Value write-downs exceed 10 billion, but GM dares not withdraw from China

![]() 12/06 2024

12/06 2024

![]() 481

481

Faced with huge losses, GM has already recognized the reality.

As the market share of independent brands continues to increase, the pressure on joint venture brands in the domestic market has become greater and greater. Especially in the second half of this year, the market share of joint venture brands has been compressed to less than 30%, and market competition has become increasingly fierce.

The price war in the first half of the year caused heavy losses to all auto companies. There are only two paths left for joint venture brands: one is to regretfully withdraw and stop losses in a timely manner; the other is to receive a transfusion of funds and wait for a turnaround.

Regardless of the choice, for global auto companies, China is no longer the same as it was years ago.

On December 4, GM disclosed in a filing submitted to the U.S. Securities and Exchange Commission (SEC) that the company is planning a business reorganization of SAIC-GM, expecting to write down the value of its joint venture in China by $2.6 billion to $2.9 billion (approximately RMB 18.957 billion to RMB 21.144 billion), as well as accrue approximately $2.7 billion (approximately RMB 19.686 billion) in additional equity losses due to the implementation of the reorganization plan, including production adjustments for factories and some models.

Announcing the write-down of the value of the joint venture with SAIC, combined with the expenses of business reorganization, the overall estimated loss is as high as $5.6 billion.

Notably, GM's bankruptcy announcement during the global financial crisis in 2009 did not affect SAIC-GM. This major adjustment may also imply that the status of the Chinese market is no longer as important to GM as it once was.

Times change

At a previous investor conference hosted by UBS Group, GM Chief Financial Officer Paul Jacobson stated, "The valuation of our Chinese business is much higher than it was more than a decade ago, so adjustments are needed. The reorganization efforts are in the final stages. Companies must be able to be self-sufficient rather than relying on substantial investments. The main purpose of the reorganization is to avoid investing more funds in the joint venture."

Typically, when the recoverable amount of a company's assets is lower than their book value, the company must recognize an impairment loss and write down the book value of the assets to the recoverable amount. Such impairments include tangible assets such as factories and land, as well as intangible assets such as brands and goodwill.

For example, a large number of energy company joint ventures also faced huge value write-downs when exiting the Russian market in the previous two years.

GM's move largely reveals a shift in strategic focus and also reflects the cruel nature of capital seeking profit.

GM's third-quarter financial report shows that the company's profit growth in the U.S. exceeded 12.9% in the third quarter. Unlike the price war in the domestic market, GM's average selling price in the North American market has consistently remained above $49,000.

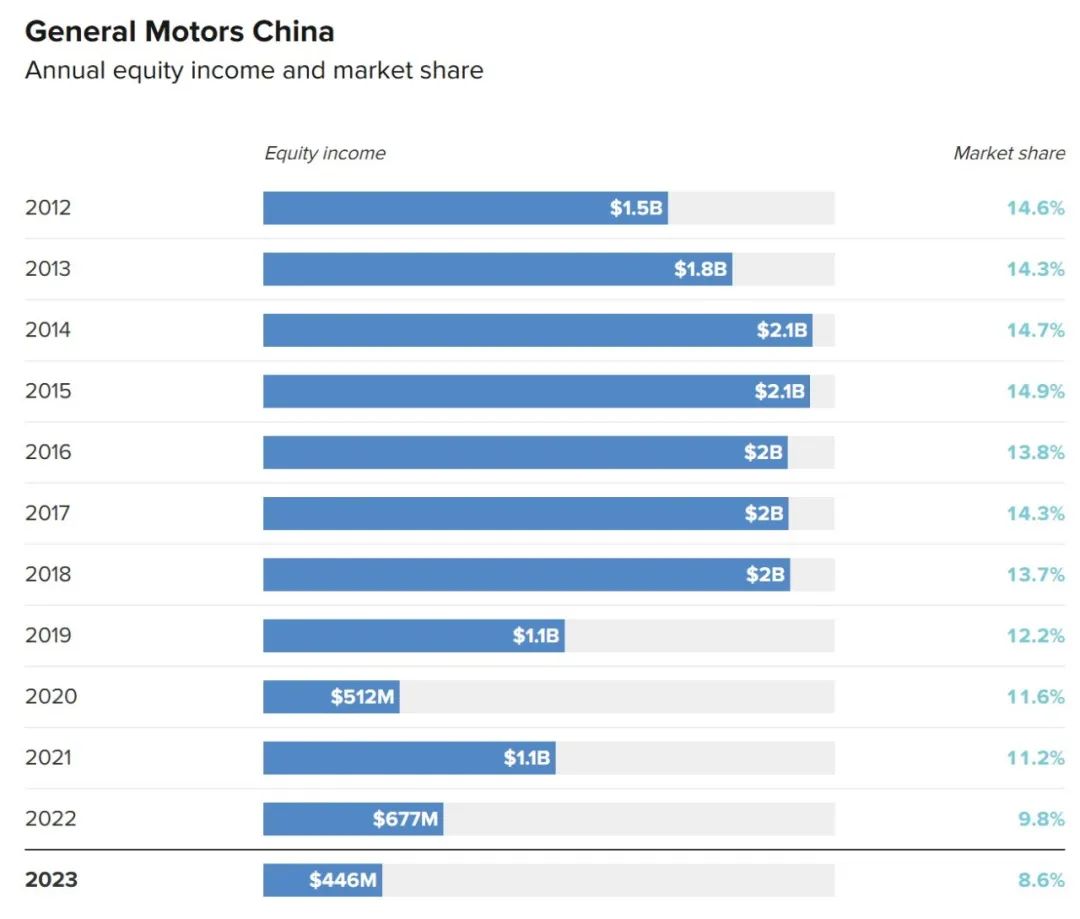

At the same time, GM in the Chinese market is facing an unprecedented blow. Since entering China in 1997, it took GM 20 years to reach its peak. In 2017, SAIC-GM achieved annual sales of 2 million vehicles, contributing $2 billion in profits to GM.

However, in just six years, SAIC-GM's sales have been halved, with sales barely maintaining 1 million vehicles in 2023. As of now, it seems difficult to maintain sales of 1 million vehicles in 2024. According to statistics, SAIC-GM's sales for the first 11 months were only 600,000 vehicles.

Financial reports show that GM's cumulative losses in the Chinese market reached $348 million (approximately RMB 2.5 billion) in the first three quarters of this year, with a loss of $137 million in the third quarter alone.

Against this backdrop, GM has had to write down the value of its business in China, which also means that from GM's perspective, SAIC-GM can no longer be as profitable as it once was.

In response, GM China stated that the Chinese business is a high-quality asset for our present and future. Our cooperation and communication with joint venture partner SAIC Motor have become closer than ever to achieve profitability and sustainable development.

To achieve long-term development goals, we are taking measures to reduce inventory, produce on demand, protect the pricing system, and reduce fixed costs.

In other words, GM will close some factories in China and cut unprofitable models. Although specific business reorganization plans and details have not been announced, the contraction is a certainty.

Production base or experimental field?

In fact, as early as August this year, there were rumors that "GM would sell Buick to SAIC and exit the Chinese market with the Chevrolet brand." Lu Xiao, general manager of SAIC-GM, responded that "speculation about the future of Buick and Chevrolet brands are just rumors. In the future, SAIC-GM will continue to adhere to the development strategy of 'multiple brands and differentiation' and simultaneously develop new and old tracks."

Faced with the Chinese market, GM knows that it is a market it cannot and dare not withdraw from because once it withdraws, GM's market share will be ceded to other competitors for nothing.

This is unacceptable to GM. Although sales have been halved, SAIC-GM still has an annual sales volume of over 500,000 vehicles at this time.

More importantly, GM also hopes to maintain its competitiveness in other regional markets through Chinese manufacturing. Unlike the high manufacturing costs in the United States, there are no labor unions conducting strikes in China, and production costs and industrial chains are controllable, which greatly facilitates exports to other regions.

According to official information, SAIC-GM has been engaged in export business since 2001 and achieved a cumulative export volume of 1 million vehicles by 2022. With the acceleration of economic globalization, SAIC-GM has exported to multiple global markets. Models like the Chevrolet Cruze, Trax, Cavalier, Equinox, and Buick Envision S are popular exports.

Even if China is only used as a manufacturing base, it is very beneficial for GM.

On the other hand, China is currently the world's largest new energy market. Although the penetration rate of new energy vehicles is not high in the United States, from a global perspective, new energy vehicles will definitely become mainstream products in the future. To grasp future development, GM needs an experimental field for new energy, and the Chinese market is the best global choice.

It is worth noting that GM's reform and adjustment in China were exposed after Volkswagen renewed its contract with SAIC. Faced with fierce competition in the new energy vehicle market, Volkswagen, a German company, understands that success in the Chinese market can be replicated in other markets. GM, of course, understands this principle as well.

Regarding its attitude towards new energy, SAIC-GM has been very clear this year. In the first 11 months, SAIC-GM sold a total of 97,056 new energy vehicles, a year-on-year increase of 77.4%. Sales also exceeded 10,000 units in November, reaching the domestic new energy vehicle qualification line. After electrification, Buick GL8 sales have returned to the forefront of the market segment.

Over the past six years, some automakers from the United States, Japan, South Korea, and Europe have closed or sold their Chinese factories, withdrawn from joint ventures, or chosen asset-light operation models in China. Some even considered the Chinese market as a "chicken rib" that is neither tasty nor worth discarding and chose to withdraw completely.

Under heavy pressure, GM is inevitably affected as well.

It is worth noting that the joint venture agreement between Volkswagen and SAIC was renewed six years early in November this year. The joint venture agreement between GM and SAIC Motor will expire in 2027, with less than two years remaining until renewal, making it imminent.

Withdrawal is impossible, and giving up is not that easy either. After this value write-down and reorganization, GM will certainly compete in China in another form, but its past glory can only remain in the past.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.