Guangzhou Automobile Group "re-embraces" Huawei, prioritizing "revival" over "soul

![]() 12/06 2024

12/06 2024

![]() 450

450

Recently, Guangzhou Automobile Group (hereinafter referred to as "GAC") and Huawei held a strategic cooperation signing event for smart vehicles. Through this cooperation, GAC will create a new high-end intelligent new energy vehicle brand in addition to Trumpchi, Aion, and Aion V Plus.

In the first three quarters of this year, GAC's revenue, net profit, and other indicators all saw the largest year-on-year decline in a decade. As a result, GAC is determined to undergo "self-transformation," relocating its headquarters from Zhujiang New Town CBD in Guangzhou City to Panyu District, Guangzhou.

However, in the eyes of outsiders, even if GAC's executives live in the "workshop," it is difficult to reverse the downturn in the short term due to issues such as weakening brand momentum and insufficient product strength. Nonetheless, the official announcement of cooperation between GAC and Huawei seems to have dispelled previous doubts, and GAC's share price even witnessed two consecutive trading halts due to surging demand.

Faced with fierce competition in the new energy vehicle industry, GAC Chairman Zeng Qinghong once called for an end to "internal competition," arguing that continuing this trend was not a viable solution as it would lead to unprofitability and ineffectiveness, ultimately making it impossible for enterprises to survive.

However, it is evident that as the market develops, competition among automakers has become cutthroat. Rather than advocating against internal competition, GAC should indeed consider how to break the deadlock.

1. GAC values both face and substance

This year, GAC's performance has indeed been unimpressive. At the beginning of the year, Zeng Qinghong set a goal of increasing sales by 10% in 2024, but based on the sales target of 2.7555 million vehicles for 2024, GAC only achieved 48% of its sales target in the first three quarters, with cumulative sales of 1.3351 million vehicles.

In the first three quarters of this year, GAC achieved revenue of 74.04 billion yuan, a year-on-year decrease of 24.18%; net profit attributable to shareholders was only 120 million yuan, a year-on-year decrease of 97.34%; excluding non-recurring gains and losses, net profit attributable to shareholders was a loss of 1.87 billion yuan, a year-on-year decrease of 146.49%. Both revenue and net profit recorded their largest year-on-year declines in a decade.

Even though the overall environment in the automotive industry has not been optimistic in recent years, GAC's performance has still underperformed compared to other joint venture automakers. For reference, SAIC Motor achieved revenue of 145.796 billion yuan in the first three quarters, a year-on-year decrease of 25.91%; net profit attributable to shareholders was 280 million yuan, a significant year-on-year decrease of 93.53%; Changan Automobile's revenue still showed positive growth, with net profit attributable to shareholders at 3.579 billion yuan, a year-on-year decrease of 63.78%.

GAC explained in its financial report that the main reasons for the decline in performance were lower sales and reduced profitability. Simply put, the inability to sell cars was the primary cause.

In terms of product sales, the sales proportion of GAC's joint venture automakers "Toyota and Honda" still accounted for up to 60% in the first three quarters, while the independent brands Trumpchi and Aion accounted for about 40%.

However, Aion, which shoulders the responsibility of leading GAC's transition to new energy, has seen a decline in monthly sales for eight consecutive months, with cumulative sales in the first ten months of this year declining by 32.51% year-on-year.

It is no longer realistic for GAC to rely on the "glory" of "Toyota and Honda" to make easy money. Last year, there were rumors of significant layoffs at "GAC Toyota and Honda," and even news of employees "voluntarily resigning."

However, after the "retreat" from traditional vehicles, GAC's progress in "electric advancement" has been less than ideal. Aion became the "sales champion" among new forces in 2022, but its sales have gradually slowed down since then. In 2024, Aion's sales have started to decline rapidly.

On the one hand, although Aion's sales surged in the past two years, most of them came from the online car-hailing market. According to calculations by Cui Dongshu, Secretary-General of the China Passenger Car Association, of the 740,000 new energy vehicles added to the online car-hailing market nationwide in 2023, Aion accounted for nearly 30%. As the online car-hailing market becomes saturated and the vehicle replacement cycle has not yet arrived, Aion's sales have naturally begun to decline.

On the other hand, after Aion aggressively targeted the online car-hailing market, its brand positioning was inevitably anchored. Coupled with the fierce price war in the new energy vehicle market, consumers have more choices and are naturally reluctant to pay for "online car-hailing vehicles."

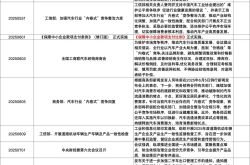

GAC's high-end and differentiated layout is imminent, which has also become a "new opportunity" for cooperation between GAC and Huawei. As everyone knows, this is not the first time GAC and Huawei have collaborated on "car manufacturing." As early as 2017, the two parties began cooperating in the field of intelligent and connected electric vehicles.

In 2021, the two parties decided to jointly develop a project called the "AH8 model," which is reported to be an SUV model. GAC is responsible for manufacturing, while Huawei provides a full-stack intelligent vehicle solution.

However, GAC announced in 2023 that it would change the AH8 project from "joint development" to "independent development," with Huawei continuing to participate in the project as a key supplier. GAC did not explain why the cooperation was terminated, but based on some side reports, there may be two reasons:

First, Huawei's intelligent driving solution is not cheap. In 2022, Xiao Yong, Deputy General Manager of GAC Aion, stated at the China Auto Marketing Summit that "Huawei is an excellent supplier in the industry, but when GAC Aion cooperates with big-name suppliers like Huawei, it has no bargaining power."

Second, GAC believes that independent research and development is not impossible. In 2023, Yuan Zhongrong, the former Vice Chairman of GAC Group, spoke at the 15th Entrepreneur Forum, mentioning that Huawei's system is excellent but arguing that Huawei does not understand car manufacturing.

Although Yuan Zhongrong's remarks at the time also caused considerable controversy, it is evident that traditional automakers find it difficult to place full trust in cross-border automakers like Huawei.

2. Huawei becomes the strongest "cheat code"

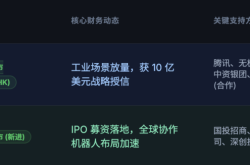

But as we all know, compared to GAC Aion's continuous "retreat," sales of Huawei's HarmonyOS Intelligent Driving Solution have been on the rise. From January to November this year, cumulative sales reached 393,477 vehicles, firmly ranking among the top-selling new forces.

Although Huawei "does not manufacture cars," in the current era of electrification and intelligent transformation in the automotive industry, Huawei has undoubtedly become the "strongest accessory" for automakers undergoing transformation.

In addition to Thalys, Chery, BAIC, and JAC, which are behind "the Four Realms," there is also Changan Automobile, which has become Huawei's largest external shareholder. Foreign automaker Audi has also officially announced cooperation with Huawei.

Even SAIC, which once vocally expressed the "soul theory," has recently been rumored to be personally leading a team to discuss a fourth mode of cooperation with Huawei, possibly even making a strategic investment in Huawei.

The trend in the automotive industry is clear, so it is not surprising that GAC is "making a comeback." Regarding this "second cooperation," the two parties have not announced more specific information. The only certainty is that they will jointly promote a brand-new high-end intelligent vehicle brand.

However, some media outlets have reported that this cooperation may not adopt the HarmonyOS Intelligent Driving Solution model, meaning that GAC does not intend to completely "sell its soul" and will not create a "Fifth Realm."

At the Guangzhou Auto Show in September this year, GAC Trumpchi and Huawei jointly launched their first concept car, the 1 Concept. At that time, GAC mentioned that the cooperation between Trumpchi and Huawei was different from other familiar models and represented a brand-new approach.

In fact, at the Fortune Global 500 Summit in 2024, Feng Xingya, General Manager of GAC Group, also mentioned the "soul theory" again, arguing that one should consider the historical background, technological development stage, and supply and demand status when viewing the "soul theory." If a technology has a significant impact on the entire vehicle and cannot be normally procured from society, it is considered the "soul"; if the technology is mature and widely available, it is not considered the "soul."

This also reflects GAC's attitude towards intelligent driving cooperation. On the one hand, the current intelligent driving technology for new energy vehicles has gradually matured, and there is more than one supplier in the market, including Huawei. For GAC, which urgently needs to promote product upgrades, adopting an intelligent driving supplier is not considered "selling its soul"; it is just that the supplier happens to be Huawei.

On the other hand, among many intelligent driving suppliers, Huawei's "brand empowerment" is indeed formidable, combining Huawei's own brand influence with solid technical expertise, which has already been verified in "the Four Realms." Currently, Thalys' market capitalization is already twice that of GAC.

Finally, judging from GAC's current product line, in addition to Aion, the monthly sales of its high-end brand Aion V Plus once dropped to only "three digits," indicating that GAC's performance in the high-end market is not ideal.

However, in the current new energy vehicle market, competition in the mid-to-low-end segment is already fierce, with brands like Xpeng and Xiaomi entering the sink market. For GAC to overtake the competition, making a breakthrough in the high-end market may be a clever strategy. In this context, Huawei's support for GAC in terms of brand, technology, and channels is particularly important.

3. "Hua-Yuan Magic" battles in the new energy vehicle circle

Currently, there is a consensus in the industry that only 5-7 automotive brands may survive in the new energy vehicle industry. Automakers must compete fiercely for these "single-digit" entry tickets and cannot afford to slow down for a moment.

In the new energy vehicle circle, intelligent driving has become an important factor influencing consumers' purchasing decisions. A survey shows that among consumers purchasing vehicles priced between 200,000 and 300,000 yuan in China, more than a quarter cited intelligent driving as a reason for their purchase; for consumers purchasing vehicles priced above 350,000 yuan, this proportion exceeds one-third.

With the continuous development of the intelligent driving industry, two factions have emerged among intelligent driving suppliers: the "self-research faction" represented by companies like Lixiang and Xpeng, and the "Hua-Yuan Magic" faction composed of leading intelligent driving suppliers such as Huawei, Yuanrong, and Momenta. In terms of the number of partnerships alone, the "Hua-Yuan Magic" faction's social circle is more active.

Based on this trend, the "self-research faction" and the "Hua-Yuan Magic" faction are expected to continuously optimize the models and technologies of intelligent driving systems through continuous data accumulation and road condition testing, thereby establishing a significant leading edge in the field of intelligent driving.

For mid-level intelligent driving suppliers, their previous-generation technology may not yet be fully resolved, while the "self-research faction" and the "Hua-Yuan Magic" faction have already moved on to the next-generation technology. This represents a "flywheel effect" brought about by technical capabilities, organizational structure, strategic resources, mass production capabilities, and other factors.

Future competition in the new energy vehicle market will not only be among automakers but also among "industrial alliances" comprising automakers, intelligent driving suppliers, and the IoT ecosystem.

Therefore, GAC's re-embrace of Huawei may be its last chance to "catch up" after missing the first opportunity for cooperation. However, some industry insiders believe that it may already be too late for GAC after missing the previous cooperation opportunity. Nevertheless, in the current era of comprehensive intelligentization of new energy vehicles, anything is still possible.

For GAC, the biggest challenge ahead will be finding differentiation in cooperation forms, product development, and brand presence while the "Huawei Alliance" gradually grows. Only by breaking through its past self can GAC embrace a new future.