China and Sweden reduces communication efficiency.

Among Volvo's existing products, except for the EX30 and EM90 based on Geely's SEA architecture, the electronic and electrical architectures of other models are still traditional and distributed, lagging at least one generation behind the centralized electronic and electrical architectures commonly used by domestic automakers.

Starting with Volvo's long-planned flagship electric SUV model EX90 (V536), the more advanced SPA2 platform will begin to be used, and Volvo's fully self-developed new vehicles will also achieve a centralized electronic and electrical architecture. However, to truly bring about changes in user experience, both software support and hardware breakthroughs are crucial.

Volvo's more adaptable SPA3 platform is expected to be introduced in 2026-2027. The new electronic and electrical architecture means that Volvo will gradually enter the era of "software-defined vehicles," and Volvo needs to solve software bottlenecks more than ever.

To improve efficiency, Volvo intends to place more R&D in China. Since February of this year, projects such as the fourth phase of Volvo Asia Pacific headquarters have been completed successively. Currently, an R&D center located in Jiading, Shanghai, is still under expansion. On many domestic job recruitment websites, Volvo Asia Pacific has released a large number of software R&D positions.

02.

Promoting Local New Vehicles

To bridge the gap between the Chinese and overseas new energy vehicle markets, BMW has partnered with Great Wall Motors to develop electric vehicles under the mini brand, Mercedes-Benz has collaborated with Geely to launch electric vehicles under the Smart brand, and Audi has cooperated with SAIC Intelligence and Autonomy to create a new Audi brand. For them, cooperating with Chinese automakers can not only compensate for their competitiveness in the Chinese new energy market but also allow them to familiarize themselves with the battlefield in advance – many automakers believe that the technological trends in China's new energy vehicles will spread to markets such as Europe in a few years.

Volvo has also begun to adopt this strategy. Auto Pixel (ID: autopix) has learned that the V446 currently under development will be a new vehicle primarily targeting the Chinese market, with Geely providing technical support for this model.

In Volvo's own planning, the EX90 was originally the first purely self-developed new vehicle with an advanced architecture and the first model of the SPA2 platform. A person close to Volvo Asia Pacific R&D told Auto Pixel (ID: autopix) that the development of the SPA2 platform was delayed by about two years compared to the original schedule. This caused Volvo to miss the first round of benefits in the pure electric vehicle market.

For traditional automakers, the hardware development of centralized electronic and electrical architectures is often more difficult than expected, as "components and ECUs (Electronic Control Units) need to be directly connected to the gateway," which requires changes to traditional automakers' previous development processes and talent pools. Many European automakers have had to collaborate with Chinese automakers to solve architectural issues, such as Volkswagen beginning to adopt domain controllers provided by XPeng to a limited extent.

For Volvo, the delayed SPA2 platform, although capable of solving vehicle architecture issues, is mainly targeted at medium and large new energy vehicles and cannot adapt to small and medium-sized pure electric products in terms of product adaptability. Volvo's SPA3 platform, which has stronger size compatibility, is expected to launch products by 2026-2027.

The close relationship with Geely gives Volvo more access to resources than other European automakers. However, in the past two years, these resources have been primarily used for overseas markets.

Volvo's new small pure electric SUV, the EX30, has been a bestseller globally. For multiple months, it has been among the top three best-selling new energy vehicles in Europe. By the end of September this year, 100,000 EX30s had been produced.

The EX30 is a Volvo product based on Geely's SEA architecture. When Volvo's own platform was not suitable, Geely's SEA architecture provided support, allowing Volvo to launch products faster than competitors and capture the overseas new energy vehicle market. Currently, based on the SEA, Volvo has launched two products: the EX30 and EM90.

This strategy can enhance Volvo's global competitiveness but does not benefit the Chinese market. The EX30 was launched in China in May this year, with monthly sales hovering between 100 and 200 units, representing a near-failure in market performance. EM90's monthly sales in China have also been below 100 units in the past three months.

▍Volvo Small Pure Electric SUV EX30

The situation of the EX30 highlights the differences between the domestic and overseas new energy vehicle markets. For the European market, the EX30 is a product with a clever design, reasonable space, stable intelligent cockpit performance, minimalist aesthetic configuration, and a price advantage. However, in the Chinese market, all the advantages of the EX30 become disadvantages, appearing cramped compared to competitors, with a thin in-car system and insufficient configuration, and an inflated price – the car is priced between 200,000 and 250,000 yuan, while competitors' starting prices are generally around 140,000 yuan.

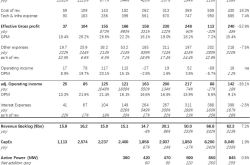

In 2023, Volvo's sales in China contributed about a quarter of its global sales. By 2024, Volvo sold 622,000 vehicles globally in the first ten months, a year-on-year increase of 9%, but in the Chinese market, Volvo's sales have seen a double-digit year-on-year decline.

Like many European automakers, Volvo's poor performance in China's rising new energy market is the primary reason for its overall sales decline. In the first ten months of this year, cumulative sales of Volvo's electrified models were less than 10,000 units.

According to the current plan, the EX90 (V536), the first product of the SPA2 platform, will be launched in 2025. If all goes well, another product on this platform, the pure electric sedan ES90 (V551), is expected to be launched next year. Like the EX30, these two delayed products may still be able to adapt to competition in the overseas pure electric vehicle market but will struggle to adapt to the Chinese market.

It is difficult for Volvo's overseas R&D team to simultaneously adapt to the two significantly different markets of China and abroad in the development of new vehicles, so Geely is beginning to provide more support. We understand that V446 is expected to achieve SOP next year.

Volvo was one of the first European automakers to announce a new energy strategy, planning to transform into a pure electric automaker globally by 2030. At that time, Volvo hoped to overtake competitors through transformation and become a mainstream luxury brand.

However, with the changing attitude towards new energy in overseas markets such as Europe, Volvo has revised this goal and become more conservative. The plan is for plug-in hybrids and pure electric vehicles to account for more than 90% of sales by 2030, with the rest primarily relying on internal combustion engines.

While being conservative, Volvo's electrification strategic objectives are similar to those of first-tier luxury brands such as BMW, Mercedes-Benz, and Audi, and its execution is even slower. China is the primary market for sales of plug-in hybrids and pure electric vehicles. For Volvo to achieve its new goals, the Chinese market remains indispensable. However, between strategic objectives and real-world strategies, Volvo's indecisiveness may have already cost it the first-mover advantage in challenging its competitors.

This article is original content by Auto Pixel (autopix)

Unauthorized reprinting is prohibited