Top 5 domestic auto sales in November: 2 companies have achieved annual targets

![]() 12/06 2024

12/06 2024

![]() 605

605

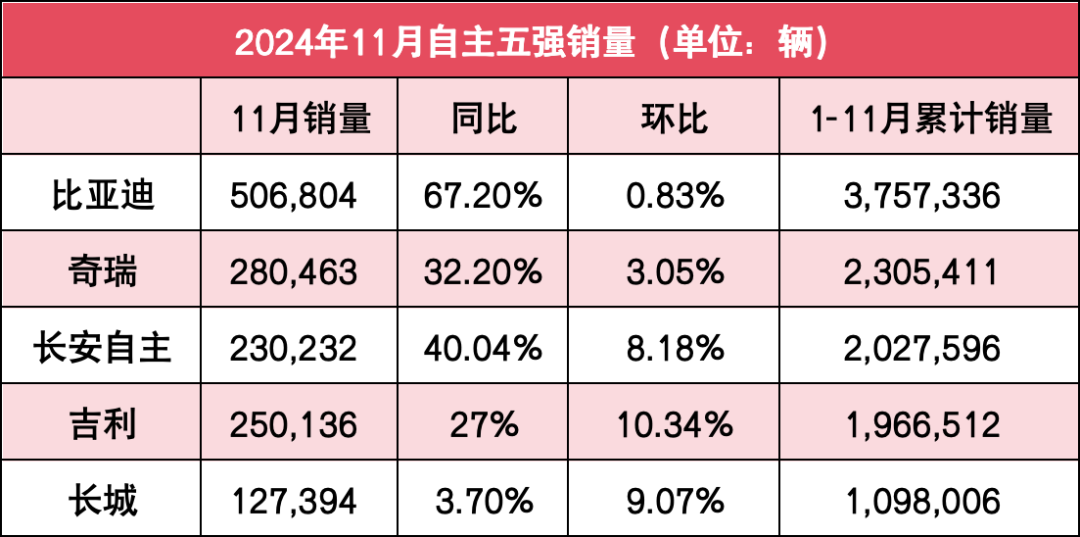

As the year-end approaches, all companies are striving to boost sales. Among the top 5 domestic auto brands (BYD, Chery, Geely, Changan, and Great Wall), BYD continues to lead in November with sales of 500,000 vehicles; Chery, Geely, and Changan rank second, third, and fourth, respectively, with sales volumes ranging from 200,000 to 300,000; while Great Wall's sales, though still last among the five, have shown a significant rebound, surpassing 100,000 for three consecutive months.

First, let's look at BYD, the industry leader. In November, BYD set another sales record with 506,800 vehicles sold, marking a year-on-year increase of 67.86% and a month-on-month increase of 0.83%. This is the second consecutive month that BYD has sold over 500,000 vehicles. From January to November this year, BYD's cumulative sales reached 3,757,336 vehicles, up 40.02% year-on-year, achieving its annual sales target of 3.6 million vehicles ahead of schedule. In the last month, BYD only needs to maintain sales above 250,000 to surpass the 4 million mark for the year. This should be a straightforward task for BYD.

Recent rumors about BYD demanding a 10% price reduction from its suppliers have caused quite a stir. This suggests that with sales exceeding 4 million vehicles, BYD may continue its price war, dealing a final blow to the gasoline vehicle market. Since 2021, BYD has maintained high growth for four consecutive years, continuously setting new sales records. Will BYD be able to maintain such high growth next year?

Chery, which has long held a steady second place, also set multiple record highs in November. The company sold 280,463 vehicles in November, up 32.2% year-on-year, including 202,633 gasoline vehicles, up 6.1% year-on-year. It is surprising that Chery's gasoline vehicle sales have continued to grow despite its rapid electrification transformation. From January to November this year, Chery's cumulative sales reached 2,305,411 vehicles, up 38.4% year-on-year, setting new monthly and cumulative sales records. This is a result of the comprehensive growth of Chery's multiple brands. In November, sales of the Chery brand reached 164,225 vehicles; the Xingtu brand sold 15,898 vehicles; the Jietu brand sold 63,040 vehicles; the iCAR brand sold 5,745 vehicles; and the Zhijie brand sold 11,401 vehicles in November, becoming a new growth point for Chery Group's sales.

Geely and Changan also made strong comebacks in November. Geely sold 250,136 vehicles, up approximately 27% year-on-year and over 10% month-on-month, marking a record high for the third consecutive month with sales exceeding 200,000 vehicles. Among Geely's brands, the Yinhe series and the Zeekr brand showed the fastest growth, with sales of 75,228 and 27,011 vehicles, respectively, up 121% and 106% year-on-year. From January to November this year, Geely Group's cumulative sales reached 1,966,512 vehicles, up approximately 31% year-on-year, bringing it close to achieving its annual sales target of 2 million vehicles.

Changan's independent sales also reached 230,232 vehicles in November, up 40.04% year-on-year and 8.18% month-on-month. This surge in sales is mainly attributed to the strong performance of three brands: Deep Blue, Qiyuan, and Avita. Specifically, Qiyuan sold 18,455 vehicles; Deep Blue sold 36,026 vehicles; and Avita sold 11,579 vehicles, totaling 66,000 vehicles. From January to November this year, Changan's cumulative independent sales reached 2,027,596 vehicles, making it the third domestic auto brand to unlock the milestone of 2 million cumulative sales for the year, surpassing Geely by about 60,000 vehicles.

Based on current data, the third-place finisher in terms of annual sales among the top 5 domestic auto brands will likely be either Geely or Changan, with Changan being the more likely candidate. Unless Geely can outperform Changan by 60,000 vehicles in December.

Great Wall Motors' sales have also started to gradually rebound. In November, the company sold 127,394 vehicles, up 3.70% year-on-year and 9.07% month-on-month, marking the fourth consecutive month of month-on-month sales growth. Among its five major brands, three have resumed positive growth. Specifically, sales of the Haval brand, its main sales driver, reached 78,386 vehicles, up 4.50% year-on-year; sales of the WEY brand reached 7,046 vehicles in November, up 145.85% year-on-year, thanks to the new Lanshan model; and sales of the Tank brand reached 20,189 vehicles, up 8.68% year-on-year. From January to November this year, Great Wall Motors' cumulative sales reached 1,098,006 vehicles, down 1.81% year-on-year.

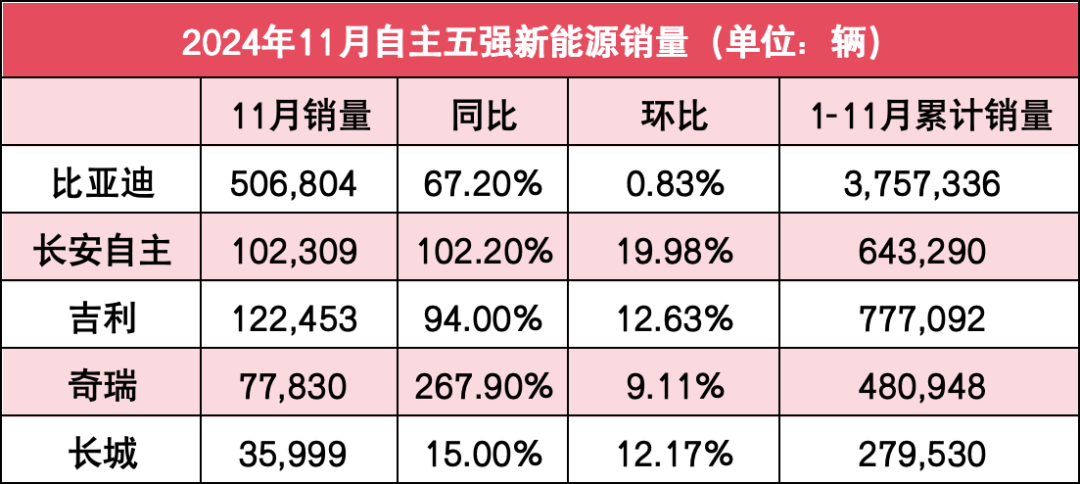

In the new energy vehicle segment, BYD continues to lead with sales far exceeding the combined sales of the other four companies. Specifically, in November, BYD's new energy vehicle sales were roughly equal to those of four Geely brands, five Changan brands, 6.5 Chery brands, and 14 Great Wall brands. Clearly, the other four companies will find it difficult to catch up with BYD in the new energy vehicle market in the short term. Although they cannot match BYD in sales volume, the other four companies' new energy vehicle sales in November also have notable highlights.

Firstly, both Geely and Changan sold over 100,000 new energy vehicles in November, with new energy penetration rates exceeding 44%. Geely sold 122,453 new energy vehicles, up 94% year-on-year and 12.63% month-on-month, mainly driven by products such as the Geely Xingyuan, Yinhe E8, and Zeekr 7X. With the combined efforts of its three major new energy brands—Deep Blue, Qiyuan, and Avita—Changan sold 102,309 new energy vehicles in November, up 19.98% month-on-month.

Chery's new energy vehicle sales grew even more rapidly. In November, Chery sold 77,830 new energy vehicles, up 267.9% year-on-year. From January to November, Chery's cumulative new energy vehicle sales reached 480,948 vehicles, up 214% year-on-year. At the end of November, the new S7 model of the Zhijie brand was "launched at a reduced price" and will start deliveries on December 1. This model, along with the Zhijie R7, will help Chery's new energy vehicle sales surpass 100,000 in December. Great Wall sold 35,999 new energy vehicles in November, up 12.17% month-on-month.

In terms of exports, Chery continues to shine the brightest. In November, Chery exported 104,911 vehicles, marking the third consecutive month with exports exceeding 100,000. From January to November, Chery's cumulative exports reached 1,046,186 vehicles, up 22.4% year-on-year, marking the first time its annual exports have surpassed 1 million vehicles. It is worth noting that in November, exports accounted for a further declining share of 37% of Chery's total sales, indicating that the company's domestic sales have grown even more rapidly in recent months.

Apart from Chery, Great Wall, BYD, Geely, and Changan have relatively small differences in overseas sales, ranging from 20,000 to 50,000 vehicles. Among them, Great Wall exported 43,186 vehicles, up 2.8% month-on-month, with exports accounting for 33.9% of total sales, second only to Chery. This sales structure has contributed to the company's stable profitability. In addition, Geely exported 32,814 vehicles in November, up 13% year-on-year and 17.1% month-on-month; BYD's overseas sales were 30,977 vehicles, roughly unchanged from the previous month; and Changan's exports were 19,391 vehicles, down 37.2% month-on-month and the only company among the five with exports below 20,000 vehicles.

With one month left before the end of 2024, let's take a look at how close these five companies are to achieving their targets. Starting with BYD, the company's goal for 2024 is to increase sales by at least 20% over 2023 levels. Based on this calculation, BYD's sales target for 2024 is at least 3.624 million vehicles. Currently, BYD has already exceeded this target and is aiming for the 4 million mark.

According to its initial plan, Chery set a target for 2024 to "exceed the industry's sales growth rate by 10-20 percentage points." If we calculate based on the industry's estimated total sales growth rate of over 3% this year, Chery's target sales growth rate for this year would be 13%-23%, corresponding to annual sales of 2.126-2.314 million vehicles. Chery has already achieved this target.

Geely's original target was 1.9 million vehicles, which it has already surpassed. After increasing its target by 100,000 vehicles, its completion rate dropped to 98%. Changan's sales target for 2024 is 2.2 million vehicles, and it has achieved 92% of this target. Based on its previously announced sales target of 1.9 million vehicles, Great Wall Motors is currently 58% towards its goal.

From the current completion rates, BYD and Chery have already achieved their annual targets; Geely and Changan are also on track to meet their targets after a strong push in December; however, Great Wall still has a significant gap to close to reach its target.