Car companies' 2025 sales targets revealed: NIO and Li Auto become conservative, Xiaomi is the most aggressive

![]() 12/09 2024

12/09 2024

![]() 526

526

A few days ago, Dianchetong summarized the completion rates of sales targets for new energy vehicle companies. While there are indeed some companies that can achieve their sales targets, the majority still fall short.

For car companies, failing to meet the sales targets set at the beginning of the year is not a big deal. As long as they can outperform previous years, they can report to investors, give bonuses to employees, and set even more ambitious sales targets for the next year.

Screenshot: 36Kr Auto

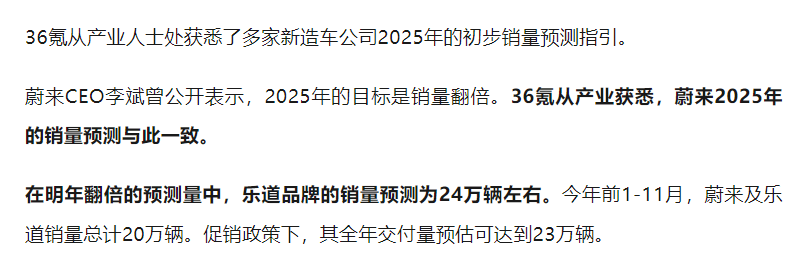

According to information disclosed by 36Kr, several new car companies have already announced their initial sales forecasts for 2025. Dianchetong has compiled the following table based on this information. It should be noted that based on past data, the difference in sales between December and November will not be significant, so the cumulative sales for the first eleven months plus November sales are used to estimate the approximate annual sales for 2024.

Chart: Dianchetong

These five new energy vehicle brands have all shown impressive sales figures this year, and it is expected that their sales targets for 2025 will increase. However, among the five companies that have revealed their sales targets for next year, Li Auto stands out as the most aggressive, while the others are even more aggressive.

This raises an interesting question: what kind of plans do these car companies have that allow them to set such ambitious goals?

Intelligence is the biggest selling point of new cars in 2025

In contrast, Xiaomi's journey in the domestic market has been relatively smooth. The monthly sales of the Xiaomi SU7 have quickly surpassed 10,000 units with increased production capacity, even exceeding 20,000 units in October and November, making it the top-selling mid-to-large sedan.

With a monthly sales volume of 20,000 units, Xiaomi is approaching the ceiling of the mid-to-large sedan market. It is not easy to compete for market share with models like the BYD Han DM, ZEEKR S7, and the "56E" series. In other words, if Xiaomi relies solely on the Xiaomi SU7 next year, achieving the annual sales target of 360,000 units will be very challenging. Therefore, Xiaomi will introduce an SUV next year to explore the potential of another market segment.

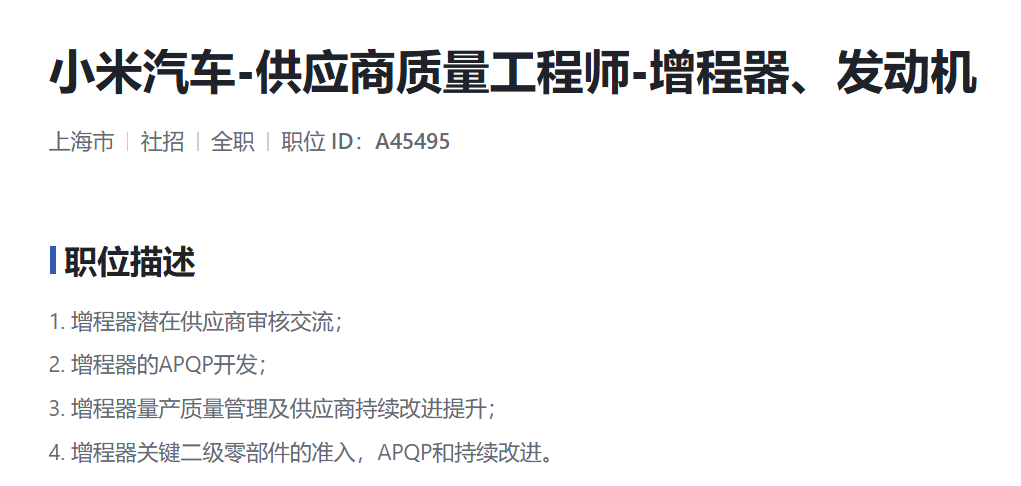

Screenshot: Xiaomi Recruitment Website

Recently, information about Xiaomi's new SUV has been gradually revealed. In addition to some design language details, it has also been revealed that the new car will be equipped with a dual-motor powertrain and rear-wheel steering system, promising excellent performance and handling. As for the extended-range SUV previously mentioned, it is rumored to be launched in 2026. Extended-range powertrains are currently a "game-changer" in the domestic market, and Xiaomi's 2026 annual sales target may be extremely high.

XPeng and Leapmotor have repeatedly broken monthly sales records this year, mainly due to the increase in cost-effective new models. XPeng's MONA M03 and P7+, as well as Leapmotor's C16 and C10, have gradually become the main sales drivers for their respective brands, allowing consumers to obtain higher intelligence and comfort configurations at lower prices.

Image Source: Dianchetong

According to information exposed online, XPeng will launch three new models and four majorly revamped models next year, including a B-segment SUV, a C+ full-size six-seater SUV, and a land aircraft carrier. Of course, XPeng's 2025 sales target is almost 50% higher than its estimated annual sales for this year. The confidence comes from the introduction of extended-range powertrains. The Kunpeng Super Electric System excels in both pure electric range and comprehensive range, enabling the C+ full-size six-seater SUV and B-segment SUV to compete in the mid-to-high-end new energy SUV market.

Leapmotor's Chairman Zhu Jiangming has stated that an annual sales volume of 500,000 units is the minimum goal. According to the plan, the Leapmotor B series will introduce three new models, all priced below 300,000 yuan, aiming to replicate the success of the C series. However, to achieve this goal, Leapmotor would need an average monthly sales volume of 40,000 units, which is already on par with Li Auto at this stage, indicating significant competition pressure.

Image Source: Dianchetong

In addition to new products, the gradual rollout of end-to-end large-scale intelligent driving systems is also crucial for the sales growth of new energy vehicle companies. XPeng's P7+ has quickly captured a significant market share thanks to this feature. Cao Li, Senior Vice President of Leapmotor, revealed that "Leapmotor is catching up with the intelligent driving progress of leading manufacturers." Moreover, Leapmotor will further increase the proportion of self-developed and self-manufactured products to better control costs and make intelligent driving technology accessible to more affordable models.

'The second half of the automotive industry is about intelligence,' but to make intelligent driving technology accessible to more people, it is essential to achieve 'intelligent driving equality,' which is precisely the direction that Leapmotor and XPeng are striving for. Of course, Dianchetong has also noticed that intelligent driving systems in vehicles priced between 100,000 and 150,000 yuan mainly adopt a cautious following strategy, with a noticeable gap compared to high-level assisted driving systems that balance efficiency and safety. It remains to be seen what innovations new energy vehicle companies will bring to intelligent driving next year.

NIO and Li Auto become more conservative, while established new energy vehicle companies become more conservative?

NIO's target may seem aggressive, but if this sales target includes the three brands of NIO, Ledao, and Firefly, then doubling sales would be a relatively conservative goal for NIO. According to the plan, NIO will launch the Firefly brand on December 21st. As an entry-level brand, Firefly has a more obvious price advantage, which will contribute to NIO's sales growth. In contrast, NIO seems more optimistic about Ledao, expecting sales to reach 240,000 units next year, on par with NIO's annual sales this year.

In short, if the doubled sales target includes all three brands, NIO believes that "the combined annual sales of NIO and Firefly will equal the annual sales of Ledao."

Image Source: NIO

For NIO to double its sales next year, Dianchetong believes that the difficulty level has reached "hellish" proportions. Currently, NIO mainly relies on entry-level products like the NIO ET5 and NIO ES6, which have stable sales. To achieve a breakthrough in sales, NIO essentially needs to rely on more affordable products. However, to maintain brand tone, these entry-level products will likely be introduced under the Ledao and Firefly brands.

Li Auto is also relatively conservative with its sales target, increasing it by about 30% for 2025. Based on current sales, the Li L series will continue to be the brand's core next year. Due to inadequacies in the energy replenishment system, the brand's first pure electric vehicle, the Li MEGA, did not achieve the expected sales success after its launch. Therefore, Li Auto has dedicated a year to improving its energy replenishment system.

It is currently certain that Li Auto will launch five extended-range models and five pure electric vehicles in 2025. If we speculate conservatively, all four extended-range models in the Li L series will be updated, and a new product will also be introduced. Additionally, pure electric powertrains will be integrated into these new models.

Image Source: Li Auto

Regarding the addition of new products and pure electric powertrains, Li Auto believes that these new models will only contribute an additional 200,000 units of annual sales, which is not as aggressive as other new energy vehicle brands. This prediction is relatively reasonable as Li Auto's energy replenishment system is far from perfect, limiting the growth potential of pure electric vehicles.

More importantly, it is evident from the plans of other new energy vehicle companies that their upcoming models will likely compete with the Li L series, such as the Hongmeng Zhixing Wenjie M8, Ledao's two home SUVs, XPeng's C+ full-size six-seater SUV and B-segment SUV, etc. While it remains to be seen if these new models can "dethrone" the Li L series, they are capable of capturing some market share.

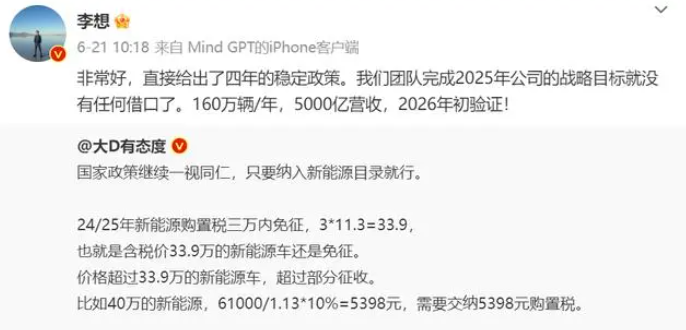

Screenshot: Weibo @Li Xiang

In fact, Li Auto has also been "aggressive" before. Li Xiang, the founder of Li Auto, posted on social media, "By 2025, Li Auto's sales target is 1.6 million units per year, with revenue of 500 billion yuan, to be verified by early 2026." However, after the initial excitement, a rational sales target is essential for the company's sustained growth. Dianchetong believes that if Li Auto's pure electric series can bring surprises, it should have no problem increasing brand sales by 10,000 units per month.

Traditional car companies become less aggressive after facing realities

Hongmeng Zhixing has not yet revealed its sales forecast for next year, but it will launch ten new models, including the Wenjie M8 and Xiangjie S9 extended-range versions. Dianchetong speculates that the sales target for 2025 announced by Hongmeng Zhixing later will be higher than Li Auto's 700,000 units. It can be said that mainstream new energy vehicle brands are relatively optimistic about the competition in the 2025 automotive market.

Looking at traditional brands, BMW and Mercedes-Benz are expected to see a 10% to 15% decrease in sales by 2025, while other traditional brands have not disclosed relevant sales forecasts. However, Toyota Motor Corporation lowered its global sales forecast for this year from 10.95 million units to 10.85 million units when releasing its second-quarter financial results for fiscal year 2025, attributing the adjustment to uncertainties in the global economic environment.

Image Source: Toyota Motor Corporation

Additionally, Toyota's retreat in the Chinese market, its main market, has led to an uncontrolled downward adjustment of its targets. Its lack of competitiveness in the new energy vehicle market is a major reason. According to a report by Nikkei Asia, Toyota plans to reduce its global electric vehicle production target for 2026 to 1 million units, about 30% lower than the sales target announced for the same year.

For companies like BYD, Geely, and Changan, which have already achieved or are on track to achieve their sales targets, they are still in the growth stage of new energy vehicles and may set aggressive sales targets. However, traditional automakers like BMW, Mercedes-Benz, and Toyota, which already have a large sales base, will be more cautious when setting targets.

(Cover Image Source: Dianchetong)

Source: Leitech