2024 Car Market Review: New Energy Vehicles Surge for Four Years, Japanese and German Brands Face Defeat

![]() 12/06 2024

12/06 2024

![]() 606

606

Chinese-made new energy vehicles have achieved high growth for four consecutive years, threatening who?

Written by: Lao Xie

Edited by: Wan Tiannan

With less than a month left in 2024, the automobile market is entering its final stage. On November 18, BYD rolled off its 10 millionth new energy vehicle, marking the fourth year of high growth for Chinese-made new energy vehicles.

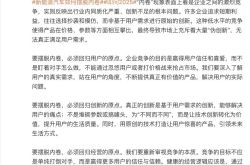

As of October this year, the cumulative sales of new energy vehicles in China have reached 9.75 million, surpassing the total sales for the entire year of last year, achieving a year-on-year growth of 34%. It is highly likely that the annual growth rate will exceed 30%, reaching the sales forecast of 11.5 million vehicles.

In stark contrast to the high sales growth of new energy vehicles, sales of fuel vehicles continue to decline, and joint venture brands are in full retreat.

In other words, while the overall size of the automobile market remains relatively unchanged, the impressive performance of new energy vehicles comes at the expense of some market share from fuel vehicles and encroachment on the territory of joint venture brands.

The automotive data released by the China Association of Automobile Manufacturers (CAAM) for the first ten months of this year provides an outline of changes in sales volume and structure in the automobile market.

(Unless otherwise specified, the following automotive sales data are sourced from the wholesale sales data of the China Association of Automobile Manufacturers, which includes export sales.)

1. New Energy Vehicles Surge, Fuel Vehicles Decline

In the first ten months of this year, sales of Chinese-made new energy vehicles reached 9.7502 million units, up 34% year-on-year, marking the fourth year of high growth since 2021.

Statistics show that the sales growth rates for the first ten months of 2021, 2022, 2023, and 2024 were 158%, 96%, 38%, and 34%, respectively. Although the growth rate has declined compared to previous years, it is still a remarkable achievement given the weak macroeconomic and consumer environment this year.

However, overall automotive sales growth has been modest. In the first ten months of this year, domestic passenger vehicle sales totaled 24.6239 million units, with a year-on-year increase of only 3.7%. As a result, traditional fuel vehicle sales even fell by 12% year-on-year.

New energy vehicles can be divided into three types based on energy sources: pure electric, plug-in hybrid, and other fuels. Other fuel vehicles refer to new energy vehicles powered by methanol, natural gas, etc., and are not yet produced in large quantities. Therefore, when we talk about new energy vehicles, we mainly refer to pure electric and plug-in hybrid vehicles. It should be noted that extended-range vehicles such as Wenjie and Lixiang also belong to plug-in hybrids.

Although new energy vehicles are growing overall, there have been significant changes in the structure of pure electric and plug-in hybrid vehicles. In 2021, pure electric vehicles accounted for 82% of new energy vehicle sales, while plug-in hybrids accounted for only 18%. By 2023, the proportion of pure electric vehicles had fallen to 69%, and the proportion of plug-in hybrids surpassed 30% for the first time. In the first ten months of this year, the proportion of pure electric vehicles further declined to 58%, while the proportion of plug-in hybrids surpassed 40%.

BYD's sales growth has significantly contributed to the increase in the proportion of plug-in hybrids. In June this year, BYD launched its 5th-generation DM hybrid drive technology. The Seal 06 model equipped with DM-5 technology has a maximum range of over 2,000 kilometers on a full charge and full tank. In the second half of the year, BYD's hybrid models, such as the Seal DM and Z9 DM, continued to sell well, contributing significantly to the sales growth.

In the first ten months of this year, domestic hybrid vehicle sales totaled 3.897 million units, of which BYD sold 1.8777 million units, accounting for 48%. On average, one out of every three new energy vehicles sold in China is a BYD, and one out of every two plug-in hybrid new energy vehicles is a BYD.

When further to subdivide ing passenger new energy vehicles, they can be categorized into sedans, MPVs, SUVs, and crossovers. In the first ten months of this year, sales of sedans, MPVs, SUVs, and crossovers were 4.42 million, 280,000, 4.55 million, and 60,000 units, respectively. Sedans and SUVs are the mainstay, accounting for 47% and 48% of total sales, respectively.

In terms of growth rates, in the first ten months of this year, sales of sedans, MPVs, and SUVs increased by 28%, 62%, and 38%, respectively. The growth rates of SUVs and MPVs were significantly faster than that of sedans. With the increasing demand for family cars, MPV sales have grown rapidly, making them a model that major automakers are scrambling to deploy.

BYD's Denza D9 has consistently ranked first in the domestic MPV market, and this year, BYD launched a new MPV model, the Xia. The popularity of MPV models such as Xpeng X9, Zeekr 009, and Voyah Dreamer has also benefited from the growing demand for MPVs.

In the first ten months of this year, automobile exports totaled 4.855 million units, accounting for 23.8% of total automobile sales, making China the world's largest automobile exporter.

However, unlike Japan, most of China's automotive production capacity is located domestically, with exports being the primary focus for the global market. In contrast, Japanese automakers such as Toyota and Honda have a global production layout, with a focus on local production and sales overseas. A smaller proportion of vehicles are exported from Japan.

In terms of overseas automotive sales, Japan's sales (outside of the Japanese market) are significantly larger than China's. In the first ten months of this year, Toyota sold 8.33 million vehicles globally, with 1.25 million sold in Japan and over 7 million sold overseas.

From the perspective of passenger vehicle export growth, this year's export growth has slowed significantly. Exports grew by 58% in 2023, but the cumulative growth rate slowed to 30% in the first half of this year and further to 24% by October.

Looking solely at the export of passenger new energy vehicles, the outlook is even less optimistic. The European Union imposed tariffs of up to 37%, and the United States increased tariffs by 100%, significantly impacting new energy vehicle exports. In 2023, new energy vehicle exports grew by 80%, but cumulative export growth slowed to 26% in the first quarter of this year, 14% by the end of June, and only 6% by October.

The impact varies at the automaker level. According to BYD's operating data, overseas sales reached 329,000 units in the first ten months of this year, an 87% increase from 176,000 units in the same period last year. BYD's export business now covers 94 countries and regions worldwide.

In stark contrast to BYD, SAIC Motor's exports declined due to the EU tariffs. In the first ten months of this year, SAIC Motor sold 937,500 units overseas, a decrease of 13% from last year's 1.083 million units.

According to the China Automotive News, China's automobile exports are primarily to Europe, Africa, Russia, the Middle East, and the Americas. In the first half of this year, 512,000 units were exported to Europe (excluding Russia), 158,000 to Africa, 478,000 to Russia, 420,000 to the Middle East, and 653,000 to the Americas.

2. Rise of Domestic Brands, Defeat of Joint Venture Brands

Chinese-made automobiles have come a long way since the 1990s, with nearly 30 years of development. As domestic brands like Great Wall, Changan, and BYD have gained consumer recognition, the market share of domestic brands reached 41% by 2015.

However, from 2015 to 2020, the market share of domestic brands did not increase but decreased, falling to 38% in 2020 for passenger vehicles.

2021 marked a turning point for the growth of new energy vehicles and the market share of domestic brands. In 2020, the penetration rate of new energy vehicles surpassed 5% for the first time, reaching a critical point where consumer acceptance accelerated. In 2021, against the backdrop of high oil prices and increased government subsidies, new energy vehicle sales reached 3.52 million units, a 158% increase over the previous year.

In 2022, new energy vehicle sales reached 6.88 million units, nearly doubling the growth rate, and in 2023, sales reached 9.5 million units, maintaining a high growth rate of over 30%.

With the rise of new energy vehicles, the market share of domestic brands has also surged significantly. In 2021, the market share of domestic brands ended three consecutive years of decline, reaching a historic high of 45%. In 2022, the market share further increased to 50%, and in 2023, it rose to 56%. In the first ten months of this year, the cumulative market share has already reached 65%.

The market share of domestic brands has increased in leaps and bounds over the past four years. It took more than 30 years to increase from 0% to 40%, but it only took three more years to increase from 40% to two-thirds.

The rise of domestic brands has squeezed the market share of joint venture and imported cars, with a greater impact on fuel-efficient Japanese cars.

Looking back over the past decade, the market share of Japanese cars has steadily increased from 16% in 2015 to 23% in 2020. However, under pressure from domestic brands, the market share began to decline in 2021, falling to only 14% last year, returning to pre-2015 levels. With further encroachment from plug-in hybrid models, the market share of Japanese brands has accelerated its decline. As of October this year, the market share was only 11.2%, less than half of its 2020 peak.

Sales data from two Japanese joint venture automakers, GAC Toyota and GAC Honda, reflect this trend. According to operating data released by GAC Group, sales of GAC Toyota fell by 30% and sales of GAC Honda fell by 23% from January to October this year.

German cars have also been affected. In 2020, the market share of German joint venture brands was 24%, and the combined market share of Japanese and German brands reached 47%, significantly higher than that of domestic brands.

From 2021 to 2023, the market share of German cars declined to 20.6%, 19.5%, and 17.8%, respectively. In October this year, the cumulative market share further declined to 15%, with a slower decline compared to Japanese cars.

At the automaker level, SAIC Volkswagen, a joint venture with Volkswagen, saw sales decline by 7% from January to October this year. Brilliance Auto, a joint venture with BMW, saw sales decline by 17%, and Beijing Automotive Group, a joint venture with Mercedes-Benz, saw no growth in sales.

Korean cars have also experienced a significant decline in the domestic market. In 2018, the market share of Korean cars peaked at 5%, but by 2023, it had fallen to only 1.6%, less than a third of its peak.

American cars have also declined, from 12.3% in 2017 to 8.8% by the end of last year. French cars have declined from 3.5% in 2015 to 0.5% last year.

In the era of new energy vehicles, the "electricity" and "technology" content of cars have increased significantly. Technological luxury has redefined the mid-to-high-end automotive market. For example, Huawei and JAC Motors jointly created the Zunjie series, and domestic brands have overtaken joint venture and imported cars in this curve, which is a logical outcome.

3. Automakers Actively Reduce Prices, Leading to Intense Competition, Yet Gross Margin Rises

At the beginning of this year, the China Association of Automobile Manufacturers (CAAM) predicted that automobile sales would reach 31 million units and new energy vehicle sales would reach 11.5 million units this year. From January to October, 24.624 million automobiles have been sold, representing 80% of the forecast, and 9.75 million new energy vehicles have been sold, representing 85% of the forecast. With two months remaining, new energy vehicle sales are highly likely to exceed expectations.

Behind the impressive sales figures lies widespread price reductions in the industry, with automakers sacrificing prices for volume. Shortly after the 2024 Chinese New Year, BYD introduced the slogan "Electricity is Cheaper than Oil," with the Qin PLUS model priced in the 70,000 yuan range. Subsequently, Volkswagen, Zero Run, Chery, and Great Wall also joined the price reduction race. Although BYD's mid-to-high-end brands such as Denza, Fangchengbao, and Nio have increased their sales of higher-priced vehicles this year, the average price per vehicle has dropped from 160,000 yuan last year to 141,500 yuan in the first half of this year.

Nio's average vehicle price in the first half of the year was 275,200 yuan, a decrease of over 10% or 32,000 yuan from the end of last year. Lixiang's average vehicle price fell from 320,000 yuan at the end of last year to 288,800 yuan in the first half of this year.

Tesla's prices have remained relatively stable but at the cost of declining sales. In the first ten months of this year, domestic sales fell by 4%. By the end of November, even Tesla, which has traditionally maintained stable prices, could no longer resist, offering a 10,000 yuan discount on the Model Y.

The price war among domestic cars has also forced joint venture and imported cars to join the price reduction race. The BMW 3 Series has seen price reductions of over 100,000 yuan, the Mercedes-Benz GLE has seen reductions of over 200,000 yuan, and the Porsche Macan is now priced below 400,000 yuan. Joint venture and imported cars, which once relied on brand premium for high margins, are gradually falling into the affordable category.

Despite significant price reductions, automakers' gross margin indicators have increased rather than decreased. On the one hand, automakers have a strong voice in the supply chain and can transfer pressure by reducing prices to suppliers. A few days ago, BYD sent an email requiring suppliers to reduce prices by 10%, which is a prime example of this.

On the other hand, raw material prices have declined significantly this year. The core raw material for batteries, lithium carbonate, has fallen from 100,000 yuan per ton at the end of last year to over 70,000 yuan per ton this year. The price of hot-rolled steel coils, mainly used in automobiles, has also fallen from an average of 4,000 yuan per ton last year to 3,700 yuan per ton this year. As sales grow, depreciation, consumables, and labor costs per vehicle are spread out.

The gross margins of the automotive business of the six listed new energy automakers tracked by Caijing Story Hui have improved in the first half of the year.",