Brave the Thai Market: Will Chinese Automakers Be Catalysts or Bullys?

![]() 12/09 2024

12/09 2024

![]() 600

600

Introduction

Introduction

The choice depends on past actions and future plans.

The Thai auto market continues to struggle.

Domestically, the automotive industry, Thailand's primary pillar industry, has seen car sales decline for 17 consecutive months since June 2023, showing no signs of stopping.

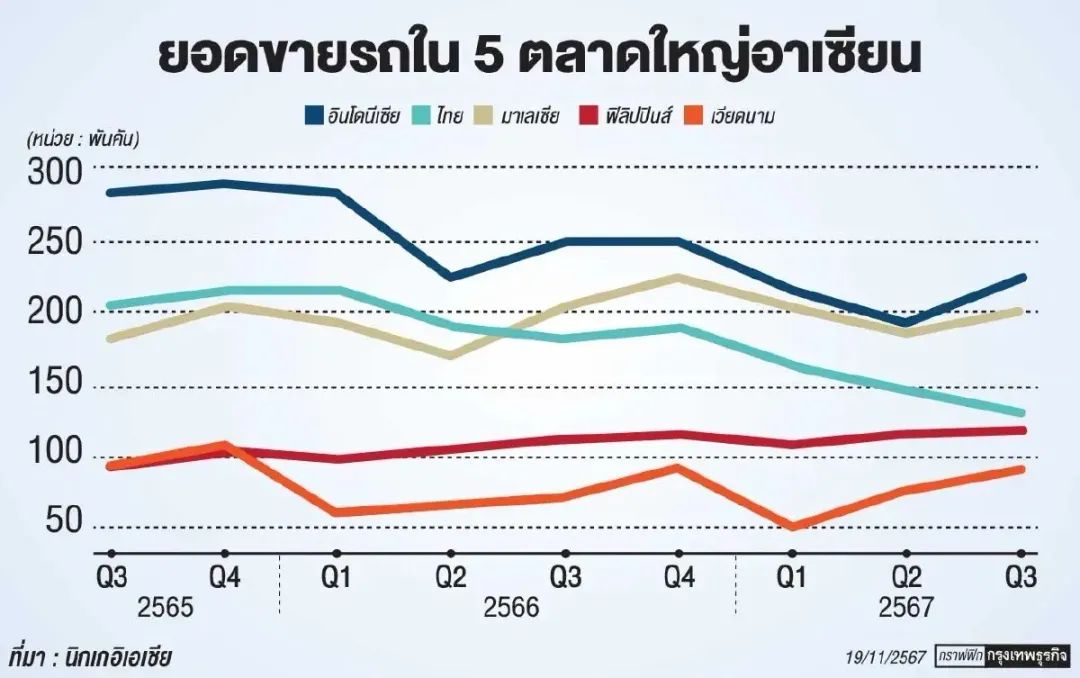

Internationally, Thailand's reputation as the 'Detroit of Asia' is fading. According to Nikkei Asia, as of the third quarter of 2024, Malaysia has surpassed Thailand for five consecutive quarters, becoming Southeast Asia's second-largest auto market. In the just-concluded third quarter, Thai car sales plummeted by 28%, the steepest drop among the five ASEAN countries. The sales gap between Thailand and the Philippines has narrowed to just 12,000 units, raising concerns that Thailand may soon slip to third place in the region.

Chart | Nikkei Asia Statistics (Thai Buddhist calendar year 2567 corresponds to the Gregorian calendar year 2024)

Every cloud has a silver lining. Amidst the downturn, the Thai auto market is ripe for reform.

Southeast Asia has long been considered a backyard for Japanese companies, and Thailand, which lacks homegrown auto brands, is no exception. For a long time, 90% of the Thai market was dominated by Japanese automakers.

However, under the dual pressure of the Thai government's 'Next Generation of Automotive Manufacturing' policy and the rise of Chinese autonomous brands, the 62-year-old stronghold built by Japanese automakers has cracked, allowing Chinese automakers to enter and make significant gains.

In 2023, the market share of Chinese automakers in Thailand surged from about 5% to about 11%, while that of Japanese automakers fell from 90% to 78%. Entering 2024, Japanese automakers like Subaru, Suzuki, and Honda have announced the closure of their factories in Thailand. While Subaru and Suzuki cited strategic reasons like optimization and transformation, there is widespread speculation that the closures are related to the rise of Chinese automakers in Thailand.

This speculation was soon confirmed.

On November 19, Thai national oil company PTT said that due to intensifying competition in the electric vehicle market, its joint venture with Foxconn, Horizon Plus, has suspended plans to build a new factory.

Three days later, on November 22, multiple media outlets, including Nikkei Asian Review, reported that Nissan plans to restructure its Thai operations next year. As part of a global layoff plan, Nissan will cut or relocate 1,000 jobs in Thailand. The report noted that Nissan's decision to lay off employees in Thailand was impacted by the popularity of Chinese automakers' electric vehicles.

The market is a jungle where the strong prey on the weak. However, competition can be benign or malicious. The question is whether to be a catalyst that revitalizes a stagnant market or a bully that disrupts it.

The choice depends on past actions and future plans.

Tightening Loans, Plunging Sales

Thai households have long been heavily indebted.

According to the Bank of Thailand, Thai household debt accounted for 90.8% of GDP in the first quarter of 2024 and 89.8% in the second quarter, despite a slight decline.

It is evident that borrowing is a common consumption pattern among Thai consumers, especially for major purchases. According to estimates from mid-to-high-level executives at various automakers in Thailand, 90% of new car sales in Thailand rely on car loans.

90% was also the market share of Japanese cars in Thailand, reflecting near-monopoly conditions. Consequently, car prices in the Thai market were inevitably inflated.

For example, the Toyota Camry, which costs around RMB 130,000 in China, retails for around RMB 300,000 in Thailand. Closer to home, even as a price war raged in the Thai auto market in late November, the GAC AION V sold for around RMB 218,000 in Thailand, RMB 90,000 more than in China. Although tariffs and other factors contribute, this price is still considered high.

The combination of borrowed consumption and inflated prices undoubtedly exacerbates the vulnerability of Thai consumers and the market. Any tightening of loans or defaults can have a significant impact on individuals and the market.

This vulnerability is now being exposed.

During the pandemic, the Thai economy suffered heavily, prompting the Bank of Thailand to introduce measures allowing debtors to defer loan repayments and interest. As the economy recovers post-pandemic, these incentive policies are gradually being phased out, shifting the burden from the government to the public. With a concentration of loan repayments and a disruption in loan balance, the market is feeling the strain.

Unlike domestic restrictions on ride-hailing, loan defaults in Thailand only restrict bank loans, allowing individuals to still borrow from informal sources.

This has led to an increase in bank non-performing loans and debt risks. In response, the Bank of Thailand introduced the 'Responsible Lending' policy, emphasizing that financial institutions must lend responsibly. This policy took effect on January 1, 2024.

Subsequently, car loans in Thailand tightened abruptly. Media reports indicate that since January 2024, the approval rate for car loans in Thailand has dropped to around 50%, leading to a plunge in car sales, which are heavily reliant on loans.

From January to October 2024, total car production in Thailand was 1.2468 million units, a year-on-year decrease of 19.3%. Domestic sales were 476,300 units, with October sales particularly weak, down 36.1% year-on-year to 37,700 units.

Based on this, the Federation of Thai Industries (FTI) has revised down its forecast for Thai car sales in 2024 from 550,000 to 450,000 units.

Prices and Volumes Both Decline, with No End in Sight

As sales plummet, car prices in Thailand are no longer holding firm.

This may be related to Thailand's shifting position and the entry of Chinese automakers.

With the fading 'Detroit of Asia' aura, Thailand is repositioning itself as a leader in the Southeast Asian electric vehicle revolution.

To this end, the Thai government has set targets for hybrid and electric vehicle production to account for 15%, 30%, and 100% of total production by 2025, 2030, and 2035, respectively, and has introduced supporting policies.

Taking Thailand's electric vehicle incentive policy from 2022 to 2023 as an example, Chinese automakers exporting electric vehicles to Thailand during this period were exempt from tariffs, had their consumption tax reduced from 8% to 1%, and were eligible for Thai government subsidies.

Apart from policy subsidies, Thailand is also the largest automotive production hub in Southeast Asia, with a complete industrial chain. Additionally, due to its strategic location, Thailand can reach most right-hand drive markets globally.

Cars produced in Thailand also benefit from tariff preferences and trade incentives among ASEAN members, further avoiding high tariffs in the European Union and the United States, serving as a springboard for autonomous brands to expand globally.

As a result, Chinese automakers such as SAIC, NIO, BYD, Changan, Chery, and Great Wall have intensified their presence in the Thai market.

However, there's no such thing as a free lunch. To enjoy these policy benefits, automakers must produce an equivalent number of electric vehicles in Thailand in 2024. If production and sales targets are not met and are postponed to 2025, automakers will need to produce 1.5 times the required number of electric vehicles between 2024 and 2025.

Subsequently, the Thai government introduced a multi-phase subsidy policy, also contingent on automakers investing and building factories in Thailand.

The Thai government's policy to reduce import taxes on complete electric vehicles, extended to 2025, requires automakers to locally produce a corresponding number of BEVs of the same specifications by the end of 2027 to offset imports. The ratio of imported to locally produced vehicles for 2024, 2025, 2026, and 2027 is set at 1:1, 1:1.5, 1:2, and 1:3, respectively.

In other words, the more cars sold today, the more that need to be produced tomorrow. This leads to a situation where once production starts, it cannot be stopped.

To quickly establish a foothold in Thailand and reduce the risk of unsold vehicles, price cuts have become the only option for Chinese automakers.

However, continuous price cuts have sparked dissatisfaction among existing customers and hesitation among potential buyers who are holding onto their money.

In simple terms, automakers continue production despite declining sales due to market downturns. To increase sales volumes, automakers try to reduce prices, but this hesitation among consumers exacerbates the sales decline, leading to a vicious cycle of falling prices and volumes.

Catalyst or Bully?

Price reductions to increase sales volumes are understandable as a market strategy, especially given that the Thai auto market has long been dominated by Japanese companies, with prices inherently inflated.

In such a context, external intervention is not only necessary but essential.

Just like the catfish in the catfish effect, its introduction forces lethargic sardines to become active, significantly reducing their mortality rate after capture.

The entry of Chinese automakers into the Thai market can inject vitality into the market and drive the development of the Thai automotive supply chain.

According to Rachanida Laohavanich, Director of the Strategy Department at the Thai Automotive Institute, Chinese electric vehicles are leading the market, not only promoting capacity cooperation between existing Thai automotive suppliers and Chinese automakers with factories in Thailand but also accelerating the development of supply chain enterprises such as batteries and charging piles, helping Thailand form a complete electric vehicle industry chain.

However, the magnitude and frequency of price cuts must also be market-driven. Eating all the meat and drinking all the soup can easily provoke criticism, let alone the gradual and relentless approach of 'cutting meat with a dull knife.'

Competition among automakers is inherent, and market share is limited. When one grows, another must shrink. It is only natural that the strong prey on the weak. However, the ultimate goal of business is to make money. In the face of profit, competitors can shake hands, cooperate, or even compete fiercely, but if they disrupt the entire market, it becomes counterproductive.

As the saying goes, 'When sparrows fight, the fisherman benefits.' However, in the current situation, the fisherman falls into the water while trying to pick up the spoils, failing to gain any advantage and even putting himself at risk.

Thai new car prices, though high, have been justified by good after-sales service, resilient used car prices, and high vehicle residual values.

Therefore, the introduction of price wars has a greater impact on Thai consumers.

On the one hand, as new car prices fall, used car values will also depreciate. If new car price reductions accelerate, they may undershoot used car prices, leading to price inversions.

On the other hand, in 2023, sales of pure electric vehicles in the Thai market reached 76,300 units, a year-on-year increase of 684.4%, with Chinese brands accounting for 80% of the Thai electric vehicle market. Japanese companies have intricate relationships with Thai finance and insurance sectors after years of development.

In response to the rise of Chinese electric vehicles, the Office of Insurance Commission (OIC) of Thailand released a new insurance policy for electric vehicles at the end of 2023, reducing the compensation ratio for electric vehicle batteries. This policy took effect on January 1, 2024, and requires insurance companies to adjust their policies by May 31, 2024.

Previously, if the battery of an electric vehicle in Thailand malfunctioned, it could be fully compensated. However, starting from January 1, 2024, electric vehicle insurance provides 100% compensation in the first year but only 90% in the second year, 80% in the third, 70% in the fourth, 60% in the fifth, and 50% beyond the fifth year.

This policy, aimed at Chinese electric vehicles, strikes more at the soft underbelly of Thai consumers.

As the saying goes, 'Water can carry a boat, but it can also capsize it.'

Once upon a time, Chinese motorcycles dominated Southeast Asia, occupying 80% of the market at its peak. However, they eventually retreated due to quality degradation caused by low-price competition, allowing Japanese motorcycles to make a comeback with their quality and service.

Today, Chinese electric vehicles occupy 80% of the Thai market, also focusing on low-price strategies. However, unlike in the past, Chinese electric vehicles now offer significantly improved quality despite their low prices.

With control over the electric vehicle market, the question is whether to repeat old mistakes or blaze a new trail, to be a catalyst that revitalizes the market or a bully that disrupts it. Chinese automakers undoubtedly have their own answers.