January car price war will start below 150,000 yuan

![]() 12/09 2024

12/09 2024

![]() 458

458

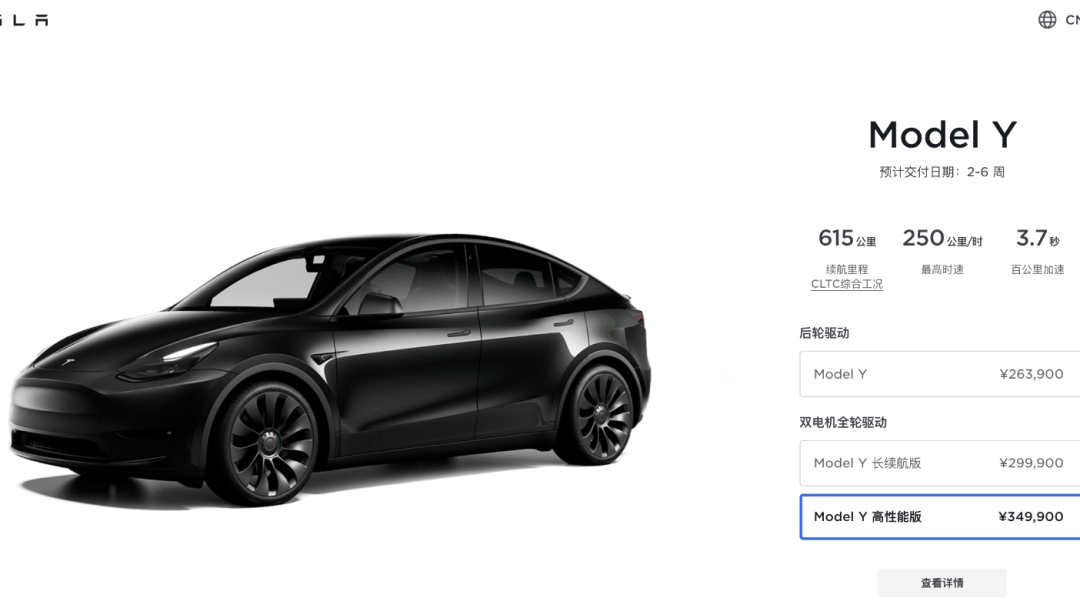

Many people are waiting for the Model Y upgrade in January but forget that it will likely increase in price. The real red-eyed market is for low-cost cars.

"About 20% of people have clearly stated that they will not buy first because they have seen online that the Model Y is estimated to be upgraded in January." Tesla stores, which have a policy of a 10,000 yuan discount on the final payment for a limited time, continue to be crowded with people, but only sales consultants understand that the frequency of impulse spending has significantly decreased.

Compared to consumers with a budget of 250,000 yuan who are considering an electric SUV and wondering whether the Model Y will be upgraded, domestic car brands at the same price point, including Lixiang, Letao, Zeekr, IM Motors, IM Intelligence, and AVATR, are more relaxed. They have already played all their cards in December. Offers include a 0% interest rate for 3 years, free battery swap coupons, and Huawei Intelligent Driving subsidies totaling over 40,000 yuan.

They are relatively relaxed because everything will have to wait until the upgraded Model Y makes its move before they can respond. Given Musk's unconventional actions, no one can guarantee that Tesla will make its move in January, as it did from 2022 to 2024.

The price war in January is not a matter of whether it will happen but how it will be fought.

It is a foregone conclusion that there will be a price war in 2025. The only variable is whether the entire industry will participate collectively, as it did from 2023 to the first half of 2024, or whether only a few brands will have the right to participate.

Staying stagnant is tantamount to failure. The market is not short of hunters in various market segments such as BYD, Geely, Lixiang, and Huawei Intelligent Driving.

Given that some automakers have already announced or are rumored to have announced their sales targets for 2025, the pressure on sales teams is immense.

NIO Auto has already achieved its full-year target of 250,000 units from January to November 2024 and will challenge 500,000 units in 2025. XPeng Motors is expected to sell 180,000 units in 2024 and aims for 350,000 units in 2025.

Xiaomi Automobile, which is expected to sell 130,000 units this year, plans to challenge 360,000 units in 2025. Its first factory, with a current capacity of 150,000 units per year, will be increased to 250,000 units per year. The second factory will be completed in June 2025 and start producing vehicles in the second half of the year.

In addition, it is rumored that BYD is expected to challenge sales of over 5 million units in 2025, Lixiang Auto is expected to sell over 700,000 units, and even Huawei Intelligent Driving is rumored to have set a sales target of 1 million units per year.

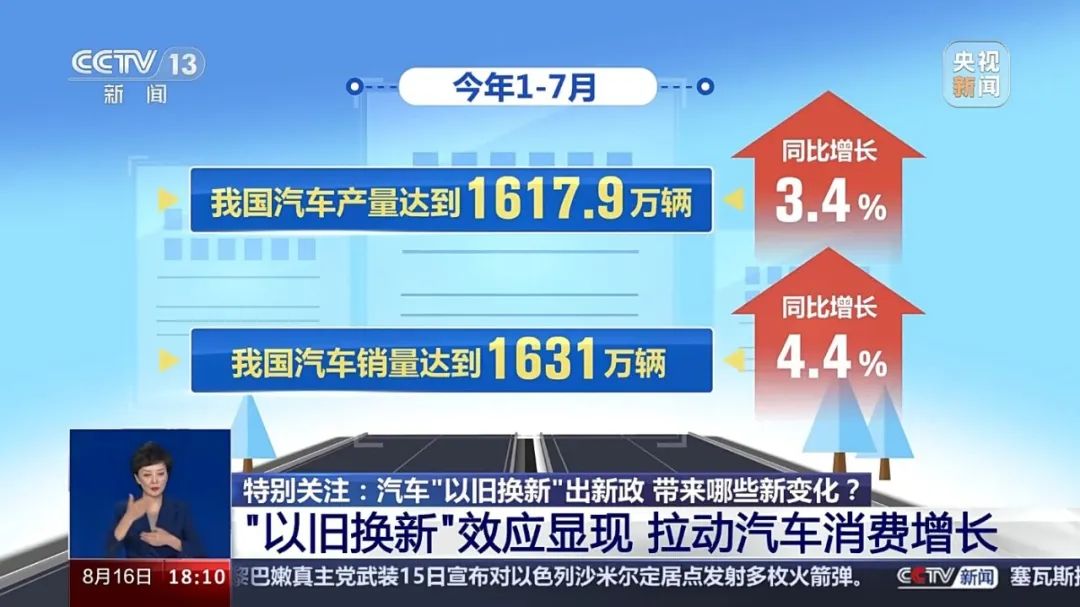

In short, the sales targets of the above six automakers are expected to increase by nearly 1.8 million units compared to 2024. At the same time, automakers such as Geely Auto, which is accelerating its transformation, Chery Automobile, and those that have already announced adjustment plans, including Changan Auto, SAIC Motor, and GAC Motor, all have sales growth targets for 2025.

The pressure of increasing sales by over 2 million units, combined with the start of a small year in 2025 and the global economic contraction, basically means that if automakers cannot achieve a strong start in 2025, the pressure will only increase in the future.

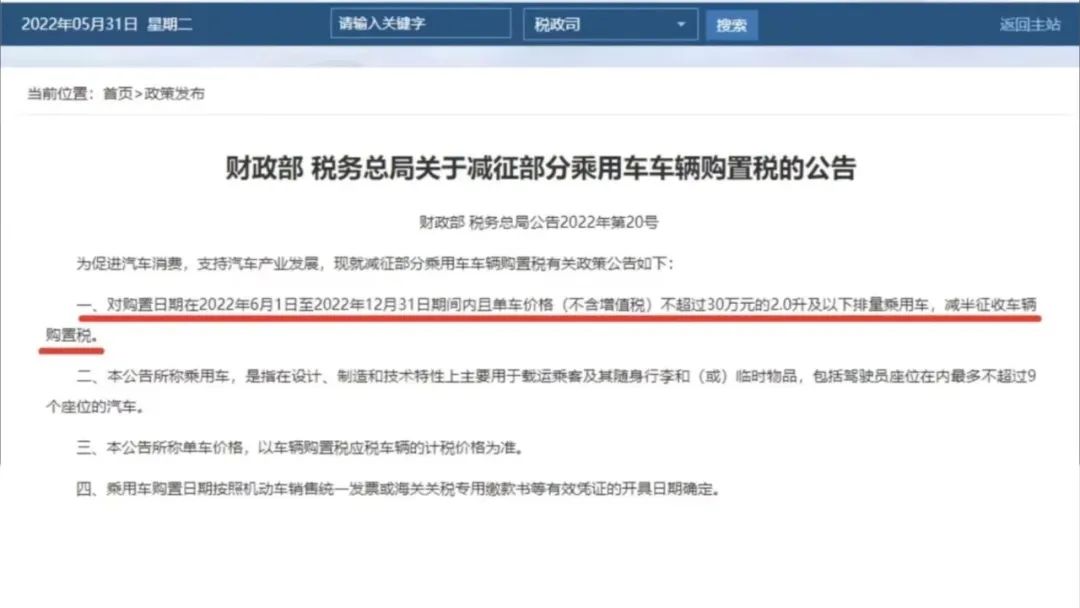

So far, two well-known figures have made predictions about the automotive market in 2025. At the end of November, during the Guangzhou Auto Show, Cui Dongshu, secretary-general of the China Passenger Car Association, wrote on his personal media that relying solely on trade-ins for car sales is not enough. The Lunar New Year's Eve in 2025 falls on January 28, and consumer demand for cars will decrease significantly in the last ten days of January. Therefore, Cui Dongshu personally suggests that the policy of halving the vehicle purchase tax should be implemented as soon as possible.

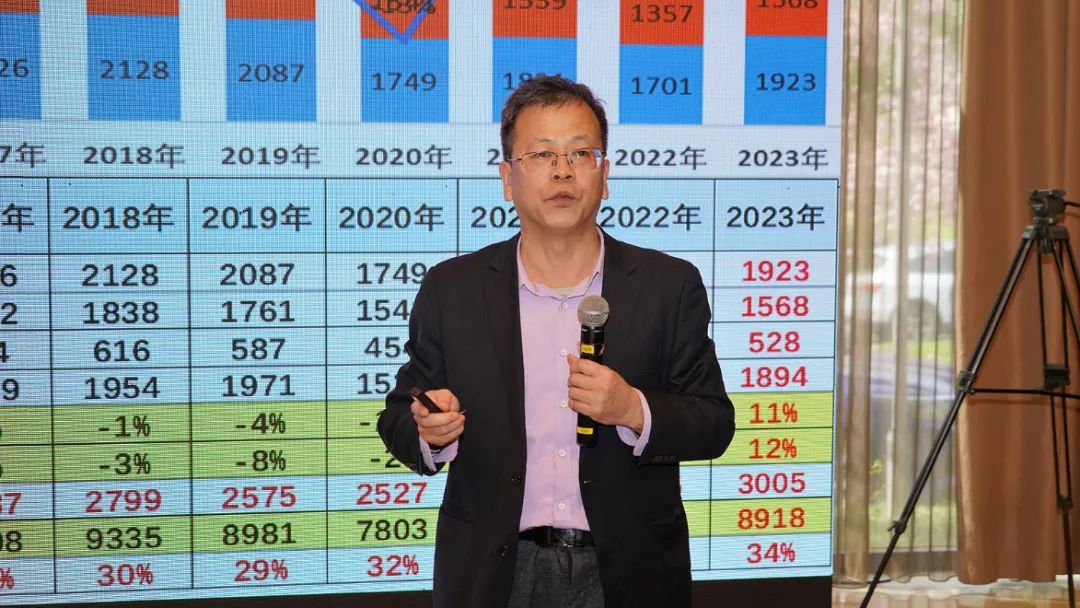

Gong Min, head of UBS China's automotive industry research, also expressed a similar view on November 25. He predicted that a price war in the automotive market would break out in January. Extending existing stimulus policies can effectively ensure a smooth transition in the market. According to data from the China Passenger Car Association, since 2017, during every small year (when the Lunar New Year falls in January), the growth rate of automobile retail sales in January and February has been negative.

In young people's terms, for all automakers participating in fierce competition, the start of 2025 will be akin to hell-level difficulty. In other words, the upgraded Model Y, which is now being vigilantly watched by many automakers, is actually far less powerful than it was in previous years.

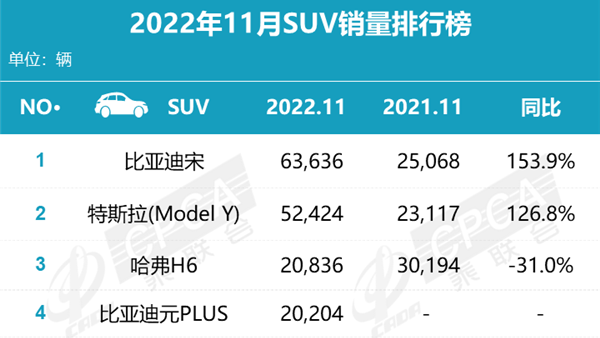

After all, in the market for similar vehicles priced above 200,000 yuan, consumers have an ever-expanding range of choices. In November 2024, Tesla sold over 73,000 units in the Chinese market, setting a new high for 2024. However, compared horizontally, sales were 82,400 units, a year-on-year decrease of 4.3%. In November 2022, this figure was 100,200 units, with a year-on-year decrease of 17.8% in 2023.

In the past three years, Tesla offered no discounts in 2022, an insurance value of 8,000 yuan in 2023, and a combined discount of up to 40,000 yuan in 2024, including a 0% interest rate for 5 years and a 10,000 yuan discount on the final payment.

It is evident that Tesla has also entered a cycle of trading price for volume. Moreover, from the market history of the upgraded Model 3, after a significant upgrade in appearance, configuration, comfort, and intelligent driving hardware, resulting in a price increase of 28,000 yuan, its sales volume plummeted from over 30,000 units per month to less than 6,000 units.

In short, both the trade-in subsidy and local subsidies were originally planned to end in January 2025, with the trade-in subsidy being 20,000 yuan and most local subsidies being 10,000 yuan. Therefore, for those who want to buy a car in January 2025, there will be a noticeable increase in car prices unless automakers themselves invest money.

However, it is questionable whether the trade-in subsidy can be seamlessly continued at the beginning of January 2025. Continuing the policy would actually diminish its stimulus effect for the next round. Since the second half of this year, many models priced below 200,000 yuan have benefited from the trade-in subsidy, such as the Xpeng MONA M03, Xpeng P7+, Geely Xingyuan, and Bestune Pony. Their sales have surged, in large part due to pushy sales tactics in the automotive industry.

"The subsidy will end in January next year, so it's cheaper to buy now." This kind of sales pitch is a magic tool, but if the trade-in subsidy is continued, on the one hand, it will make those who rushed to buy cars before feel like they didn't get much of a deal. On the other hand, it will cast doubt on the policy's credibility.

As for halving the vehicle purchase tax, mentioned by the two celebrities, whether it is a good solution remains to be seen. The effect also needs further verification. The market share of fuel vehicles has already dropped below 50%, and halving the vehicle purchase tax generally does not apply to luxury brands priced above 300,000 yuan. The impact is not global, but it will be good news for those who want to buy a fuel vehicle for the New Year.

Below 150,000 yuan, the automotive market becomes a meat grinder

2025 marks the beginning of a true elimination round in the automotive market, a view that no one believed two years ago. Just as Li Xiang once said, all automakers with multi-speed hybrid systems will gradually follow the trend of range extension.

Supporters of this view have gradually expanded from Li Xiang of Lixiang Auto initially to Zhu Huarong of Changan Auto, Li Shufu of Geely Auto, Yu Chengdong of Huawei, Li Bin of NIO Auto, Zhu Jiangming of NIO Auto, Lei Jun of Xiaomi Auto, and He Xiaopeng of XPeng Motors, based on their views or actions.

Judging from the visible trends brought or about to be brought by these companies and set to occur in January 2025, a growing polarization will emerge with a price of 200,000 yuan as the dividing line. More importantly, competition in the market below 150,000 yuan will be the fiercest in recent years.

From the perspective of new car launches, the following are the key new models to be released around January 2025:

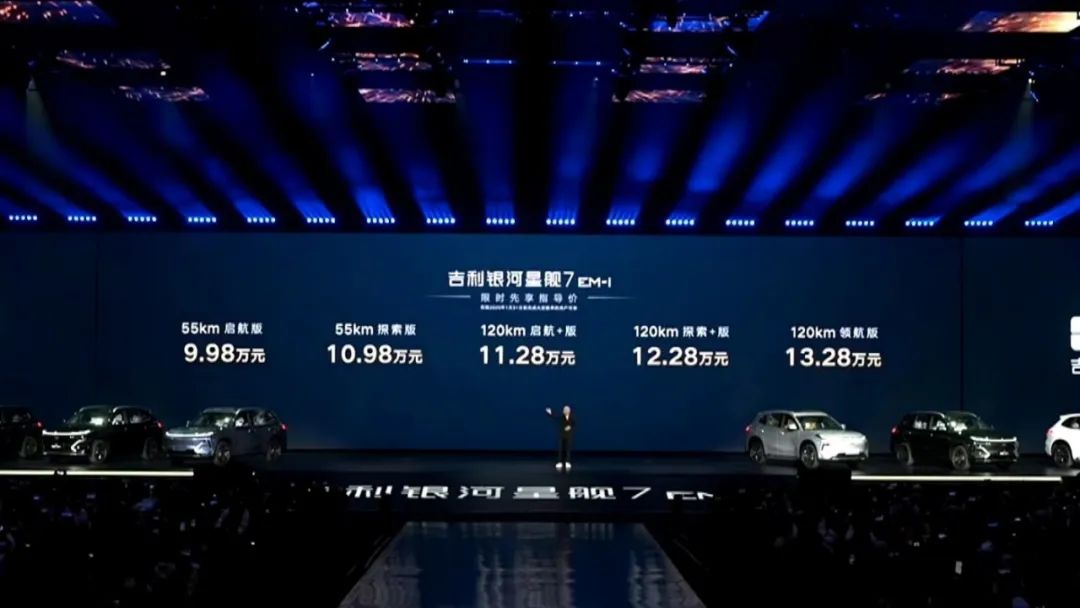

The Geely Galaxy Starship 7 was launched on December 7 with a limited-time starting price of 99,800 yuan, which is an extremely competitive price. It is about 10,000 yuan cheaper than mainstream expectations and a direct challenge to BYD. Its competitive logic is similar to that of the Geely Xingyuan, which is dislocation competition. It is nearly 10,000 yuan cheaper than the BYD Song Pro DM-i after discounts, despite having a guiding price of 109,800-142,800 yuan. In terms of overall product strength, it is comparable to the BYD Song PLUS and even surpasses it in many aspects.

Moreover, it will put tremendous pressure on fuel SUVs, especially mainstream SUVs from joint ventures. Models such as the Honda CR-V, Toyota RAV4, and Honda BREEZE now have entry-level prices well below 140,000 yuan. SAIC Volkswagen has launched the Tharu XR, reducing the price to a limited-time offer of 79,900 yuan. Although its sales figures have declined from their peak, they are still performing well.

The average monthly sales of the Honda CR-V are still over 15,000 units, with a cumulative total of 155,700 units from January to October. Toyota RAV4 sold a cumulative total of 132,800 units, averaging 13,000 units per month. It is evident that with the launch of the Geely Galaxy Starship 7, fuel SUVs will face tremendous pressure.

Geely Auto has more than just this one killer move. Due to the merger of Lynk & Co and Zeekr, they have achieved higher efficiency and lower costs. Looking at Geely Auto as a whole, each of its models now has an explosive low price. In December, another new model will be launched, continuing the logic of the Starship 7.

After basically clearing out its inventory, the Zeekr X will be replaced by the Lynk & Co Z20. In late November, Lynk & Co Z20 opened for pre-orders at the Guangzhou Auto Show with a pre-order price of 146,000-161,000 yuan, lower than that of the Zeekr X. With a 0-100 km/h acceleration time of 5.3 seconds for all trims, it can basically secure its position as the best hot hatch in its class at 150,000 yuan. Given Geely Auto's current aggressive pricing strategy, it is highly likely that the Lynk & Co Z20 will directly compete with the BYD Yuan PLUS, priced between 119,800 and 163,800 yuan.

Meanwhile, following the footsteps of Geely, BYD, and Xpeng, GAC Aion is also preparing for new moves in January. Aion UT Parrot Dragon will be available for pre-sale, with an estimated price of 100,000 yuan, according to the official announcement. With dimensions of 4270*1850*1575mm and a wheelbase of 2750mm, it is larger than BYD Dolphin in terms of data. Based on Aion's consistent product philosophy and pricing strategy, it will directly compete with the current market's representative model, Geely Xingyuan. So far, Geely Xingyuan has been highly competitive in the market, with a price range of 69,800-98,800 yuan, similar to that of BYD Seagull, but with the same size and range as the more expensive BYD Dolphin.

Given Geely Xingyuan's sales performance—over 30,000 units sold in 49 days since its launch—Aion UT Parrot Dragon is unlikely to lag far behind. This judgment is based on the logic of Aion RT shortly after its launch.

After a new car becomes a hit, Aion tends to introduce related models in similar market segments. Due to its strong cost control abilities, R&D innovation capabilities, and other reserves, it quickly gains a late-mover advantage. Aion RT sold over 10,000 units in its first month on the market, reaching 11,811 units, even surpassing the current market hit, Xpeng MONA M03, which has almost identical product features.

It is evident that the new vehicles launched by leading automakers within the 150,000 yuan price range have further driven down prices by an additional 10,000 yuan or more, breaking the previous tacit price understanding among competitors.

Final Thoughts

Will other markets engage in price wars? The answer is yes, but it is more likely to start in March 2025 rather than January. According to the new car plans announced by several leading automakers, the competitors of AITO M9 and Li Auto L9, Tengshi N9, will be launched in the first quarter. AITO's expensive and high-volume new model, AITO M8, will also be launched in the first quarter, while the price of the existing AITO M5 is expected to be reduced, and that of AITO M7 is expected to be increased.

Li Auto's i-series pure electric SUVs are expected to be launched in the first quarter, Xiaomi's SUV may be unveiled in January and launched around the Beijing Auto Show, with deliveries possibly starting in the second half of the year following the completion of its second factory in June. Tesla's influence on the market remains significant, but with the entry of Huawei, Xiaomi, Li Auto, and BYD, the first half of this year will be the starting point for a new round of all-out price wars.